Latest Posts

Your organization would make a great participant in our Universal Patient Network. We’ve developed a unique solution leveraging Experian’s demographic data to establish a universal patient identifier, which has higher match performance than standard industry tools. We would like to offer YOU an opportunity to leverage our Universal Identity Manager (UIM) Batch product at NO CHARGE.* What you give: Patient demographic data in a secure file/message What you get: File with Universal Patient Identifier (UPI) and identified duplicates (at your specific frequency) How you benefit: Information exchange, care coordination, patient safety, operational efficiency and financial savings Your organization can address duplicate issues and be at the forefront of promoting a universal patient identifier. Contact Experian Health today to learn more! Visit www.experian.com/umpi, email experianhealth@experian.com or call 1 888 661 5657. *Offer is limited to Experian Health’s UIM Batch Process product and shall remain open for such time as Experian Health may decide.

Experian Health and NCPDP (National Council for Prescription Drug Programs) have joined forces to introduce a vendor-neutral solution that powers a national patient identifier. Experian Health and NCPDP have announced a strategic alliance to provide a vendor neutral solution to address the complexities of managing patient identification. With a shared vision to create solutions and leverage data for the common good, this alliance brings an innovative matching solution that provides the framework for establishing a unique patient identifier to address patient safety, financial and operational challenges across the U.S. healthcare ecosystem. Read the press release here.

Below is a collection of some of most compelling article we've read in recent months. We hope you find these interesting, too! One Goal; One Contract: How a Nationwide Health Data Sharing Framework is Revolutionizing Interoperability https://www.himss.org/news/one-goal-one-contract-how-nationwide-health-data-sharing-framework-revolutionizing-interoperability 7 things to know about Aetna's ACA exchange exit https://www.beckershospitalreview.com/payer-issues/7-things-to-know-about-aetna-s-aca-exchange-exit.html 5 steps to cybersecurity for Internet of Things medical devices https://www.healthcareitnews.com/news/5-steps-cybersecurity-internet-things-medical-devices CMS: ICD-10 specificity kicks in Oct. 1, 2016 https://www.healthcareitnews.com/news/cms-icd-10-specificity-kicks-oct-1-2016 3 leadership skills crucial for a culture change http://www.beckershospitalreview.com/hospital-management-administration/3-leadership-skills-crucial-for-a-culture-change.html

