All posts by Kirsten Von Busch

The pickup truck market is shifting gears, and hybrids are emerging as a driving force behind the change. As more drivers prioritize fuel efficiency while still expecting towing power, hybrid models are stepping in to redefine the segment. According to Experian’s Automotive Consumer Trends Report: Q3 2025, gas-hybrid and plug-in hybrid pickup trucks accounted for nearly one-in-five new light-duty trucks sold, coming in at 17.8% this quarter. This signals a major shift in a historically ICE-dominated category. Hybrids are likely gaining traction because they offer the best of both worlds. While their systems provide fuel efficiency by combining gas or diesel engines with electric motors to avoid range anxiety, they’re also meeting most towing and hauling requirements that accompany the traditional gas-powered trucks. Overall pickup truck market trends fueling hybrid growth When looking at the market from a broader perspective, there were 55.3 million light-duty trucks on U.S. roads in the third quarter of 2025, representing 20.10% of all vehicles in operation. Furthermore, as of Q3 2025, 34% of U.S. households with one-or-more vehicles also own a light-duty pickup truck, giving this segment a strong foothold in transportation options. The widespread presence underscores the pickup truck’s influence in the automotive industry as they set the pace for consumer expectations and steer market trends. The increased momentum for hybrid trucks can also help OEMs and dealers capitalize on growing their presence in an increasingly competitive space. It’s important for automotive professionals to consider aligning sales strategies with evolving buyer preference to elevate consumer engagement as this trend offers benefits today and even greater potential ahead. To learn more about pickup truck insights, view the full Automotive Consumer Trends Report: Q3 2025 presentation.

While the dynamics of the electric vehicle (EV) market continue to drive headlines, recent data reveals that although EV registrations remain steady, hybrids are becoming a practical bridge between gas-powered vehicles and EVs. Experian’s Automotive Consumer Trends Report: Q2 2025 found EVs accounted for 9.2% of new retail registrations, down from 10.5% in Q2 2024, and gas-powered vehicles declined from 73.7% to 71.9% year-over-year. Meanwhile, hybrids jumped from 15.8% to 18.9% in the same time frame. Digging a bit deeper, one of the most telling insights from the data was the apparent transition that consumers make when returning to the market for another vehicle purchase. The data shows that as consumers become familiar with alternative fuel types, some “graduate” into more electrified vehicles. For example, nearly 13% of gas-powered vehicle owners replaced their vehicle with a hybrid (10.8% for hybrids and 2.0% for plug-in hybrids [PHEV], respectively). Meanwhile, 52.2 % of hybrid owners returned to the market to purchase another hybrid and 5.0% returned to purchase a PHEV. Further along in the electrified vehicle funnel, we’re seeing 11.0% of PHEV owners returning to market to purchase a hybrid, while 31.7% returned to purchase another PHEV and 22.2% purchase an EV. Most EV households are not exclusively electric Data in the second quarter of this year found 80% of EV-owning households also have a gas-powered vehicle and 14.9% also own a hybrid, demonstrating that consumers are looking for ways to accommodate their diverse driving needs. While the interest in EVs remains strong, many consumers still rely on more traditional fuel types for various reasons. Though, hybrids are notably becoming a middle ground solution as they offer fuel efficiency without the other concerns that can accompany an EV. As alternative fuel types continue to create a household name in the automotive industry, hybrids are starting to play a notable role in the transition to electrification. Data from this quarter not only shows that consumers are experimenting with alternative fuel types, but they’re also integrating them into multi-vehicle households. With their growing popularity reflects a pragmatic approach to balancing the latest innovation with everyday practicality, hybrids may be the key steppingstone that brings mainstream consumers closer to the electrified space. To learn more about alternative fuel type insights, view the full Automotive Consumer Trends Report: Q2 2025 presentation.

