Many companies rely on attributes for decisioning but lack the resources needed to invest in developing, managing, and updating the attributes themselves. Experian is there to guide you every step of the way with our Attribute Toolbox – our source independent solution that provides maximum flexibility and multiple data sources you can use in the calculation and management of attributes.

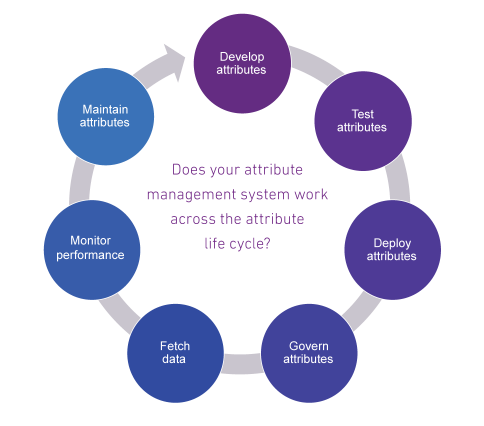

To create and manage our attributes, Experian has established development principles and created a set methodology to ensure that our attribute management system works across the attribute life cycle.

Here’s how it works:

Develop Attributes

The attribute development process includes: discovery, exploratory data analysis, filter leveling, and the development of attributes. When we create attributes, Experian takes great care to ensure that we:

- Analyze the available data elements and how they are populated (the frequencies of fields).

- Determine a “sensible” definition of the attribute.

- Evaluate attribute frequencies.

- Review consumer credit reports, where possible.

- Refine the definition and assess more frequencies and examples.

Test Attributes

Before implementing, Experian performs an internal audit of filters and attributes. Defining, coding and auditing filters is 80% of the attribute development process. The main objective of the auditing process is to ensure both programming and logical accuracy. This involves electronic and manual auditing and requires a thorough review of all data elements used in development.

Deploy Attributes

Deployment is very similar to attribute testing. However, in this case, the primary objective of the deployment audit is to ensure both the programming and logical accuracy of the output is executing correctly on various platforms. We aim to maintain consistency among various business lines and products, between batch and online environments across the life cycle, and wherever your models are deployed: on premises, in the cloud, and off-site in your partners’ systems.

Govern Attributes

Experian places a robust attribute governance process in place to ensure that our attributes remains up-to-date and on track with internal and external compliance regulations and audits. New learnings, industry and regulatory changes can lead to updated attributes or new attributes over time. Because attributes are ever-changing, we take great care to expand, update and add new attributes over time based on three types of external changes: economic, bureau, and reporting changes.

Fetch Data

While we gather the data, we ensure that you can integrate a variety of external data sources, including: consumer bureau, business, fraud, and other data sources.

Attributes need to be:

- Highly accurate.

- Suitable for use across the Customer Life Cycle.

- Suitable for use in credit decisioning and model development.

- Available and consistent across multiple platforms.

- Supportive and adaptable to ever-evolving regulatory considerations.

- Thoroughly documented and monitored.

Monitor Performance

We generate attribute distribution reports and can perform custom validations using data from credit reporting agencies (CRAs) and other data providers. This is based on monthly monitoring to ensure continued integrity and stability to stand up to regulatory scrutiny and compliance regulations. Variations that exceed predetermined thresholds are identified, quantified, and explained. If new fields or data values within existing fields are announced, we assess the impact and important of these values on attributes – to determine if revisions are needed.

Maintain Attributes

Credit bureau data updates, new attributes in response to market needs, compliance requirements, corrections in logic where errors are identified or improvements to logic often lead to new version releases of attributes. With each new version release, Experian takes care to conduct thorough analyses comparing the previous and current set of attributes. We also make sure to create detailed documentation on what’s changed between versions, the rationale for changes and the impact on existing attributes.

Experian Attributes are the key to unlocking consistent, enhanced and more profitable decisions. Our data analysts and statisticians have helped hundreds of clients build custom attributes and custom models to solve their business problems.

Our Attribute Toolbox makes it easier to deploy and manage attributes across the customer lifecycle. We give companies the power to code, manage, test, and deploy all types of attributes, including: Premier AttributesSM, Trended 3DTM, and custom attributes – without relying on a third-party.

We do the heavy lifting so that you don’t have to.