Sometimes life throws you a curve ball. The unexpected medical bill. The catastrophic car repair. The busted home appliance. It happens, and the killer is that consumers don’t always have the savings or resources to cover an additional cost. They must make a choice. Which bills do they pay? Which bills go to the pile? Suddenly, a consumer’s steady payment behavior changes, and in some cases they lose control of their ability to fulfill their obligations altogether.

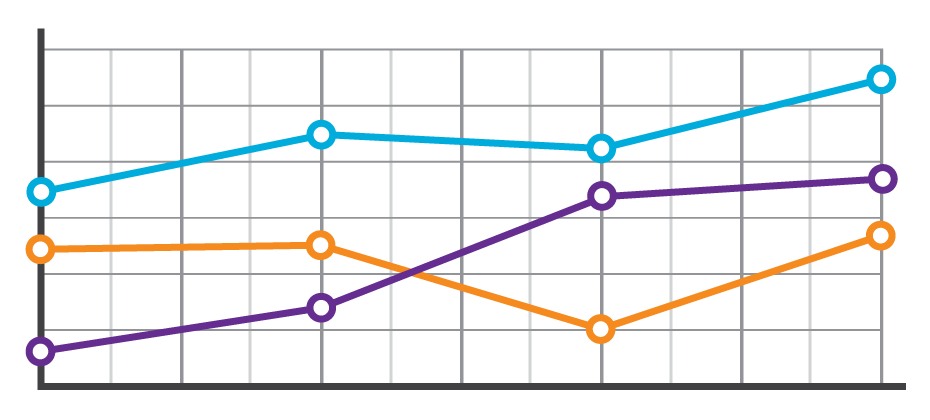

These shifts in payment patterns aren’t always reflected in consumer credit scores. At a single point in time, consumers may look identical. However, when analyzing their past payment behaviors, differences emerge. With these insights, lenders can now determine the appropriate risk or marketing decisions.

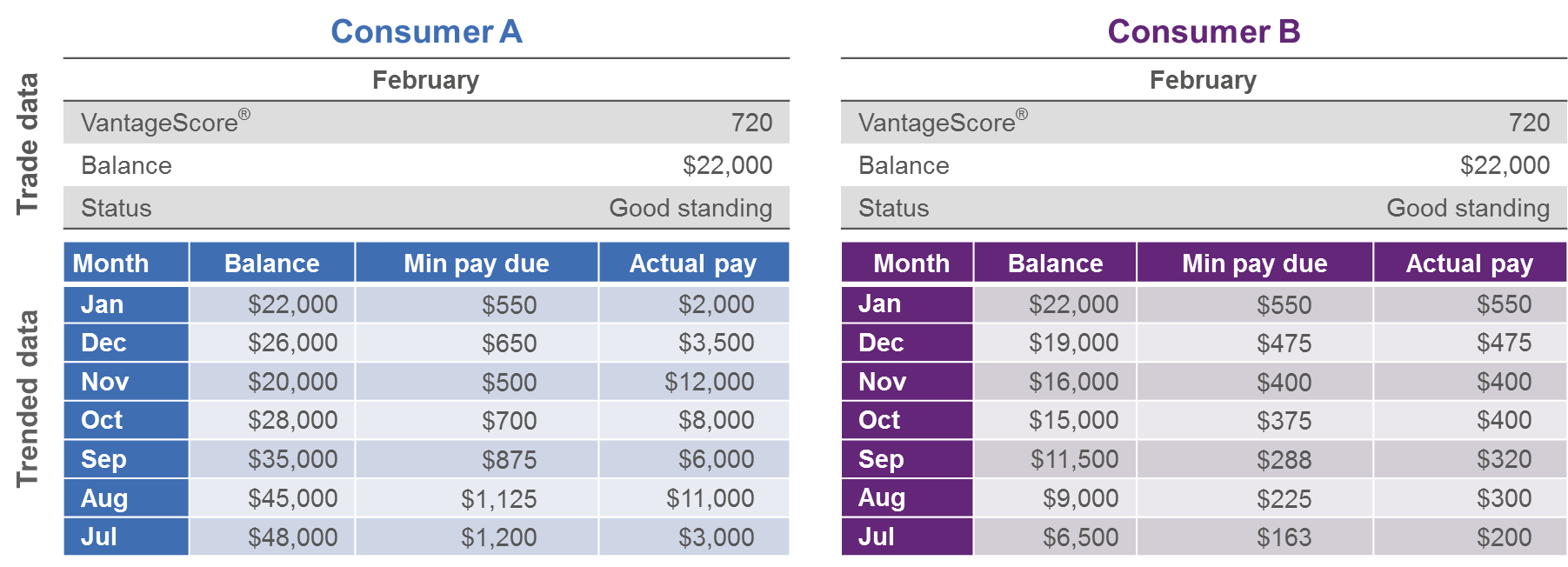

In the example below, we see that based on the trade-level data, Consumer A and Consumer B have the same credit score and balance. But once we see their payment pattern within their trended data, we can clearly see Consumer A is paying well over the minimum payments due and has a demonstrated ability to pay. A closer look at Consumer B, on the other hand, reveals that the payment amount as compared to the minimum payment amount is decreasing over time. In fact, over the last three months only the minimum payment has been made.

