Automotive

Quick Answer: A new consumer survey reveals that 90% of survey respondents would like to have more than one Vehicle History Report when shopping for a used car. Offering an Experian AutoCheck® VHR as a second Vehicle History Report is a smart, simple strategy to help you close more deals. In today’s used car market, standing out from the crowd is more important than ever. As buyers become savvier and more informed, dealerships need to find new ways to build trust and close sales. One simple yet effective strategy? Offering a second Vehicle History Report (VHR) to your customers. Why VHRs Matter So Much Let’s face it—buying a car is a big deal. Most people don’t just walk onto a lot and pick the first car they see. They do their homework, and a big part of that research involves Vehicle History Reports. In fact, a recent survey found that 70% of people used a VHR the last time they bought a car. And it’s not just a one-time thing—83% of buyers say they’ll use a VHR for their next purchase too. Why? Because these reports provide crucial details like accident history, mileage accuracy, and service records that give buyers confidence in their decisions. The Case for Offering Multiple VHRs Here’s something that might surprise you: 90% of surveyed car buyers said they’d like to see more than one VHR when shopping for a used car. Think about that for a second. People want that extra layer of reassurance that only comes from cross-checking information. This is especially true for those who prefer buying from dealerships—these customers expect comprehensive, reliable data before they make a decision. How Multiple VHRs Can Give Your Dealership an Edge So, what’s the big deal about offering more than one VHR? It’s all about trust and transparency. Just like banks look at multiple credit reports before approving a loan, offering multiple VHRs can help you provide a fuller, more accurate picture of a vehicle’s history. This can reduce your liability and protect your dealership’s reputation. We have done some digging into this, and the results are eye-opening. For instance, in one case study, a dealership found additional damage events through an Experian AutoCheck® VHR that weren’t picked up by other VHRs. This kind of discrepancy shows just how valuable it can be to provide that second report—it helps ensure that all the facts are on the table, which protects both you and your customers. Meeting and Exceeding Customer Expectations Here’s something else to keep in mind: people expect dealerships to go the extra mile. The survey found that 86% of used car buyers believe VHRs should be provided for free by the dealership. By offering multiple reports at no additional cost, you’re not just meeting their expectations—you’re exceeding them. And that’s a surefire way to boost customer confidence, satisfaction, and, ultimately, your sales. What You Can Do Today Offering a second Vehicle History Report is a smart, simple strategy to help you close more deals. It shows your customers that you’re committed to transparency and that you care about providing them with all the information they need to make a confident decision. In a competitive market, it’s the little things like this that can make a big difference. Your customers—and your bottom line—will thank you. Experian Automotive is here to help you with your vehicle history data needs. If you’d like to learn more about our AutoCheck solution and how we can support you, click below to have someone from our team contact you.

