All posts by Experian Health

On March 11, CMS posted a transmittal stating it awarded Noridian Healthcare Solutions, LLC, a new contract for the administration of Medicare Fee-for-Service claims for DME, prosthetics, orthotics, and supplies in Jurisdiction A. The incumbent is NHIC, Corp. The Jurisdiction A DME MAC serves Medicare beneficiaries who reside in the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, and the District of Columbia. Under this contract, Noridian will process and pay Medicare DMEPOS claims; process redetermination requests; respond to supplier inquiries; perform supplier outreach and education; and, review claims for medical necessity. Noridian will begin processing Jurisdiction A claims in May 2016 from its offices in Fargo, ND. Jurisdiction A includes over 8.2 million Medicare Fee-for-Service beneficiaries. The Jurisdiction A DME MAC will serve approximately 20,000 Medicare DMEPOS suppliers. This jurisdiction comprises nearly 18% of the overall national Medicare Fee-for-Service DMEPOS claims volume. The Jurisdiction A DME MAC contract includes a base year and four option years, for an anticipated duration of five years. The contract is a “cost plus award fee” contract; the award fee will be earned only if the contractor exceeds the base requirements of the contract. Effective date: December 16, 2015 Implementation date: July 1, 2016, for all cutover requirements outside of those related to system changes; July 5, 2016, for system changes View Transmittal R1634OTN here: https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1634-OTN.pdf View MLN Matters article MM9546 here: https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM9546.pdf

CMS recently released an extensive revision of QIO Manual Chapter 9 related to QIO reviews in cases potentially involving sanction recommendations from the OIG for quality and EMTALA issues. The chapter has been renamed to include the reference to EMTALA. This update supersedes all the information in the October 3, 2003 version of Chapter 9, any previously issued Question & Answer guidance, and any previously issued TOPS, Standard Data Processing System, and Healthcare Quality Information System memos related to Chapter 9. Effective date: March 14, 2016 Implementation date: March 14, 2016 View Transmittal R139DEMO.

On March 17th, the Centers for Medicare & Medicaid Services Office of Minority Health (CMS OMH) released a new interactive map to increase understanding of geographic disparities in chronic disease among Medicare beneficiaries. The Mapping Medicare Disparities (MMD) Tool identifies disparities in health outcomes, utilization, and spending by race and ethnicity and geographic location. Understanding geographic differences in disparities is important to informing policy decisions and efficiently targeting populations and geographies for interventions. “Our commitment to health equity begins with properly measuring the care people get and having an honest dialogue on how and where we need to improve,” said CMS Acting Administrator Andy Slavitt. “Today’s tool aims to make it harder for disparities to go unaddressed.” Racial and ethnic minorities experience disproportionately high rates of chronic diseases, and are more likely to experience difficulty accessing high quality of care than other individuals. The identification of areas with large differences in the proportions of Medicare beneficiaries with chronic diseases is an important step for informing and planning health equity activities and initiatives. The Mapping Medicare Disparities Tool features: A dynamic interface with data on the prevalence of 18 chronic conditions, end stage renal disease, or a disability; Medicare spending, hospital and emergency department (ED) utilization, preventable hospitalizations, readmissions, and mortality rates. The ability to sort by state or county of residence, sex, age, dual-eligibility for Medicare and Medicaid, and race and ethnicity. Built-in benchmarking features to investigate disparities within counties and across racial and ethnic groups, and within racial and ethnic groups across counties. “It’s not enough to improve average health care quality in the U.S.,” said CMS OMH Director Cara James. “As the CMS Equity Plan lays out, we must identify gaps in quality of care at all levels of the health care system to address disparities. We are excited to share this new tool, which allows us to pinpoint disparities in health care outcomes by population and condition.” See the Medicare Mapping Disparities Tool here: https://www.cms.gov/About-CMS/Agency-Information/OMH/OMH-Mapping-Medicare-Disparities.html The Medicare Mapping Disparities Tool FAQ’s are here:https://www.cms.gov/About-CMS/Agency-Information/OMH/Downloads/MMDT-FAQs.pdf