While many view Experian as a credit bureau, we have a rich history in identifying and analyzing emerging market shifts and consumer behaviors across industries, particularly automotive. In fact, Experian’s Automotive Consumer Trends Report: Q1 2025 is one of our many reports that provide essential intel for automotive professionals navigating today’s competitive landscape. And this quarter’s report sheds light on SUVs (including SUVs and CUVs)—a segment that continues to pique consumers’ interest. Data in the first quarter of this year found 62.8% of new retail registrations were SUVs, accounting for the largest portion of market share over the last 12 months—compared to sedans (18.4%), pickup trucks (16.6%), and vans (2.2%). While overall SUV registrations highlight the growing dominance in this sector, a closer look at the data revealed that electric SUVs are emerging as a contributor to this momentum. In Q1 2025, electric SUVs accounted for 10.5% of new retail SUV registrations—and within that group, 30.7% were registered in the state of California. It’s crucial for automotive professionals to monitor these trends and prepare accordingly as the fuel type continues to grow. Which electric SUV models are catching buyers’ attention? Knowing which types of electric SUVs are attracting consumer interest can enable professionals to align their offerings with market demand. The Tesla Model Y made up nearly half of the new retail SUV registrations for exotic and luxury in the last 12 months, coming in at 40.5%. Interestingly, the next closest model, Ford Mustang Mach-E, trailed behind at 5.8%. Rounding out the top five were the Hyundai IONIQ 5 (5.5%), Honda Prologue (4.9%), and Chevrolet Equinox EV (4.3%). Understanding SUV registrations goes beyond data—it’s about spotting the shift in consumer behavior as this segment as well as the EV fuel type continues to break ground in the automotive landscape. This insight gives professionals the leverage they need to adapt and refine their strategies in the next era of mobility. To learn more about SUV insights, view the full Automotive Consumer Trends Report: Q1 2025 presentation.

Electric vehicles (EVs) continue to gain traction in certain markets. In fact, at the end of 2024, 9.2% of all new retail registrations were electric, up from 8%+ in 2023 and 6%+ in 2022. Clearly, more and more in-market shoppers are leaning towards EVs, but what is actually a determining factor in their decision? A recent Experian survey [1] found 65% of respondents said they prioritize battery life, while 62% consider price, 58% are concerned with range on a full battery and 53% are focused on infrastructure and maintenance. It’s not just EVs, hybrids are getting into the mix While EVs certainly are the buzzword in the industry, it’s not the only alternative fuel type consumers are opting for. For instance, 55% of respondents said they’d consider a new hybrid and 50% said they’d consider a new EV for their next vehicle purchase. On the used side, 38% of respondents said they’d consider an EV and 42% would consider a hybrid. More granularly, the survey revealed 67% of Gen Z and 61% of Millennials are likely to buy a new EV, while 62% and 63% of these groups, respectively, expressed similar intentions for purchasing new hybrid. Gen Z and Millennials also showed a stronger-than-average interest on the used side, with 57% and 49% opting for EVs, and 57% and 52% choosing hybrids. With the younger generations gravitating towards these fuel types, it’s likely going to influence adoption rates down the road, a trend that should be watched closely as manufacturers roll out more models to meet the growing demand. However, when assessing the viewpoints of other generations, some are less likely to purchase an alternative fuel type. Two-in-five, albeit still a healthy percentage, of Gen X respondents said they’re likely to purchase a new EV and only 25% of Baby Boomers shared a similar sentiment. Meanwhile, 27% of Gen X and 12% of Baby Boomers say they’re likely to purchase a used EV. Furthermore, 46% of Gen X and 43% of Baby Boomers indicated they are likely to buy a new hybrid, while 33% and 21% of these groups, respectively, conveyed similar thoughts towards purchasing used hybrids. It’s crucial for professionals to stay attuned to shifting trends and concerns among consumers, as these factors play a role in consumer decision-making. By addressing potential setbacks and knowing where their target audience is, they can better align their strategies with consumer needs as these fuel types continue to move up on the list for everyday commuters. To learn more about EV insights, visit Experian Automotive’s EV Resource Center. [1] Experian commissioned Atomik Research to conduct an online survey of 2,005 adults throughout the United States. The sample consists of adults who estimate they will purchase or lease their next vehicle within the next 24 months or sooner. The margin of error is +/- 2 percentage points with a confidence level of 95 percent. Fieldwork took place between March 24 and March 27, 2025.

