Latest Posts

Despite the majority of elective procedures being up and running again, patients are still keeping their distance. Nearly half of Americans say they or a family member have delayed care since the beginning of the pandemic, while visits to the emergency room and calls to 911 have dropped significantly. Patients are avoiding care, but it’s not for the reason you’d expect. Beyond obvious worries about catching and spreading the virus, a second concern is becoming apparent: patients are fearful of the potential cost of medical care. With so many furloughed, laid off or losing their insurance coverage, medical care has become unaffordable for millions of Americans. It’s especially tough for those who fall into the coverage gap, where their income is too high to grant access to Medicaid coverage, but too low to be caught by the ACA safety net. If patients continue to delay care, it’s only a matter of time before their symptoms worsen, leading to more complex and expensive treatment or even risking their lives. For the hospitals and health systems with revenue levels at a record low, encouraging patients to return for routine care is a matter for their own financial survival too. The answer lies in making sure patients feel safe and comfortable both when they come in for care, and when they look at their financial responsibilities. 5 ways to ease the return to routine care 1. Reassure patients about safety measures before and during their visit Patients are understandably anxious about what their visit is going to be like. Will they have their temperature taken? What should they do if they have symptoms of the virus? Will seating areas be spaced out and sanitized? Pre-visit communications and proactive information on arrival will help them feel comfortable and eliminate the shock factor of seeing more stringent infection control measures. 2. Minimize unnecessary contact by shifting patient intake online From online scheduling and pre-registration to telehealth and contactless payment, there are many ways to keep face-to-face interactions to a minimum. Not only will this help reduce the spread of the virus, it’ll make the whole patient experience more convenient for patients. Exploring a virtual and automated patient intake experience can also free up staff to work on other tasks, thus also protecting the organization’s bottom line through efficiency savings. 3. Encourage patients back to care with automated outreach campaigns With so much uncertainty at the moment, patients may be unsure if it’s even appropriate to come in for routine care. Use automated outreach to prompt them to book appointments and schedule follow up care. A digital scheduling platform can help you set up text-based outreach campaigns, to reassure patients that it’s safe (and essential!) to come in for any overdue care – without placing any undue burden on your call center. 4. Provide price transparency before and at the point of service With healthcare experts pointing to financial worries as a major barrier to care, anything providers can do to improve the patient financial experience is an advantage. Price transparency is the first step. When patients have clear and accessible payment estimates upfront, they can plan accordingly and/or seek financial assistance as quickly as possible, reducing the risk of non-payment. 5. Screen for charity care eligibility with faster automated checks Once those payment estimates have been generated, the next step is to confirm whether the patient is eligible for financial support, in the event that they’re unable to cover their bill. Checking eligibility for charity assistance is a time-suck for patient collections teams, but with access to the right datasets, it’s a perfect candidate for automation. These steps become even more urgent as providers face the prospect of a ‘twindemic’ – or a surge in COVID-19 cases colliding with flu season. By avoiding delays to care, patients can avoid the need for more serious and expensive treatment further down the line, when hospitals are likely to be under even greater pressures. Contact us to find out more about how our data-driven, automated patient intake solutions can help make your patients feel as safe and comfortable as possible, both physically and financially.