Beginning in 2016, claims for CT (Computed Tomography) scans identified by the CPT codes listed below (and by successor codes) that are furnished on non-NEMA (National Electric Manufacturers Association) Standard XR-29-2013-compliant CT scans must include modifier “CT” that will result in an applicable payment reduction. 70450-70498 71250-71275 72125-72133 72191-72194 73200-73206 73700-73706 74150-74178 74261-74263 75571-75574 CMS Change Request (CR) 9250 informs providers that effective January 1, 2016, a payment reduction of 5 percent applies to CT services furnished on equipment that is inconsistent with the CT equipment standard and for which payment is made under the physician fee schedule. When such payment reductions are made, MACs will supply: Claim Adjustment Reason Code 237 – Legislated/Regulatory Penalty. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.) Remittance Advice Remark Code N759 – Payment adjusted based on the National Electrical Manufacturers Association (NEMA) Standard XR-29-2013; and Group Code: CO (contractual obligation) The payment reduction increases 15 percent in 2017 and subsequent years. System attestation by providers will be verified through the periodic supplier accreditation process. Read the official instruction here: https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R3402CP.pdf

The Centers for Medicare & Medicaid Services (CMS) published a final rule February 11, 2016 that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable. A separate final rule was published in the May 23, 2014 Federal Register (79 FR 29844) that addresses Medicare Parts C and D overpayments. Summary The requirements in this rule are meant to support compliance with applicable statutes, promote the furnishing of high quality care, and to protect the Medicare Trust Funds against improper payments, including fraudulent payment. This rule clarifies requirements for the reporting and returning of self-identified overpayments. Health care providers and suppliers have been and will remain subject to the statutory requirements found in section 1128J(d) of the Social Security Act (the Act) and could face potential False Claims Act (FCA) liability, Civil Monetary Penalties Law (CMPL) liability, and exclusion from federal health care programs for failure to report and return an overpayment. Health care providers and suppliers will also continue to be required to comply with current CMS procedures when we, or our contractors, determine an overpayment exists and issue a demand letter. Background Section 6402(a) of the Affordable Care Act established a new section 1128J(d) of the Act. Section 1128J(d)(1) of the Act requires a person who has received an overpayment to report and return the overpayment to the Secretary, the state, an intermediary, a carrier, or a contractor, as appropriate, at the correct address, and to notify the Secretary, state, intermediary, carrier, or contractor to whom the overpayment was returned in writing of the reason for the overpayment. Section 1128J(d)(2) of the Act requires that an overpayment be reported and returned by the later of: (A) the date which is 60 days after the date on which the overpayment was identified; or (B) the date any corresponding cost report is due, if applicable. Section 1128J(d)(3) of the Act specifies that any overpayment retained by a person after the deadline for reporting and returning an overpayment is an obligation (as defined in 31 U.S.C. 3729(b)(3)) for purposes of 31 U.S.C. 3729. In the February 16, 2012 Federal Register (77 FR 9179), CMS published a proposed rule to implement the provisions of section 1128J(d) of the Act for Medicare Parts A and B providers and suppliers. Major Provisions The major provisions of this final rule include clarifications around: the meaning of overpayment identification; the required lookback period for overpayment identification; and the methods available for reporting and returning identified overpayments to CMS. Meaning of “Identification” Section 1128J(d) of the Act provides that an overpayment must be reported and returned by the later of: (i) the date which is 60 days after the date on which the overpayment was identified; or (ii) the date any corresponding cost report is due, if applicable. This final rule states that a person has identified an overpayment when the person has or should have, through the exercise of reasonable diligence, determined that the person has received an overpayment and quantified the amount of the overpayment. Creating this standard for identification provides needed clarity and consistency for health care providers and suppliers regarding the actions they need to take to comply with requirements for reporting and returning of self-identified overpayments. Lookback Period Under this final rule, overpayments must be reported and returned only if a person identifies the overpayment within six years of the date the overpayment was received. Specifying the length and other parameters of the look back period provides additional clarity for providers and suppliers who have identified an overpayment that is covered by the provisions of 1128J(d). How to Report and Return Overpayments This final rule provides that providers and suppliers must use an applicable claims adjustment, credit balance, self-reported refund, or another appropriate process to satisfy the obligation to report and return overpayments. This approach for returning overpayments provides an array of familiar options from which providers and suppliers can select. This rule also provides that if a health care provider or supplier has reported a self-identified overpayment to either the Self-Referral Disclosure Protocol managed by CMS or the Self-Disclosure Protocol managed by the Office of the Inspector General (OIG), the provider or supplier is considered to be in compliance with the provisions of this rule as long as they are actively engaged in the respective protocol. View the final rule in the Federal Register here: https://www.gpo.gov/fdsys/pkg/FR-2016-02-12/pdf/2016-02789.pdf

