Review of Findings & Front-line Insights

Panel Participants:

- Richard Goldberg (Moderator) – Constangy, Brooks, Smith & Prophete, LLP

- Michael Bruemmer – Experian

- Sean Renshw – RSM US, LLP

- Mark Greisiger – NetDiligence

About NetDiligence Cyber Claims Study

It is NetDiligence’s 13th year of doing this Cyber Claims Study. A total of 9,028 claims were analyzed during the past five years 2018-2022.

An observation from the over 9,000 Cyber Claims (5000 of which are brand new claims this past year in 2023) analyzed is while many of the categories over the last five years have remained the same, the data has changed, sometimes dramatically.

About Experian

We provide call center coverage, notification coverage, as well as, identity theft protection, and all the consumer resolutions that go along with it for about 5000 data breaches every year, and I was delighted to be on the panel.

Key Insights

Experian has proudly sponsored the annual NetDiligence Cyber Claims Study for three years. During this time, I’ve witnessed companies adapt and transform their operations to confront the growing tide of cyber threats. The evolution of their infrastructure to anticipate and respond to these challenges has been remarkable and necessary. However, despite my front-row seat in this fast-changing landscape, the results of each study never fail to surprise and intrigue me.

The insights from the latest study, conducted in 2023, continue to shape our understanding of the evolving cyber landscape.

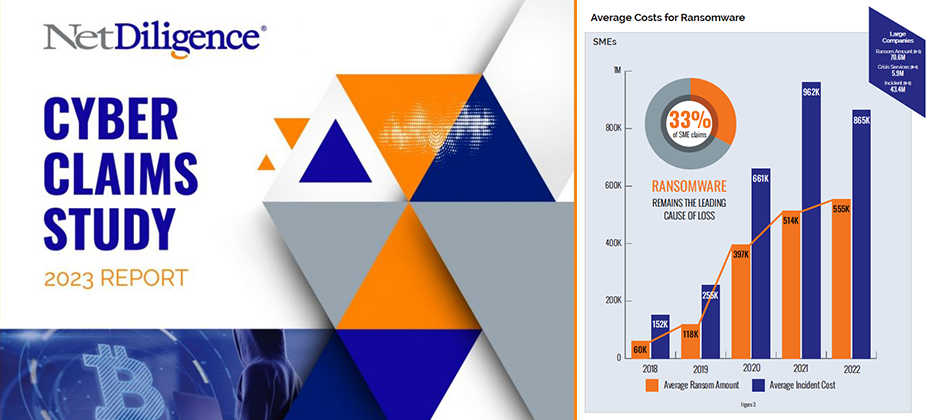

Ransomware’s Dominance

Mark kicked off the discussion by shedding light on the escalating costs associated with cyber incidents. In 2022, the average incident cost for SME organizations remained stable at $169,000 (similar to the combined five-year window from 2018 to 2022 at about 175,000). However, there was a substantial increase for large companies, reaching $20.3 million in 2022 (and if you look at the five-year average, it was about 13 million). This surge raised eyebrows and set the stage for a deep dive into ransomware, a leading cause of concern.

Examining Ransomware Trends

The conversation swiftly shifted to ransomware, a pervasive threat in the cyber insurance landscape. As I stated, at Experian we see a correlation between the rise in ransomware and third-party breaches. Most of the industry experts on the panel participate in a Ransomware Advisory Group together. Mark brought up a good insight from our advisory group on the brazen tactics employed by threat actors lately, showcasing their intimate knowledge of the cyber insurance world.

Business Sectors Under Siege

Richard and Sean added to the discussion the top ten business sectors affected by ransomware, with professional services leading the pack. The impact on technology, with a payout of $830,000, stood out as well.

Beyond Ransomware

The conversation broadened to encompass other types of losses, such as social engineering and business email compromise. The focus on business interruption emerged as a key concern for cyber insurance claims, with the industry grappling with criminal acts versus non-criminal acts.

Looking Ahead

As the discussion unfolded, industry experts, including myself, expressed eagerness to anticipate the future cyber landscape. Predictions range from the industry mutating to the emergence of new players in the nation-state game. The role of artificial intelligence and innovative solutions from new vendors becomes a focal point of interest.

In conclusion, the NetDiligence Cyber Claims Study 2023 Report paints a vivid picture of the challenges and transformations within the cyber insurance domain. The increasing sophistication of threat actors, coupled with evolving business strategies, sets the stage for continuous adaptation and innovation in the fight against cyber threats. As we look ahead, the resilience of businesses and the collaboration between industry stakeholders will play a pivotal role in shaping the cybersecurity landscape. I invite you to access the report and view the discussion replay for a deeper understanding of the challenges and transformations within the cyber insurance claims domain.

Get NetDiligece Cyber Claims Study resources on-demand now!

NetDiligence’s latest Cyber Claims Study and Webinar, sponsored by Experian Data Breach, is available on-demand. This report serves as a resounding call to action, prompting businesses to ready themselves against cyber threats. Dive in to get insights and stay one step ahead of cyber adversaries.