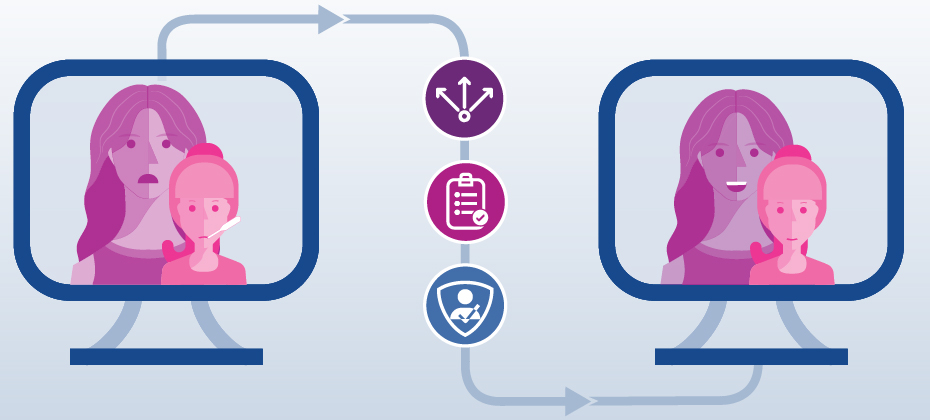

The rates for closing gaps in care are some of the most widely used, quantitative metrics to measure quality, allocate incentives, and control costs. Unfortunately, health plans face numerous obstacles closing gaps in care, from social determinants of health to inconsistent coordination of care, and don’t always have a care gap closure program in place. Thankfully, digital solutions like web-based scheduling and automated outreach can help health plans jump many of these hurdles while also helping to close gaps in care. Call center schedulingMany health plans are still grappling with the difficulty of three-way scheduling calls between themselves, members and providers. Calls are lengthy and cumbersome as agents dig through binders of provider schedules and scheduling rules to determine and book the right appointment for each member. Members are often put on hold, sometimes more than once, and are much more likely to drop out of the scheduling process entirely when faced with this experience. As a result, these members may face significant care delays, or in some cases miss their necessary follow-up care entirely. With web-based scheduling, member engagement call centers can eliminate three-way calls. Guided search helps to narrow down the right provider for each member and the scheduling platform allows for immediate, on-the-spot appointment selection. Health plans can more efficiently close gaps in care as members can quickly and easily schedule their appointments. This has proven to cut call times in half, and increase scheduling rates by 140%. To learn more, read this case study. Automated OutreachHealth plans typically have a list of individuals to follow up with on a regular (bi-weekly or monthly) basis to book whatever care service is needed to close the gap in care. Now, health plans have the ability to automate this outreach via interactive voice response (IVR) or text message (SMS) while simultaneously enabling members to schedule appointments on-the-spot, either through a link in the text or during the IVR call. The automation improves the member experience with convenient access and helps close more gaps in care – all without a single call center agent. The ultimate combination for closing gaps in careUsed alone, automated outreach and call center scheduling are both effective for closing gaps in care. When used together, health plans can fast track the path to closing gaps in care and further improve efficiencies. Members can first be reached via automated outreach, prompting the individual to schedule an appointment. This allows members the opportunity to self-schedule and essentially self-close their gap in care, without a single live agent phone call. From there, call center agents can pinpoint the members who didn’t schedule as part of the outreach campaign and then call them directly to book the necessary care. We know that despite the flexibility and convenience offered by digital solutions, like automated outreach, there are still individuals who prefer to schedule over the phone and have personal interaction when booking care. The combination of web-based scheduling and automated outreach enables omnichannel access for health plans while helping call center agents focus their attention on the members who need their help most. Contact us to learn more about how Experian Health can help health plans fast track the path to closing gaps in care.

The age of consumerism has been a catalyst in the shift towards patient-centered care, driving hospitals and health systems across the board to evaluate and improve their current methods of patient access. For one multi-specialty medical group, fast and easy access to care meant providing strategic tools for patients to use beyond the four walls of the organization and outside of the traditional hours of the practice. In order to provide a more flexible and convenient method to access care, CareMount Medical, the largest independent multi-specialty group in New York State, turned to Experian Health to enable online self-scheduling. With it in place, patients now have the ability to schedule an appointment online, across any specialty, any time of day or night. Providers’ scheduling protocols are automated within the solution to accurately match patients with the right provider and appointment based on care need. Those same protocols are also used to prevent overbooking, allowing providers to maintain close and comfortable control over their calendars. Improved call center efficiencies. Automated scheduling relieves call center staff of the associated administrative work, allowing more time for nurses and other credentialed staff to answer health questions and concerns over the phone. Increased patient acquisition and retention. In addition to attracting new patients, the solution has proven valuable for patient retention. Since implementation, the organization has seen on average 30 online appointment bookings per provider per month. Higher patient satisfaction. Patients are no longer required to call to schedule an appointment during office hours. This level of convenience gives patients more control over their day and has contributed to rising patient satisfaction scores for the organization as a whole. Continued Improvements. Real-time analytics and dashboards provide direct line-of-sight into scheduling activity, helping leaders at CareMount Medical to both identify areas for improvement and fine-tune the process to further improve online bookings. "Experian Health’s guided search and scheduling solution adds immediate benefits for our patients, supporting our commitment to provide our patients with cutting-edge technology in the convenience of their home." — Scott D. Hayworth, MD, FACOG, President & CEO, CareMount Medical Learn more about CareMount Medical's journey and how your organization can also improve patient access with patient scheduling from Experian Health.