While CUVs and SUVs continue to dominate the market, sedans remain a popular choice among consumers. According to Experian’s Automotive Consumer Trends Report: Q4 2024, sedans accounted for 18.4% of new retail registrations and 36.9% of used. Comparatively, CUVs/SUVs came in at 59.3% for new and 38.6% for used. For retail sedan registrations, the Toyota Camry made up the most market share for both new and used in the last 12 months, coming in at 10.5% and 6.0%, respectively. Meanwhile, the Honda Civic came in a close second for new sedan registrations at 10.1% and the Honda Accord followed closely for used at 5.9%. Knowing which sedan models are leading in registrations is important for professionals as it helps them understand evolving consumer preferences, enhance marketing strategies, and make informed inventory decisions. Understanding the key generations fueling the sedan segment When examining generational interest in this vehicle segment, data found Gen Z and Millennials over-indexed in new retail sedan registrations. In the past 12 months, Gen Z represented 12.4% of new retail sedan registrations, while their total new retail registration was 8.2%. Millennials had 27.3% of sedan registrations out of 27% total registrations. Understanding who is purchasing and what models they’re gravitating towards can unlock valuable insights as professionals craft their next move and position themselves one step ahead in a competitive market. To learn more about sedan insights, view the full Automotive Consumer Trends Report: Q4 2024 presentation.

The electric vehicle (EV) market continues to see remarkable growth as both new and used registrations rise year-over-year. For the first time, new EVs accounted for 9.2% of all retail vehicle registrations across the U.S. in 2024, according to Experian’s 2024 EV Year in Review Report, and used EV registrations climbed to just over 1%, from 0.7% the year prior. As we dove into the data, we found that Tesla remains the dominant player in both new and used sectors; however, the shift in consumer preferences is extending across various manufacturers with more models hitting the market. For instance, Tesla accounted for 50.7% of new retail registrations in 2024, from 60.6% in 2023. Meanwhile, Ford increased from 4.7% to 6.2% year-over-year and Hyundai went from 4.2% to 5.4%. On the used side, Tesla made up 59% of retail registrations, from 60% in 2023, while Chevrolet grew from 7.1% to 9% and Nissan was at 5.4%, from 8.3%. As the EV market continues to grow, it’s not just the various manufacturers making waves; geographical trends are also coming into play in shaping how these vehicles are being embraced nationwide. While EV adoption is expanding well beyond the traditional EV strongholds, California still holds the highest number of registrations, with Los Angeles accounting for more than 180,000 new retail EV registrations, followed by San Francisco at 91,000+ and San Diego with more than 31,000. Hartford and New Haven, Connecticut experienced the highest growth in new retail EV registrations over the last five years, reaching 110.5% in 2024. Close behind were El Paso, Texas (with a 99% increase), and Colorado Springs, Colorado (with an 85.7% spike). These shifts highlight the rapid expansion of EV adoption across the country as we see more consumers in diverse areas opting for the fuel type. Analyzing and leveraging the broader range of registrations will help automotive professionals as they identify emerging markets to effectively tailor their strategies. To learn more about EV insights, visit Experian Automotive’s EV Resource Center.