Driven by a range of appealing factors including lower monthly payments and a wider array of models—due to the continuous rise in new vehicle inventory—leasing has reappeared as an optimal choice for consumers who are in the market for a vehicle. According to Experian’s State of the Automotive Finance Market Report: Q2 2024, leasing increased to 25.35%, up from 21.14% in Q2 2023 and 19.30% the year prior. While the average monthly payment and interest rate for a new loan modestly increased year-over-year, leasing is increasingly becoming a more attractive option for those leaning towards flexibility and affordability. For example, the average monthly payment on a leased vehicle was $148 less than a loan this quarter. What’s more, it seems consumers are leaning towards larger vehicles. For instance, the Honda CR-V (2.98%) continued to lead the top leased models in Q2 2024, and it was followed closely by the Tesla Model Y (2.61%). Rounding out the top five were the Honda Civic (2.29%), Ford F-150 (2.02%), and Chevrolet Silverado 1500 (1.86%). Prime financing grows and lease payments decline across all segments When looking at risk distribution trends in Q2 2024, prime consumers accounted for nearly 70% of the total finance market—with prime coming in at 37.82%, down from 39.84% last year and super prime increasing from 28.98% to 31.59% year-over-year. Subprime also saw a slight increase, going from 13% to 13.06% during the same period. It’s notable that all risk segments experienced a decrease in average monthly payments for leased vehicles, as super prime went from $601 in Q2 2023 to $586 in Q2 2024, prime declined to $583 this quarter, from $596 last year, and subprime was at $597, from $611. With the average monthly payments declining year-over-year for majority of shoppers, it can potentially create a more competitive market and drive more consumers towards this finance option—something automotive professionals should keep a close eye on. New and used vehicle finance market overview Data in Q2 2024 found that new vehicle loan amounts increased slightly, reaching $40,927, up from $40,743 last year, and the average interest rate went from 6.78% to 6.84% year-over-year. Despite the increases, the average monthly payment for a new vehicle only experienced a $1 growth to $734 this quarter. On the used side, the average loan amount declined from $27,316 Q2 2023 to $26,248 in Q2 2024, and the average rate grew from 11.47% to 12.01% in the same time frame. Though, the average monthly payment declined to $525 this quarter, from $536 last year. As the automotive industry continues to adapt to the changing market conditions and consumer preferences, it’s important for professionals to leverage the most current data—this will allow them to effectively assist consumers by meeting their financial needs with the available options. To learn more about automotive finance trends, view the full State of the Automotive Finance Market: Q2 2024 presentation on demand.

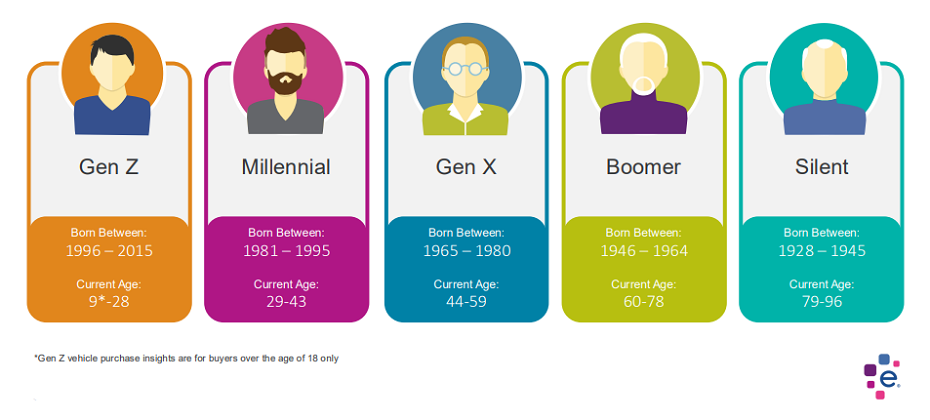

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

Quick Answer: Dealerships can avoid purchasing flood-damaged vehicles with Experian AutoCheck's Free Flood Risk Check. The used car market is tough right now. Unfortunately, recent floods in several areas have added another challenge: flood-damaged vehicles. These cars pose a big risk to dealerships. Buying one can lead to expensive repairs, unhappy customers, and damage to your reputation. Experian AutoCheck's Free Flood Risk Check can help. We've updated it with data from recent floods to give you a head start. Here's what the Free Flood Risk Check does: Quickly checks any car's flood risk with just the 17-digit VIN. Provides you with two levels of reporting: See if the car was registered in a region hit by a major FEMA disaster. Find potential flood damage based on Experian data (flood titles, auction records, etc.). Important things to remember: A "Yes" in the first report doesn't confirm flood damage, just that the car was in a flood zone. Even a clean second report isn't a guarantee - some flood damage goes unreported. For extra protection: Run a full Experian AutoCheck Vehicle History Report to uncover other issues like accidents or recalls. Have a mechanic thoroughly inspect any car before you buy it. By using Experian AutoCheck's Free Flood Risk Check and following these tips, you can dramatically reduce the risk of buying a flood-damaged car and protect your dealership. Ready to safeguard your dealership? Not an Experian AutoCheck subscriber?