Imagine if every time you wanted to sign up to buy groceries online, book a vacation, or apply for a job, you had to fill out a paper registration form. For 21st century consumers who are accustomed to sleek digital and self-service experiences in industries such as retail, travel and banking, such an antiquated and cumbersome process seems unthinkable. Unfortunately, when it comes to healthcare services, we don’t have to use our imagination. Too often, we’re still required to fill out time-consuming, repetitive and tedious forms before accessing services. For providers who want to stay competitive, the long waits and wasted time that arise from paper-based registration system do nothing to win consumer loyalty. And on top of the disappointing patient experience, manual intake processes often lead to delays and errors that can disrupt the billing cycle, costing time and money further down the line. In fact, up to half of denied claims occur because of issues around the point of registration, such as identification errors, sub-standard data analytics and inefficient workflows. And at a time when patients and staff are trying to minimize face-to-face contact due to COVID-19, manual registration seems like an unnecessary extra touch point. Is it time to say goodbye to paper-based paper registration? Reimagining the patient intake experience for the digital age During registration, patients can be asked to provide personal details, submit their medical history, and confirm payer information. They may also need to schedule appointments, organize billing, or sign up for care management programs. It’s often a patient’s first glimpse of how a provider is going to look after them, so making the registration experience as stress-free as possible is a great way to build customer loyalty from the start. As the competition for consumer business heats up, providers should look for ways to give patients the virtual and mobile-friendly experience they desire, with as little time as possible spent in waiting rooms filling in forms. By letting patients tick off their registration to-do list online or via a mobile device – before even coming into hospital – providers can improve patient satisfaction, while using automated workflows to drive down costly errors and increase revenue. Here are two examples of how healthcare providers have embraced self-service registration and automated pre-registration workflows to benefit both their consumers and bottom line: 1. Schneck Medical Center used automated pre-registration to double their productivity For the patient access team at Schneck Medical Center, getting the correct patient information in a timely manner during registration was a challenge. By introducing eCare NEXT®, they were able to automate pre-registration workflows so the majority of manual, repetitive patient tasks could be completed automatically, freeing up staff to focus on patients who needed specific attention before being cleared. With Registration QA added to the mix, they could track and correct errors and spot opportunities to improve performance in real-time, for a better patient experience and more efficient operations. Skylar Earley, Director of Patient Access and Communication, said that by using Experian Health’s patient intake solutions, “we were able to make some fairly minor workflow changes, but double our pre-registration productivity on a daily basis and then repurpose some labor to different areas in patient access.” 2. Martin Luther King Jr. Community Hospital (MLKCH) used automated registration to reduce claim denials Seeing that a large portion of claim denials were originating during patient registration, MLKCH introduced an automated registration workflow to eliminate unnecessary manual tasks and increase the accuracy of the data being collected. For Patient Access Manager Lori Westman, the results have been impressive: “We get fewer denials because we’re getting true verification data, and our patient volumes continue to increase. So the fact that we can take off at least two to three minutes on half of our registrations is speeding up the work for the team, and the turnaround time is much better for the patients.” By reducing paper-based tasks and introducing automated pre-registration options, these providers were able to make life easier for patients while slimming down their workflows. Is it time for your organization to do the same? Download our free eBook to find out more about how automated patient intake workflows could help you create a seamless, more efficient patient registration experience.

Due to COVID-19 and the subsequent delay of elective procedures, many healthcare providers today are struggling to ensure their patient populations are getting the care they need. While online scheduling and referral coordination solutions can no doubt help improve patient access, especially as those who cancelled or postponed appointments look to reschedule, it’s the use of automated outreach combined with the ability to schedule appointments in real-time that can take it one step further and help providers close gaps in care. Automated outreach via interactive voice response (IVR) and text messaging (SMS) is now effectively closing gaps in care and streamlining the entire scheduling process from start to finish. Healthcare organizations leveraging automated outreach are seeing numerous benefits. Among them: Extended Outreach Capabilities – An automated and technologically advanced outreach system has far greater capacity to reach patients, when compared to the bandwidth of traditional call centers. The system enables thousands of automated calls per day that don’t require an agent to personally facilitate. Increased Appointment Bookings – Reaching more patients means more successfully booked appointments, and in turn, fewer gaps in care. Our technology successfully automates the process all the way through the booking itself, scheduling far more appointments with much less effort. Higher Patient Satisfaction – Automated outreach ensures that patients are notified on-time about any necessary follow-up care, and then provides the opportunity to quickly and easily book appointments that fit their schedule. This convenience and simplicity fosters patient engagement and satisfaction. Using a targeted outreach list, an automated calling and texting system manages the bookings, coordination and follow-up, completely lifting the burden off of the organization and its call center. Additionally, this type of technology can track metrics (i.e. response rates, booking rates, opt-outs, etc.) in real-time, allowing health plans to easily identify areas for improvement and make the necessary changes to their processes. For these reasons – as well as the benefits outlined above – a growing list of both providers, payers and ACOs are choosing to employ automated outreach technology today. Learn more about automated outreach and how it fits into an omnichannel access strategy. Learn more Contact us

Download our free eBook to find out how digital health solutions can help your organization improve the patient journey now and beyond COVID-19. You can also check out our free COVID-19 Resource Center, where you can get free access to telehealth payer policy alerts to help avoid payment denials and delays.

