High property values and rising interest rates have priced many borrowers out of the market. In the face of declining home purchases, lenders are focusing on their portfolios and opportunities to expand borrower relationships. At the same time, portfolio health is increasingly important. Keeping a pulse on and successfully managing portfolio risk is just as important as portfolio growth.

To effectively manage a mortgage portfolio, an understanding of the complete financial standing of a borrower, along with the most recent loan performance and property data characteristics, is crucial. Below we discuss three ways to analyze your portfolio to maximize performance.

Portfolio risk

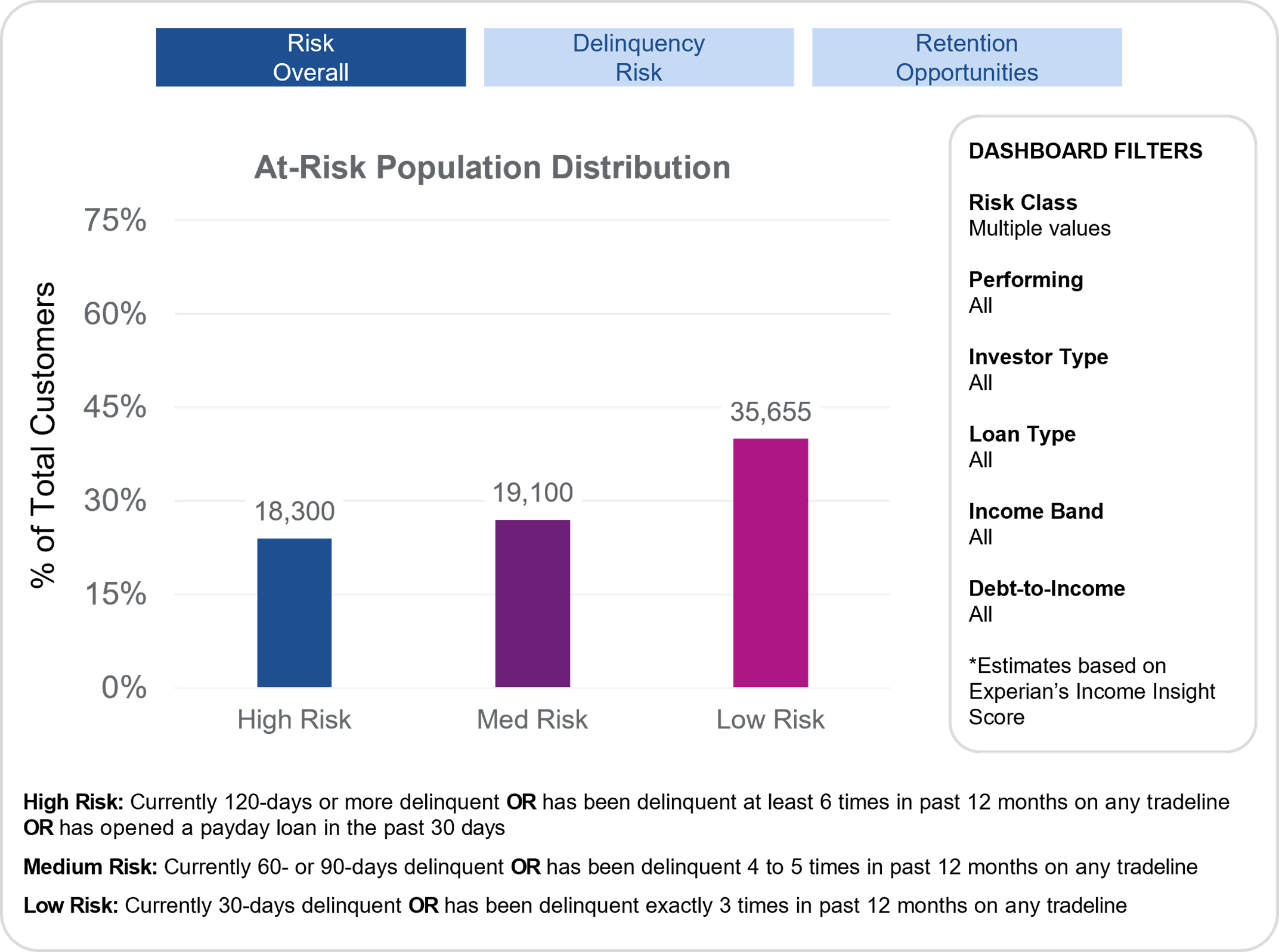

While mortgage delinquencies remain well below pre-pandemic levels, rolling delinquency rates are seeing an uptick. In a recent study, we found that, of the at-risk population, over 24% may be at high risk of delinquency or default. Having the tools and resources to segment your portfolio and identify these borrowers is key to preemptively assisting or modifying loan terms and reducing risk exposure to the business.