For car dealers, the holy grail isn't a flashy sports car or a top-selling SUV. It's a simple whisper: "I'm thinking about getting a new car." Imagine if you could hear that murmur from every potential customer walking through your doors, online, or even driving down the street. That's the power of knowing who's in the market for a new car, and it's a game-changer for dealerships. Go beyond the cookie and website tracking and leverage the power of psychographic data and predictive analytics to know who is coming into the market in the next 30, 60, 90 days with the Experian Marketing Engine’s Affinity AutoAudiences. Boost Efficiency and ROI: Targeted Sales: No more shotgun blasts of marketing campaigns! Precisely target consumers considering a new car with personalized offers and incentives. Imagine tailoring financing proposals based on their budget and desired features, not guesswork. Inventory Optimization: Say goodbye to dusty lots filled with unsold models. Knowing market trends and individual preferences allows you to stock in-demand vehicles, maximizing sales and minimizing depreciation costs. Streamlined Sales Process: When a customer walks in already open to buying, the entire process becomes smoother. Focus on addressing their specific needs and preferences, leading to quicker deals and happier customers. Build Stronger Customer Relationships: Proactive Engagement: Instead of waiting for leads, reach out at the perfect moment. A friendly call or email during their research phase demonstrates attentiveness and builds trust, setting you apart from the competition. Personalized Recommendations: Forget one-size-fits-all pitches. Recommend models based on their lifestyle, budget, and driving habits. This shows genuine interest and builds rapport, increasing the likelihood of conversion. Enhanced Customer Experience: Cater to their specific needs before they even step onto the lot. Offer virtual test drives, online financing options, and even home delivery – all tailored to their preferences. This level of personalized service fosters loyalty and repeat business. Leverage the Power of Data: Knowing when a consumer is in the market for a new car isn't just about a head start, it's about building trust, offering convenience, and tailoring the entire experience to their needs. In a competitive market, this inside knowledge is the key to unlocking increased sales, stronger customer relationships, and ultimately, a thriving dealership. So, what are you waiting for? Start listening and turn those whispers into deals! Or

According to Experian’s Automotive Market Trends Report: Q1 2024, hybrids accounted for 11.8% of new vehicle registrations, an increase from 8.8% last year.

As more consumers lean towards adaptable and efficient vehicles that fit their everyday lifestyle, it’s no surprise to see the nuanced shifts in consumer preferences over recent years. For instance, compact utility vehicles (CUVs) have resonated with those seeking versatility—emerging as the most registered new vehicle segment in the first quarter of 2024 at 51.1%, according to Experian’s Automotive Consumer Trends Report. When exploring the depths of CUV registrations, data showed Toyota led the market share for the non-luxury segment at 14.9% in Q1 2024. They were followed by Chevrolet (12.1%), Honda (11.4%), Subaru (10.4%), and Hyundai (10.0%). On the luxury side, Tesla accounted for 28.0% of the market share this quarter and Lexus trailed behind at 14.1%. Rounding out the top five were BMW (12.2%), Audi (8.6%), and Volvo (6.2%). CUV registration trends by generations It’s notable that different generations are drawn to CUVs for a multitude of personal preferences that align with their respective lifestyles. For example, Baby Boomers made up 32.3% of new retail registrations for CUVs and Gen X was close behind at 30.4% in Q1 2024. They were followed by Millennials (23.6%), Gen Z (7.9%), and the Silent Generation (5.4%). While some generations seek a vehicle that strikes a balance between practicality and comfort, others may prefer smaller and more maneuverable vehicles. Nonetheless, CUVs making up just over half of new retail registrations is something that should be watched closely. By leveraging multiple data points such as who is in the market for a CUV as well as the types of makes and models they’re interested in, professionals have the opportunity to strategize new ways to effectively reach shoppers. To learn more about CUVs, view the full report at Automotive Consumer Trends Report: Q1 2024. Or