Experian Health is pleased to announce that its Patient Estimates solution has joined the athenahealth® Marketplace, also known as the More Disruption Please (MDP) program. Experian Health has participated in this program since the launch of the marketplace in 2013 (starting with our Contract Management offerings) and has worked with athenahealth to integrate its industry-leading capabilities into the organization’s growing network of more than 73,000 healthcare providers. Learn more about Experian Health’s Patient Estimates solution. Read the press release To learn more about athenahealth’s MDP program and partnership opportunities, please visit https://www.athenahealth.com/disruption.

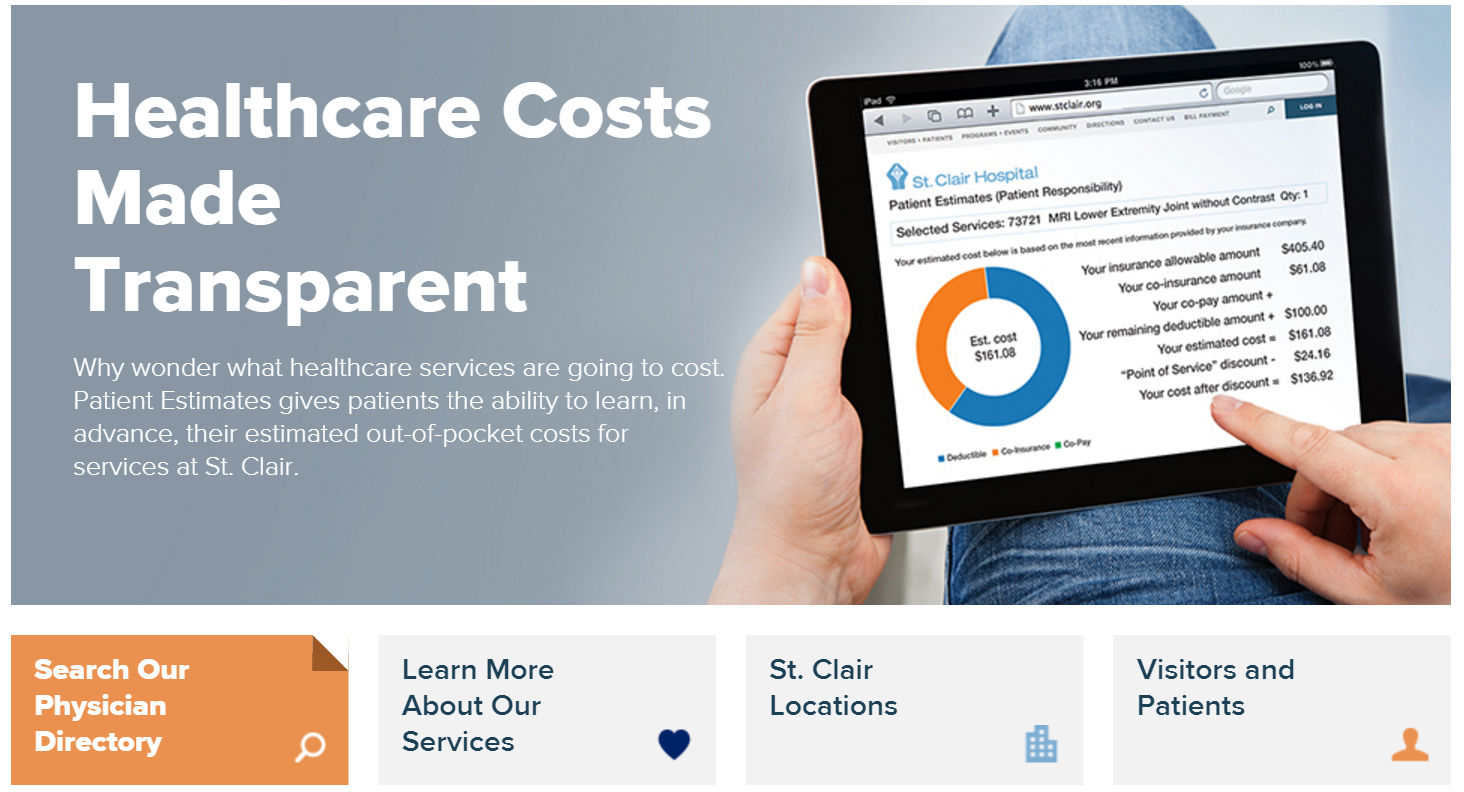

Experian Health is pleased to announce that we went live with Patient Estimates at St. Clair Hospital located in Pittsburgh, PA on February 22, 2016. A true representation of vendor and hospital collaboration and commitment, the Patient Estimates cost transparency tool gives St. Clair a competitive edge as the first hospital in its region to offer patients cost estimates in advance. Patient Estimates is not a list of charges, but an interactive and user-friendly tool that provides information that is highly specific to the individual. Estimates are designed to determine, in advance, each patient’s out-of-pocket costs (deductibles, co-pays and co-insurance) for services at St. Clair based upon his/her insurance coverage. The estimates also incorporate St. Clair’s discounts for payment on the date of service and for those without insurance. The estimates remain in the system and can be recalled for future reference. Patient Estimates is simple to use and is conveniently available 24/7 at www.stclair.org. On the home page, patients will select the “Financial Tools” option, then click on Patient Estimates. They will then enter their health insurance information before choosing one of the 100 listed clinical services (e.g., a procedure, treatment or diagnostic test) from the drop-down menu. The tool then provides a customized estimate of their out-of-pocket expenses. Patient Estimates is designed to help insured and uninsured patients get clear, real-time, easy-to-understand cost estimates for St. Clair’s services so patients can make informed decisions about their care. Below are some of the press mentions of St. Clair Hospital's implementation of Patient Estimates: Pittsburgh TRIBLIVE https://bit.ly/1oxlKna Pittsburgh Post-Gazette: https://bit.ly/219dqfd Pittsburgh Business Times: https://bit.ly/1QWfqNa

