What are lenders prioritising when it comes to Gen AI? We take a look at five transformative use cases in lending, and organisational priorities for integrating Gen AI into customer lifecycle processes.

Although Generative Artificial Intelligence (Gen AI) only launched publicly in the form of Chat GPT last November, adoption has been widespread and rapid. Even in typically risk-adverse industries like financial services, our research shows that there is widespread recognition that Gen AI could deliver a range of benefits across business functions. We identified five areas of focus for lenders based on our research.

In a study conducted by Forrester Consulting on behalf of Experian, we surveyed 660 and interviewed 60 decision makers for technology purchases that support the credit lifecycle at their financial services organisation. The study included businesses across North America, UK and Ireland, and Brazil.

The qualitative research showed that lenders are already using a type of Gen AI, Large Language Models (LLMs), in their operations, with a focus on testing across areas such as customer service and internal processes before deploying to credit operations. We look at the potential use cases, and how businesses are using Gen AI now.

1. Personalised customer experience

Customers today expect a personalised lending experience that is tailored to their unique needs and preferences. GenAI can leverage customer data to generate personalised loan offers, recommendations, and repayment plans. This helps lenders improve customer satisfaction and loyalty, leading to increased customer retention and revenue growth. This is an area that is front of mind for the companies in our research – nearly half of businesses surveyed are planning to implement or expand technology capabilities to either upsell or retain customers in the next 12 months.

Furthermore, 50% of companies believe that offering more tailored underwriting and pricing is a top priority in their credit operations, followed by 44% who also aim to increase personalisation in marketing, products, and services to their customers.

According to the research, some organisations have formed alliances with technology providers like OpenAI and Microsoft to investigate and further explore the use of LLMs. These partnerships involve analysing customer data to identify opportunities for cross-selling.

2. Enhancing models with new data sources

With new data sources emerging all the time, Gen AI is one of the technologies that will most likely accelerate the opportunity for businesses to incorporate them into models. Lenders could include sources such as social network data into their models by using LLMs. This unstructured data, including customer emotions and behaviours on social networks, would be treated as an additional variable in the models.