So while Consumer B may be well within the portfolio risk tolerance, they are trending down. This could indicate payment stress. With this knowledge, the lender could decide to hold off on offering Consumer B any new products until an improvement is seen in their payment pattern. Alternatively, Consumer A may be ripe for a new product offering.

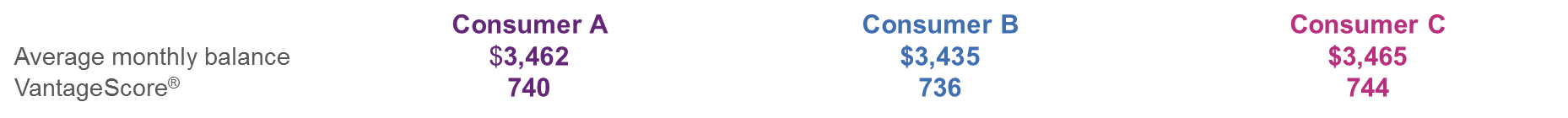

In another example, three consumers may appear identical when looking at their credit score and average monthly balance.

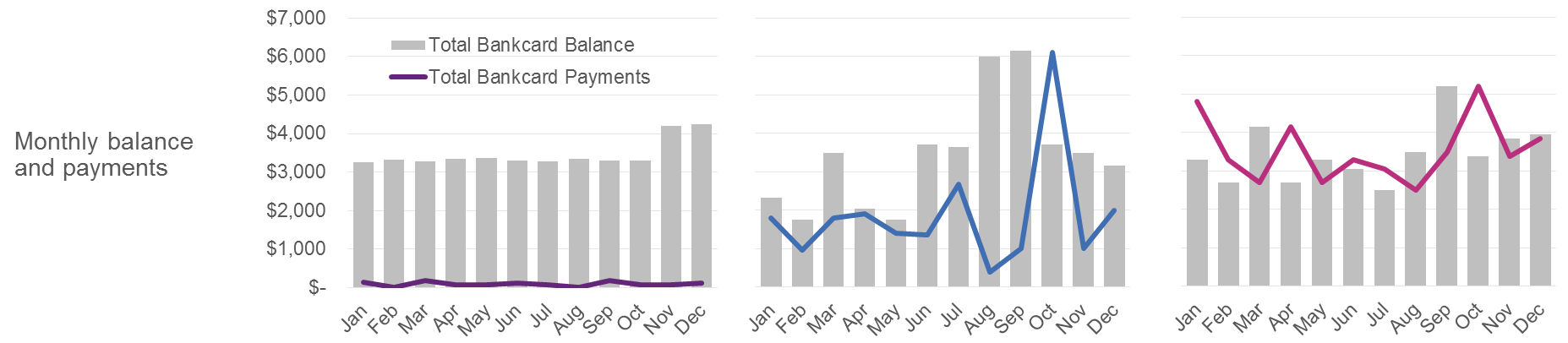

But when you look at the trend of their historical bankcard balances as compared to their payments, you start to see very different behaviors.

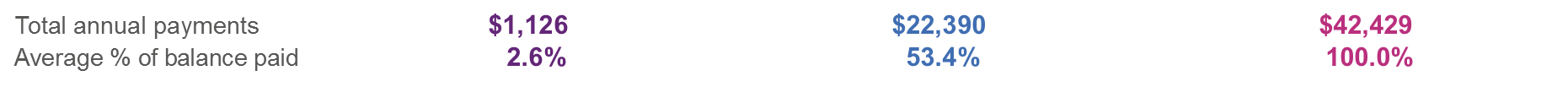

Consumer A is carrying their balances and only making the minimum payments. Consumer B is a hybrid of revolving and transacting, and Consumer C is paying off their balances each month.

When we look at the total annual payments and their average percent of balance paid, we can see the biggest differences emerge.

Having this deeper level of insight can assist lenders with determining which consumer is the best prospect for particular offerings. Consumer A would likely be most interested in a low- interest rate card, whereas Consumer C may be more interested in a rewards card.

The combination of the credit score and trended data provides significant insight into predicting consumer credit behavior, ultimately leading to more profitable lending decisions across the customer lifecycle:

- Response – match the right offer with the right prospect to maximize response rates and improve campaign performance

- Risk – understand direction and velocity of payment performance to adequately manage risk exposure

- Retention – anticipate consumer preferences to build long-term loyalty

All financial institutions can benefit from the value of trended data, whether you are a financial institution with significant analytical capabilities looking to develop custom models from the trended data or looking for proven pre-built solutions for immediate implementation.