A recent Peterson-KFF brief found that around 20 million adults have unpaid medical bills, with 14 million owing at least $1,000. Data from the Survey of Income and Program Participation puts the total figure at more than $220 billion. Healthcare providers must find ways to streamline patient financial assistance screening, to help patients and prevent unpaid bills piling up from uncompensated care. Many patients who would be eligible for financial assistance miss out on much-needed discounts due to outdated screening processes, leaving their unpaid bills to linger in accounts receivable.

Automated presumptive charity screening offers a cost-effective solution for healthcare providers to modernize the process and reduce avoidable write-offs. Patient financial assistance software can also aid providers in fostering compassionate patient experiences, by identifying individuals in need of help and efficiently guiding them towards appropriate financial assistance pathways.

The hidden consequences of medical debt

Rising costs, unexpected medical emergencies and lack of insurance are the main culprits in the growing problem of medical debt. Though uninsured rates have dropped, millions of insured Americans remain without adequate coverage: high deductibles and co-payments leave many individuals “underinsured” with out-of-pocket costs they cannot afford. Providers end up shouldering the costs, leading to revenue loss, operational strain, and impaired capacity to deliver high-quality care.

In some cases, the burden of an individual’s medical debt may be initially concealed from the health system, papered over with credit card bills and loans. But it does not remain hidden for long: medical debt becomes simply “debt,” as families cut back on food and clothing, fall behind on other household bills, or even declare bankruptcy. The repercussions can escalate for patients and providers as patients opt out of further care, which eventually causes their medical needs – and costs – to spiral. Creating a more compassionate financial experience for patients will help avoid these ripple effects, with benefits for providers, too.

Who is eligible for patient financial assistance programs?

Patients who cannot afford to pay may be eligible for support via a patient financial assistance program. These programs, offered by providers, charities and government agencies, alleviate the financial pressures on patients by covering some or all of the cost of care in the form of partial or full discounts. Providers can offer patients information and support early in their healthcare journey to help them access such programs. The challenge is figuring out who is eligible.

Eligibility criteria for financial assistance is often complex, covering the individual’s income, household income and size, savings and medical need. Gathering and analyzing this data using manual processes can be time-consuming and often lead to gaps and inaccuracies. These inadequate screening processes result in missed opportunities to connect patients with the financial assistance they need, and risk falling foul of charity care regulations and policies.

On-demand webinar: Hear how Eskenazi Health boosted Medicaid charity approvals by 111% with financial aid automation.

How to use data to identify patients eligible for financial assistance

Instead of asking the patient to fill out a stack of forms and manually checking data against the Federal Poverty Level to determine eligibility for charity care, providers can get the answers they need using data analytics and automation.

Patient Financial Clearance automates eligibility checks prior to service to see if patients qualify for financial assistance programs. It uses Experian data and analytics to predict the patient’s ability to pay and calculate the best-fit payment plan based on individual needs and circumstances. It also generates scripts for staff to use when running the tool and helping patients find assistance, which makes for a more compassionate experience.

Alex Liao, Product Manager for Patient Financial Clearance at Experian Health, says, “Many patients are unaware that they’re even eligible for financial assistance and need help to navigate the process. Discussing personal finances can also be uncomfortable, so it’s not uncommon for patients to avoid sharing information that could actually lead to them getting support. Automating presumptive charity screening is more efficient and reliable. It’s also a lot more compassionate than the old way of collecting forms and documents. Patient Financial Clearance pulls together credit information and demographic data to determine whether the patient qualifies without long, drawn-out discussions. Patients get the help they need and providers can reduce bad debt without delay.”

Case study: Discover How UCHealth wrote off $26 million in charity care with Patient Financial Clearance.

