It should come as no surprise that reaching consumers on past-due accounts by traditional dialing methods is increasingly ineffective. The new alternative, of course, is to leverage digital channels to reach and collect on debts.

The Past: Dialing for dollars.

Let’s take a walk down memory lane, shall we?

The collection approach used for many years was to initially send the consumer a collection letter recapping the obligation and requesting payment, usually when an account was 30 days late. If the consumer failed to respond, a series of dialing attempts were then made, trying to reach the consumer and resolve the debt.

Unfortunately, this approach has become less effective through the years due to several reasons:

- The use of traditional landlines continues to drop as consumers shift to cell and Voice Over Internet Protocol (VOIP) services.

- The cost of reaching consumers by cell is more costly since predictive dialers can’t be used without prior consent, and the obtaining and maintaining consent presents its own set of tricky challenges.

- Consumers simply aren’t answering their phones. If they think a bill collector is calling, they don’t pick up. It’s that simple.

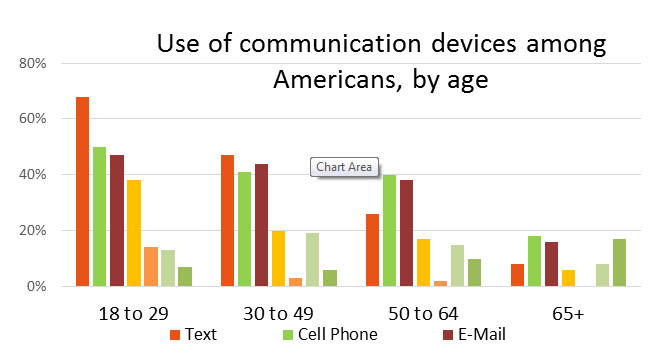

In fact, here is a breakdown by age group that Gallup published in 2015, highlighting the weakness of traditional phone-dialing.

The Present: Hello payment portal.

With the ability to get the consumer on the phone to negotiate a payment on the wane, the logical next step is to go digital and use the Internet or text messaging to reach the consumer. With 71 percent of consumers now using smartphones and virtually everyone having an Internet connection, this can be a cost-effective approach.

Some companies have already implemented an electronic payment portal whereby a consumer can make a payment using his or her PC or smartphone. Usually this is prompted by a collection letter, or if permitted by consumer consent, a text message to their smartphone.

The Future: Virtual negotiation.

But what if the consumer wants to negotiate different terms or payment plans? What if they want to try and settle for less than the full amount? In the past – and for most companies operating today – this translates into a series of emails or letters being exchanged, or the consumer must actually speak to a debt collector on the phone. And let’s be honest, the consumer generally does not want to speak to a collector on the phone.

Fortunately, there is a new technology involving a virtual negotiator approach coming into the market now. It works like this:

- The credit grantor or agency contacts the consumer by letter, email, or text reminding them of their debt and offering them a link to visit a website to negotiate their debt without a human being involved.

- The consumer logs onto the site, negotiates with the site and hopefully comes to terms with what is an acceptable payment plan and amount. In advance, the site would have been fed the terms by which the virtual negotiator would have been allowed to use.

- Finally, the consumer provides his payment information, receives back a recap of what he has agreed to and the process is complete.

This is the future of collections, especially when you consider the younger generations rarely wanting to talk on the phone. They want to handle the majority of their matters digitally, on their own terms and at their own preferred times. The collections process can obviously be uncomfortable, but the thought is the virtual negotiator approach will make it less burdensome and more consumer-friendly.

Learn more about virtual negotiation.