All posts by Tessa Case

By Erik Hjermstad, VP of Product Management for Experian Automotive In today's digital landscape, where consumers increasingly turn to connected TV and addressable TV for entertainment, precision targeting has become more critical than ever for automotive advertisers. By delivering highly relevant ads to the most likely potential customers, advertisers can maximize campaign effectiveness, increase conversion rates, and ultimately drive a better return on investment (ROI). The following is a summary from a recent article I wrote for Ad Age. The Power of Precision Targeting Precision targeting allows advertisers to focus their efforts on the right people with the right message at the right time. This targeted approach helps minimize wasted ad spend and ensures that every dollar invested makes a meaningful impact. By understanding an audience's demographics, interests, and behaviors, automotive marketers can tailor their messaging to resonate with specific consumer segments and pointedly reach those ready to purchase. Leveraging Data Intelligence for Competitive Advantage To stay competitive, automotive marketers must stay on top of the latest data intelligence. Agencies and marketers have turned to data-driven strategies to set their campaigns apart and increase the likelihood of a consumer purchasing a vehicle. When choosing their consumer audiences, automotive marketers turn to companies like Experian Automotive for data like license, registration, and title. They utilize models based on actual vehicle sales and ownership to target the right audience and measure effectiveness more accurately. Measuring Success: Key Metrics and Omnichannel Measurement To ensure that advertising campaigns deliver results, automotive marketers must have a robust measurement strategy. This involves tracking key metrics such as: Sales: Did the buyer purchase a vehicle? Impressions: The number of times an ad is seen. Clicks: The number of times an ad is clicked on. Conversions: The number of people who take a desired action, such as purchasing. Cost per acquisition (CPA): The cost of acquiring a new customer. Return on ad spend (ROAS): The revenue generated by an ad campaign divided by the cost of the campaign. Experian Automotive offers advertisers a robust measurement solution that provides omnichannel measurement, connecting website visitation and ad exposures to automotive sales. Analysis includes make, model, and vehicle class reporting, competitive analysis, and 30-, 60-, and 90-day vehicle sales projections. The Importance of Omnichannel Measurement In today's interconnected world, automotive consumers interact with brands across multiple channels, including TV, digital, social media, and in-store. Advertisers must adopt an omnichannel measurement approach to truly understand their audience and measure the effectiveness of their campaigns. By tracking consumer behavior across all channels, advertisers can gain a more complete picture of the customer journey and identify opportunities for optimization. Omnichannel measurement integrates data from various sources, such as website analytics, social media metrics, and point-of-sale data. This allows advertisers to understand how consumers interact with their brand at different stages of the buying process and attribute conversions to specific channels and touchpoints. By leveraging omnichannel measurement, advertisers can make more informed decisions about their marketing investments and deliver a more cohesive and personalized customer experience. Measurement is critical to advertising success for several reasons: Optimization: By tracking key metrics, advertisers can identify what is working versus what is not and make necessary adjustments to improve campaign performance. Attribution: Measurement helps determine which marketing channels and tactics drive the most conversions. ROI analysis: By measuring the ROI of their campaigns, advertisers can justify their marketing investments and demonstrate the value they bring to the business. Navigating the Challenges of the Streaming Era While precision targeting and measurement are essential in the streaming era, advertisers face unique challenges. The fragmented nature of the streaming landscape, with its multiple platforms and devices, can make it challenging to track consumer behavior and measure campaign effectiveness. However, advancements in data technology and measurement tools provide advertisers with many new opportunities to overcome these challenges. By leveraging data intelligence, using deterministic data models to understand their audience, and tracking key metrics, advertisers can deliver highly relevant ads that drive results and maximize their ROI.

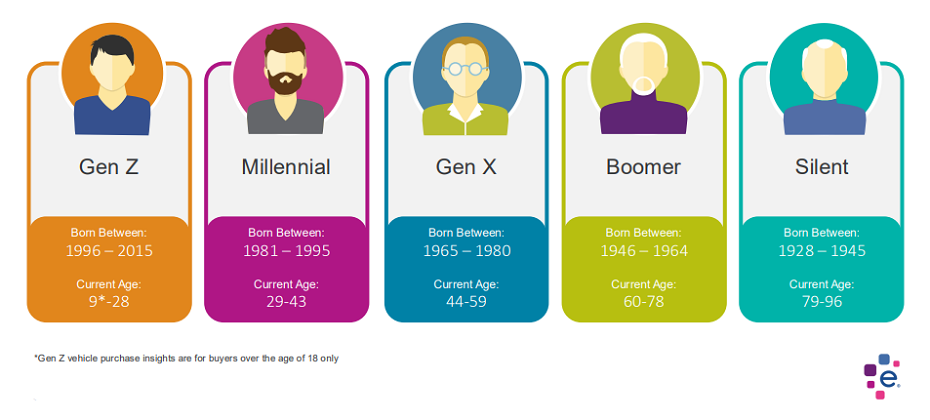

Summary: Gen Z, Millennials, Gen X, and Boomers each have unique automotive buying preferences and your strategies to reach each generation should reflect these preferences. The automotive landscape is shaped by the distinct preferences of different generations. From Gen Z to Boomers, each generation brings unique buying habits that automotive marketers must understand to stay competitive. Below is a brief overview of the key insights from the latest reports on Gen Z, Millennials, Gen X, and Boomers. To learn more about how to market to each generation, download the respective playbook. Gen Z (Born 1996–2015) Gen Z buyers are digital natives who prefer compact vehicles. The Honda Civic leads in market share for this group, showcasing their preference for smaller, fuel-efficient cars. They rely heavily on digital platforms for their research, with 73% of impressions delivered through Connected TV (CTV). Millennials (Born 1981–1995) Millennials value technology and eco-friendly options. Crossovers (CUVs) are their top choice, making up 50.2% of new vehicle registrations. Electric and hybrid vehicles are also popular, reflecting their environmental consciousness. Popular models include the Honda Civic and Toyota RAV4. Gen X (Born 1965–1980) Gen X buyers favor practicality and reliability, gravitating toward SUVs and trucks. The Ford F-150 is the top model among this group, and they are more likely to invest in luxury or exotic vehicles than younger generations. Boomers (Born 1946–1964) Boomers remain loyal to traditional brands, with a strong preference for non-luxury and luxury cars, such as the Honda CR-V and Ford F-150. They also favor gas-powered vehicles over electric, though hybrid options are gaining ground. Summary Understanding generational differences is crucial to developing effective marketing strategies that resonate with each group’s unique preferences. For a more detailed generational analysis, download the full report. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

Quick Answer: A new consumer survey reveals that 90% of survey respondents would like to have more than one Vehicle History Report when shopping for a used car. Offering an Experian AutoCheck® VHR as a second Vehicle History Report is a smart, simple strategy to help you close more deals. In today’s used car market, standing out from the crowd is more important than ever. As buyers become savvier and more informed, dealerships need to find new ways to build trust and close sales. One simple yet effective strategy? Offering a second Vehicle History Report (VHR) to your customers. Why VHRs Matter So Much Let’s face it—buying a car is a big deal. Most people don’t just walk onto a lot and pick the first car they see. They do their homework, and a big part of that research involves Vehicle History Reports. In fact, a recent survey found that 70% of people used a VHR the last time they bought a car. And it’s not just a one-time thing—83% of buyers say they’ll use a VHR for their next purchase too. Why? Because these reports provide crucial details like accident history, mileage accuracy, and service records that give buyers confidence in their decisions. The Case for Offering Multiple VHRs Here’s something that might surprise you: 90% of surveyed car buyers said they’d like to see more than one VHR when shopping for a used car. Think about that for a second. People want that extra layer of reassurance that only comes from cross-checking information. This is especially true for those who prefer buying from dealerships—these customers expect comprehensive, reliable data before they make a decision. How Multiple VHRs Can Give Your Dealership an Edge So, what’s the big deal about offering more than one VHR? It’s all about trust and transparency. Just like banks look at multiple credit reports before approving a loan, offering multiple VHRs can help you provide a fuller, more accurate picture of a vehicle’s history. This can reduce your liability and protect your dealership’s reputation. We have done some digging into this, and the results are eye-opening. For instance, in one case study, a dealership found additional damage events through an Experian AutoCheck® VHR that weren’t picked up by other VHRs. This kind of discrepancy shows just how valuable it can be to provide that second report—it helps ensure that all the facts are on the table, which protects both you and your customers. Meeting and Exceeding Customer Expectations Here’s something else to keep in mind: people expect dealerships to go the extra mile. The survey found that 86% of used car buyers believe VHRs should be provided for free by the dealership. By offering multiple reports at no additional cost, you’re not just meeting their expectations—you’re exceeding them. And that’s a surefire way to boost customer confidence, satisfaction, and, ultimately, your sales. What You Can Do Today Offering a second Vehicle History Report is a smart, simple strategy to help you close more deals. It shows your customers that you’re committed to transparency and that you care about providing them with all the information they need to make a confident decision. In a competitive market, it’s the little things like this that can make a big difference. Your customers—and your bottom line—will thank you. Experian Automotive is here to help you with your vehicle history data needs. If you’d like to learn more about our AutoCheck solution and how we can support you, click below to have someone from our team contact you.

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

Quick Answer: Dealerships can avoid purchasing flood-damaged vehicles with Experian AutoCheck's Free Flood Risk Check. The used car market is tough right now. Unfortunately, recent floods in several areas have added another challenge: flood-damaged vehicles. These cars pose a big risk to dealerships. Buying one can lead to expensive repairs, unhappy customers, and damage to your reputation. Experian AutoCheck's Free Flood Risk Check can help. We've updated it with data from recent floods to give you a head start. Here's what the Free Flood Risk Check does: Quickly checks any car's flood risk with just the 17-digit VIN. Provides you with two levels of reporting: See if the car was registered in a region hit by a major FEMA disaster. Find potential flood damage based on Experian data (flood titles, auction records, etc.). Important things to remember: A "Yes" in the first report doesn't confirm flood damage, just that the car was in a flood zone. Even a clean second report isn't a guarantee - some flood damage goes unreported. For extra protection: Run a full Experian AutoCheck Vehicle History Report to uncover other issues like accidents or recalls. Have a mechanic thoroughly inspect any car before you buy it. By using Experian AutoCheck's Free Flood Risk Check and following these tips, you can dramatically reduce the risk of buying a flood-damaged car and protect your dealership. Ready to safeguard your dealership? Not an Experian AutoCheck subscriber?

For car dealers, the holy grail isn't a flashy sports car or a top-selling SUV. It's a simple whisper: "I'm thinking about getting a new car." Imagine if you could hear that murmur from every potential customer walking through your doors, online, or even driving down the street. That's the power of knowing who's in the market for a new car, and it's a game-changer for dealerships. Go beyond the cookie and website tracking and leverage the power of psychographic data and predictive analytics to know who is coming into the market in the next 30, 60, 90 days with the Experian Marketing Engine’s Affinity AutoAudiences. Boost Efficiency and ROI: Targeted Sales: No more shotgun blasts of marketing campaigns! Precisely target consumers considering a new car with personalized offers and incentives. Imagine tailoring financing proposals based on their budget and desired features, not guesswork. Inventory Optimization: Say goodbye to dusty lots filled with unsold models. Knowing market trends and individual preferences allows you to stock in-demand vehicles, maximizing sales and minimizing depreciation costs. Streamlined Sales Process: When a customer walks in already open to buying, the entire process becomes smoother. Focus on addressing their specific needs and preferences, leading to quicker deals and happier customers. Build Stronger Customer Relationships: Proactive Engagement: Instead of waiting for leads, reach out at the perfect moment. A friendly call or email during their research phase demonstrates attentiveness and builds trust, setting you apart from the competition. Personalized Recommendations: Forget one-size-fits-all pitches. Recommend models based on their lifestyle, budget, and driving habits. This shows genuine interest and builds rapport, increasing the likelihood of conversion. Enhanced Customer Experience: Cater to their specific needs before they even step onto the lot. Offer virtual test drives, online financing options, and even home delivery – all tailored to their preferences. This level of personalized service fosters loyalty and repeat business. Leverage the Power of Data: Knowing when a consumer is in the market for a new car isn't just about a head start, it's about building trust, offering convenience, and tailoring the entire experience to their needs. In a competitive market, this inside knowledge is the key to unlocking increased sales, stronger customer relationships, and ultimately, a thriving dealership. So, what are you waiting for? Start listening and turn those whispers into deals! Or

Experian's Automotive Consumer Trends Quarterly Report goes beyond understanding general car-buying trends. Each quarter, we delve deeper into a specific vehicle segment, analyzing the demographics (who's buying) and psychographics (why they're buying) of those consumers. New eBrochures help turn insights into action Although valuable, what can you do with this information? That's where The Trade Desk comes in. They leverage the insights from our report to create a comprehensive omnichannel strategy for reaching in-market car buyers. This strategy goes beyond demographics, revealing: Top web content preferences: Where are these consumers spending their online time? Frequented websites and apps: What digital platforms are most relevant to them? Top CTV and audio examples: Which streaming services and audio channels should be targeted? A Consolidated Snapshot The Trade Desk provides a clear picture of channel distribution, ensuring your advertising reaches the right audience across the most effective platforms. This combined approach empowers you to target car shoppers with laser precision, maximizing your advertising impact. Experian Automotive and The Trade Desk are committed to developing solutions that balance advertiser needs with consumer privacy. The Trade Desk’s clients can access Experian’s over 2,400 syndicated audiences across eight verticals, including over 750 automotive audiences by make, model, fuel type, price, vehicle age, and more. Accessing the insights: To view the latest Experian Automotive Consumer Trends Quarterly Report, visit us at: www.experian.com/automotive/auto-consumer-trends-form. You can review Experian and The Trade Desk’s collaborative eBrochures for the following vehicle segments:

In the ever-evolving landscape of automotive marketing, insight and measurement are paramount. Recognizing this, Strategus and Experian Automotive have joined forces to help improve digital automotive marketing campaign measurement. The Challenge The case study unfolds against a backdrop familiar to many advertisers: a regional advertising agency representing an OEM sought to evaluate the performance of their CTV automotive marketing campaign. Their objectives were clear: Assess digital and TV campaign performance, attributing actual vehicle sales accurately. Pinpoint top-performing audience segments and offers, factoring in demographic and psychographic variations. Adapt marketing strategy based on real-time campaign performance metrics. The Solution Strategus took the helm, leveraging Experian’s OmniImpact for Automotive solution to navigate these goals. They crafted a programmatic campaign targeting previous buyers of a specific vehicle model within a targeted geographic region. Through CTV advertising, they heightened awareness among the targeted audience, ensuring maximum engagement. Joel Cox, co-founder and EVP of Innovation and Strategy at Strategus summarizes the value of this collaboration perfectly: “Strategus is thrilled to collaborate with Experian to offer this novel auto sales attribution solution. While we know the positive influence CTV advertising can play in driving auto sales, the measurement and attribution of those sales can be a murky and incongruent snapshot heavily reliant on assumption and incomplete first-party datasets. While Experian’s OmniImpact for Automotive campaign measurement solution has been available to the largest auto advertisers, this relationship between Strategus and Experian Automotive democratizes this comprehensive measurement solution to all auto-selling clients of Strategus, regardless of size or sales volume.” Click here to learn more about the specific results and how Strategus and Experian Automotive work together to optimize campaign focus. Conclusion In a digital age where data reigns supreme, collaborations like that between Strategus and Experian Automotive showcase the power of leveraging precise insights to drive campaign results and automotive sales. By combining innovative strategies with advanced analytics, advertisers can not only measure campaign performance accurately but also adapt in real-time to maximize impact. As automotive marketing continues to evolve, relationships such as these that prioritize precision and insight will undoubtedly shape the industry's future. Or

For auto dealerships, the roar of engines and the clink of deals used to be the only sounds associated with financial risk. But in today's world, a silent threat lurks in every showroom: identity fraud. This insidious crime is costing dealerships millions, leaving a trail of financial and reputational wreckage in its wake. The Numbers Don't Lie: Reports of the impact of identity fraud on auto dealerships are becoming more common as the industry leans more heavily on digital retailing. According to the Federal Trade Commission, nearly 80,000 cars were stolen in 2023 via fraud. Who's Behind the Wheel? The perpetrators of fraud come in all shapes and sizes. While classic ID theft with stolen documents still exists, the real menace lies in synthetic identities: Frankenstein accounts cobbled together from stolen data and fake documents. These sophisticated creations can fool even the most vigilant dealership, resulting in high-value car loans taken out on non-existent people. The Ripple Effect: The consequences of identity fraud extend far beyond lost cars. Dealerships face: Financial losses: Wrecked credit and repossessions add up quickly. Operational headaches: Investigations and legal proceedings are time-consuming and costly. Reputational damage: News of fraud breaches trust and scares away potential customers. So, What Can Dealerships Do? Arming themselves with the right tools and practices is crucial. Here are some key steps: Invest in identity verification technology: Advanced document scanning, and facial recognition can crack down on fake licenses. Experian's Fraud ProtectTM leverages cutting-edge technology to compare licenses to selfies to confirm consumers are who they say they are AND their license is valid. Train staff on fraud detection: Fraud Protect takes the challenge out of identifying fraud in a very simple way. There is no hardware or extensive training. It is as simple as sharing a URL and reading the results in your CRM. Implement stringent verification procedures: Fraud Protect allows dealers to implement fraud identification measures in a frictionless manner. As simple as one-time passcodes, selfies, and taking pictures, the consumer experience is very smooth. For automotive dealers, the results are returned to their CRM within a few moments including all the information they need for proper decisioning. Fighting Back, One Mile at a Time: Identity fraud is a growing problem, but auto dealerships are not powerless. By raising awareness, investing in security, and embracing vigilance, dealers can protect themselves and drive this silent threat off the road. With Fraud Protect, dealers can verify documents and identity in a frictionless manner that does not interrupt the sales process. Learn more about auto fraud prevention solutions available or contact us to get started. *This article includes content created by an AI language model and is intended to provide general information.

The automotive industry is rapidly evolving and digital marketing is becoming increasingly important. To stay ahead of the competition, it’s essential to understand the top digital audiences in the automotive industry. To help you with this, we recently analyzed audience activation activity and compiled the Auto 2024 Digital Audience Report. The report highlights the top four digital audience categories for the automotive industry: Automotive Lifestyle and Interests Retail Shoppers Purchase Based Demographics For each of the top four categories, the report provides specific audience examples automotive marketers can leverage for specific marketing campaigns. Examples include likely frequent spenders at auto service and repair shops or consumers who are likely to be in the market to buy an Alternate Fuel Electric vehicle in the next 180 days. To learn more about where Experian is seeing the top third-party audience activation, read the Auto 2024 Digital Audience Report.

Are you ready to talk football? And read some Taylor Swift puns? And hear about a big automotive ad measurement success story? 'Don’t Blame Me’, I warned you…. As we are all aware, Travis Kelce will be playing for the Chiefs on Superbowl Sunday. Whether you are cheering for the Chiefs, the 49er’s, or you’re just there to watch the commercials and half-time show, ‘You Need to Calm Down’ and just expect to hear a couple references during the game about Taylor and Travis’ ‘Love Story’. Ad Measurement at the Top of Its Game Before the final match-up of this season though, let’s go ‘Back to December’ and talk about a “Red” hot advertising success story from Thursday Night Football. An automotive advertiser wanted to better understand the impact of advertising frequency on vehicle purchase activity. To do this, the advertiser initiated an Amazon Prime streaming advertising campaign to reach Thursday Night Football (TNF) audience viewers. They reached these viewers by leveraging in-game media to raise awareness with new and TNF-engaged audience viewers. In addition, the advertiser used remarketing techniques and other Amazon ads to re-engage the previously exposed TNF viewers. Campaign Results—More Than Just Karma! After the campaign was over, the automotive advertiser wanted to learn whether the results were more than just ‘Karma’. They used Experian’s Vehicle Purchase Insights data within Amazon Marketing Cloud (AMC) to fill in the ‘Blank Space’ and attribute vehicle sales to the exposed TNF audience. Customers exposed 2-3 times to their ads were 1.3X more likely to purchase a vehicle than viewers who were exposed to the advertising only once Customers exposed to their ads 4 times were 1.6X more likely to purchase a vehicle than viewers who were exposed to the advertising only once The advertiser understood ‘All Too Well’ the results, the campaign was a success! Even if you’re over all the pop culture references and the Swift romance, ‘Shake it Off’, there’s no reason for any ‘Bad Blood.” The ‘Fearless’ leader of the scoreboard will have their ‘Wildest Dreams’ come true and be named the Super Bowl LVIII champion. To read more about this case study, (without the Taylor Swift song title puns), click here.

Auto dealerships may sell dreams of open roads and freedom, but unfortunately, they also attract a different kind of customer: the identity thief. With high-value transactions and access to sensitive personal information, auto dealerships are prime targets for various fraudulent schemes. So, buckle up as we explore the most common types of identity fraud impacting dealerships and how to keep your wheels safe. Four common fraud schemes dealers need to be aware of 1. Third-Party Identity Fraud (Stolen Identities): Hijacking the Identity Highway This method doesn't involve creating new identities; it steals existing ones. Thieves steal personal information, often through data breaches or phishing scams, and use it to apply for auto loans under the victim's name. The dealership unwittingly approves the loan, leaving the real person saddled with the debt and a ruined credit score. 2. Synthetic Identity (Fabricated Credentials): Frankenstein Fraud on the Fast Lane Think of synthetic identity fraud as identity theft with a twist. Criminals combine real and fake information, like stolen Social Security numbers and fabricated addresses, to create entirely new personas. These fabricated identities then build clean credit histories, allowing them to qualify for high-value loans like car financing. By the time the dealership realizes the fraud, the car, and the fake persona have vanished. 3. First Party: No Way Will I Pay This method doesn't involve creating new identities; rather it is when a person knowingly misrepresents their identity or gives false information for financial or material gain. Fraudsters often have no plans to pay for their vehicle. 4. Document Fraud: Paper Trails of Deception Fraudsters can also manufacture fake or altered documents like driver's licenses, proof of income and employment verification. These forged documents create a veneer of legitimacy, allowing them to bypass dealership verification checks and secure loans based on fabricated information. Four ways dealerships can keep their brakes on fraud 1. Robust verification: Implementing multi-factor authentication, cross-referencing information with reliable sources, and verifying documents with advanced technology can significantly reduce the risk of deception. Fraud Protect™ from Experian Automotive leverages license scanning and selfie capture to verify identity. Dealers can find the true person and verify the activity through device, behavior, and step-up services. 2. Employee vigilance: Training staff to identify suspicious behavior and report potential fraud attempts can create a strong internal defense system. Fraud Protect fits within your current systems and processes. The software integrates with your CRM and does not require heavy software training or any additional hardware simplifying employee usage. 3. Secure data: Investing in data security measures like encryption and access controls can significantly deter hackers and minimize the damage from data breaches. Fraud Protect leverages Experian’s world-class data to handle the customer relationship carefully and detect errors and discrepancies. 4. Partnerships: Collaborating with credit bureaus, law enforcement agencies and fraud prevention systems can provide valuable insights and resources for fighting fraud. Experian is the world’s leading information services company. Fraud Protect from Experian Automotive offers a unique partnership for dealers through seamless CRM integration. This simple process makes multiple levels of risk identification quick and efficient for busy buyers. By acknowledging the various forms of identity fraud and implementing proactive measures, dealerships can protect themselves and their consumers from the impact of identity fraud. Fraud Protect empowers dealers with our leading fraud, identity and verification capabilities, integrated within your unique workflows. Whether on your website, leveraged before test drives, initiating out-of-state & and remote closings, or before contracting, Fraud Protect quickly uncovers potential fraud. The entire process is a quick and painless way to address risk while establishing customer trust. Take the first step in protecting profits and preventing fraud by visiting our auto fraud prevention solutions webpage.

Vehicles with recalls are on the road. In fact, as of July 2023, there were over 15M vehicles on the road in the United States that have a recall that was reported for that vehicle between January and June 2023². Awareness of Open Recalls and the availability of remedies is important for our Automotive clients. As a result, we have added the National Highway Transportation Safety Administration (NHTSA) number and remedy availability flag to three of our Vehicle History Data Solutions: AutoCheck Vehicle History Report Dealers and consumers will be aware of open recalls and if there is a remedy available for the recall. This can alleviate consumer concern over an open recall if there is no remedy available facilitating consumer confidence in a vehicle purchase. AutoCheck Triggers Clients will be aware of any open recalls and the remedy viability in their vehicle portfolio. Many clients use AutoCheck Triggers to make business decisions regarding their vehicle portfolio. Auto AccuSelect Adding the NHTSA recall number and remedy availability flag to Auto AccuSelect allows clients to be aware and take action regarding the vehicles they are evaluating. It is critical to know open recall information, as well as the overall history of a vehicle before buying or selling a used car. Experian Automotive’s vehicle history data solutions, such as a the AutoCheck vehicle history report, can help you buy and sell vehicles with confidence. AutoCheck has 98.96% of manufacturer coverage for recall data based on vehicles in operation. If you’d like to learn more about a recent analysis Experian Automotive conducted about the number of recalls reported for the first half of 2023, where those events were reported and where those vehicles are currently in operation, click to view our Recall Insights Infographic.