With the National Automobile Dealers Association (NADA) Show set to kickoff later this week, it seemed fitting to explore how the shifting dynamics of the used vehicle market might impact dealers and buyers over the coming year. Shedding light on some of the registration and finance trends, as well as purchasing behaviors, can help dealers and manufacturers stay ahead of the curve. And just like that, the Special Report: Automotive Consumer Trends Report was born. As I was sifting through the data, one of the trends that stood out to me was the neck-and-neck race between Millennials and Gen X for supremacy in the used vehicle market. Five years ago, in 2019, Millennials were responsible for 33.3% of used retail registrations, followed by Gen X (29.5%) and Baby Boomers (26.8%). Since then, Baby Boomers have gradually fallen off, and Gen X continues to close the already minuscule gap. Through October 2024, Millennials accounted for 31.6%, while Gen X accounted for 30.4%. But trends can turn on a dime if the last year offers any indication. Over the last rolling 12 months (October 2023-October 2024), Gen X (31.4%) accounted for the majority of used vehicle registrations compared to Millennials (30.9%). Of course, the data is still close, and what 2025 holds is anyone’s guess, but understanding even the smallest changes in market share and consumer purchasing behaviors can help dealers and manufacturers adapt and navigate the road ahead. Although there are similarities between Millennials and Gen X, there are drastic differences, including motivations and preferences. Dealers and manufacturers should engage them on a generational level. What are they buying? Some of the data might not come as a surprise but it’s a good reminder that consumers are in different phases of life, meaning priorities change. Over the last rolling 12 months, Millennials over-indexed on used vans, accounting for more than one-third of registrations. Meanwhile, Gen X over-indexed on used trucks, making up nearly one-third of registrations, and Gen Z over-indexed on cars (accounting for 17.1% of used car registrations compared to 14.6% of overall used vehicle registrations). This isn’t surprising. Many Millennials have young families and may need extra space and functionality, while Gen Xers might prefer the versatility of the pickup truck—the ability to use it for work and personal use. On the other hand, Gen Zers are still early in their careers and gravitate towards the affordability and efficiency of smaller cars. Interestingly, although used electric vehicles only make up a small portion of used retail registrations (less than 1%), Millennials made up nearly 40% over the last rolling 12 months, followed by Gen X (32.2%) and Baby Boomers (15.8%). The market at a bird’s eye view Pulling back a bit on the used vehicle landscape, over the last rolling 12 months, CUVs/SUVs (38.9%) and cars (36.6%) accounted for the majority of used retail registrations. And nearly nine-in-ten used registrations were non-luxury vehicles. What’s more, ICE vehicles made up 88.5% of used retail registrations over the same period, while alternative-fuel vehicles (not including BEVs) made up 10.7% and electric vehicles made up 0.8%. At the finance level, we’re seeing the market shift ever so slightly. Since the beginning of the pandemic, one of the constant narratives in the industry has been the rising cost of owning a vehicle, both new and used. And while the average loan amount for a used non-luxury vehicle has gone up over the past five years, we’re seeing a gradual decline since 2022. In 2019, the average loan amount was $22,636 and spiked $29,983 in 2022. In 2024, the average loan amount reached $28,895. Much of the decline in average loan amounts can be attributed to the resurgence of new vehicle inventory, which has resulted in lower used values. With new leasing climbing over the past several quarters, we may see more late-model used inventory hit the market in the next few years, which will most certainly impact used financing. The used market moving forward Relying on historical data and trends can help dealers and manufacturers prepare and navigate the road ahead. Used vehicles will always fit the need for shoppers looking for their next vehicle; understanding some market trends will help ensure dealers and manufacturers can be at the forefront of helping those shoppers. For more information on the Special Report: Automotive Consumer Trends Report, visit Experian booth #627 at the NADA Show in New Orleans, January 23-26.

Pickup trucks are a staple of the automotive industry. Their utility and versatility allow consumers to haul heavy loads or tow large trailers, making them ideal for blue-collar workers. At the same time, pickup trucks offer a sleek appearance that can be aesthetically appealing. And now, we’re seeing the next evolution of the pickup truck: EVs. According to Experian’s Automotive Consumer Trends Report: Q3 2024, of the 292.1 million vehicles in operation, more than 54 million were pickup trucks. Furthermore, 17.4% of new retail registrations this quarter were pickup trucks, while pickup trucks made up 19.2% of used retail registrations. Interestingly, we’re seeing more consumer demand for EV pickup trucks. Over the last 12 months, the Ford F-150 Lightening made up 42.2% of the EV pickup truck market share, closely followed by the Tesla Cybertruck at 37.9%. Rounding out the top five were the Rivian R1T (14.2%), GMC Hummer EV (4.8%) and Chevrolet Silverado EV (0.9%). Still room for the ICE pickup Although we’re beginning to see EV pickup trucks gain some prominence, the overwhelming majority of pickups on the road are gas-powered. In fact, over the last 12 months, 14.5% of new retail pickup truck registrations were attributed to the Chevrolet Silverado 1500, followed by the Ford-150 at 13.4% and the GMC Sierra 1500 (9.1%). Though, data found the preference flipped for the used side, with the Ford F-150 leading at 18.1% of retail pickup registrations and the Chevrolet Silverado 1500 at 13.9%, followed by the GMC Sierra 1500 (6.2%). With more consumers not only maintaining a keen interest in gasoline pickup trucks, but also moving into the EV space, the current data can be leveraged in more ways than one as professionals diversify their sales strategies while optimizing dealership inventory. To learn more about pickup truck insights, view the full Automotive Consumer Trends Report: Q3 2024 presentation or The Trade Desk Brochure.

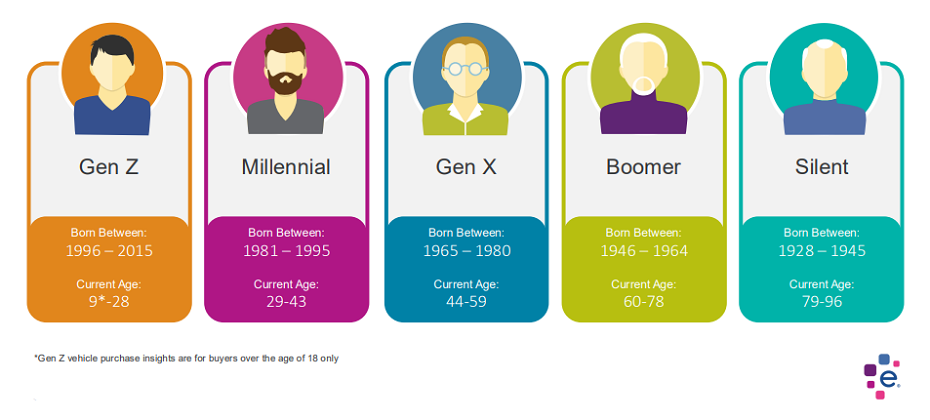

Summary: Gen Z, Millennials, Gen X, and Boomers each have unique automotive buying preferences and your strategies to reach each generation should reflect these preferences. The automotive landscape is shaped by the distinct preferences of different generations. From Gen Z to Boomers, each generation brings unique buying habits that automotive marketers must understand to stay competitive. Below is a brief overview of the key insights from the latest reports on Gen Z, Millennials, Gen X, and Boomers. To learn more about how to market to each generation, download the respective playbook. Gen Z (Born 1996–2015) Gen Z buyers are digital natives who prefer compact vehicles. The Honda Civic leads in market share for this group, showcasing their preference for smaller, fuel-efficient cars. They rely heavily on digital platforms for their research, with 73% of impressions delivered through Connected TV (CTV). Millennials (Born 1981–1995) Millennials value technology and eco-friendly options. Crossovers (CUVs) are their top choice, making up 50.2% of new vehicle registrations. Electric and hybrid vehicles are also popular, reflecting their environmental consciousness. Popular models include the Honda Civic and Toyota RAV4. Gen X (Born 1965–1980) Gen X buyers favor practicality and reliability, gravitating toward SUVs and trucks. The Ford F-150 is the top model among this group, and they are more likely to invest in luxury or exotic vehicles than younger generations. Boomers (Born 1946–1964) Boomers remain loyal to traditional brands, with a strong preference for non-luxury and luxury cars, such as the Honda CR-V and Ford F-150. They also favor gas-powered vehicles over electric, though hybrid options are gaining ground. Summary Understanding generational differences is crucial to developing effective marketing strategies that resonate with each group’s unique preferences. For a more detailed generational analysis, download the full report. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

As the desire for flexibility and affordability continues to grow across the overall vehicle market, it seems the trend is carrying over into the electric vehicle (EV) space—resulting in more manufacturers rolling out new models as the number of consumers opting for the electric fuel type rises. According to Experian’s Automotive Consumer Trends Report: Q2 2024, non-luxury EV registrations grew to 26.6%, from 22.7% last year, while exotic and luxury declined from 77.3% to 73.4% year-over-year. Furthermore, of the 291.1 million vehicles on the road in Q2 2024, EVs accounted for over 3.5 million, an increase from more than 2.7 million last year. Historically, EVs were often viewed as luxury vehicles that offered limited model availability to choose from. Though, it’s notable that as more non-luxury models are introduced, the EV market share is witnessing a shift in consumer preference. For instance, Ford led the new retail non-luxury EV market at 21.9% in Q2 2024, from 24.0% last year. Hyundai increased from 15.2% to 19.3% year-over-year, Chevrolet decreased from 24.2% to 13.2%, Kia went from 9.2% to 12.5%, and Volkswagen declined to 11.2% this quarter, from 15.8% in Q2 2023. Consumers continue to embrace EVs While understanding the current EV market share allows automotive professionals to assist in-market shoppers more effectively, leveraging multiple data points allows for a more nuanced perspective while helping them prepare for the future as the market continues to evolve. It’s notable that 77.4% of EV owners replaced their current EV with another one in the last 12 months. Meanwhile, 16.2% transitioned to a gasoline fuel type and 3.2% switched to a hybrid. With the EV model lineup expanding, consumers are potentially intrigued by the new options or holding steadfast to a manufacturer. Regardless, the majority of current EV owners are remaining loyal to the fuel type. However, data found that 81% of households with at least one EV also own a gasoline-powered vehicle, 14% also own a hybrid, and 12% own an additional EV. There are a number of factors that can play a role in owning another vehicle alongside an EV—such as range anxiety or tasks that require a larger and more versatile vehicle—so having a secondary option allows consumers to maintain the flexibility to meet diverse transportation needs. To learn more about EV insights, view the full Automotive Consumer Trends Report: Q2 2024 presentation.

Quick Answer: A new consumer survey reveals that 90% of survey respondents would like to have more than one Vehicle History Report when shopping for a used car. Offering an Experian AutoCheck® VHR as a second Vehicle History Report is a smart, simple strategy to help you close more deals. In today’s used car market, standing out from the crowd is more important than ever. As buyers become savvier and more informed, dealerships need to find new ways to build trust and close sales. One simple yet effective strategy? Offering a second Vehicle History Report (VHR) to your customers. Why VHRs Matter So Much Let’s face it—buying a car is a big deal. Most people don’t just walk onto a lot and pick the first car they see. They do their homework, and a big part of that research involves Vehicle History Reports. In fact, a recent survey found that 70% of people used a VHR the last time they bought a car. And it’s not just a one-time thing—83% of buyers say they’ll use a VHR for their next purchase too. Why? Because these reports provide crucial details like accident history, mileage accuracy, and service records that give buyers confidence in their decisions. The Case for Offering Multiple VHRs Here’s something that might surprise you: 90% of surveyed car buyers said they’d like to see more than one VHR when shopping for a used car. Think about that for a second. People want that extra layer of reassurance that only comes from cross-checking information. This is especially true for those who prefer buying from dealerships—these customers expect comprehensive, reliable data before they make a decision. How Multiple VHRs Can Give Your Dealership an Edge So, what’s the big deal about offering more than one VHR? It’s all about trust and transparency. Just like banks look at multiple credit reports before approving a loan, offering multiple VHRs can help you provide a fuller, more accurate picture of a vehicle’s history. This can reduce your liability and protect your dealership’s reputation. We have done some digging into this, and the results are eye-opening. For instance, in one case study, a dealership found additional damage events through an Experian AutoCheck® VHR that weren’t picked up by other VHRs. This kind of discrepancy shows just how valuable it can be to provide that second report—it helps ensure that all the facts are on the table, which protects both you and your customers. Meeting and Exceeding Customer Expectations Here’s something else to keep in mind: people expect dealerships to go the extra mile. The survey found that 86% of used car buyers believe VHRs should be provided for free by the dealership. By offering multiple reports at no additional cost, you’re not just meeting their expectations—you’re exceeding them. And that’s a surefire way to boost customer confidence, satisfaction, and, ultimately, your sales. What You Can Do Today Offering a second Vehicle History Report is a smart, simple strategy to help you close more deals. It shows your customers that you’re committed to transparency and that you care about providing them with all the information they need to make a confident decision. In a competitive market, it’s the little things like this that can make a big difference. Your customers—and your bottom line—will thank you. Experian Automotive is here to help you with your vehicle history data needs. If you’d like to learn more about our AutoCheck solution and how we can support you, click below to have someone from our team contact you.

