The U.S. Senate declared April to be Financial Literacy Month back in 2004. Fast forward 13 years and one has to question if we’ve moved the needle on educating Americans about personal finance and money management.

There is still no national standard or common curriculum to teach our kids the basics in schools, and only five states require high school students to take one semester of personal finance in order to graduate.

I read an interesting stat years back that high school seniors spend more time shopping for their prom attire than they do researching financial education options for college. No wonder there is sticker shock post-graduation when those first student loan bills coming.

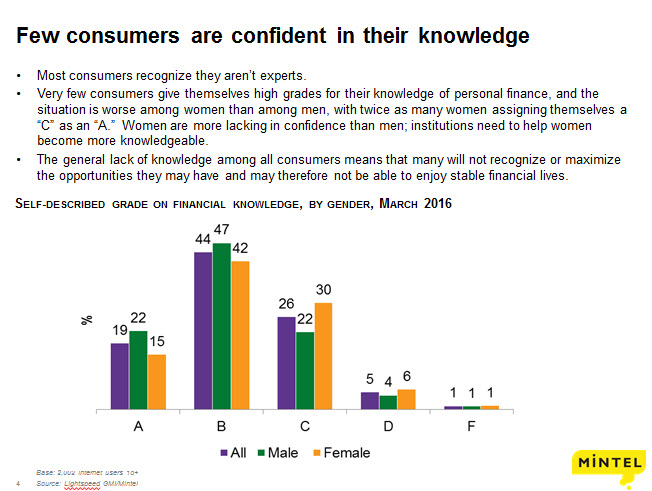

The lack of investment shows. In a 2016 Mintel study, very few consumers gave themselves high grades for their knowledge of personal finance, and the situation was worse among women, with twice as many assigning themselves a “C” as an “A.”

Having worked in the financial services industry for more than a decade, I can say with certainty I’m a bit of a personal finance geek. Learning about the latest products and economic shifts has been rolled into my job, and I’ve sadly seen the consequences of what happens to consumers when they make poor financial decisions.

Slumping credit scores. Delinquent payments. Repossessed vehicles. Hard times.

The good news? There are plenty of resources to help Americans learn. The challenge? Finding the right ways to capture mind share via the right mediums at the right time.

There is obviously a benefit to the consumer to be more financially literate, but financial institutions benefit as well when consumers are money smart. Individuals who understand financial products and how they can use them to achieve their goals are more likely to purchase those products throughout their financial lives.

So how can financial institutions help close the financial literacy gap?

Make online education and resources readily available.

Research shows more consumers would like to get information about finance through the use of online resources rather than seminars. This preference is likely due to the fact that online resources can be accessed on one’s own schedule and gives the user more control over the topics s/he wants to explore.

Provide parents resources to launch smart money talks with their kids.

Study after study reveals parents are one of the most powerful teachers in their kids’ lives – and this includes providing an education and modeling strong money management skills. Consider adding online education for kids – or partnering with a provider who has already built a money app for youngsters. Additionally, educate parents about when it might be time to help a child establish their first savings account. Advise them on ways to finance college. Talk about co-signing on vehicles. Explain the power of saving. Train up your next wave of customers and they will likely remain loyal to you.

Offer one-on-one credit education sessions.

A high-touch solution is sometimes the perfect opportunity to grow a customer in the right financial direction. Perhaps a low credit score prevents an individual from securing an ideal interest rate for an auto or home loan. Each person’s financial situation is different, and a one-on-one session with a trained agent can help them understand what is specifically contributing to their low score. With a few insights, a customer can determine if they need to pay down some debt, address a few late payments, or reduce their number of credit lines. Knowledge is power, and consumers will appreciate this service and personable touch.

—

Lenders have a vested interest to close the financial literacy gap, and while they can’t solve for everything, they can certainly make a difference with some basic steps and investments. If nothing else, April seems like a perfect time to evaluate what you’re doing and what resolutions you can make for the year ahead. Just as every saved penny counts, so does every effort to educate Americans on manning their money more effectively.