Growth and retention

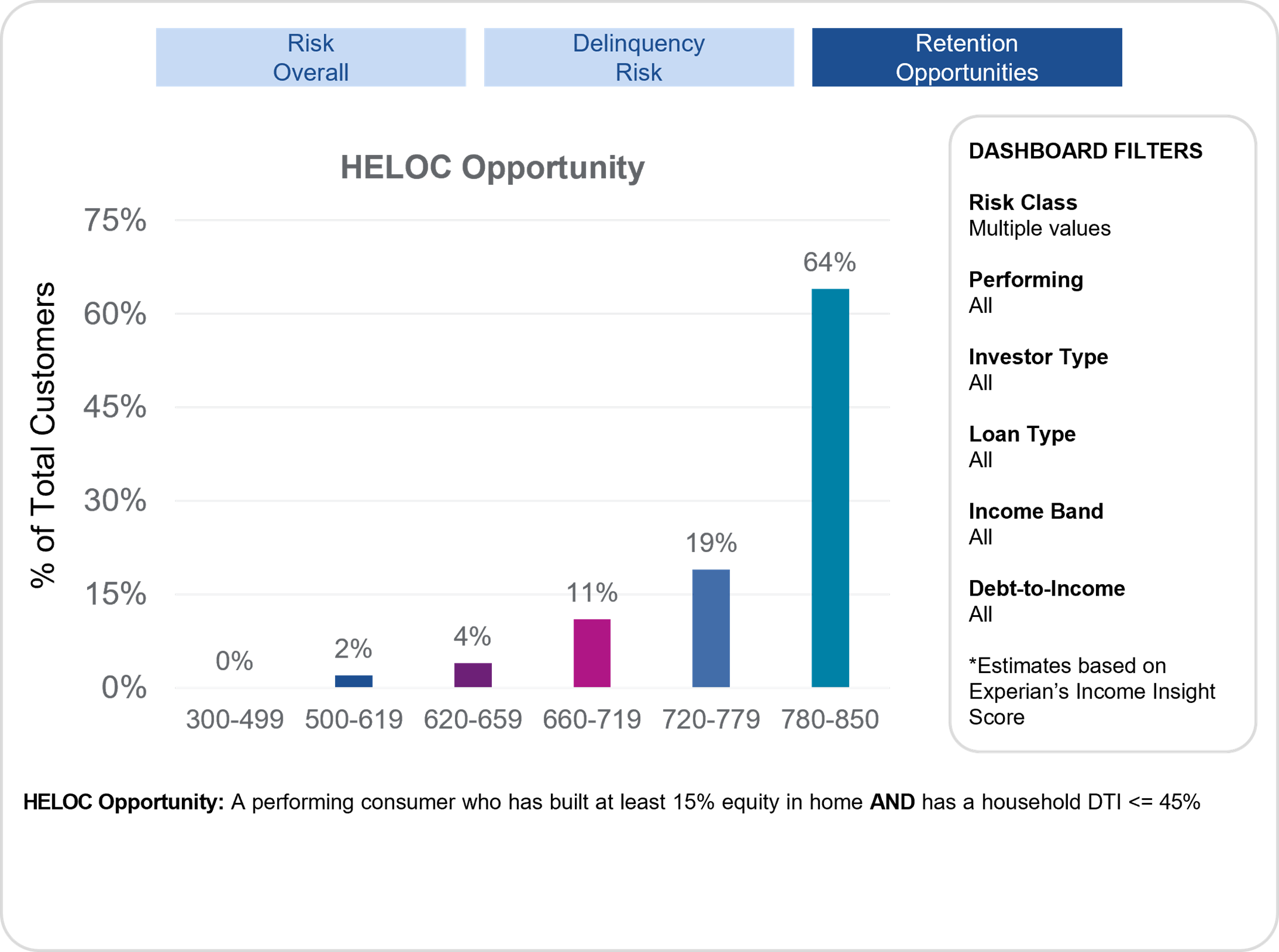

Did you know up to 64% of prime and above borrows may be ideal Home Equity Line of Credit (HELOC) candidates? Having the ability to segment your portfolio to identify borrowers who can tap into their home equity as a line of credit for upgrades, remodeling, or simply a rainy-day fund, will allow you to grow your originations pipeline while also supporting your mortgage retention strategy.

