Providers can improve the customer experience and bottom line with the power of data and analytics.

Introduction

In an increasingly competitive and consumer-driven healthcare marketplace, it’s no surprise that providers are working harder to acquire and retain customers. Higher out-of-pocket expenses combined with more choice and control in when and where consumers receive care are driving more retail-like shopping behavior.

As a result, healthcare organizations are looking for ways to slow or stop customer churn, drive audience engagement, and redefine how they interact with their customers instead of seeing them through a clinical transactional lens. Providers understand that they must deliver a positive overall experience to maintain a favorable brand in the community and earn customer loyalty, key factors in maintaining their financial solvency.

While there are many facets to consider in providing customers a great experience during their healthcare journey, there hasn’t been much attention paid to the intersection between the clinical and financial sides of this experience.

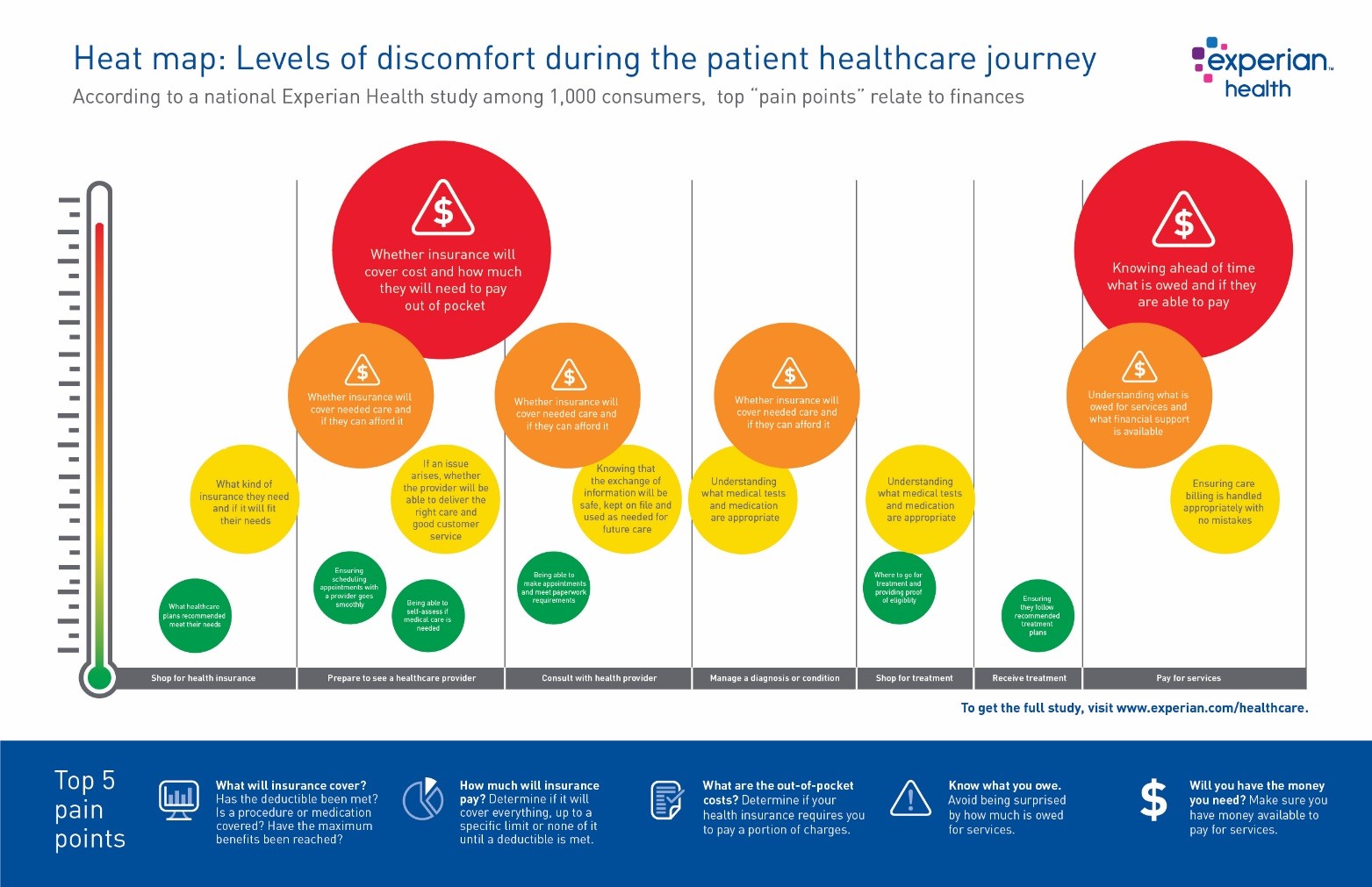

According to findings from an Experian Health study among 1,000 consumers and select providers, the greatest pain points and opportunities for improvement around the complete customer healthcare journey center on the financial aspects, from shopping for health insurance to understanding medical bills.