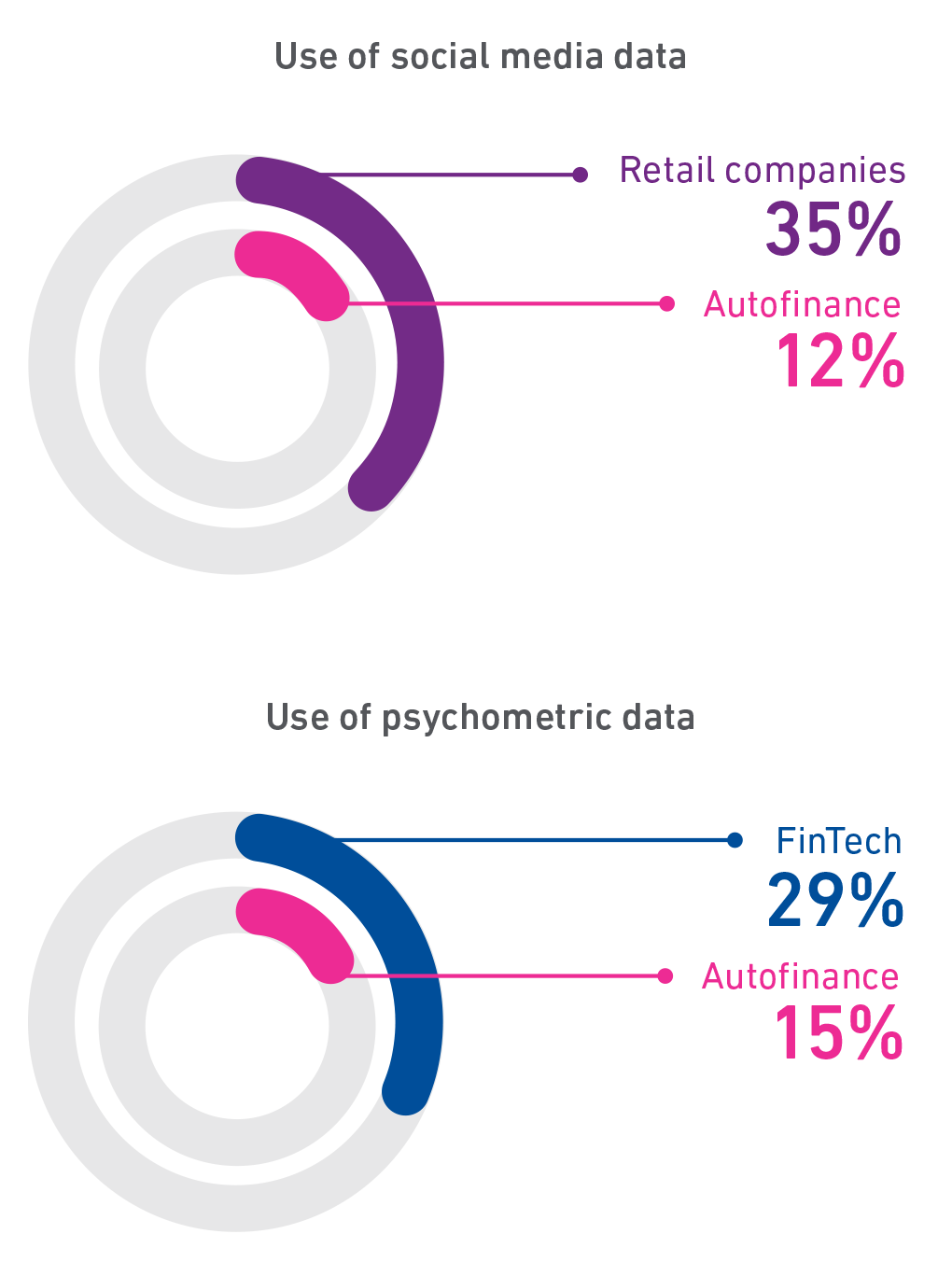

According to the research social media data and psychometric data is already used across financial services, to varying degrees. It showed that 35% of retail companies use social media data, while 29% of FinTechs use psychometric data. Auto finance companies sit at lower end of the adoption scale, with only 12% using social media data and 15% psychometric data.

3. Operational efficiencies

Gen AI can help bring operational efficiencies to customer

journeys across the entire lifecycle, offering lenders the

ability to automate and streamline various processes,

resulting in improved productivity, cost savings, and

enhanced customer experiences.

One of the top challenges for businesses surveyed is

improving customer journeys during onboarding, and this

was particularly significant for credit unions / building

societies (53%).

4. Detecting and preventing fraud

Gen AI can play a crucial role in fraud detection by analysing patterns and anomalies in vast datasets. By leveraging machine learning techniques, Gen AI models can proactively identify potentially fraudulent activities and mitigate risks. The ability to detect fraud in real-time improves the overall security of lending operations and helps protect lenders and borrowers from financial losses.

Detecting and preventing fraud is a constant challenge for lenders. 51% of retailers and 47% of credit unions/ building societies surveyed said that reducing fraud losses is a key challenge for them.

5. Customer service

Driven by advances in the machine learning and AI space, the world of customer service has benefited hugely from the adoption of virtual assistants and chatbots in recent years. This looks to continue, with businesses saying that LLMs are being tested for customer service purposes, allowing lenders to identify customer issues and automate actions.

What’s next for lenders?

The research found that lenders are utilising various machine learning techniques like regression, decision trees, neural networks, and random forest, along with LLMs. Businesses are in the early stages of exploring how they can use LLMs in credit risk models, but it will undoubtedly involve a blend of existing and new capabilities.

As with any emerging technology, it’s important to look at potential risk. The research indicated that organisations see challenges and concerns when it comes to the use of LLMs in their models. It is crucial to ensure the models are trusted, validated, and properly understood to avoid reliance on outsourced solutions and maintain control and visibility over the models’ functions. The ability to explain decisions in Gen AI to avoid bias can be difficult, and businesses will be watching the regulators to understand how best to proceed. There is no doubt, however, that Gen AI will optimise the credit customer lifecycle, creating vast opportunities for lenders.