To optimize your segmentation strategy, consider leveraging In the Market Models (ITMM) to identify borrowers with a high propensity to respond to HELOC offers. Through a retrospective analysis, we found that ITMM can improve campaign performance by over 700%.

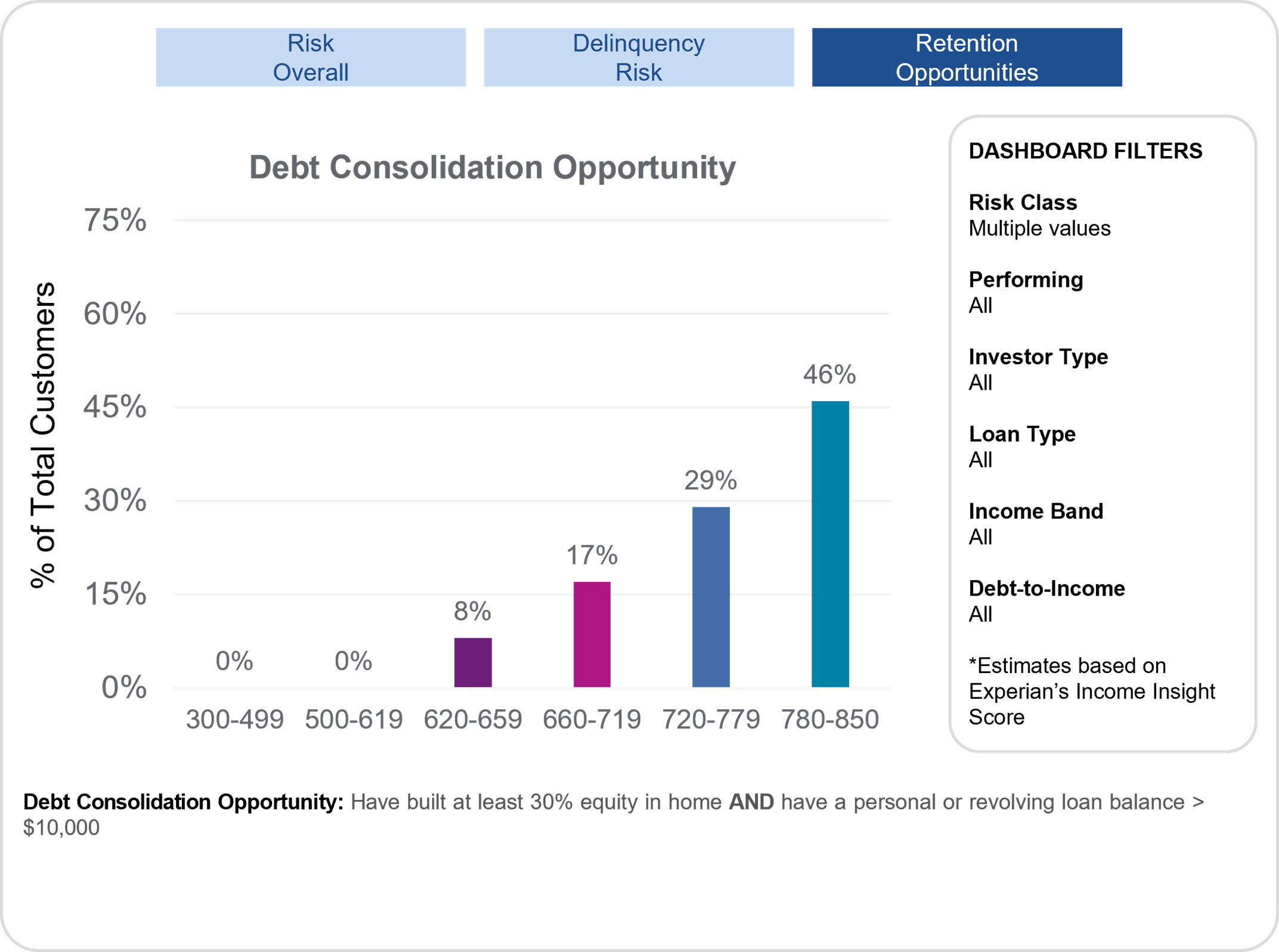

Similarly, a HELOC can be a prime option for borrowers with increasing debt. Through our newly launched solution, Mortgage Insights Dashboard for Servicing, we found that up to 46% of prime and above borrowers may be ideal candidates for debt consolidation. For this segment of your portfolio, a HELOC can consolidate high-interest debt from credit cards, retail cards, or even short-term loans.

Peer analysis

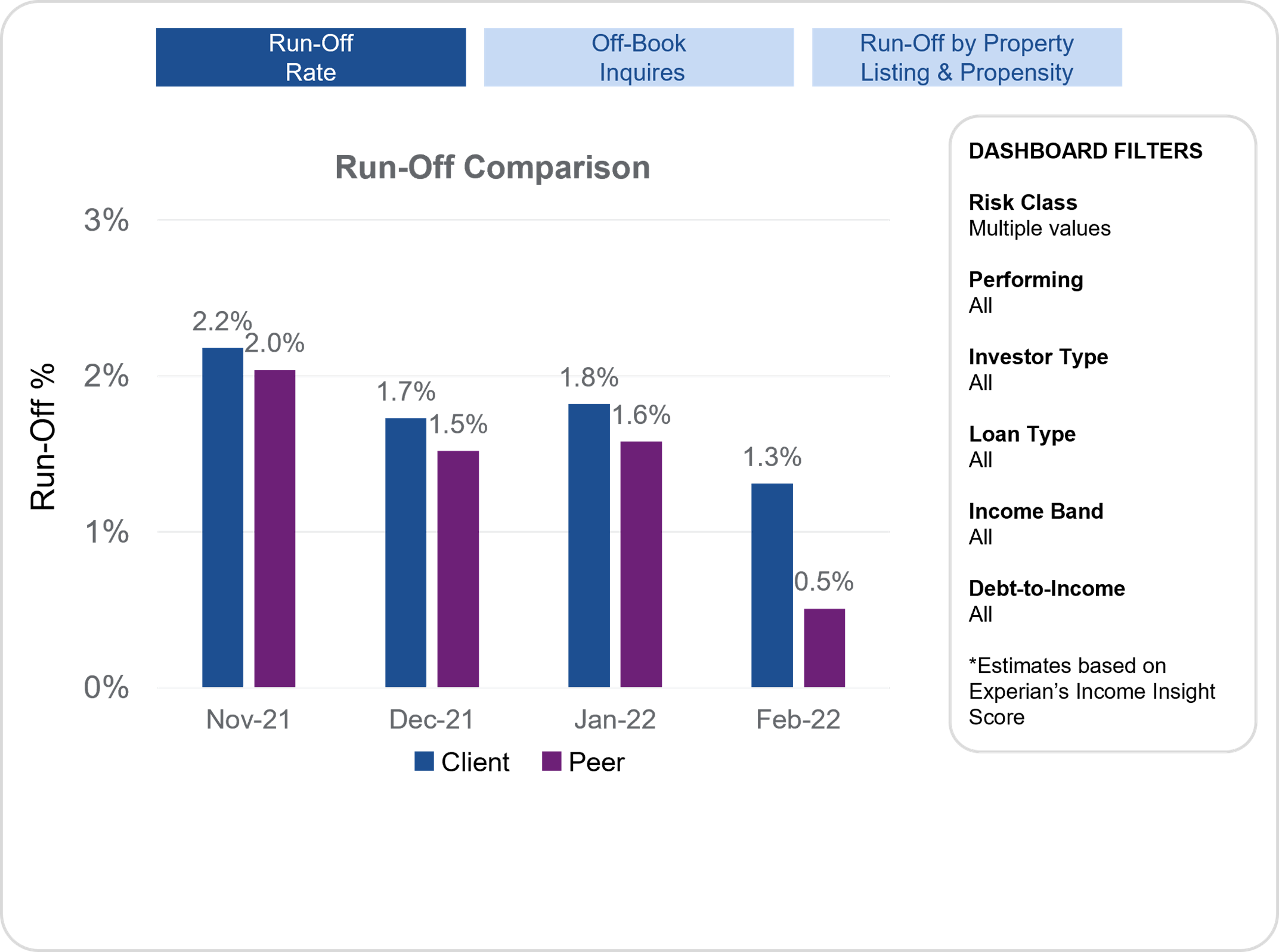

Like sports teams, many mortgage lenders and servicers are interested in comparing their performance against that of their peers. Are your portfolio runoff rates above, equal to, or below that of your competitors? In some instances, we’ve seen a lender’s runoff rate averaging 10% MoM higher than their peers. By comparing your portfolio performance against your peers (and the market) you can assess both the efficacy of portfolio recapture strategies and demonstrate loan quality to investors.

While these are just a few examples of ways to analyze your portfolio, perhaps what’s most important is having the data, such as credit, income, DTI, and property information, needed for this type of intelligence available in one place.

Partner with a provider that can offer you the mortgage servicing solutions to easily segment your portfolio to gain insights and inform ongoing strategic decisions.

*Data charts source: Experian’s Mortgage Insights Dashboard for Servicing