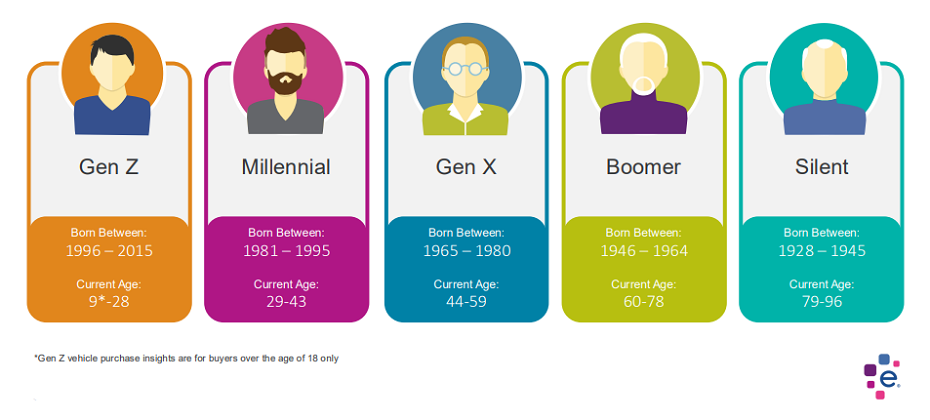

If you listen to some of the latest auto industry analysis, you might get the impression that the industry is doomed because younger consumers aren’t interested in buying cars. It is true the vast majority – 61.3 percent – of new vehicle registrations in 2016 were from customers 45 years old and older, but is that really a cause for concern? Or are automotive marketers simply doing a better job of identifying customers with the means to buy their product?

Remember Willie Sutton’s response when asked why he robbed banks? “Because that’s where the money is.”

Maybe, just maybe, automotive marketers are getting better at market segmentation and finding the right customers for their vehicles. Maybe, they’re simply going to “where the money is” like Willie Sutton.

How do auto marketers know where to look? Experian’s Mosaic® USA consumer lifestyle segmentation is a good place to start. It is made up of 71 different consumer groupings from the most affluent suburbanites to the most economically challenged. Understanding who and where these customers are and knowing which vehicles fit their current lifestyles and economic standing can help automakers and retailers boost sales.

Take luxury vehicles, for example. In Q4 2016, the top three Mosaic® consumer segments in the luxury vehicle category included:

- American Royalty – 12.67 percent

- Silver Sophisticates – 7.69 percent

- Aging in Aquarius – 5.01 percent

Who are these folks? Individuals and households in the:

- American Royalty include wealthy, empty nest Baby Boomers with million dollar homes;

- Silver Sophisticates include a mix of older and retired couples and singles living in suburban comfort; and

- Aging in Aquarius include empty-nesting couples between 50 and 65 years old with no children at home who are finally enjoying the kick-back-and-relax stage of their lives.

What do each of these segments have in common? Their members have the disposable income to pamper themselves a bit, and a luxury vehicle might just be the way to do it.

But, what if you sell minivans? The Mosaic consumer segment Babies and Bliss is one target audience to consider targeting. These large families with multiple children live in homes valued over $250,000 and should be at the top of your prospecting list.

How about those younger customers who seem so anti-auto? Fast Track Couples — families on the road to upward mobility, under the age of 35, with good jobs and own their homes are ripe for a CUV. Or perhaps Status Seeking Singles — younger, middle-class singles preoccupied with balancing work and leisure lifestyles? There’s got to be a hybrid vehicles waiting for them, right?

Just because younger customers are still in the minority of auto buyers, it doesn’t mean the industry is in crisis. The right customer segment for the right vehicle is out there – even in the younger demographics. And besides…younger customers get older so now is the time to win their hearts and minds and begin building a long-term relationship with them. But, if you’re not the patient type and you’ve got a vehicle to sell, you can find your next best customer by using Mosaic USA to create cross-channel messaging that connects with the lifestyle and values of your audience.

For more information on automotive target marketing, visit Experian Automotive.