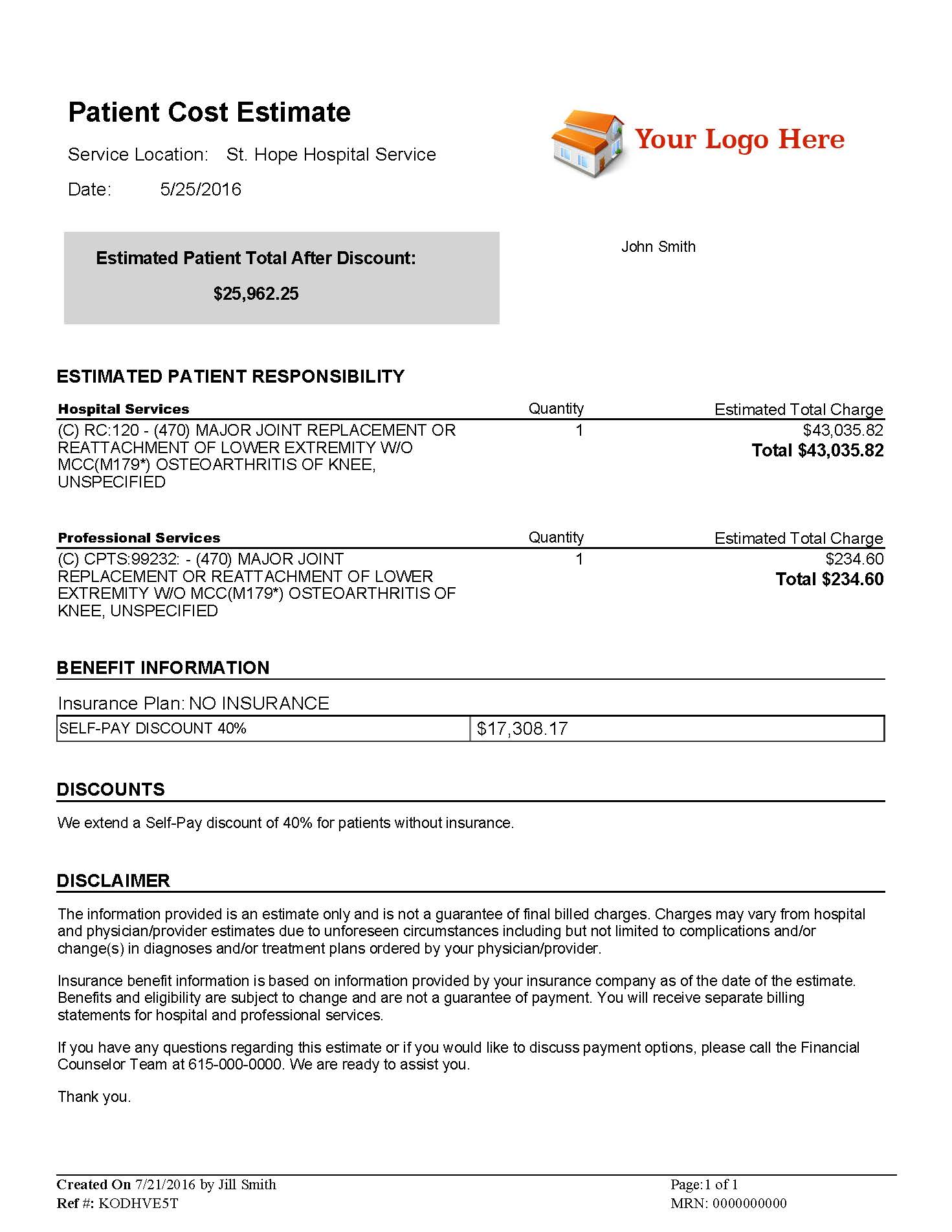

Undoubtedly, you have been monitoring progress toward legislation for healthcare providers to furnish patients with estimates for their cost of care. And if it’s not already in place, there’s a strong chance your state will be next on the list to require price transparency. Additionally, with the continued popularity of high deductible health plans, patients are looking to price shop for their healthcare services. Patients expect more healthcare cost information available online, like in every other industry. Helping patients know what they will owe prior to service can enable them to make more informed decisions about their care and increase patient satisfaction. As more states begin to mandate providing pre-service estimates to patients, it’s critical for healthcare providers to know what solutions are available to help them comply. According to a recent Fierce Healthcare article, “Real healthcare price transparency for consumers is dependent on rich data sources that provide meaningful price information on a wide range of procedures and services.1" Experian Health is here to help! Our Patient Estimates solution is a pricing transparency tool that enables you to create accurate estimates of services, before or at the point-of-service. Patient Estimates is also offered within our Patient Self-Service portal, allowing patients to access estimates on-demand. See how Patient Estimates helped St. Clair Hospital in the Pittsburgh market. According to the June 2016 KLAS Healthcare Price Transparency Solutions Performance Report, “…clients feel [Experian Health’s] Patient Estimates is a critical element in their efforts to help patients know up front what their costs will be, and clients report overall satisfaction with the product, services, and vendor engagement. The solution is seen as very complete and robust, with strong customer support.” Experian Health's Patient Estimates can help your organization: Increase up-front collections Provide patient’s pricing prior to service Increase patient satisfaction Let us help you prepare now for state requirements that will ultimately increase accurate up-front collections and more importantly improve patient satisfaction! Call us at 1 888 661 5657 or email experianhealth@experian.com to get started! 1Ron Shinkman, “A few more states get passing grades on price transparency,” Fierce Healthcare, July 28, 2016

Scott Lee oversees the Experian Health Reference Program. Scott graduated with a BA in Business Management from The University of Texas at San Antonio, and has been with the organization for 12 years, beginning with MPV, which was acquired by Experian in 2011. Scott lives in San Antonio with his wife and two children and says his second home is the San Antonio Zoo based on how much time he and his family spend there. Scott is a catalyst for fostering the connection between Experian Health’s current and potential clients to allow the former to share their positive experience and ROI using our solutions. Our clients also benefit from being a reference by learning about the workflow and best practices of similar organizations. Because of the importance of protecting our clients’ privacy, Scott schedules calls on behalf of our clients and ensures that the experience is mutually beneficial and minimally disruptive for all parties involved. “We’re very appreciative of our reference clients, and it’s a privilege for our potential clients to hear their experiences firsthand.” he said. Share your story by being an Experian Health Reference Client! Contact your Sales Director/Account Manager or contact Scott Lee at scott.lee@experian.com or (210) 582-6320.

Below is an update from the Experian Health Support Team. Network & System Performance Last six months: Upgrades to the network, compute and storage infrastructure have improved performance and scalability. Enhanced alerting and reporting to strengthen proactive measures for issues remediation Next six months: Data Center move and consolidation will localize production communications to improve efficiencies Automation improvements to reduce on-boarding times for new clients Subscribe to Receive Product Support Updates Opt in to receive emails about significant product updates or changes. Access the Experian Health Product Dashboard here.

Care Coordination Manager is the industry’s first solution designed specifically to help hospitals, health systems, and provider-led health plans succeed with 30-90 day episode management. It is a flexible, rules-driven care coordination system designed specifically for physician groups, hospitals, health systems, and provider-led health plans, whether for ensuring bundled payment profitability, maximizing ACO and health plan savings, managing post-acute costs, or reducing readmissions. Contact us today for more information at 1 888 661 5657 or visit the Care Coordination Manager page.

Our congratulations and admiration go out to all Experian Health clients who were recently recognized by Hospitals and Health Networks (H&HN) magazine with the prestigious 2016 “Most Wired” distinction: http://www.hhnmag.com/articles/7393-2016-most-wired-themes. Following are two (of the MANY) Experian Health clients who were honored. Altru Health System has been recognized in the Advanced Category in this year’s HealthCare’s Most Wired™ survey. The survey, released on July 6 by the American Hospital Association’s Health Forum, is a leading industry barometer measuring information technology (IT) use and adoption among hospitals nationwide. It examined how organizations are leveraging IT to improve performance for value-based healthcare in the areas of infrastructure, business and administrative management, quality and safety, and clinical integration. St. Clair Hospital’s Patient Estimates tool, the only one of its kind in the greater Pittsburgh region, has garnered the Mt. Lebanon-based medical center Hospitals & Health Networks (H&HN) magazine’s prestigious Innovator Award for its co-development of the cost transparency software. Patient Estimates, which was made available to the public earlier this year at www.stclair.org, gives patients the ability to learn, in advance, what their estimated out-of-pocket costs will be for services at St. Clair or the Hospital’s Outpatient centers. Patient Estimates is highly accurate and based on information provided by each patient’s health benefit plan. Please contact us to add your organization’s Innovative Achievements to our future Shout Outs!

In case you missed them, below are some great tools to help you address key business challenges. Enjoy the read! Press Releases Innovative Mindset Enables Experian Health to Deliver New Capabilities Experian Health Rises to 45 On The 2016 Healthcare Informatics 100 List White Paper Why Start the Payment Process Prior to Service? As a patient’s financial obligation grows, it’s imperative to tailor payment strategies to each unique situation. In pre-service stages, data-driven solutions provide a higher likelihood of securing patient payment. Flexible patient payment plans contribute to a positive billing, payment, and overall engagement experience, as well as a provider’s financial health. Read our white paper to learn more about the importance of the Personalization in the Healthcare Consumer Payment Process. Read Now Article: Healthcare IT Transformation - How Has Ransomware Shifted the Landscape of Healthcare Data Security? Read Now