Using patient financial assistance technology to create compassionate patient experiences

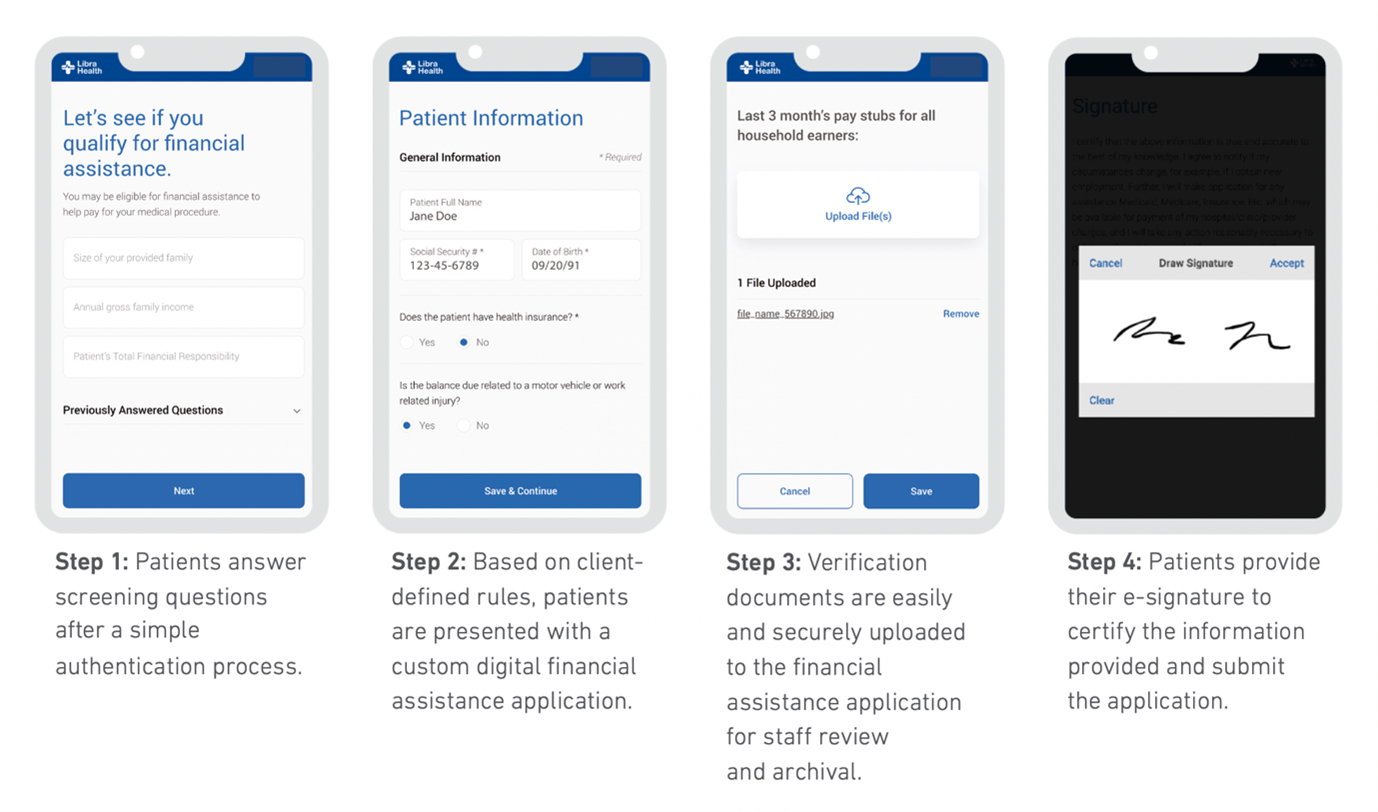

As Liao notes, many patients feel awkward or hesitant when discussing their financial situation with a stranger. Additionally, patients are increasingly looking for digital channels to handle their administrative tasks. Experian Health’s Self-Service Patient Financial Clearance option offers patients a simple and more private way to complete eligibility checks, whenever and wherever it suits them. Using a mobile and web-based platform, patients can fill out screening forms and upload supporting documents, then get real-time status updates without having to call up their providers. Information is stored securely so staff can check application status as needed.

How Self-Service Patient Financial Clearance works

Self-Service Patient Financial Clearance puts patients in control, so more individuals complete their applications and find out if they’re eligible for financial assistance. This frees up staff to focus on other revenue-generating tasks that require their attention. With a cost-effective, compassionate and convenient option on the table, is it time to say goodbye to paper-based presumptive charity checks?

Find out more about how Patient Financial Clearance helps providers reduce bad debt and improve the patient experience by quickly and correctly checking eligibility for charity care.