It’s Halloween time – time for trick or treating, costume parties and monsters lurking in the background. But this year, the monsters aren’t just in the background. They’re in your portfolio. This year, “Frankenstein” has another meaning. Much more ominous than the neighbor kid in the costume.

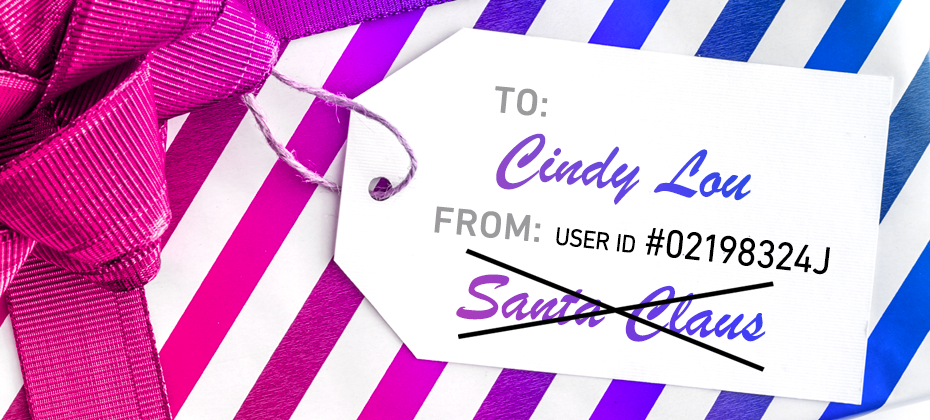

“Frankenstein IDs” refer to synthetic identities — a type of fraud carried out by criminals that have created fictitious identities. Just as Dr. Frankenstein’s monster was stitched together from parts, synthetic IDs are stitched together pieces of mismatched identities — some fake, some real, some even deceased.

It typically takes fraudsters 12 to 18 months to create and nurture a synthetic identity before it’s ready to “bust out” – the act of building a credit history with the intent of maxing out all available credit and eventually disappearing. That means fraudsters are investing money and time to build numerous tradelines, ensure these “fake” identities are in good credit standing, and ultimately steal the largest amount of money possible.

“Wait Master, it might be dangerous . . . you go, first.” — Igor

Synthetic identities are a notable challenge for many financial institutions and retail organizations.

According to the recently released Federal Reserve Board White Paper, synthetic identity fraud accounts for roughly 20% of all credit losses, and cost U.S. businesses roughly $6 billion in 2016 with an estimated 41% growth over 2 years. 85-95% of applicants identified as potential synthetic are not even flagged by traditional fraud models.

The Social Security Administration recently announced plans for the electronic Consent Based Social Security Number Verification service – pilot program scheduled for June 2020. This service is designed to bring efficiency to the process for verifying Social Security numbers directly with the government agency. Once available, this verification could be an important tool in the fight against the elusive “Frankenstein” identity monster.

But with the Social Security Administration’s pilot program not scheduled for launch until the middle of next year, how can financial institutions and other organizations bridge the gap and adequately prepare for a potential uptick in synthetic identity fraud attacks? It comes down to a multilayered approach that relies on advanced data, analytics, and technology — and focuses on identity.

Any significant progress in making synthetic identities easier to detect could cost fraudsters significant time and money.

Far too many financial institutions and other organizations depend solely on basic demographic information and snapshots in time to confirm the legitimacy of an identity. These organizations need to think beyond those capabilities. The real value of data in many cases lies between the data points. We have seen this with synthetic identity — where a seemingly legitimate identity only shows risk when we can analyze its connections and relationships to other individuals and characteristics.

In addition to our High Risk Fraud Score, we now have a Synthetic Fraud Risk Level Indicator available on credit profiles. These advanced detection capabilities are delivered via the simplicity of a straightforward indicator returned on the credit profile which lenders can use to trigger additional identity verification processes.

While there are programs and initiatives in the works to help financial institutions and other organizations combat synthetic identity fraud, it’s important to keep in mind there’s no silver bullet, or stake to the heart, to completely keep these Frankenstein IDs out.

Oh, and don’t forget… “It’s pronounced ‘Fronkensteen.’ ” — Dr. Frankenstein