Experian’s new global report is now available on how businesses can enhance efficiency, insights, and growth through integration to transform the future of risk strategy.

In the ever-evolving financial landscape, the convergence of credit risk, fraud risk, and compliance is becoming a game-changer. Financial institutions (FIs) increasingly recognise the need to integrate these functions to enhance efficiency, gain deeper insights, and drive growth. The 2024 global report on the convergence of credit, fraud, and compliance sheds light on this critical transformation, emphasising how a unified strategy can revolutionise risk management. The report highlights the importance of convergence in shaping the future of financial services.

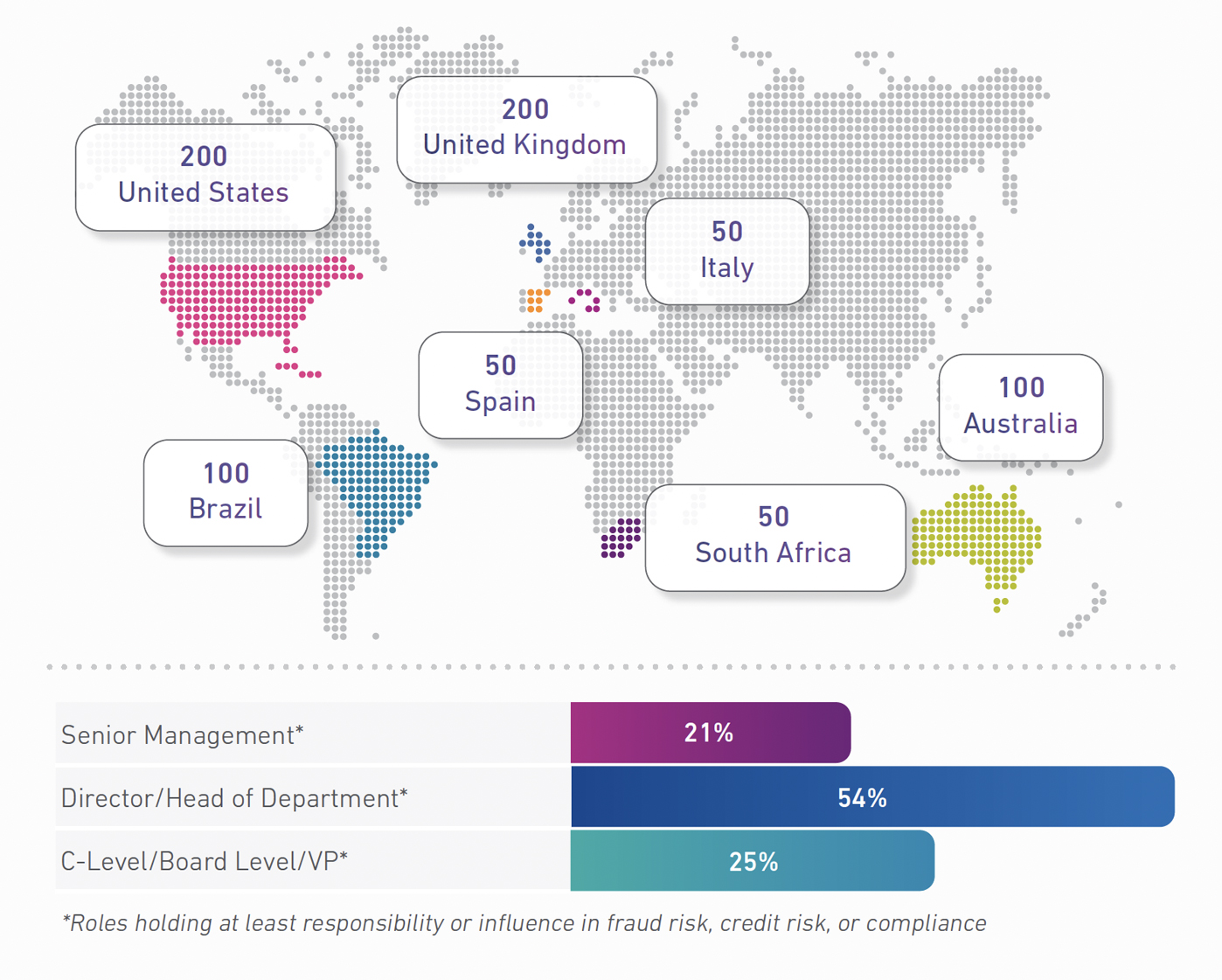

We surveyed 750 leaders in credit risk, fraud risk and compliance in financial services organisations across the world.

Inside the report:

The need for convergence

As technology advances, financial institutions (FIs) face the dual challenge of managing complex systems while simplifying consumer processes. The report reveals that organisations use an average of eight tools across credit, fraud, and compliance, with some using more than ten. This fragmentation leads to inefficiencies and increased risks.In addition, 79% of respondents want to work with fewer vendors to manage credit risk, fraud, and compliance, underscoring the need for streamlined operations.

Independent evolution of functions and associated challenges

Credit risk, fraud risk, and compliance functions have evolved independently, creating operational silos and technology management challenges. This separation has led to increased fraud and credit losses. The report highlights that only 9% of organisations prioritise these functions equally, with most focusing on fraud. However, 87% of respondents acknowledge the overlap between these areas and are working towards closer collaboration.

Regulatory pressures and advanced fraud techniques

New regulations in the US, UK, and EU are compelling FIs to reimburse consumers for losses due to scams, increasing the liability for both sending and receiving banks. Penalties for failing to implement effective Anti-Money Laundering (AML) solutions have also intensified. These regulatory demands and advanced fraud techniques necessitate a more integrated approach to risk management.

Early stages of convergence

While the market is beginning to recognise the benefits of convergence, many FIs are still in the early stages of this journey. The convergence speed varies, but mature organisations have already started or plan to start the process soon. The report shows that 91% of respondents believe that forward-looking companies will centralise these functions within the next three years. However, only 15% prefer a ‘point solution’, 36% prefer a single integrated solution, and 49% prefer modular integration.

The role of technology

Technology plays a crucial role in integrating functions and managing risk. Next-generation platforms are essential for adapting to market needs, delivering innovative products, and meeting regulatory requirements. The report emphasises the importance of data aggregation, which combines diverse data for deeper insights, and the integration of credit decisioning and fraud detection solutions to balance risk and growth goals simultaneously.

Improving risk management through alignment

Correctly identifying consumers, managing fraud risk, making informed credit decisions, and ensuring compliance share common ground. The report shows that 57% of respondents believe aligning credit risk, fraud, and compliance functions leads to better overall risk management. Businesses with more centralised practices report improved risk management effectiveness, operational efficiencies, and data integrity.

Benefits of convergence

The convergence of credit risk, fraud, and compliance offers numerous benefits, including:

- Improved risk management effectiveness: Better alignment leads to more effective risk management strategies.

- Operational efficiencies: Streamlined processes and reduced duplication of efforts enhance operational efficiency.

- Increased data integrity: Centralised data management ensures consistency and accuracy.

- Cost reduction: Consolidation of functions and technology reduces costs.

- Enhanced customer experience: A unified approach improves customer recognition and service across all channels.

Read the report to find out how to prove value through integration.