The Federal Reserve (Fed) took a big step towards revolutionizing the U.S. payment landscape with the official launch of FedNow, a new instant payment service, on July 20, 2023. While the new payment network offers advantages, there are concerns that fraudsters may be quick to exploit the new real-time technology with fraud schemes like automated push payment (APP) fraud.

How is FedNow different from existing payment networks?

To keep pace with regions across the globe and accelerate innovation, the U.S. created a alternative to the existing payment network known as The Clearing House (TCH) Real-Time Payment Network (RTP).

Fraudsters can use the fact that real-time payments immediately settle to launder the stolen money through multiple channels quickly. The potential for this kind of fraud has led financial regulators to consider measures to better protect against it.

While both FedNow and RTP charge a comparable fee of 4.5 cents per originated transaction, the key distinction lies in their governance. RTP is operated by a consortium of large banks, whereas FedNow falls under the jurisdiction of the Federal Reserve Bank. This distinction could give FedNow an edge in the market.

One of the advantages of FedNow is its integration with the extensive Federal Reserve network, allowing smaller local banks across the country to access the service. RTP estimates accessibility to institutions holding approximately 90% of U.S. demand deposit accounts (DDAs), but currently only reaches 62% of DDAs due to limited participation from eligible institutions.

What are real-time payments?

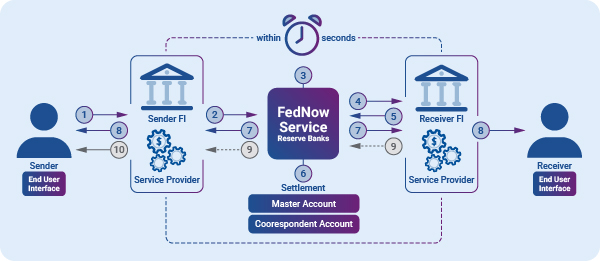

Real-time payments refer to transactions between bank accounts that are initiated, cleared, and settled within seconds, regardless of the time or day. This immediacy enhances transparency and instills confidence in payments, which benefits consumers, banks and businesses. Image sourced from JaredFranklin.com

Image sourced from JaredFranklin.com

Real-time payments have gained traction globally, with adoptions from over 70 countries on six continents. In 2022 alone, these transactions amounted to a staggering $195 billion, representing a remarkable year-over-year growth of 63%. India leads the pack with its Unified Payments Interface platform, processing a massive $89.5 billion in transaction volume. Other significant markets include Brazil, China, Thailand, and South Korea.

The fact that real-time payments cannot be reversed promotes trust and ensures that contracts are upheld. This also encourages the development of new methods to make processes more efficient, like the ability to pay upon receiving the goods or services. These advancements are particularly crucial for small businesses, which disproportionately bear the burden of delayed payments, amounting to a staggering $3 trillion globally at any given time.

The launch of FedNow marks a significant milestone in the U.S. financial landscape, propelling the country towards greater efficiency, transparency, and innovation in payments. However, it also brings a fair share of challenges, including the potential for increased fraud.

Are real-time payments a catalyst for fraud?

As the financial landscape evolves with the introduction of real-time payment systems, fraudsters are quick to exploit new technologies. One particular form of fraud that has gained prominence is authorized push payment (APP) fraud.

APP fraud is a type of scam where fraudsters trick individuals or businesses into authorizing the transfer of funds from their bank accounts to accounts controlled by the fraudsters. The fraudster poses as a legitimate entity and deceives the victim into believing that there is an urgent need to transfer money. They gain the victim’s trust and provide instructions for the transfer, typically through online or telephone banking channels. The victim willingly performs the payment, thinking it is legitimate, but realizes they have been scammed when communication halts. APP fraud is damaging as victims authorize the payments themselves, making it difficult for banks to recover the funds. To protect against APP fraud, it’s important to be cautious, verify the legitimacy of requests independently, and report any suspicious activity promptly.

Fraud detection and prevention with real-time payments

Advances in fraud detection software, including machine learning and behavioral analytics, make unusual urgent requests and fake invoices easier to spot — in real time — but some governments are considering legislation to ensure more support for victims.

For example, in the U.K., frameworks like Confirmation of Payee have rolled out instant account detail checks against the account holder’s name to help prevent cases of authorized push payment fraud. The U.K.’s real-time payments scheme Pay.UK also introduced the Mule Insights Tactical Solution (MITS), which tracks the flow of fraudulent transactions used in money laundering through bank and credit union accounts. It identifies these accounts and stops the proceeds of crimes from moving deeper into the system – and can help victims recover their funds.

While fraud levels related to traditional payments have slowly come down, real-time payment-related fraud has recently skyrocketed. India, one of the primary innovators in the space, recorded a 23% rise in fraud related to its real-time payments system in 2022.

The same ACI report stated that the U.S., making up only 1.2% of all real-time payment transactions in 2022, had, for now, avoided the effects. However, “there is no reason to assume that without action, the U.S. will not follow the path to crisis levels of APP scams as seen in other markets.”

FedNow currently has no specific plans to bake fraud detection into their newly launched technology, meaning the response is left to financial institutions.

Fight instant fraud with instant answers

Artificial Intelligence (AI) holds tremendous potential in combating the ever-present threat of fraud. With AI technologies, financial institutions can process vast amounts of data points faster and enhance their fraud detection capabilities. This enables them to identify and flag suspicious transactions that deviate from the norm, mitigating identity risk and safeguarding customer accounts.

The ability of AI-powered systems to ingest and analyze real-time information empowers institutions to stay one step ahead in the battle against account takeover fraud. This type of fraud, which poses a significant challenge to real-time payment systems, can be better addressed through AI-enabled tools. With ongoing monitoring of account behavior, such as the services provided by FraudNet, financial institutions gain a powerful weapon against APP fraud.

In addition to behavioral analysis, location data has emerged as an asset in the fight against fraud. Incorporating location-based information into fraud detection algorithms has proven effective in pinpointing suspicious activities and reducing fraudulent incidents.

As the financial industry continues to grapple with the constant evolution of fraud techniques, harnessing the potential of AI, coupled with comprehensive data analysis and innovative technologies, becomes crucial for securing the integrity of financial transactions.

Taking your next step in the fight against fraud

Ultimately, the effectiveness of fraud prevention measures depends on the implementation and continuous improvement of security protocols by financial institutions, regulators, and technology providers. By staying vigilant and employing appropriate safeguards, fraud risks in real-time payment systems, such as FedNow, can be minimized.

To learn more about how Experian can help you leverage fraud prevention solutions, visit us online or request a call.

*This article leverages/includes content created by an AI language model and is intended to provide general information.