Payers are using automation to adjudicate healthcare claims at scale, leaving providers struggling to keep up. One major insurer was found to have denied over 300,000 claims in two months, with each one taking an average of just 1.2 seconds. Providers that continue to rely on manual claims management methods will see their margins squeezed as the denials challenge grows. The future of healthcare claims management is here – and the answer lies in artificial intelligence (AI).

Providers can level the playing field by turning to AI and automation , using tools like AI Advantage™ to streamline healthcare claims management. This article summarizes a recent webinar with two early adopters, Eric Eckhart of Community Regional Medical Center (Fresno) and Skylar Earley of Schneck Medical Center, who are using the technology to prevent denials and increase collections.

Small increases in claim denials can lead to major revenue loss

Makenzie Smith, Product Manager for AI Advantage at Experian Health, set the stage with observations on the current state of claims management. She notes that one of the biggest challenges when it comes to denials is constantly shifting payer behavior:

“So many payer decisions are now being driven by artificial intelligence. Insurers are reviewing and denying at scale using intelligent logic, leaving providers fighting harder for every dollar.”

Two hypothetical scenarios illustrate the potential impact of just a 2% increase in denials, assuming other variables remained constant:

- In an organization with a gross patient revenue (GPR) of $500m, an increase in denials from 10% to 12% could squeeze operational margins from 3% to 2.6%, resulting in a drop in net income from $15m to $13m.

- In an organization with a GPR of $2000m, an increase in denials from 18% to 20% could wipe out a 0.35% margin completely, causing net income to fall from $7m to 0.

Some providers are choosing to stick with their existing processes; changing course seems too risky within thin margins. But as Eric Eckhart points out, “the just-work-harder approach doesn’t work anymore.” Providers need a more efficient way to sustain operating margins.

How AI Advantage helps reduce denial volume and improve net collections

AI technology is emerging as a better alternative to the status quo. By using automation and AI, providers can gain insights into their claims and denial data, resulting in improved financial performance, greater efficiency and improve the future of healthcare claims management.

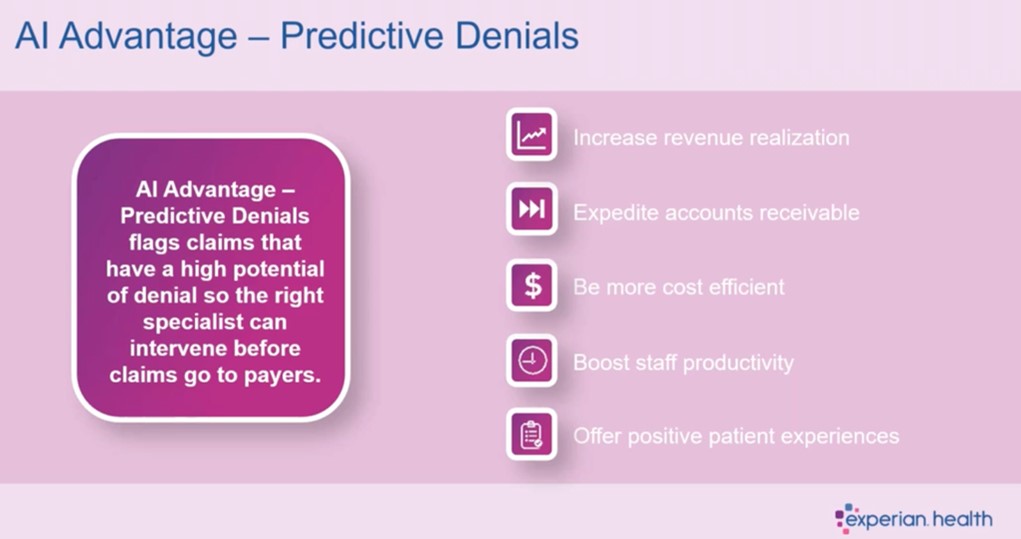

AI Advantage™ – Predictive Denials uses AI to identify claims with a high likelihood of denial based on an organization’s historical payment data. This allows staff to intervene prior to claim submission. It identifies undocumented payer adjudication rules that result in new denials. It works within Experian Health’s ClaimSource® solution to proactively flag at-risk claims, allowing teams to review them within their existing claims workflow.

Key takeaways from 2 real-world examples of AI in healthcare claims management

Eckhart and Earley share how they are approaching denial prevention in today’s fast-changing claims environment. Below are the key takeaways from their conversation about how AI is helping to optimize reimbursement and support their teams:

Providers need to move beyond the “just work harder” approach to claims management

Eckhart says that staffing challenges were a major driver of his organization’s early adoption of AI Advantage, as it became harder to manage the increasing rate of denials with existing resources: “I think we’ve all tried the “let’s work very hard approach” and worked overtime for months on end, but that’s just not a long-term solution. We were looking for something technology-based to help us bring down denials and stay ahead of staff expenses. We’re very happy with [AI Advantage] and the results we’re seeing now.”

Skylar Earley agrees, saying that despite their efforts, the rate of denials stayed the same. “It’s so important for us to reduce denials because costs are increasing, reimbursements are decreasing, payments are shrinking. In our smaller community, there are only so many ways to grow revenue. We’ve got to maximize reimbursement, however we can.”

Discover how Schneck Medical Center used AI to prevent claim denials.

Seamless integration with ClaimSource® was key to staff adoption

While senior leadership teams may have been on board with testing the new technology, staff members were more hesitant about the potential pitfalls of introducing a new tool. Eckhart says, “Experian were already processing our claims through Claim Scrubber, so the workflow was essentially the same. I got some pushback when I said it was AI. I think the biggest fear for my billers was that they were going to get 5000 alerts that they would have to override and ignore. But we phased it in slowly and that was a good approach.”

Earley agrees: “This is probably one of the most seamless products I’ve seen: it’s entirely in ClaimSource®. If you didn’t know about it, you wouldn’t know it was there. The people using the product don’t toggle back and forth between screens, they don’t run reports to view alerts. The product shows them what claims they need to look at.”

The predictive model gives staff their time back – so savings snowball

For both organizations, a big win from AI Advantage was being able to reduce denials so staff could focus on other tasks. Making better use of staff time is increasingly urgent as the growth in denied claims outpaces recruitment.

Eckhart says that over the last six months, his team have saved 30 hours a month in collector time. “Now I have almost a whole week a month of staff time back, and I can put that on other things. I can pull that back from outsourcing to other follow-up vendors and bring that in house and save money. The savings have snowballed. That’s really been the biggest financial impact.”

Reducing denials with accurate predictions

Eckhart and Earley report that the success of the tool comes down to the accuracy of predictions, and the fact that it uses their own data. This applies to claims submitted to commercial and government payers, including prior authorizations. For example, Schneck Medical Center is seeing an ongoing reduction in AR days, while the number of authorized outpatient visits has increased by around 2.5% since implementing the technology.

In addition to improving claims management processes, AI Advantage also helps root out persistent payer errors. Eckhart says that while denials teams tend to focus on high value claims, smaller payers can sometimes make erroneous denials that add up over time. The tool brings this to light so providers can raise it with the payer and fix it going forward.

The future of healthcare claims management is here

Ultimately, every prevented denial means more dollars coming back to the provider, increasing their capacity to deliver high quality services. Revenue growth makes it possible to recruit more staff, reduce outsourcing, increase capital purchases, introduce new service lines, and even explore merger and acquisition strategies.

Payers are already making strides in their use of AI technology and automation, but with AI Advantage, providers can process accurate claims and reduce denials at a scale and pace to match.

Find out more about how AI Advantage™ is changing the future of healthcare claims management and watch the webinar to hear the full conversation on ‘The Future of Claims Management. Today.’