With so many complexities surrounding deductibles, premiums, copays and more, consumers sometimes struggle to understand the financial components of their health plans and are often unaware of the out of pocket for their healthcare needs. Recognizing that confusion about healthcare costs can make it difficult for consumers to ask the right questions, define priorities and take a more active role in their healthcare, Silver Cross Hospital made a point to educate and provide its patient base with health care estimates prior to service being rendered. With the Self-Service Patient Estimates tool from Experian Health, patients of Silver Cross Hospital now have a consumer-friendly, easy-to-use and accessible path to obtain out of pocket cost estimates. The Self-Service Patient Estimates tool works both with the hospital’s electronic medical record (EMR) and as a standalone tool for the community to use when needed. Integrating with Silver Cross Hospital’s EMR, the solution calculates estimates based on the hospital’s charge master pricing information and payer contracted rates and utilizes each patient’s individual eligibility and benefits information to create specific out of pocket costs. The tool also allows for detailed and accurate estimate creation using historical claims data to determine the typical procedures and related charges to generate average out of pocket cost estimates by health plan. Accessible via the hospital’s website, the tool acts as a digital front door in the patient exploratory process. Patients can obtain an out-of-pocket estimate any time of day or night, and as part of the process are then connected to the next place of service, whether that be to schedule an appointment, ask additional questions or obtain more information. Since implementing Patient Estimates, Silver Cross Hospital has: Increased point of service (POS) collections by bringing more awareness and education of out of pocket costs to patients upfront Reduced inbound calls and queries to the organization regarding cost estimates Integrated the solution into scheduling and pre-registration workflows within the EMR Reduced time spent training staff on other systems or workflows Learn more about Patient Estimates and how we can help create accurate estimates of authorized services for patients before, or at the point-of-service. “Patient Estimates acts a great digital front door for Silver Cross Hospital, facilitating that first step in the patient exploratory process.” – Miguel Vigo IV, Administrator Director Revenue Cycle, Silver Cross Hospital

Financial recovery after COVID-19 is likely to be a slow burn for most healthcare organizations, according to a recent survey. Nearly 90% of healthcare executives expect revenue to drop below pre-pandemic levels by the end of 2020, with one in five anticipating a hit greater than 30%. While the return of elective procedures will be a lifeline for many hospitals and health systems, the road to financial recovery remains fraught with obstacles: Five months of canceled and postponed procedures need to be rescheduled Worried patients must be reassured of hygiene measures, so they feel safe to attend appointments Patient intake and payment processes must be modified, in order to minimize face-to-face contact As the rate of infection continues to grow, providers must find new ways to also grow their revenue and protect against a further dent in profits. The healthcare industry is unlikely to see the recovery curve hoped for across the wider economy, but digital technology, automation and advanced data analytics could help provider finances to bounce back more quickly. 4 ways technology can accelerate your post-pandemic financial recovery 1. Easy and convenient patient scheduling unlocks your digital front door Patients want to reschedule appointments that were postponed or canceled over the last few months. To manage the backlog and minimize pressure on staff, consider using a digital patient scheduling platform, so patients can book their appointments online. A self-scheduling system that incorporates real-time scheduling and calendar reminders will help to create a positive consumer experience, while offering analytics and behind-the-scenes integration to keep your call center operations running smoothly. 2. Secure and convenient mobile technology can enhance your telehealth services Telehealth is the top choice for many hospitals looking to boost revenue growth and counter the impact of COVID-19, with two-thirds of executives expecting to use telehealth at least five times more than before the coronavirus hit. Many new digital tools and strategies designed to improve the patient journey as a whole can support telehealth delivery, and help to meet growing consumer demand for virtual care. For those beginning their telehealth journey, our COVID-19 Resource Center, which offers free access to telehealth payer policy alerts, may be the place to start. 3. A digital patient intake experience can lessen fears of exposure Although many providers are starting to open up for routine in-person appointments again, patients may wonder if it’s safe. Proactive communication about the measures in place to protect staff and patients will be essential. Another way to minimize concern is to allow as many patient intake tasks as possible to be completed online. Automating patient access through the patient portal can give patients quicker and more convenient ways to complete pre-registration, while contactless payment methods are a safe way to settle bills without setting foot in the provider’s office. 4. Optimize collections to bolster financial recoveryAutomation can also play a huge role in helping providers tighten up their revenue cycle, find new ways to enhance accounts receivable collections and avoid bad debt. Tools such as Coverage Discovery and Patient Financial Clearance enable providers to find missing or forgotten coverage, and help the patient manage any remaining balances in a sensitive and personalized way. Palo Pinto General Hospital uses automated coverage checks to find out whether a patient is eligible for charitable assistance within three seconds, so self-pay accounts can be directed to the most appropriate payment plan before the patient even comes in for treatment. With fewer accounts being written off, Palo Pinto has seen a noticeable improvement to their bottom line. The pandemic has been a wake-up call for an industry that has been traditionally slow to adopt new technologies. Ahead of a second wave of COVID-19, providers must move now to take advantage of automation and digital strategies to speed up financial recovery. Contact us to find out how we can help your organization use technology to improve the patient experience, increase efficiencies and kickstart your revenue cycle.

