For Michael Smith, it all began with seemingly innocuous text messages from a PA University Hospital, indicating a wait time for an emergency room visit. A peculiar situation for someone who no longer resided in Philadelphia and hadn’t used the hospital system for years. Initially dismissing it as spam, Mike’s skepticism deepened when a hospital staffer named Ellen reached out to discuss diagnostic results from an ER visit, he never made.

The revelation was unsettling – someone had registered with Smith’s name, and the lack of ID verification raised eyebrows. While the recorded name and date of birth were accurate, the address associated with the account was outdated. A discrepancy that hinted at a more insidious problem.

Undeterred, Smith took matters into his own hands. Following an unsatisfactory conversation with the hospital’s billing department, he penned a letter to the privacy officer, expressing his concerns about potential fraud. In his words: “I think there’s something going on, that someone is using my information, and the visit and the charges appear to be fraudulent.”

Smith’s proactive approach sheds light on a crucial aspect of dealing with medical identity theft – swift and assertive action. As cyberattacks on healthcare institutions escalate, individuals must be vigilant in protecting their personal data.

Everyone shares the burden

Whether enrolled in employer-sponsored health insurance or securing coverage through HealthCare.gov, or the individual market, instances of healthcare fraud invariably translate into heightened financial burdens for consumers. Such malfeasance results in elevated premiums and increased out-of-pocket expenses, often accompanied by diminished benefits or coverage. In the realm of employers, both private and governmental entities, healthcare fraud escalates the costs associated with providing insurance benefits to employees, consequently raising the overall operational expenses. For a significant portion of the American population, the augmented financial strain stemming from fraudulent activities could be the decisive factor in realizing or forgoing health insurance.

Yet, the financial ramifications are merely one facet of the impact wrought by healthcare fraud. Beyond monetary losses, this malpractice carries a distinctly human toll. Individual victims of healthcare fraud are distressingly prevalent, individuals who fall prey to exploitation and unnecessary or unsafe medical procedures. Their medical records may be compromised, and legitimate insurance information can be illicitly utilized to submit falsified claims.

It is crucial not to be deceived into perceiving healthcare fraud as a victimless transgression, as its repercussions extend far beyond financial considerations, undeniably inflicting devastating effects.

Healthcare fraud, like any fraud, demands that false information be represented as truth. An all-too-common healthcare fraud scheme involves perpetrators who exploit patients by entering into their medical records’ false diagnoses of medical conditions they do not have, or of more severe conditions than they actually do have. This is done so that bogus insurance claims can be submitted for payment. Unless and until this discovery is made (and inevitably this occurs when circumstances are particularly challenging for a patient) these phony or inflated diagnoses become part of the patient’s documented medical history, at least in the health insurer’s records.

How does medical identity theft happen?

Medical identity theft involves someone using another patient’s name name or insurance information to receive healthcare or filing fraudulent claims, posing significant financial and health risks. It can result in bills for procedures the patient has never had, inaccurate medical records, and potentially life-threatening care. Common ways it occurs include database breaches, improper disposal of records, phishing scams, insider theft by healthcare professionals, and theft by family members.

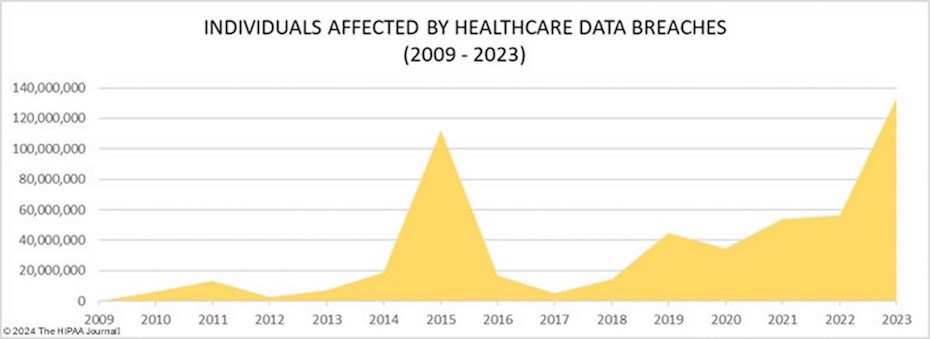

Data breaches in healthcare have reached alarming levels, with the Office of Civil Rights reporting 725 notifications of breaches in 2023, where more than 133 million records were exposed or impermissibly disclosed. Social engineering poses a threat to individual Medicare beneficiaries, but healthcare providers also face risks from ransomware attacks, hacking, and employee errors. Hacking constitutes the dominant threat, accounting for 75% of reportable breaches.

Regardless of how health data is exposed, be it through individual identity theft, hacking attacks, or unintended sharing, any disclosure of payment information increases the risk of healthcare fraud.

Protecting patients and improving their experience

To prevent medical fraud and ensure eligibility integrity, here are some steps healthcare organizations can take:

- Implement robust verification processes: Develop and enforce strict protocols to verify patient eligibility and review supporting documents. This includes verifying insurance coverage, confirming the patient’s identity, and validating their relationship to the covered individual (e.g., spouse, dependent).

- Stay updated with legal and regulatory requirements: Stay informed about the latest laws, regulations, and industry guidelines related to medical eligibility and fraud prevention. This could include understanding requirements for reporting changes in eligibility status and keeping up with best practices recommended by regulatory authorities.

- Train staff on fraud prevention: Provide comprehensive training to all staff members regarding medical fraud prevention, eligibility verification procedures, and red flags to look out for. Staff should be educated on relevant laws and regulations, as well as proper documentation practices.

- Conduct regular internal audits: Regularly review patient records, claims, and billing processes to identify any inconsistencies or irregularities. Internal audits can help detect potential fraud and ensure compliance with eligibility requirements.

- Utilize technology and automation: Implement healthcare management systems or software that incorporate automated eligibility verification processes. This can help streamline and improve accuracy in eligibility determinations, reducing the risk of fraudulent benefits being provided.

- Encourage patient engagement: Educate patients about their responsibilities in maintaining accurate eligibility information. Promptly notify patients about the importance of reporting changes in their circumstances (e.g., marital status, employment status) that may affect their eligibility for medical benefits.

- Report suspicious activity: Train staff to recognize and report any suspicious activity or potential fraud. Establish clear reporting channels within your practice and encourage a culture of transparency and accountability.

- Stay vigilant: Stay alert for emerging trends, schemes, and new types of medical fraud. Regularly review industry updates, attend relevant workshops or seminars, and participate in fraud prevention initiatives to stay informed about evolving threats and prevention strategies.

By implementing these measures, healthcare organizations can help safeguard their medical practices against medical fraud and preserve the integrity of eligibility determinations.

Finding the right partner

Healthcare fraud is a serious crime that affects everyone and should concern everyone—government officials and taxpayers, insurers and premium-payers, healthcare providers and patients—and it is a costly reality that can’t be overlooked. By taking steps to find the right partner along the way, providers are helping to protect the integrity of the nation’s healthcare system. Experian Health works across the healthcare journey to improve the patient experience, make providers more effective and efficient, and enhance and simplify the overall healthcare ecosystem.

Learn more or contact us to see how Experian Health’s patient identity solutionscan help healthcare organizations prevent medical ID theft.