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

Quick Answer: Dealerships can avoid purchasing flood-damaged vehicles with Experian AutoCheck's Free Flood Risk Check. The used car market is tough right now. Unfortunately, recent floods in several areas have added another challenge: flood-damaged vehicles. These cars pose a big risk to dealerships. Buying one can lead to expensive repairs, unhappy customers, and damage to your reputation. Experian AutoCheck's Free Flood Risk Check can help. We've updated it with data from recent floods to give you a head start. Here's what the Free Flood Risk Check does: Quickly checks any car's flood risk with just the 17-digit VIN. Provides you with two levels of reporting: See if the car was registered in a region hit by a major FEMA disaster. Find potential flood damage based on Experian data (flood titles, auction records, etc.). Important things to remember: A "Yes" in the first report doesn't confirm flood damage, just that the car was in a flood zone. Even a clean second report isn't a guarantee - some flood damage goes unreported. For extra protection: Run a full Experian AutoCheck Vehicle History Report to uncover other issues like accidents or recalls. Have a mechanic thoroughly inspect any car before you buy it. By using Experian AutoCheck's Free Flood Risk Check and following these tips, you can dramatically reduce the risk of buying a flood-damaged car and protect your dealership. Ready to safeguard your dealership? Not an Experian AutoCheck subscriber?

As more consumers lean towards adaptable and efficient vehicles that fit their everyday lifestyle, it’s no surprise to see the nuanced shifts in consumer preferences over recent years. For instance, compact utility vehicles (CUVs) have resonated with those seeking versatility—emerging as the most registered new vehicle segment in the first quarter of 2024 at 51.1%, according to Experian’s Automotive Consumer Trends Report. When exploring the depths of CUV registrations, data showed Toyota led the market share for the non-luxury segment at 14.9% in Q1 2024. They were followed by Chevrolet (12.1%), Honda (11.4%), Subaru (10.4%), and Hyundai (10.0%). On the luxury side, Tesla accounted for 28.0% of the market share this quarter and Lexus trailed behind at 14.1%. Rounding out the top five were BMW (12.2%), Audi (8.6%), and Volvo (6.2%). CUV registration trends by generations It’s notable that different generations are drawn to CUVs for a multitude of personal preferences that align with their respective lifestyles. For example, Baby Boomers made up 32.3% of new retail registrations for CUVs and Gen X was close behind at 30.4% in Q1 2024. They were followed by Millennials (23.6%), Gen Z (7.9%), and the Silent Generation (5.4%). While some generations seek a vehicle that strikes a balance between practicality and comfort, others may prefer smaller and more maneuverable vehicles. Nonetheless, CUVs making up just over half of new retail registrations is something that should be watched closely. By leveraging multiple data points such as who is in the market for a CUV as well as the types of makes and models they’re interested in, professionals have the opportunity to strategize new ways to effectively reach shoppers. To learn more about CUVs, view the full report at Automotive Consumer Trends Report: Q1 2024. Or

Experian's Automotive Consumer Trends Quarterly Report goes beyond understanding general car-buying trends. Each quarter, we delve deeper into a specific vehicle segment, analyzing the demographics (who's buying) and psychographics (why they're buying) of those consumers. New eBrochures help turn insights into action Although valuable, what can you do with this information? That's where The Trade Desk comes in. They leverage the insights from our report to create a comprehensive omnichannel strategy for reaching in-market car buyers. This strategy goes beyond demographics, revealing: Top web content preferences: Where are these consumers spending their online time? Frequented websites and apps: What digital platforms are most relevant to them? Top CTV and audio examples: Which streaming services and audio channels should be targeted? A Consolidated Snapshot The Trade Desk provides a clear picture of channel distribution, ensuring your advertising reaches the right audience across the most effective platforms. This combined approach empowers you to target car shoppers with laser precision, maximizing your advertising impact. Experian Automotive and The Trade Desk are committed to developing solutions that balance advertiser needs with consumer privacy. The Trade Desk’s clients can access Experian’s over 2,400 syndicated audiences across eight verticals, including over 750 automotive audiences by make, model, fuel type, price, vehicle age, and more. Accessing the insights: To view the latest Experian Automotive Consumer Trends Quarterly Report, visit us at: www.experian.com/automotive/auto-consumer-trends-form. You can review Experian and The Trade Desk’s collaborative eBrochures for the following vehicle segments: