Price Transparency

Patient trust is influenced by transparent pricing. Discover how price transparency builds a better patient experience.

As 2020 draws to a close and headlines hint that the end might finally be in sight for the pandemic, the healthcare industry is considering COVID-19’s legacy. The sudden shift to contactless care, financial consequences of widespread social distancing measures and changing expectations of the patient experience have upended the world of healthcare and health IT – but which changes are here to stay? And what do these changes mean for the patient experience in 2021? We asked several leaders across Experian Health for their predictions in the areas of patient access, collections, and identity management, and here is a preview of what they had to say: “Patients will choose providers that give them control over their healthcare experience” Patients have more opportunity today than ever before to manage their healthcare experience from the comfort of their own home, whether that be through patient portals, online self-scheduling and registration or online payment tools. As lockdowns and social distancing prevented patients from presenting in person, providers were forced to offer patients with more options for self-service. Unsurprisingly, this was a move a lot of patients have been waiting for and many welcomed this new technology with open arms. Jason Kressel, senior vice president of consumer products and analytics at Experian Health, expects that, as patients become more accustomed to this level of self-service, more than half of consumers will change providers in favor of one that offers premium digital healthcare services: “Providers who can meet patients where they are—through web-based services and via their mobile devices—will have the most success with retaining and attracting patients.” Online self-scheduling can put patients in the driver seat while also avoiding unnecessary contact while many remain cautious about on-site visits. With access issues removed, the patient experience will improve, in turn improving health outcomes (and providers’ bottom lines!). “With hospital finances on shaky ground, collections will be a top priority for survival” As COVID-related unemployment leads to an unstable insurance landscape, many providers are worried about maintaining effective collections processes, and they cannot afford to spend time chasing payments. Guarding against uncompensated care and tightening up the collections process will be essential. Automated collections software can help collections teams focus their efforts on patients who are most likely to pay, while also helping patients manage their financial obligations with as little stress as possible. Providers can also quickly determine which patients qualify for financial assistance, helping them get them on the right payment pathway for their circumstance without delay. Not only will this provide a much better patient financial experience, it’ll prevent “lost coverage” and allow providers to collect a larger portion of dollars owed. “The surge in portal usage means providers need to watch out for fraudsters” What does the rapid growth in portal uptake mean for data security? The speedy rollout of telehealth and other digital services has exposed security concerns for many providers, who fear a rise in fraudulent activity in 2021 as cybercriminals sniff out opportunities to steal patient data. To protect patient information and avoid costly reputational damage, providers must adopt more sophisticated identity management solutions. By combining cutting edge identity proofing, risk-based authentication and knowledge-based questions, providers can more easily verify a patient’s identity when they log on to their portal, greatly eliminating the risk of fraud. Interested in learning more about other trends that could affect the patient experience moving forward?

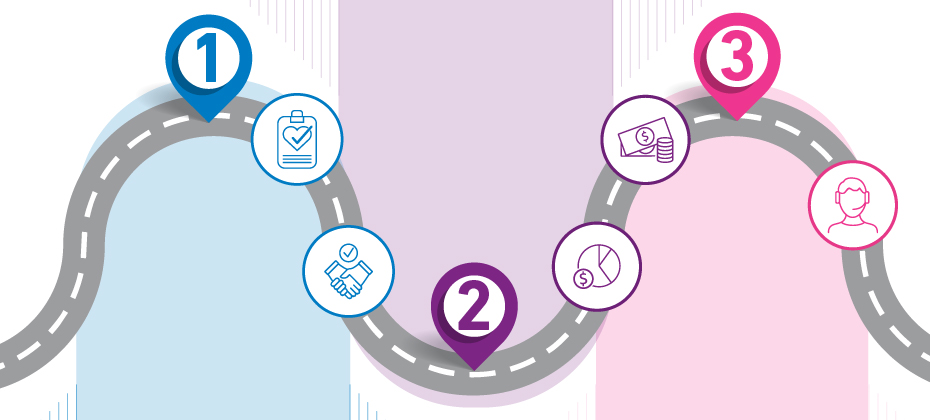

How did Starbucks lose $1.2 billion in sales during the pandemic, but still exceed revenue expectations in the last quarter? The answer lies in contactless mobile payments. By making it possible for coffee lovers to pre-order and pay for their morning cappuccino through a mobile app, the company was able to offer a safe and convenient slice of normality during the pandemic. While stores were limited to drive-thru and takeout, customers could still get their caffeine fix, but in an easy, socially distanced way. And customers want convenient and contactless ways to pay – as evidenced by $6.2 billion in quarterly sales. Thanks to the app introduced a few years ago, the company has been able to withstand much of the disruption that’s hit the rest of the industry hard. Can healthcare providers learn from Starbucks’ strategy? Yes. Social distancing measures and fears about face-to-face contact are preventing many patients from visiting healthcare facilities and it’s becoming harder for providers to collect payments and maintain a steady revenue cycle. Self-service and contactless payment methods are now a necessity if providers want to remain profitable during these uncertain times. But it’s not just about facilitating payments in the context of social distancing. Even before the pandemic, patients were looking for more convenient ways to manage their out-of-pocket expenses and thinking more like active consumers than passive participants in their healthcare journey. Starbucks’ story shows how prioritizing the consumer experience wins out in the end. So how do providers accelerate collections, ensure patients and staff remain safe, and keep up with consumer expectations? Here are three ways to use pre- and post-service online and mobile payment tools to optimize both collections and consumer satisfaction: 3 ways to improve the patient financial journey with easy contactless payments 1. Empower patients with upfront payment estimates Imagine sending patients an email or text as soon as their appointment is scheduled, with a personalized cost estimate, relevant payment options and convenient ways to pay before they even arrive. Healthcare payments could be as easy as ordering and paying for a coffee! With Patient Financial Advisor and Patient Estimates, providers can do just that. With a single text message, providers can give patients transparency, control and reassurance about what they’re going to owe and how they can settle their bill quickly and easily. 2. Help patients find the right payment plan The pandemic means finances are tighter than usual for many families as well as many organizations, so helping patients manage their bills and get on the right plan pre-service is especially important. With a consumer-friendly online portal, patients can check their balances, manage payment plans and apply for financial support at the tap of a button. Quicker insurance checks will also increase the likelihood of faster payments and minimize the risk of claim denials for providers. 3. Make it easy to pay – before or after treatment Reducing friction at the point of payment is probably the biggest dial-mover when it comes to accelerating collections. If patients can settle their bill at the click of a button, the job is ticked off quickly without too much effort on their part, and with minimal input from providers taff. Why make paying harder than it needs to be? Consider offering patients safe and secure digital payment methods that they can access anytime, anywhere, both before and after their appointment. Post-service, maintain a positive consumer experience with proactive follow-up, timely account information and options to navigate payments from home, if not already settled. The pandemic has intensified the need for healthcare payments to evolve. Contactless and mobile payments can keep revenue coming in the door (even when the real doors are shut). And as Starbucks has shown, consumers expect easier ways to pay. Every day that a patient struggles to pay a bill is a missed opportunity for the bottom line. Find out more about how pre- and post-service contactless payments could help your organization withstand financial turbulence, during the pandemic and beyond.

With high-deductible health plans, larger out of pocket costs, and confusion about medical costs in general, it’s no surprise that patients today face increased financial responsibility. Unfortunately, the current pandemic has introduced an entirely new level of financial responsibility and uncertainty for both patients and providers. Like many provider organizations across the country, Yale New Haven Health was feeling the impact of the changing healthcare landscape. Patients are finding it harder and harder to pay their medical bills, and more accounts are going to debt. The organization obviously needed to be compensated for their services and improve collections, but it needed to do so in a way that matched its mission and vision of providing high value, patient-centered care. A few years ago, Yale New Haven Health turned to Experian Health to improve collections with an elevated patient experience. With Experian Health’s Collections Optimization Manager, Yale New Haven Health was able to score and segment patient accounts based on who has the propensity to pay, determine how a patient could best resolve their bill and then direct them to the appropriate resources for doing so. The organization supplemented this activity with PatientDial, a cloud-based dialing platform that offers inbound and outbound communication options to increase collections. While these efforts have improved collections for the organization in the past, they have proven invaluable for both the revenue cycle and the patient experience during COVID-19. Increased patient satisfaction. A billing indicator was included for patients that might be experiencing financial hardship as a result of COVID-19, allowing the organization to hold that particular billing statement for 90 days. After 90 days, those accounts were again reviewed and evaluated for charity care as necessary. Patients have been grateful for the extra time and flexibility for payment during such a stressful event. Continued collections. With these steps in place, Yale New Haven Health was able to maintain the regular daily statement production and movement of accounts through the revenue cycle for those not experiencing COVID-related hardship. The additional revenue supported the institution and helped to maintain collection levels as close to normal as possible during uncertain times. Improved communications. Even with the 90-day delay for select accounts, call campaigns with PatientDial continued throughout the pandemic. Connection rates have increased by 5.5% month over month from January to present. Patients are not only pleased with the communications over balances due but are more receptive to attempts to resolve debt as the organization has approached billing-related communications in a more empathetic manner.

A consumer-first healthcare revolution has been simmering for years. Despite efforts to create more human-friendly services, the industry still lags behind other consumer-centric sectors. Patients want healthcare to be simple, convenient and on-demand, but a persistent lack of coordination, accessibility and affordability leaves many struggling to navigate the healthcare landscape with ease. Is this about to change? Has COVID-19 flipped the switch? The pandemic has prompted people to engage with their own care in a way the industry hasn’t seen before, with a surge in telehealth and virtual care. Infection-control forced much of the patient journey online, while providers were pushed to find new ways to communicate quickly and clearly. Now, those with an eye on the road to post COVID-19 financial recovery are optimizing these digital strategies to meet new consumer expectations and improve patient loyalty. Embracing digital technology and automation throughout the entire patient journey will be key to patient acquisition and retention. Where should providers focus first? 4 consumer-led strategies to keep patients loyal 1. Prioritize convenience across the entire consumer experience Eighty percent of patients would switch providers for convenience factors alone – ranking ‘convenient, easy access’ ahead of insurance coverage and quality of care. Creating a digital experience that gives patients the flexibility and simplicity they desire should be priority number one in any patient loyalty plan. Providers can start by reviewing their digital platforms. Encourage patients to use their patient portal to access information, book appointments and manage their healthcare when appropriate. Telehealth and virtual care solutions can be future-proofed with reliable identity protection, so patients can safely access care from home and not worry about cumbersome log-in procedures. 2. Make patient access…accessible The patient experience shouldn’t begin with time-consuming forms, long waits and error-prone manual intake processes. Rather, providers can make it easy for patients to complete as many tasks as possible BEFORE they set foot in the office by automating patient access. Online patient scheduling lets patients book, cancel and change appointments online – which 77% of patients say is very important. It has the potential to reduce delays and no-shows, and can minimize the administrative burden for provider staff. While patients remain concerned about the risk of infection during COVID-19, providers can ease their concerns by reducing face-to-face contact with online pre-registration. 3. Respond to affordability and pricing pain points One Experian Health study found that the top pain points in the consumer journey center on the financial experience, from shopping for health insurance to understanding medical bills. Patients may be unsure what their insurance covers, whether their deductible has been met and whether they can afford the out-of-pocket costs. By providing clear, upfront pricing information about coverage and financial responsibility, providers can protect their patients from unnecessary surprises and reduce the risk of missed payments. Self-service patient payment tools can simplify the payment process too: patients can settle their bills anytime, anywhere, and get advice on financial assistance and best-fit payment plans. 4. Personalize the patient experience from end to end A one-size-fits-all approach doesn’t cut it anymore. Patients are looking for communications and services tailored to their individual needs. That used to be both technically and logistically impossible, but not anymore. Providers today can use comprehensive data and analytics to personalize the entire healthcare journey, from customer relationship management to patient collections. By combining automation, self-service tools and accurate insights into the patient’s circumstances, providers can help consumers make better decisions about their care and how to pay for it. To ensure data reliability and integrity, providers should consider partnering with a trusted data vendor, who can translate robust, multi-source consumer and financial data into a competitive consumer experience. There is no question that COVID-19 has changed the way we do healthcare, but the industry is perfectly posed to harness the change in consumer behavior and shift towards greater patient engagement. By bringing together a myriad of digital tools, providers can create a healthcare experience that’s convenient, compassionate and in line with consumer expectations. Interested in learning more about how we can help your organization welcome new patients through its digital door, and boost loyalty among existing patients?

Few of us would buy a new car or TV without checking the price tag first. Why should our healthcare be any different? Yet this is exactly what many patients are forced to do when they need medical tests or treatment. Following the breadcrumbs on a provider’s website is a time-consuming and confusing way for patients to piece together a price estimate. Even with a rough idea of the cost of care, variations in health plan pricing often bump up the final bill. The lack of transparency is stressful for patients and costly for providers, who end up chasing slow payments and losing revenue to bad debt. But could things be about to change? Many providers have been proactive in offering transparent pricing, and thanks to recent regulatory changes, this could soon be an industry-wide requirement. The CMS Price Transparency Final Rule mandates that by 1 January 2021, hospitals should publish consumer-friendly pricing information on certain ‘shoppable’ services, to help patients understand and plan their bills ahead of time. The proposed Health PRICE Transparency Act would similarly compel providers to publish real cash prices alongside rates negotiated with insurers. As households, businesses and public bodies grapple with the economic impact of COVID-19, any additional clarity around pricing that could help make a dent in healthcare-related debt is to be welcomed. Liz Serie, Director of Product Management and Patient Experience at Experian Health, says that regardless of changes to the regulatory landscape, pricing transparency is here to stay: “It’s great for the patient because they have visibility, transparency and clarity about what they owe. They can prepare financially before their visit, so they can focus on what matters most – healing. Providers are excited about price transparency tools because they let patients pick and plan payment options, reducing the total cost to collect. And with more reliable billing data, it’s a win from a decision-making perspective too.” Transparency is becoming the norm in other aspects of healthcare consumer experience, and billing should be no different. 4 steps to fast and simple patient-friendly pricing 1. Remove the guesswork with accurate, upfront pricing estimates No one wants to play detective with their deductibles. Giving patients pricing information upfront puts them in control of their payments, improving their engagement and increasing the likelihood of faster collections – a top priority for providers today as they continue to feel the effects of COVID-19 on the bottom line. A Patient Estimates tool can generate accurate, easy-to-understand estimates based on known treatment costs, payer rates and real-time benefits data. Estimates and secure payment options can be sent straight to the patient’s mobile device, improving the patient financial experience with a single text message. 2. Give patients 24/7 control through their online portal With COVID-19 pushing even more of our lives online, a 24/7 patient portal is a must for providers that want to stay competitive. Yale New Haven Health (YNHH) used PatientSimple to give patients a mobile-friendly, self-service portal through which they can generate price estimates, choose payment plans, and monitor payment information. Sharlene Seidman, Executive Director Corporate Business Services at YNHH says patients have welcomed online access: “ROI is not just tangible dollars in additional revenue, it’s patient satisfaction and improving the financial experience.” 3. Minimize delayed payments with quicker insurance checks Millions of Americans have experienced sudden job losses or changes to their insurance status in the wake of the pandemic, causing confusion about their current coverage. Payment delays and denied claims are an inevitable side-effect. Providers can help by offering fast, automated insurance eligibility verification, so patients can confirm coverage at the point of service and take the next steps with confidence. 4. Move to mobile for a more convenient patient experience Imagine if your patients could have all the information they need about their healthcare account, right there in their pocket. Patient Payment Solutions offer real-time pricing estimates based on provider pricing, payer rates and benefit information, so patients can review their bill at a time and place that suits them. There’s also the option to offer secure and contactless payment methods, so they can settle their bill at the click of a button. Estimates suggest that the average family of four could save up to $11,000 a year if they had the option to choose care on the basis of more transparent pricing. Savings on this scale mean that demand for clear information about out-of-pocket expenses is going to soar, whatever happens with price transparency regulations. Learn how Experian Health can help your organization support patients and improve collections through more transparent pricing.

The regulatory requirements for price transparency are in full effect. The Centers for Medicare and Medicaid Services (CMS) is moving forward with the OPPS Price Transparency Final Rule (CMS-1717-F2), which states that hospitals must provide transparency that will help consumers understand medical costs and make informed decisions. At this point, it is recommended that hospitals begin to form a strategy for price transparency. The concept behind price transparency is simple: provide transparency that will help consumers understand medical costs and make informed decisions. Experian Heath's commitment is simple: provide solutions that benefit the patient and the provider, that improve collections and patient satisfaction. Discover how Experian Health can help you succeed with price transparency.

With so many complexities surrounding deductibles, premiums, copays and more, consumers sometimes struggle to understand the financial components of their health plans and are often unaware of the out of pocket for their healthcare needs. Recognizing that confusion about healthcare costs can make it difficult for consumers to ask the right questions, define priorities and take a more active role in their healthcare, Silver Cross Hospital made a point to educate and provide its patient base with health care estimates prior to service being rendered. With the Self-Service Patient Estimates tool from Experian Health, patients of Silver Cross Hospital now have a consumer-friendly, easy-to-use and accessible path to obtain out of pocket cost estimates. The Self-Service Patient Estimates tool works both with the hospital’s electronic medical record (EMR) and as a standalone tool for the community to use when needed. Integrating with Silver Cross Hospital’s EMR, the solution calculates estimates based on the hospital’s charge master pricing information and payer contracted rates and utilizes each patient’s individual eligibility and benefits information to create specific out of pocket costs. The tool also allows for detailed and accurate estimate creation using historical claims data to determine the typical procedures and related charges to generate average out of pocket cost estimates by health plan. Accessible via the hospital’s website, the tool acts as a digital front door in the patient exploratory process. Patients can obtain an out-of-pocket estimate any time of day or night, and as part of the process are then connected to the next place of service, whether that be to schedule an appointment, ask additional questions or obtain more information. Since implementing Patient Estimates, Silver Cross Hospital has: Increased point of service (POS) collections by bringing more awareness and education of out of pocket costs to patients upfront Reduced inbound calls and queries to the organization regarding cost estimates Integrated the solution into scheduling and pre-registration workflows within the EMR Reduced time spent training staff on other systems or workflows Learn more about Patient Estimates and how we can help create accurate estimates of authorized services for patients before, or at the point-of-service. “Patient Estimates acts a great digital front door for Silver Cross Hospital, facilitating that first step in the patient exploratory process.” – Miguel Vigo IV, Administrator Director Revenue Cycle, Silver Cross Hospital

Medical expenses are often a source of anxiety for many patients, whether they are unsure about the amount owed or how they’ll ultimately pay for it. Unfortunately, intimidating collections processes don’t help, and a crisis like COVID-19 only exacerbates this stress. A more compassionate billing approach could help patients better navigate their financial obligations and also build long-term loyalty—a necessity for providers today looking to retain patient volume during a time of crisis. Consumers overwhelmingly want to understand the cost of healthcare services, prior to services being performed. Effective price transparency involves offering patients clear, accessible, and easy-to-understand estimates of their financial responsibility for services before they are performed. Give patients clarity from the start with precise pricing estimates and up-front info about what they’ll have to pay can reduce sticker shock, help them plan and create an overall better patient financial experience. By empowering your patients with financial expectations, their feeling of control increases, improving their engagement and the likelihood that you will collect payments faster and more efficiently. Just as you don’t provide identical medical treatment to every patient, processing all patient accounts the same way doesn’t make sense. Every patient is different. Using comprehensive data and advanced analytics, providers can better understand an individual's propensity to pay and make the payment process a positive one by assessing and assigning each patient to the appropriate financial pathway based on their unique financial situation. Medical bills are often the most direct contact providers have with patients after a service is rendered. Unfortunately, money is often a sensitive topic for patients and statements are often overwhelming and difficult for patients to read. Tailoring communications at each stage can convey compassion and increase patient satisfaction. Customizing patient statements gives providers the ability to simplify and customize bills quickly and easily, turning an often confusing process into one that adds value. Including relevant, personalized messages and educational updates can turn billing statements into a useful resource, all with the potential to drive revenue. In addition to offering personalized payment options, providers can also find out whether a patient prefers to discuss billing by phone or email. Minimizing friction at the point of payment is crucial to fostering compassionate collections. Providers should offer flexible options that include in-person, telephone, mobile and online patient portals, so they can pay in a way that’s most convenient for them. This also frees up staff to help those patients who may need a little extra help understanding their statement. Want to learn more? Check out Experian Health’s Collections Optimization Manager which helps providers segment patients based on an individual’s propensity to pay and payment preferences, informing a compassionate patient engagement strategy and improving collections.

For many patients, unanticipated healthcare bills are up there with car breakdowns and untimely home repairs. No one likes a surprise bill. But when your washing machine is on its last legs, you probably do a bit of shopping around to find the best price for a replacement. Are patients doing the same when it comes to their healthcare provider? This is the idea behind recent industry and legislative moves to improve price transparency in healthcare. Recognizing that surprise billing leaves patients feeling stressed out and anxious, lawmakers are working to find a solution that would end ‘balance billing’, where patients are billed the difference between what providers charge and what insurers will pay. These bills often come as a shock, firstly, because the patient didn’t expect the bill in the first place and secondly, because the complexities associated with healthcare expenses create opacity around the actual cost of care. How transparent pricing builds a better patient experience In theory, an end to balance billing in favor of more transparent pricing should improve the patient financial experience. The hope is it leads to more competition and therefore better choice and quality overall. CMS Administrator, Seema Varma, says: "We want to empower consumers and patients to shop around for their health care and pick the provider that works best for them." However, some believe patients don’t yet think of healthcare providers in the same way as other consumer goods. Larry Levitt, Executive Vice President of Health Policy at the Kaiser Family Foundation says: “Most patients don’t think of healthcare as something you can shop around for, and there’s not much incentive when you don’t foot most of the bill directly.” Still, many healthcare organizations are on board. Giving patients greater clarity through more accurate pricing estimates and proactive communication about who pays what should reduce sticker shock, creating a better patient experience. Patient collections are likely to be a smoother and more cost-effective process, while consumer loyalty will be reinforced. All in, transparent pricing is an increasingly useful strategy to improve revenue alongside patient satisfaction. So, how should providers be using transparent pricing to improve the patient experience? How to use transparent pricing to build a better patient experience 1. Provide proactive pricing info to patients Don’t leave your patients to be surprised. Let them know upfront what the cost of treatment is going to be, including their coverage status, so they can plan ahead with confidence instead of heading into treatment with no clue as to what their final bill will be. Digital platforms can help you make this a seamless experience. A text-to-mobile solution such as Patient Financial Advisor gives patients a personalized and simple-to-read cost estimate prior to their healthcare visit and secure links to their bills so they don’t have to chase your collections team for updates. 2. Create a personalized payment experience Transparent pricing isn’t just about providing accurate estimates pre-service. It’s about seeing each patient as an individual with different circumstances, needs and preferences. A price transparency tool can reveal valuable insights about a patient’s specific situation and propensity to pay. With that, you can tailor the information you give them, the way you communicate and any payment plans you might want to recommend. For example, let’s say a patient is due to have an MRI, which will cost $650 with their high deductible health plan. For many, that’s a lot of money. Imagine how much less stressful the experience could be if you’re able to text them in advance to let them know what they owe and give them flexible payment options to manage the cost. 3. Make it easy for patients to pay One simple way to improve collections is to make the payment process as accessible and frictionless as possible. Patients have come to expect a similar consumer experience to what they’d get with online banking, booking travel or online grocery shopping. With the data-driven technology available today, it’s entirely possible for providers to deliver this. Self-service dashboards and tools are a way for patients to see what various procedures might cost and pay their bills whenever is most convenient. These can let patients apply for charity care, update their insurance details and even schedule appointments, giving them greater financial confidence and control over the process. Find out more about how to set up personalized and compassionate pricing estimates and payment options.