The title of Best in KLAS is a highly coveted recognition of outstanding efforts to help healthcare professionals deliver better patient care. It is reserved for vendor solutions that lead the software and services market segments with the broadest operational and clinical impact on healthcare organizations. ~KLAS Enterprises LLC Last month, Experian Health’s eCare NEXT® platform was awarded the highest score in the Patient Access category of the 2015/2016 Best in KLAS: Software & Services report. This is the 5th straight year Experian Health has received the highest ranking in the patient access category—3 years as Category Leader in Patient Access – Eligibility Checking and now 2 years Best in KLAS in the broader Patient Access category. The KLAS award confirms our strong commitment to continually provide advanced technology and revenue cycle products for our clients, and consistently develop enhancements and new solutions with them. We are proud of the collaboration between our progressive clients and our dedicated employees to ensure clients provide the best patient care experience, and achieve payment certainty for every patient. It’s a great honor that our clients continue to hold Experian Health’s solutions in such high regard that we have been recognized consistently by KLAS year after year. View Press Release View full list of Best in KLAS winners and Category Leaders

Episode management, particularly the 30-90 days post-discharge, is incredibly important for all types of healthcare entities seeking to succeed under value-based reimbursement. Millions of dollars in revenue, shared savings, and bundled payment contracts are at-risk when hospitals, ACOs, bundled payment conveners, and others don’t have visibility into their patient’s care after hospital discharge. Leading health care organizations are realizing the solution is not simply to hire an army of care managers, but rather, to supplement a care management team with focused automation to double or triple their productivity by sharing workflow and care management with the patient’s community providers, including independent MD offices, skilled nursing facilities (SNFs), home health agencies (HHAs), and others. Having the right care solutions in place is critical to ensuring successful episode management. View our on demand webinar to learn care coordination best practices and find out how Experian Health’s innovative solutions can help your organization: Reduce readmissions and manage episode/post-acute costs Maximize Medicare reimbursement, minimize Medicare penalties and, hopefully, earn bonuses Profit at and contract for bundled payments Maximize commercial reimbursement Improve outcomes and lower costs for greater fee for value (FFV) in the future Learn how Experian Health can help you success in the new FFV environment. Access our on demand Episode Management webinar.