The focus on improving health plan member engagement and overall experience has been steadily growing over the years, much of it being driven by the push towards a more consumer-friendly healthcare experience. James Beem, Managing Director, Global Healthcare Intelligence at J.D. Power, states, “health plans are doing a good job managing the operational aspects of their businesses, but they are having a harder time addressing the expectations members have based on their experiences in other industries where their service needs are more effectively addressed with better technology.” His remarks are based off of findings from the annual Commercial Member Health Plan Study, which also found that care coordination between different providers and care settings is a top challenge health plans are facing today. Most of our conversations with health plan prospects and customers revolve around how digital technology can improve health plan member engagement and close gaps in care. From our experience, here are five key digital strategies that health plans can employ to better engage members and improve satisfaction. Call centers remain a cornerstone of member engagement. From onboarding new members to closing gaps in care, the call center is where the rubber meets the road between health plans and their members. At Experian Health, we focus on making it easier for call center agents to find and book appointments on behalf of members – specifically, we eliminate the need for three-way calls with providers by giving agents access to a digital scheduling platform. It automates providers’ scheduling rules, while also protecting their calendars, and allows health plans to schedule appointments for members without having to call the provider office. In some cases, once our platform is in place, we’ve seen scheduling rates increase by 140%, call times cut in half, and show rates go up. A large factor in social determinants of health is the availability of transportation – are your members physically able to make it to and from their appointment? While members may know what care they need and are able to book an appointment, they may not be able to show up for that appointment due to unreliable or non-existent transportation. The member doesn’t show, the care gap remains, and health plans take a hit on quality metrics. What’s worse, the member puts themselves at risk for readmission or other, costly trips to the ED for care that remains unaddressed – all an expensive medical cost for the plan. We are proud to work with transportation vendors and ultimately, include the ability to schedule transportation in a workflow while booking an appointment. By facilitating easy access to transportation as part of the appointment scheduling process, we are ensuring a better outcome for everyone. Why not offer the functionality that consumers are accustomed to in nearly every other industry? Booking a hotel, flight, or dinner reservation can all be done online via a mobile device, so why not an appointment? Imagine being able to extend this type of convenience and consumer-friendly experience to your members. They come to the health plan’s site or app to search for an in-network provider and can then schedule an appointment in real-time, on the spot, day or night, no phone call required. Instead of simply sending members text and phone call reminders to schedule care, health plans can use automated outreach to send those messages with the ability to schedule an appointment via self-service. The member would receive a text message or phone call, and after confirming their identity, would receive their personal health-related message along with the ability to schedule an appointment as part of the outreach process. In a few clicks, or with a few verbal responses, the appointment is scheduled, and the care gap is closed with very minimal effort. The struggle to find and maintain accurate contact info for members is real. Fortunately, Experian Health has unprecedented access to consumer data. With the largest consumer database, collected on more than 300 million consumers, we can provide a deeper understanding of your current members or prospects in your markets. These data assets can enable the most effective marketing and communication strategies to improve enrollment rates as members are more successfully identified and reached. The data can also be leveraged to enhance internal analytics, like member risk score algorithms or other models, to improve member outcomes. Learn more about how a digital care coordination platform can help your organization improve member engagement and the member experience.