Our latest Global Identity and Fraud Report reveals that fraud has been of high concern for consumers over the past year. In fact, more than half of consumers report that they are worried about online transactions, and 40% say that their concern has increased over this period. Data breaches, well-publicised scams, and direct first-hand experience with fraud have all contributed to these higher levels of concern. Our study shows that 77% of consumers had increased concern after experiencing online fraud, with more than half of consumers surveyed having had a close encounter with fraud:

- 58% of consumers say they have been a victim of online fraud, know someone who has been a victim, or both

- 57% of consumers say they have been a victim of identity theft, know someone who has been a victim, or both

- 53% of consumers say they have been a victim of account takeover, know someone who has been a victim, or both

As a consequence, it makes sense that consumers rank security and privacy above convenience and personalisation when evaluating their online experience and expect businesses to take the necessary security steps to protect them online.

We look at the main factors that play a role in the high levels of fraud concern among consumers and what businesses should do to address challenges in their fraud strategies.

Three contributing factors to increased fraud concern among consumers

Identity fraud has increased

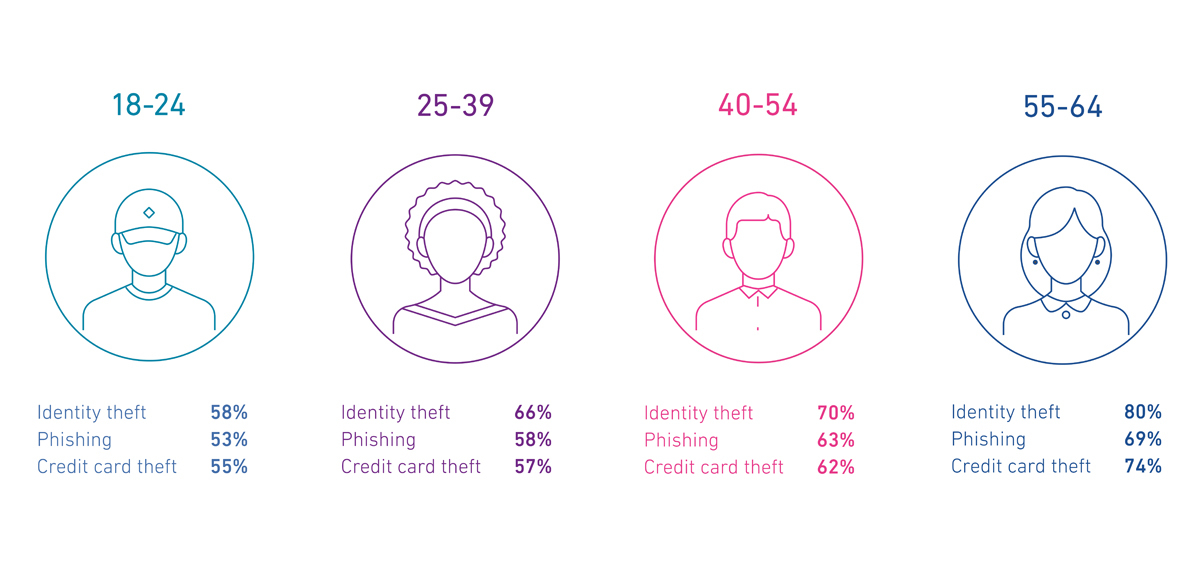

Our research also unveils that identity theft has overtaken credit card theft as consumers’ biggest security worry across all age groups.

Furthermore, a recent report from the UK showed that recorded cases of identity fraud have grown by 22% over the past year. Fraud prevention and security professionals have been trying to educate consumers for a long time on this topic. Stealing identity data and using it in multiple fraud schemes can be significantly more harmful than criminals having access to someone’s credit card numbers, where transactions can be traced quickly and revoked or charged back.

While many factors contributed to an increase in concern about identity theft, the most impactful over the past two years were the numerous cases of unemployment and benefits fraud. Multiple countries reported cases where criminals applied for loans in the name of genuine consumers or through synthetic identities, created by combining real stolen information with fake data. The cost of these scams is yet to be discovered, and it could take years to see their full effect, with fraud losses well into the billions (if not trillions) of dollars worldwide.

Criminals can access stolen data and fraud tutorials beyond the dark web

To commit many types of fraud, criminals need Personal Identifiable Information (PII) that is stolen through techniques such as hacking attacks, credential harvesting, credential stuffing, phishing, or other types of social engineering. For years the knowledge of how to do that, along with the stolen data available after a successful attack, was available mainly on cybercriminal forums accessed through the dark web. However, over the past year, it has become easier than ever to obtain not only PII data but also valuable information on how to bypass some of the security and fraud features in place for a certain institution.

Criminals no longer need to go to the dark web to do that – it’s available on platforms like Telegram, just a few clicks away, where other fraudsters are selling tutorials (often called ‘Sauce’) on how to commit fraud, as well as PII data (called ‘Fullz’) to achieve it. As a result, the entry level for those that want to commit fraud has been set lower than ever before – both in terms of skillset and accessibility.

Phishing and scams are at all-time high

Another contributing factor to the increase in consumer concern is the number of scams resulting in authorised push payment fraud, which totalled £583.2 million in the UK alone during 2021. Criminals continue to seek out consumer vulnerabilities and use a variety of tactics to apply pressure on their victims and convince them to transfer money out of their bank accounts. This could take many forms – from various types of impersonation scams, romance scams, and investment (fraud) opportunities, to scams related to utility bills and easy loan offers among other types. This wouldn’t be possible without numerous phishing/smishing/vishing attempts and the amount of data available through data breaches.

One other factor that helps criminals is the direct access to potential victims given by social media and the sheer volume of personal information available in the public domain. These types of scams sometimes get high publicity (and rightly so) which can also contribute to the increased level of concern among the public while also applying additional pressure on financial institutions to improve their fraud screening and transaction monitoring capabilities to protect consumers.

How businesses can improve fraud screening capabilities and increase consumer trust

To restore consumer trust, businesses need to look for ways to improve their capabilities both at account opening and login to prevent criminals from gaining easy access to their services. There are multiple ways to do that, from introducing online identity document verification or phone-centric identity verification capabilities at the account opening stage, to adding behavioural biometrics, device intelligence, or fraud data sharing capabilities during different stages of the customer journey.

By introducing some of these capabilities businesses also can improve the digital customer journey for genuine consumers and increase trust. Online identity document verification and phone-centric identity verification solutions both offer pre-fill capabilities. These tools can streamline registration processes and thus contribute greatly to a positive consumer outlook of the company that offers them. While behavioural biometrics, device intelligence, and fraud data sharing tools are invisible to both fraudsters and genuine consumers creating a more frictionless experience.

Businesses should look carefully at the fraud they are experiencing along with fraud trends shared by similar businesses. This should help inform whether to introduce new capabilities as part of the existing strategy. It’s common that companies might need a mix of capabilities to mitigate fraud issues, with additional support from machine learning models to blend them into one cohesive output while limiting the number of false positives and building consumer trust.

Stay in the know with our latest research and insights: