All posts by Laura Burrows

New challenges created by the COVID-19 pandemic have made it imperative for utility providers to adapt strategies and processes that preserve positive customer relationships while continuing to collect delinquent balances during an unpredictable and unprecedented time. As part of our ongoing Q&A perspective series, Beth Bayer, Experian’s Vice President of Energy Sales, and Danielle Grigaliunas, Product Manager of Collection Solutions, discuss the changing collections landscape and how the utility industry can best adapt. Check out what they had to say: Q: How are the COVID-19 crisis and today’s economic environment impacting consumer behavior? Particularly as it relates to delinquencies and payments? BB: Typically, when we experience recessions, delinquency goes up. In this recession, delinquency is declining. Stimulus money and increased unemployment benefits, coupled with stay at home orders, appear to be leading to more dollars available for consumers to repay obligations and debts. Another factor is related to special accommodations, forbearances, and payment holidays or extensions, that provide consumers with flexible options in making their regularly scheduled payments. Once an accommodation is granted, the lender or bank puts a code on the account when it’s reported to the bureaus and the account does not continue to age. Q: As a result of the pandemic, many regulatory bodies are recommending or imposing changes to involuntary disconnect policies. How can utility providers effectively collect, even if they can’t disconnect? BB: The public utility commissions in many areas have suspended disconnects due to non-payment, further increasing balances, delinquency and delaying final bill generation. Without the fear of being disconnected for non-payment in some regions of the country, customers are not paying delinquent utility bills. Utility providers should continue to provide payment reminders and delinquency notices and offer payment plans in exchange for partial payments to continue to engage customers. Identifying which customers can pay and are actively paying other creditors and institutions helps prioritize proactive outreach. Q: For utility providers who offer in-house collection services, what strategies and credit data do you find most valuable? DG: Current and accurate data is key when looking to provide stronger and more strategic collections. This data is built into efficient scoring models to articulate which debts are most collectible and how much money will be recovered from each consumer. Without the overlay of credit data, it’s harder for utility providers to predict how consumers prioritize utility debt during times of economic stress. By better understanding the current state of the consumer, utility providers can focus on consumers who are most likely to pay. Investing in monitoring solutions allows utility providers to receive notifications when their consumers are beginning to cure and pay off other obligations and take a more proactive approach. Q: What are the best methods for utility providers to reach collection consumers? What do they need to know as they begin to utilize omnichannel communications? DG: Regular data hygiene checks and skipping are the first line of defense in collections. Confirming contact information is correct and up to date throughout the entire consumer lifecycle helps to establish a strong relationship. Those who are successful in collections invest in omnichannel messaging and self-service payment options, so consumers have a choice on how they’d like to settle their obligations. Q: What current collection trends/challenges are we seeing within the utility space? BB: Utility providers do not traditionally report active customer payments and delinquencies to the credit bureaus. Anecdotally, our utility partners tell us that delinquencies are up and balances are growing. Many customers know that they cannot currently be disconnected if they fall behind on their utility payments and are using this opportunity to prioritize other debts. We also know that some utilities have reduced collection activities during the pandemic due to office closures and have cut back on communication efforts. Additionally, we’re hearing from some of our utility partners that collections and recoveries of final billed or charged-off accounts are increasing, despite many agencies closing and limited to no collection activities occurring. We assume this is because these balances are typically reported to the credit reporting agencies, triggering a payment and interest in clearing that balance first. Constant communication, flexibility, and empathizing with your customers by offering payment plans and accommodations will lead to an increase in dollars collected. DG: There’s been a large misunderstanding that because utility providers can’t disconnect, they can’t attempt to collect. The success of collections has been seen within first parties, as they are still maintaining strong relationships by reaching out at optical times and remaining top-of-mind with consumers. The utility industry needs to take a proactive approach to ensure they are focusing on the right consumers through the right channels at the right time. Credit data that matches the consumer’s credit health (i.e. credit usage and payments) is needed insight when trying to understand a consumer’s overall financial standing. For more insight on how to enhance your collection processes and capabilities, watch our Experian Symposium Series event on-demand. Watch now About our Experts: Beth Bayer, Vice President of Sales, Experian Energy, North America Beth leads the Energy Vertical at Experian, supporting regulated, deregulated and alternative energy companies throughout the United States. She strives to bring innovative solutions to her clients by leveraging technology, data and advanced analytics across the customer lifecycle, from credit risk and identity verification through collections. Danielle Grigaliunas, Product Manager of Collections Solutions, Experian Consumer Information Services, North America Danielle has dedicated her career to the collections space and has spent the last five years with Experian, enhancing and developing collections solutions for various industries and debt stages. Danielle’s focus is ensuring that clients have efficient, compliant and innovative collection and contact strategies.

In today’s uncertain economic environment, the question of how to reduce portfolio volatility while still meeting consumers’ needs is on every lender’s mind. With more than 100 million consumers already restricted by traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By leveraging alternative credit data, you can continue to support your borrowers and expand your lending universe. In our most recent podcast, Experian’s Shawn Rife, Director of Risk Scoring and Alpa Lally, Vice President of Data Business, discuss how to enhance your portfolio analysis after an economic downturn, respond to the changing lending marketplace and drive greater access to credit for financially distressed consumers. Topics discussed, include: Making strategic, data-driven decisions across the credit lifecycle Better managing and responding to portfolio risk Predicting consumer behavior in times of extreme uncertainty Listen in on the discussion to learn more. Experian · Effective Lending in the Age of COVID-19

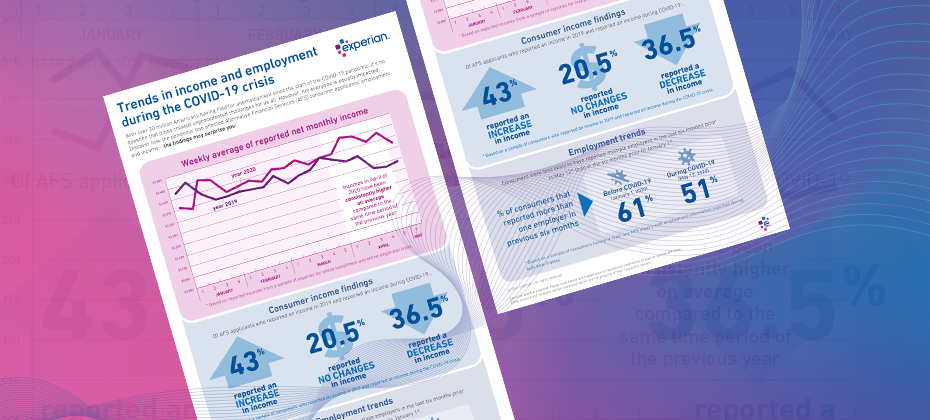

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

The COVID-19 pandemic has created unprecedented challenges for the utilities industry. This includes the need to plan for – and be prepared to respond to – changing behaviors and a sudden uptick in collections activities. As part of our recently launched Q&A perspective series, Mark Soffietti, Experian’s Senior Manager of Analytics Consulting and Tom Hanson, Senior Energy Consultant, provided insight on how utility providers can evolve and refine their collections and recovery processes. Check out what they had to say: Q: How has COVID-19 impacted payment behavior and debt collections? TH: Consumer payment behavior is changing. For example, those who paid as agreed, may not currently have the means to pay and are now distressed borrowers. Or those who were sloppy payers before the pandemic may now be defaulting on a more consistent basis. MS: As we saw with the last recession when faced with economic stress, consumer and commercial payment behavior changes based on their needs and current cash flow. For example, people prioritize their car, as they need it to get to and from work, so they’ll likely pay their auto bills on time. The same goes for their credit cards, which they need to make ends meet. We expect this will also be true with COVID-19. The commercial segment will face more dramatic and challenging circumstances, where complete or partial business closures and lack of federal relief could have severe ramifications. Q: What new restrictions have been put in place surrounding debt collection efforts and outbound calls? TH: To protect consumers who may be experiencing financial distress, most states have imposed new, stringent restrictions to prevent utilities from engaging in certain collections activities. Utilities are currently not charging any late payment fees and are instead structuring payment plans. Additionally, all outbound collections efforts have been suspended and there is fieldwork being executed of services for both commercial and consumer properties. As of now, consumer and commercial fieldwork will likely not commence until after the first year or when the winter moratorium concludes. MS: The new restrictions imposed upon collections activities will likely drive consumer payment behavior. If consumers know that their utilities (i.e. energy and water) will not be shut off if they miss a payment, they will make these bills less of a priority. This will dramatically increase the amount owed when these restrictions are lifted next year. Q: Can we predict how the utilities industry will fare post-COVID-19? TH: The volume of accounts in collections and eligible for disconnect will be overwhelming. Many utility providers fear the unpaid balances consumers and commercial entities accumulate will be nearly impossible to fit into a repayment schedule. Both analyzing internal payment segments and overlaying external factors may be the best way to optimize the most critical go-forward plan. MS: The amount of people who fall into collections is going to greatly increase and utility providers need to start planning for it now to weather the storm. They will need to use data, analytics and tools to help them optimize their tasks, so they can be more efficient with their resources. Like many other industries, the utilities sector will look to increasing digitalization of their processes and having less social interaction where possible. This could mean the need and drive for expediting current smart meter programs where possible to enable remote fieldwork to assist in managing this unprecedented level of activity that is sure to overwhelm field operations (where allowed by state regulators). Q: What should utility providers be doing to plan for an uptick in collections activities post-COVID-19? TH: With regulatory mandated suspensions of collections activities for utility providers and self-selected reductions due to stay at home orders and staff protection, the backlog of payments, calls and inquiries once business resumes as normal is set to overwhelm existing capacity. More than ever, self-service options (text/web), Q&A and alternative communication methods will be needed to shepherd consumers through the collections process and minimize the strain on call center agents. Many utility providers are asking for external data points to segment their consumers by industry or by those whose employment would have been adversely impacted by COVID-19. MS: Utility providers should be monitoring consumer data in order to prepare for when they are able to collect. This will help them strategize the number of resources they will need in their call centers and out in the field performing shut off activities. Given that the rise in cases will be more volume than their call centers can handle, they will need to use their resources wisely and plan to use them efficiently when they are able to resume collections. Q: How can Experian help utility providers reduce collections costs and maximize recovery? TH: Experian can help revise collections tactics and segmentation strategies by providing insight on how consumers are paying other creditors and identifying new segmentation opportunities as we emerge from the freeze on collections activities. Collections cases will be complex, and many factors and constraints will need to balanced against changing goals, making optimization key. MS: Utilizing Experian’s credit data and models can help ensure that resources are being used efficiently (i.e. making successful calls). There is also a need to leverage ability to pay models as well as prioritization models. By using these models and tools, utility providers can optimize their treatment strategies, reduce costs and maximize dollars collected. Learn more About our Experts: Tom Hanson, Senior Energy Consultant, Experian CEM, North America Tom is a Senior Consultant within the Energy Vertical at Experian, supporting regulated energy companies throughout the U.S. He brings over 25 years of experience in the energy field and supports his clients throughout the customer lifecycle, providing expertise in ID verification, account treatment, fraud solutions, analytics, consulting and final bill/field optimization strategies and techniques. Mark Soffietti, Analytics Consulting Senior Manager, Experian Decision Analytics, North America Mark has over 15 years of experience transforming data into actionable knowledge for effective decision management. Mark’s expertise includes solution development for consumer and commercial lending across the credit spectrum – from marketing to collections.

When running a credit report on a new applicant, you must ensure Fair Credit Reporting Act (FCRA) compliance before accessing, using and sharing the collected data. The Coronavirus Aid, Relief, and Economic Security (CARES) Act has impacted credit reporting under the FCRA, as has new guidance from the Consumer Financial Protection Bureau (CFPB). Recent updates include: The CARES Act amended the FCRA to require furnishers who agree to an “accommodation,”1 to report the account as current, although it is permitted to continue to report the account as delinquent if the account was delinquent before the accommodation was made. Although not legally obligated, data furnishers should continue furnishing information to the credit reporting agencies (CRAs) during the COVID-19 crisis, and make sure that information reported is complete and accurate. Below is a brief FCRA-related compliance overview2 covering various FCRA requirements3 when requesting and using consumer credit reports for an extension of credit permissible purpose. For more information regarding your responsibilities under the FCRA as a user of consumer reports, please consult your Legal Counsel and the Notice to Users of Consumer Reports: Obligations of Users Under the FCRA handbook located on our website. Before obtaining a consumer report you have… Reviewed your federal and state regulations and laws related to consumer reports, scores, decisions, etc. Made sure you have a valid permissible purpose for pulling the consumer report. Certified compliance to the CRA from which you are getting the consumer report. You have certified that you complied with all the federal and state requirements. After you take an adverse action based on a consumer report you… Provide the consumer with an oral, written or electronic notice of the adverse action. Provide written or electronic disclosure of the numerical credit score used to take the adverse action, or when providing a “risk-based pricing” notice. Provide the consumer with an oral, written or electronic notice, which includes the below information: Name, address and telephone number of CRA that supplied the report, if nationwide. A statement that the CRA did not make the adverse decision and therefore can’t explain why the decision was made. Notice of the consumer’s right to a free copy of their report from the CRA, if requested within 60 days. Notice of the consumer’s right to dispute with the CRA the accuracy or completeness of any information in a consumer report provided by the CRA. Provide the consumer with a “risk-based pricing” notice if credit was granted but on less favorable terms based on information in their consumer report. We understand how challenging it is to understand and meet all your obligations as a data furnisher – we’re here to make it a little easier. Click below to speak with a representative and gain more insight on how the CARES Act impacts FCRA reporting. Download overview Speak with a representative 1An “accommodation” is defined as “an agreement to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or any other assistance or relief” granted to a consumer affected by COVID-19 during the covered period. 2This FCRA overview is not legal guidance and does not enumerate all your requirements under the FCRA as a user of consumer reports. Additionally, this FCRA Overview is not intended to provide legal advice or counsel you regarding your obligations under the FCRA or any other federal or state law or regulation. Should you have any questions about your institution’s specific obligations under the FCRA or any other federal or state law or regulation, you should consult with your Legal Counsel. 3This FCRA overview is intended to be used solely by financial service providers when extending credit to consumers and does not include all FCRA regulatory obligations. You are responsible for regulatory compliance when requesting and using consumer reports, which includes adhering to all applicable federal and state statutes and regulations and ensuring that you have the correct policies and procedures in place.

Today’s lending market has seen a significant increase in alternative business lending, with companies utilizing new data assets and technology. As the lending landscape becomes increasingly competitive, consumers have more choices than ever when it comes to lending products. To drive profitable growth, lenders must find new ways to help applicants gain access to the loans they need. How Spring EQ is leveraging Experian BoostTM Home equity lender Spring EQ turned to Experian’s first-of-its-kind financial tool that empowers consumers to add positive payments directly into their credit file to assist applicants with attaining the best loan opportunities and rates. By using Experian BoostTM, which captures the value of consumer’s utility and telecom trade lines, in their current lending process, Spring EQ can help applicants near approval or risk thresholds move to higher risk tiers and qualify for better loan terms and conditions. Driving growth with consumer-permissioned data Over 40 million consumers in the U.S. either have no credit file or have insufficient information in their files to generate a traditional credit score. Consumer-permissioned data empowers these individuals to leverage their online financial data and payment histories to gain better access to loans and other financial services while providing lenders with a more comprehensive view of their creditworthiness. According to Experian research, 70% of consumers see the benefits of sharing additional financial information and contributing positive payment history to their credit file if it increases their odds of approval and helps them access more favorable credit terms. Read our case study for more insight on using Experian Boost to: Make better lending decisions Offer or underwrite credit to more people Promote the right credit products Increase conversion and utilization rates Read case study Learn more about Experian Boost

The coronavirus (COVID-19) outbreak is causing widespread concern and economic hardship for consumers and businesses across the globe – including financial institutions, who have had to refine their lending and downturn response strategies while keeping up with compliance regulations and market changes. As part of our recently launched Q&A perspective series, Shannon Lois, Experian’s Head of DA Analytics and Consulting and Bryan Collins, Senior Product Manager, tackled some of the tough questions for lenders. Here’s what they had to say: Q: What trends and triggers should lenders be prepared to react to? BC: Lenders are still trying to figure out how to assess risk between the broader, longer-term impacts of the pandemic and the near-term Coronavirus Aid, Relief, and Economic Security (CARES) Act that extends relief funds and deferment to consumers and small businesses. Traditional lending processes are not possible, lenders will have to adjust underwriting strategies and workflows as they deploy hardship programs while complying with the Act. From a utilization perspective, lenders need to look for near-term trends on payments, balances and skipped payments. From an extension standpoint, they should review limits extended or reduced by other lenders. Critical trends to look for would be missed or late auto payments, non-traditional credit shopping and rental payment delinquencies. Q: What should lenders be doing to plan for an uptick in delinquencies? SL: First, lenders should make sure they have a complete picture of how credit risk and losses are evolving, as well as any changes to their consumers’ affordability status. This will allow a pointed refinement of their customer management strategies (I.e. payment holidays, changing customer to cheaper product, offering additional services, re-pricing, term amendment and forbearance management.) Second, given the increased stress on collection processes and regulations guidelines, they should ensure proper and prepared staffing to handle increased call volumes and that agency outsourcing and automation is enabled. Additionally, lenders should migrate to self-service and interactive communication channels whenever possible while adopting new segmentation schemas/scores/attributes based on fresh data triggers to queue lower risk accounts entering collections. Q: How can lenders best help their customers? SL: Lenders should understand customers’ profiles with vulnerability and affordability metrics allowing changes in both treatment and payment. Payment Holidays are common in credit card management, consider offering payment freezes on different types of credit like mortgage and secured loans, as well as short term workout programs with lower interest rates and fee suppression. Additionally, lenders should offer self-service and FAQ portals with information about programs that can help customers in times of need. BC: Lenders can help by complying with aspects of the CARES Act guidance; they must understand how to deploy payment relief and hardship programs effectively and efficiently. Data integrity and accuracy of loan reporting will be critical. Financial institutions should adjust their collection and risk strategies and processes. Additionally, lenders must determine a way to address the unbanked population with relief checks. We understand how challenging it is to navigate the changing economic tides and will continue to offer support to both businesses and consumers alike. Our advanced data and analytics can help you refine your lending processes and better understand regulatory changes. Learn more About Our Experts: Shannon Lois, Head of DA Analytics and Consulting, Experian Data Analytics, North America Shannon and her team of analysts, scientists, credit, fraud and marketing risk management experts provide results-driven consulting services and state-of-the-art advanced analytics, science and data products to clients in a wide range of businesses, including banking, auto, credit, utility, marketing and finance. Shannon has been a presenter at many credit scoring and risk management conferences and is currently leading the Experian Decision Analytics advisory board. Bryan Collins, Senior Product Manager, Experian Consumer Information Services, North America Bryan is a member of Experian's CIS product management team, focusing on the Acquisitions suite and our evolving Ascend Identity Services Platform. With more than 20 years of experience in the financial services and credit industries, Bryan has established strong partnerships and a thorough understanding of client needs. He was instrumental in the launch of CIS's segmentation suite and led product management for lender and credit-related initiatives in Auto. Prior to joining Experian, Bryan held marketing and consumer experience roles in consumer finance, business lending and card services.

With new legislation, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act impacting how data furnishers will report accounts, and government relief programs offering payment flexibility, data reporting under the coronavirus (COVID-19) outbreak can be complicated. Especially when it comes to small businesses, many of which are facing sharp declines in consumer demand and an increased need for capital. As part of our recently launched Q&A perspective series, Greg Carmean, Experian’s Director of Product Management and Matt Shubert, Director of Data Science and Modelling, provided insight on how data furnishers can help support small businesses amidst the pandemic while complying with recent regulations. Check out what they had to say: Q: How can data reporters best respond to the COVID-19 global pandemic? GC: Data reporters should make every effort to continue reporting their trade experiences, as losing visibility into account performance could lead to unintended consequences. For small businesses that have been negatively affected by the pandemic, we advise that when providing forbearance, deferrals be reported as “current”, meaning they should not adversely impact the credit scores of those small business accounts. We also recommend that our data reporters stay in close contact with their legal counsel to ensure they follow CARES Act guidelines. Q: How can financial institutions help small businesses during this time? GC: The most critical thing financial institutions can do is ensure that small businesses continue to have access to the capital they need. Financial institutions can help small businesses through deferral of payments on existing loans for businesses that have been most heavily impacted by the COVID-19 crisis. Small Business Administration (SBA) lenders can also help small businesses take advantage of government relief programs, like the Payment Protection Program (PPP), available through the CARES Act that provides forgiveness on up to 75% of payroll expenses and 25% of other qualifying expenses. Q: How do financial institutions maintain data accuracy while also protecting consumers and small businesses who may be undergoing financial stress at this time? GC: Following bureau recommendations regarding data reporting will be critical to ensure that businesses are being treated fairly and that the tools lenders depend on continue to provide value. The COVID-19 crisis also provides a great opportunity for lenders to educate their small business customers on their business credit. Experian has made free business credit reports available to every business across the country to help small business owners ensure the information lenders are using in their credit decisioning is up-to-date and accurate. Q: What is the smartest next play for financial institutions? GC: Experian has several resources that lenders can leverage, including Experian’s COVID-19 Business Risk Index which identifies the industries and geographies that have been most impacted by the COVID crisis. We also have scores and alerts that can help financial institutions gain greater insights into how the pandemic may impact their portfolios, especially for accounts with the greatest immediate exposure and need. MS: To help small businesses weather the storm, financial institutions should make it simple and efficient for them to access the loans and credit they need to survive. With cash flow to help bridge the gap or resume normal operations, small businesses can be more effective in their recovery processes and more easily comply with new legislation. Finances offer the support needed to augment currently reduced cash flows and provide the stability needed to be successful when a return to a more normal business environment occurs. At Experian, we’re closely monitoring the updates around the coronavirus outbreak and its widespread impact on both consumers and businesses. We will continue to share industry-leading insights to help data furnishers navigate and successfully respond to the current environment. Learn more About Our Experts Greg Carmean, Director of Product Management, Experian Business Information Services, North America Greg has over 20 years of experience in the information industry specializing in commercial risk management services. In his current role, he is responsible for managing multiple product initiatives including Experian’s Small Business Financial Exchange (SBFE), domestic and international commercial reports and Corporate Linkage. Recently, he managed the development and launch of Experian’s Global Data Network product line, a commercial data environment that provides a single source of up to date international credit and firmographic information from Experian commercial bureaus and Tier 1 partners across the globe. Matt Shubert, Director of Data Science and Modelling, Experian Data Analytics, North America Matt leads Experian’s Commercial Data Sciences Team which consists of a combination of data scientists, data engineers and statistical model developers. The Commercial Data Science Team is responsible for the development of attributes and models in support of Experian’s BIS business unit. Matt’s 15+ years of experience leading data science and model development efforts within some of the largest global financial institutions gives our clients access to a wealth of knowledge to discover the hidden ROI within their own data.

In the face of severe financial stress, such as that brought about by an economic downturn, lenders seeking to reduce their credit risk exposure often resort to tactics executed at the portfolio level, such as raising credit score cut-offs for new loans or reducing credit limits on existing accounts. What if lenders could tune their portfolio throughout economic cycles so they don’t have to rely on abrupt measures when faced with current or future economic disruptions? Now they can. The impact of economic downturns on financial institutions Historically, economic hardships have directly impacted loan performance due to differences in demand, supply or a combination of both. For example, let’s explore the Great Recession of 2008, which challenged financial institutions with credit losses, declines in the value of investments and reductions in new business revenues. Over the short term, the financial crisis of 2008 affected the lending market by causing financial institutions to lose money on mortgage defaults and credit to consumers and businesses to dry up. For the much longer term, loan growth at commercial banks decreased substantially and remained negative for almost four years after the financial crisis. Additionally, lending from banks to small businesses decreased by 18 percent between 2008-2011. And – it was no walk in the park for consumers. Already faced with a rise in unemployment and a decline in stock values, they suddenly found it harder to qualify for an extension of credit, as lenders tightened their standards for both businesses and consumers. Are you prepared to navigate and successfully respond to the current environment? Those who prove adaptable to harsh economic conditions will be the ones most poised to lead when the economy picks up again. Introducing the FICO® Resilience Index The FICO® Resilience Index provides an additional way to evaluate the quality of portfolios at any point in an economic cycle. This allows financial institutions to discover and manage potential latent risk within groups of consumers bearing similar FICO® Scores, without cutting off access to credit for resilient consumers. By incorporating the FICO® Resilience Index into your lending strategies, you can gain deeper insight into consumer sensitivity for more precise credit decisioning. What are the benefits? The FICO® Resilience Index is designed to assess consumers with respect to their resilience or sensitivity to an economic downturn and provides insight into which consumers are more likely to default during periods of economic stress. It can be used by lenders as another input in credit decisions and account strategies across the credit lifecycle and can be delivered with a credit file, along with the FICO® Score. No matter what factors lead to an economic correction, downturns can result in unexpected stressors, affecting consumers’ ability or willingness to repay. The FICO® Resilience Index can easily be added to your current FICO® Score processes to become a key part of your resilience-building strategies. Learn more

In today’s rapidly changing economic environment, the looming question of how to reduce portfolio volatility while still meeting consumers' needs is on every lender’s mind. So, how can you better asses risk for unbanked consumers and prime borrowers? Look no further than alternative credit data. In the face of severe financial stress, when borrowers are increasingly being shut out of traditional credit offerings, the adoption of alternative credit data allows lenders to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure without unnecessarily impacting insensitive or more “resilient” consumers. What is alternative credit data? Millions of consumers lack credit history or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and subprime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-regulated data that is typically not included in a traditional credit report and helps lenders paint a fuller picture of a consumer, so borrowers can get better access to the financial services they need and deserve. How can it help during a downturn? The economic environment impacts consumers’ financial behavior. And with more than 100 million consumers already restricted by the traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By pulling in alternative credit data, such as consumer-permissioned data, rental payments and full-file public records, lenders can gain a holistic view of current and future customers. These insights help them expand their credit universe, identify potential fraud and determine an applicant’s ability to pay all while mitigating risk. Plus, many consumers are happy to share additional financial information. According to Experian research, 58% say that having the ability to contribute positive payment history to their credit files makes them feel more empowered. Likewise, many lenders are already expanding their sources for insights, with 65% using information beyond traditional credit report data in their current lending processes to make better decisions. By better assessing risk at the onset of the loan decisioning process, lenders can minimize credit losses while driving greater access to credit for consumers. Learn more 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

This article was updated on September 11, 2023. According to research, only 15% of American consumers have swapped out their go-to credit card in the past year and spend more money both online and offline with the card they designate as their top-of-wallet card. With over 578 million existing credit card accounts in the U.S., here are four top-of-wallet strategies to keep your card top of mind: Go digital In today’s digital world, the rules of customer engagement are changing – and card issuers must develop their digital capabilities, including identity resolution, to keep pace. Cardholders enjoy (and expect) the convenience of being able to apply for credit, track their purchases, make payments and view their monthly statements on-the-go. Another popular phenomenon? Digital wallets. Also known as e-wallets, these house digital versions of credit or debit cards and are stored in an app or a mobile device. Digital wallets can be used in conjunction with mobile payment systems, allowing customers to store digital coupons and pay for purchases with their smartphones. Financial institutions that digitally transform and adapt to these new dynamics can more efficiently service and retain their customers. Prioritize fraud prevention As customers’ affinity for e-commerce rises and cyberthieves grow smarter and more sophisticated, card issuers must improve their security measures and increase their focus on cutting-edge fraud management solutions. Not only should you be familiar with the many ways that criminals steal customer payment information, but you should ensure customers that you have multiple lines of defense against cyber threats. Many financial institutions have added digital “on/off switches,” allowing customers to remotely turn off their credit or debit card should they have misplaced it or suspect that they’re a victim of identity theft. With credit card fraud being the most prevalent in identity theft cases, failing to properly safeguard your customers impacts not only their experience but also your ability to grow revenue. Create a single customer view A single customer view is a consolidated, consistent and holistic representation of the data known by an organization about its customers. And according to Experian research, 68% of businesses are currently attempting to implement this type of strategy. By achieving a consolidated customer view, you can attain better consumer insight and fully understand your cardmembers’ needs and buying preferences. Careful tracking of all customer interactions enables you to target more accurately and implement effective marketing strategies. Provide incentives According to Experian research, 58% of consumers select credit cards based on rewards. The top incentives when selecting a rewards card include cashback, gas rewards and retail gift cards. Rewarding loyalty with ongoing benefits goes a long way to encourage customers to keep your credit card top of wallet but it’s also important to figure out what works – and what doesn’t. Bonus tip: Optimize credit limit management Managing credit limits is just as important as setting optimal credit limits from the get-go. Consumer credit needs will evolve over time along with their income and ability to pay. The key here is being able to identify qualified customers who can take on higher spending limits and also have a need. Leveraging advanced analytics models and a proactive credit limit management strategy can help you uncover areas of opportunity to increase wallet share and push your card toward that coveted top-of-wallet spot — or remain there. We recommend reviewing your credit limits at a regular cadence, but especially ahead of periods of increased spending such as the holiday season. In today’s competitive marketplace, getting your credit card top of wallet isn’t easy. That’s why we’re here to help. Experian’s comprehensive view of consumer credit data and best-in-class account management solutions help you target higher-spending customers and promote top-of-wallet use. Learn more

To provide consumers with clear-cut protections against disturbance by debt collectors, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA) earlier this year. Among many other things, the proposal would set strict limits on the number of calls debt collectors may place to reach consumers weekly and clarify requirements for consumer-facing debt collection disclosures. A bigger discussion Deliberation of the debt collection proposal was originally scheduled to begin on August 18, 2019. However, to allow commenters to further consider the issues raised in the NPRM and gather data, the comment period was extended by 20 days to September 18, 2019. It is currently still being debated, as many argue that the proposed rule does not account for modern consumer preferences and hinders the free flow of information used to help consumers access credit and services. The Association of Credit and Collection Professionals (ACA International) and US House lawmakers continue to challenge the proposal, stating that it doesn’t ensure that debt collectors’ calls to consumers are warranted, nor does it do enough to protect consumers’ privacy. Many consumer advocates have expressed doubts about how effective the proposed measures will be in protecting debtors from debt collector harassment and see the seven-calls-a-week limit on phone contact as being too high. In fact, it’s difficult to find a group of people in full support of the proposal, despite the CFPB stating that it will help clarify the FDCPA, protect lenders from litigation and bring consumer protection regulation into the 21st century. What does this mean? Although we don’t know when, or if, the proposed rule will go into effect, it’s important to prepare. According to the Federal Register, there are key ways that the new regulation would affect debt collection through the use of newer technologies, required disclosures and limited consumer contact. Not only will the proposed rules apply to debt collectors, but its provisions will also impact creditors and servicers, making it imperative for everyone in the financial services space to keep watch on the regulation’s status and carefully analyze its proposed rules. At Experian, our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to connect with consumers while staying compliant. Our best-in-class data and analytics will play a key role in helping you reach the right consumer, in the right place, at the right time. Learn more

The future is, factually speaking, uncertain. We don't know if we'll find a cure for cancer, the economic outlook, if we'll be living in an algorithmic world or if our work cubical mate will soon be replaced by a robot. While futurists can dish out some exciting and downright scary visions for the future of technology and science, there are no future facts. However, the uncertainty presents opportunity. Technology in today's world From the moment you wake up, to the moment you go back to sleep, technology is everywhere. The highly digital life we live and the development of our technological world have become the new normal. According to The International Telecommunication Union (ITU), almost 50% of the world's population uses the internet, leading to over 3.5 billion daily searches on Google and more than 570 new websites being launched each minute. And even more mind-boggling? Over 90% of the world's data has been created in just the last couple of years. With data growing faster than ever before, the future of technology is even more interesting than what is happening now. We're just at the beginning of a revolution that will touch every business and every life on this planet. By 2020, at least a third of all data will pass through the cloud, and within five years, there will be over 50 billion smart connected devices in the world. Keeping pace with digital transformation At the rate at which data and our ability to analyze it are growing, businesses of all sizes will be forced to modify how they operate. Businesses that digitally transform, will be able to offer customers a seamless and frictionless experience, and as a result, claim a greater share of profit in their sectors. Take, for example, the financial services industry - specifically banking. Whereas most banking used to be done at a local branch, recent reports show that 40% of Americans have not stepped through the door of a bank or credit union within the last six months, largely due to the rise of online and mobile banking. According to Citi's 2018 Mobile Banking Study, mobile banking is one of the top three most-used apps by Americans. Similarly, the Federal Reserve reported that more than half of U.S. adults with bank accounts have used a mobile app to access their accounts in the last year, presenting forward-looking banks with an incredible opportunity to increase the number of relationship touchpoints they have with their customers by introducing a wider array of banking products via mobile. Be part of the movement Rather than viewing digital disruption as worrisome and challenging, embrace the uncertainty and potential that advances in new technologies, data analytics and artificial intelligence will bring. The pressure to innovate amid technological progress poses an opportunity for us all to rethink the work we do and the way we do it. Are you ready? Learn more about powering your digital transformation in our latest eBook. Download eBook Are you an innovation junkie? Join us at Vision 2020 for future-facing sessions like: - Cloud and beyond - transforming technologies - ML and AI - real-world expandability and compliance

What do movie actors Adam Sandler and Hugh Grant, jazz singer Michael Bublé, Russian literary giant Leo Tolstoy, and Colonel Sanders, the founder of KFC, have in common? Hint, it’s not a Nobel Prize for Literature, a Golden Globe, a Grammy Award, a trademark goatee, or a “finger-lickin’ good” bucket of chicken. Instead, they were all born on September 9, the most common birth date in the U.S. Baby Boom According to real birth data compiled from 20 years of American births, September is the most popular month to give birth to a child in America – and December, the most popular time to make one. With nine of the top 10 days to give birth falling between September 9 and September 20, one may wonder why the birth month is so common. Here are some theories: Those who get to choose their child’s birthday due to induced and elective births tend to stay away from the hospital during understaffed holiday periods and may plan their birth date around the start of the school year. Several of the most common birth dates in September correspond with average conception periods around the holidays, where couples likely have more time to spend together. Some studies within the scientific community suggest that our bodies may actually be biologically disposed to winter conceptions. While you may not be feeling that special if you were born in September, the actual differences in birth numbers between common and less common birthdays are often within just a few thousand babies. For example, September 10, the fifth most common birthday of the year, has an average birth rate of 12,143 babies. Meanwhile, April 20, the 328th most common birthday, has an average birth rate of 10,714 newborns. Surprisingly, the least common birthdays fall on Christmas Eve, Christmas Day and New Year’s Day, with Thanksgiving and Independence Day also ranking low on the list. Time to Celebrate – but Watch out! Statistically, there’s a pretty good chance that someone reading this article will soon be celebrating their birthday. And while you should be getting ready to party, you should also be on the lookout for fraudsters attempting to ruin your big day. It’s a well-known fact that cybercriminals can use your birth date as a piece of the puzzle to capture your identity and commit identity theft – which becomes a lot easier when it’s being advertised all over social media. It’s also important for employers to safeguard their organization from fraudsters who may use this information to break into corporate accounts. While sharing your birthday with a lot of people could be a good or bad thing depending on how much undivided attention you enjoy – you’re in great company! Not only can you plan a joint party with Michelle Williams, Afrojack, Cam from Modern Family, four people I went to high school with on Facebook and a handful of YouTube stars that I’m too old to know anything about, but there will be more people ringing in your birthday than any other day of the year! And that’s pretty cool.

Earlier this year, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA). The proposal, which will go into deliberation in September and won't be finalized until after that date at the earliest, would provide consumers with clear-cut protections against disturbance by debt collectors and straightforward options to address or dispute debts. Additionally, the NPRM would set strict limits on the number of calls debt collectors may place to reach consumers weekly, as well as clarify how collectors may communicate lawfully using technologies developed after the FDCPA’s passage in 1977. So, what does this mean for collectors? The compliance conundrum is ever present, especially in the debt collection industry. Debt collectors are expected to continuously adapt to changing regulations, forcing them to spend time, energy and resources on maintaining compliance. As the most recent onslaught of developments and proposed new rules have been pushed out to the financial community, compliance professionals are once again working to implement changes. According to the Federal Register, here are some key ways the new regulation would affect debt collection: Limited to seven calls: Debt collectors would be limited to attempting to reach out to consumers by phone about a specific debt no more than seven times per week. Ability to unsubscribe: Consumers who do not wish to be contacted via newer technologies, including voicemails, emails and text messages must be given the option to opt-out of future communications. Use of newer technologies: Newer communication technologies, such as emails and text messages, may be used in debt collection, with certain limitations to protect consumer privacy. Required disclosures: Debt collectors will be obligated to send consumers a disclosure with certain information about the debt and related consumer protections. Limited contact: Consumers will be able to limit ways debt collectors contact them, for example at a specific telephone number, while they are at work or during certain hours. Now that you know the details, how can you prepare? At Experian, we understand the importance of an effective collections strategy. Our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to reach consumers while staying compliant. Powerful locating solution: Locate past-due consumers more accurately, efficiently and effectively. TrueTraceSM adds value to each contact by increasing your right-party contact rate. Exclusive contact information: Mitigate your compliance risk with a seamless and unparalleled solution. With Phone Number IDTM, you can identify who a phone is registered to, the phone type, carrier and the activation date. If you aren’t ready for the new CFPB regulation, what are you waiting for? Learn more Note: Click here for an update on the CFPB's proposal.