This means organizations that want to meet the new demands of consumerism in healthcare and improve the holistic customer experience must address the end-to-end revenue cycle.

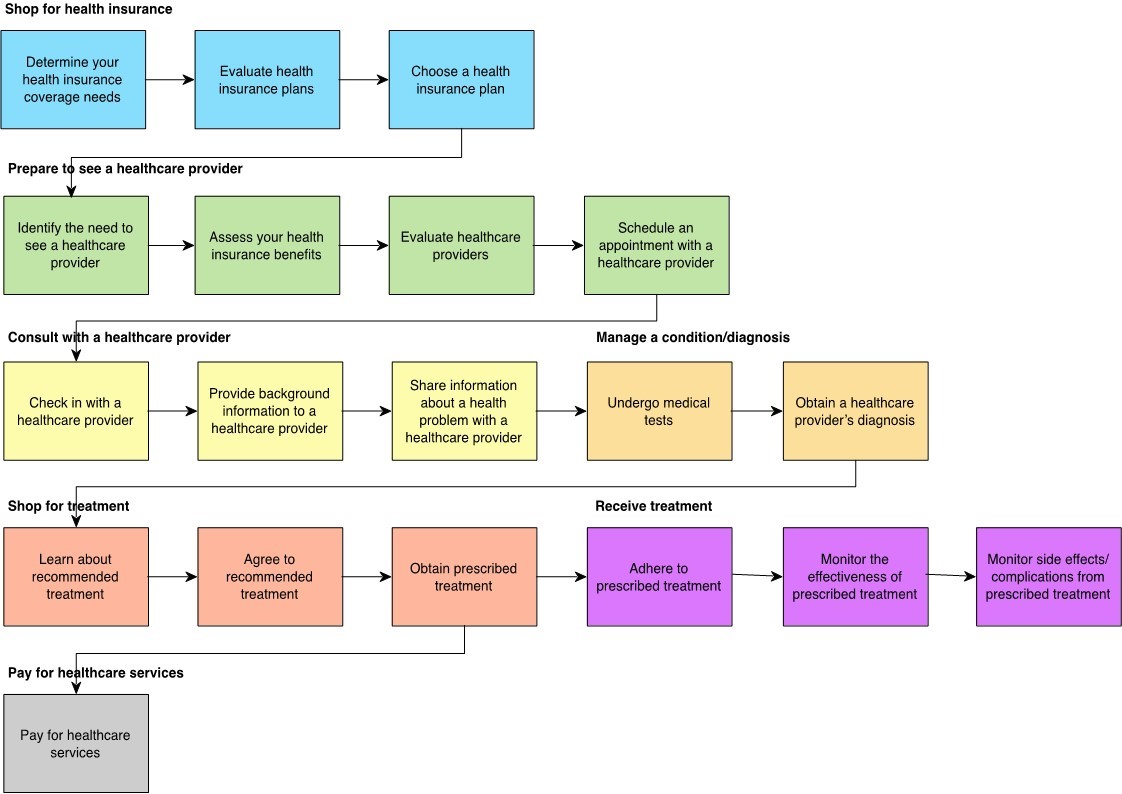

Typical consumer healthcare journey*

*Consumers revealed 137 “jobs” or “needs” associated with their healthcare experience, with varied levels of importance, difficulty and satisfaction.

Money matters give consumers high levels of discomfort

Using a “jobs to be done” methodology, qualitative insights were gleaned as to the jobs, or microtasks and decisions, consumers associate with a healthcare journey.

Despite the staggering number and complexity of different “jobs” consumers must undertake just to access the care they need, patients’ biggest dissatisfaction centers on the process of paying for their care. Of all the activities included in a consumer’s healthcare experience — from acquiring health insurance to making appointments with providers to receiving treatment — the top “pain points” relate to money matters.

- Specific issues for patients surveyed include:

- Understanding how much is owed for services and if the amount is a fair market price

- Making sure they have money available to pay for services

- Determining what financial support is available (e.g., a payment plan)

- Ensuring that what is owed to the provider is accurate

- Understanding the amount covered by their health insurance

Providers also feeling the sting from unpaid collections, lack of customer service

The most glaring opportunity for improvement in the patient experience comes early in the journey — price transparency. Patients are understandably confused about what their health insurance covers. They can’t always understand medical bills, and they have difficulty finding out how much their out-of-pocket charges will be and what payment options are available to them. Providers are also suffering — from unpaid collections, low customer satisfaction levels and an inability to address issues holistically. Here’s what providers had to say:

- We’re addressing the patient experience in one-off initiatives. Help us holistically improve the end-to-end patient journey. Providers said key impediments to progress include lack of clear and consistent prioritization, significant interoperability issues, and complicated organizational structures. They are frustrated by how hard it is to execute holistic changes efficiently.

- We need to measure our customer experience better. We want to standardize an approach that will drive progress and impactful change. Providers don’t have a clear path to move from customer experience as a concept to a measurable discipline. It’s a priority for them, but few are using a measurement system they feel is helping them understand and improve their patient experience.

- Patients are suffering, in part due to a lack of understanding of their charges. We want to set better expectations and make the charges and the value of our services easier to understand. Rising patient responsibility and the proliferation of high-deductible health plans drive the desire for full transparency in costs. Managing expectations at each step is crucial to providing the most accurate information to the patient.

- We’re not equipped to address customer acquisition and loyalty. Help us efficiently attract more consumers and keep them with us long-term. The focus has always been on healing people, with less attention to the business and marketing aspects of providing care. Providers need to focus efforts on acquisition and loyalty, but they’re generally understaffed and lack the skills to do so.

There’s no doubt that healthcare organizations want to evolve and are thinking differently about how they deliver services and the value associated with those services. Ultimately, those that see driving customer engagement and redefining how they interact with their customers as a necessity, rather than a luxury, will succeed.

Revenue cycle solutions for today’s consumerism environment

Where to start? Key areas that can be addressed in the healthcare financial journey include:

- Comprehensive data – One of the core components of a patient-centric revenue cycle begins with the ability to use reference data to address duplicate medical records, understand a patient’s propensity to pay and identify social determinants of health. Incorporating this type of outside data into the revenue cycle won’t just create better patient experiences from the moment patients begin interfacing with staff, it will also optimize revenue for health systems while enabling a revenue cycle that puts the patient at the center of care.

- Patient identification – As hospitals must now deal with hundreds of thousands of electronic patient records, spanning multiple systems and departments, the traditional technologies for managing patient information are no longer sufficient. Using sophisticated matching technology and outside data sources can improve patient identification and prevent duplicate or overlapping records that result in inappropriate care, redundant tests and medical errors — as well as improving data accuracy for clinical, administrative and quality improvement decision purposes.

- Insurance reconciliation – Organizations can use automated technology to monitor claims data, real-time eligibility and benefits information, payer contracts, and charge description master (CDM) information to ensure that payers are meeting their obligations fully and achieve accuracy and transparency in healthcare costs. Closing the gap in payer contracts and reimbursement allows organizations to focus on providing transparent cost estimates throughout every patient’s continuum of care and helps patients know their costs so they are better prepared to pay them.

- Price estimates – Providing accurate patient estimates is quickly becoming the norm for health organizations. But to ensure patient satisfaction rates are being met, health organizations need to empower patients with a frictionless financial experience. By incorporating credit data into the patient billing process, health organizations can enable a people-first product design to price transparency and collections that extends benefits to more people by understanding the unique financial needs of each patient.

- Self-service portals – One way to engage patients is with an online and mobile-optimized experience that’s proactive, smooth and compassionate to empower patients to set up payment plans, apply for financial assistance, estimate the cost of care and review insurance benefits.

Conclusion

With so much to consider when addressing the evolving patient/customer journey, providers are well-served to start by improving their customers’ financial experience. As the link between customer satisfaction and a health organization’s revenue continues to grow, efforts to create a better financial experience are crucial. Using comprehensive data and analytics to power the revenue cycle and customer relationship management initiatives will allow health systems to encompass the end-to-end customer journey to ensure streamlined operations, measure and improve performance with payers, and provide accurate insights into each unique customer and their needs.

The key to establishing this customer-centric mindset is embracing the power of data and analytics. From offering access to automated, personalized tools to providing price estimates to informing about charity aid options and offering payment plans — all these innovations help customers feel they can make better decisions about their care and how to pay for it. The result is more satisfied customers and an improved bottom line for providers.