If we’ve learned anything from the past year and a half, it’s the need to adapt and pivot in real-time based on the current automotive market trends. One such trend that represents the need for flexibility is the unexpected change in new vehicle registrations by generation in the first quarter of Q1 2021. Namely, Gen X’s significant increase, and millennials’ decrease, in new vehicle registrations. This unexpected change is a reminder of the importance of remaining close to current data throughout the year to inform marketing strategies.

New Vehicle Registration Trends Reverse

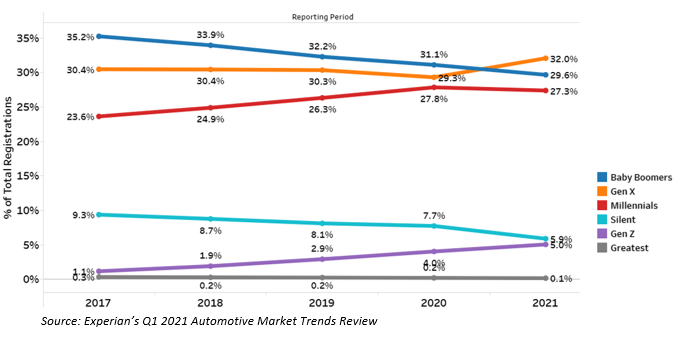

Over the past several years, new vehicle registration trends by generation have remained relatively consistent. For example, baby boomers have seen a steady decrease in new registrations, while millennials and Gen Z have seen a steady increase. But Experian’s Q1 2021 Automotive Market Trends Review revealed that some of these once-consistent trends have reversed.

Gen X had one of the more surprising shifts, with new vehicle registrations increasing from 29.3% in Q1 2020 to 32% in Q1 2021. By comparison, Gen X had previously been steadily decreasing since 2018. As a result, Gen X now makes up the largest cohort of new vehicle buyers, pushing baby boomers from their top spot in 2020 (31.1%) down to 29.6% this year.

Likewise, the decrease in new registrations for millennials was equally as unexpected. Millennials have consistently made up a larger portion of new vehicle registrations over the past few years. But for the first time since 2017, millennials experienced a decrease in new registrations, from 27.8% in Q1 2020 to 27.3% in 2021. While the decrease may be small, it is an interesting and unexpected shift from the data we’ve seen over the last few years. Additionally, while millennials experienced a decrease, Gen Z continued to see an increase. Their generation grew from 4% in Q1 2020 to 5% in Q1 2021.

While we don’t know how these trends will continue to play out moving forward, dealers can stay one step ahead by understanding the generational trends in real-time, so they are prepared to market to them, no matter how the trends shift. This comes down to meeting each group where and how they like to be reached, an even trickier factor now that so much of everyday life has turned digital.

For example, according to Pew Research, around seven-in-ten Americans use social media. But the platforms can vary significantly depending on age. Pew Research found that Gen Z and younger millennials are more likely to use Instagram, Snapchat and TikTok, while Gen X is more likely to use Facebook and YouTube. Meanwhile, Statista found that 67% of millennials prefer online shopping, compared to 56% of Generation X and 41% of Baby Boomers. As consumers continue to leverage the many different digital opportunities for communicating and shopping, it will be important for OEMs and dealers to shift their marketing strategies to ensure they reach these consumers.

The automotive landscape is continually changing and fluctuating. As a result, we can’t be certain if these trends are a long-term or short-term change. As dealers and OEM’s look to fine tune their marketing strategies, staying close to these trends will allow them to be more informed, more strategic and tailor their marketing campaigns accordingly.

To watch the Experian Q1 2021 Automotive Market Trends Review, click here.