Experian's Automotive Consumer Trends Quarterly Report goes beyond understanding general car-buying trends. Each quarter, we delve deeper into a specific vehicle segment, analyzing the demographics (who's buying) and psychographics (why they're buying) of those consumers. New eBrochures help turn insights into action Although valuable, what can you do with this information? That's where The Trade Desk comes in. They leverage the insights from our report to create a comprehensive omnichannel strategy for reaching in-market car buyers. This strategy goes beyond demographics, revealing: Top web content preferences: Where are these consumers spending their online time? Frequented websites and apps: What digital platforms are most relevant to them? Top CTV and audio examples: Which streaming services and audio channels should be targeted? A Consolidated Snapshot The Trade Desk provides a clear picture of channel distribution, ensuring your advertising reaches the right audience across the most effective platforms. This combined approach empowers you to target car shoppers with laser precision, maximizing your advertising impact. Experian Automotive and The Trade Desk are committed to developing solutions that balance advertiser needs with consumer privacy. The Trade Desk’s clients can access Experian’s over 2,400 syndicated audiences across eight verticals, including over 750 automotive audiences by make, model, fuel type, price, vehicle age, and more. Accessing the insights: To view the latest Experian Automotive Consumer Trends Quarterly Report, visit us at: www.experian.com/automotive/auto-consumer-trends-form. You can review Experian and The Trade Desk’s collaborative eBrochures for the following vehicle segments:

In the ever-evolving landscape of automotive marketing, insight and measurement are paramount. Recognizing this, Strategus and Experian Automotive have joined forces to help improve digital automotive marketing campaign measurement. The Challenge The case study unfolds against a backdrop familiar to many advertisers: a regional advertising agency representing an OEM sought to evaluate the performance of their CTV automotive marketing campaign. Their objectives were clear: Assess digital and TV campaign performance, attributing actual vehicle sales accurately. Pinpoint top-performing audience segments and offers, factoring in demographic and psychographic variations. Adapt marketing strategy based on real-time campaign performance metrics. The Solution Strategus took the helm, leveraging Experian’s OmniImpact for Automotive solution to navigate these goals. They crafted a programmatic campaign targeting previous buyers of a specific vehicle model within a targeted geographic region. Through CTV advertising, they heightened awareness among the targeted audience, ensuring maximum engagement. Joel Cox, co-founder and EVP of Innovation and Strategy at Strategus summarizes the value of this collaboration perfectly: “Strategus is thrilled to collaborate with Experian to offer this novel auto sales attribution solution. While we know the positive influence CTV advertising can play in driving auto sales, the measurement and attribution of those sales can be a murky and incongruent snapshot heavily reliant on assumption and incomplete first-party datasets. While Experian’s OmniImpact for Automotive campaign measurement solution has been available to the largest auto advertisers, this relationship between Strategus and Experian Automotive democratizes this comprehensive measurement solution to all auto-selling clients of Strategus, regardless of size or sales volume.” Click here to learn more about the specific results and how Strategus and Experian Automotive work together to optimize campaign focus. Conclusion In a digital age where data reigns supreme, collaborations like that between Strategus and Experian Automotive showcase the power of leveraging precise insights to drive campaign results and automotive sales. By combining innovative strategies with advanced analytics, advertisers can not only measure campaign performance accurately but also adapt in real-time to maximize impact. As automotive marketing continues to evolve, relationships such as these that prioritize precision and insight will undoubtedly shape the industry's future. Or

Over the past few years, we’ve seen in-market shoppers lean into the used vehicle space; however, with new vehicle inventory continuing to rebound, we’re starting to see a reversal of fortune. Data in the first quarter of 2024 shows how the resurgence of new vehicle inventory is reshaping the automotive landscape.

For auto dealerships, the roar of engines and the clink of deals used to be the only sounds associated with financial risk. But in today's world, a silent threat lurks in every showroom: identity fraud. This insidious crime is costing dealerships millions, leaving a trail of financial and reputational wreckage in its wake. The Numbers Don't Lie: Reports of the impact of identity fraud on auto dealerships are becoming more common as the industry leans more heavily on digital retailing. According to the Federal Trade Commission, nearly 80,000 cars were stolen in 2023 via fraud. Who's Behind the Wheel? The perpetrators of fraud come in all shapes and sizes. While classic ID theft with stolen documents still exists, the real menace lies in synthetic identities: Frankenstein accounts cobbled together from stolen data and fake documents. These sophisticated creations can fool even the most vigilant dealership, resulting in high-value car loans taken out on non-existent people. The Ripple Effect: The consequences of identity fraud extend far beyond lost cars. Dealerships face: Financial losses: Wrecked credit and repossessions add up quickly. Operational headaches: Investigations and legal proceedings are time-consuming and costly. Reputational damage: News of fraud breaches trust and scares away potential customers. So, What Can Dealerships Do? Arming themselves with the right tools and practices is crucial. Here are some key steps: Invest in identity verification technology: Advanced document scanning, and facial recognition can crack down on fake licenses. Experian's Fraud ProtectTM leverages cutting-edge technology to compare licenses to selfies to confirm consumers are who they say they are AND their license is valid. Train staff on fraud detection: Fraud Protect takes the challenge out of identifying fraud in a very simple way. There is no hardware or extensive training. It is as simple as sharing a URL and reading the results in your CRM. Implement stringent verification procedures: Fraud Protect allows dealers to implement fraud identification measures in a frictionless manner. As simple as one-time passcodes, selfies, and taking pictures, the consumer experience is very smooth. For automotive dealers, the results are returned to their CRM within a few moments including all the information they need for proper decisioning. Fighting Back, One Mile at a Time: Identity fraud is a growing problem, but auto dealerships are not powerless. By raising awareness, investing in security, and embracing vigilance, dealers can protect themselves and drive this silent threat off the road. With Fraud Protect, dealers can verify documents and identity in a frictionless manner that does not interrupt the sales process. Learn more about auto fraud prevention solutions available or contact us to get started. *This article includes content created by an AI language model and is intended to provide general information.

With wider model availability and technology continuing to develop, the electric vehicle (EV) market experienced shifting in 2023, most notably among the top five newly registered models. According to Experian’s Electric Vehicles 2023 Year in Review, Tesla only made up two of the top five newly registered models in 2023, compared to four of the top five a year prior. The Tesla Model Y made up 36.8% of new retail EV registrations in 2023, followed by the Tesla Model 3 (19.6%), Volkswagen ID.4 (3.4%), Ford Mustang Mach-E (2.9%) and Chevrolet Bolt EUV (2.8%). The Volkswagen ID.4 and Chevrolet Bolt EUV were the newest entrants to the top five, replacing the Tesla Model X and Tesla Model S. EV registrations grow We’re also witnessing shoppers gravitate toward EVs more often than in years past. For instance, of the 11.8 million new retail registrations in 2023, more than 8% were EVs. Comparatively, of the 12.3 million new retail registrations in 2022, just over 6% were EVs. It’s notable that EVs continue to be most popular on the West Coast—particularly in California and Washington. According to the data, 33% of new retail EV registrations were in California—Los Angeles (170,000+), San Francisco (90,000+) and San Diego (30,000+) were among the top five DMAs for new retail EV registrations, along with Seattle, Washington (35,000+). While California exhibits robust EV registration growth, other states show the potential to expand, something automotive professionals should keep in mind. For instance, El Paso, Texas, was the fastest growing DMA for new retail EV registrations—with an 89.5% five year, year-over-year growth average, Savannah, Georgia, came in second at 81.8%, followed by Peoria-Bloomington, Illinois (76.7%), and Waco, Texas (73.7%). EV buyer insight Beyond the “what” and “where” of the EV market, the “who” is perhaps most important. Which customers have the highest propensity to buy an EV? According to the data, Gen Xers accounted for 32.0% of new retail registrations in 2023, however they accounted for 37.7% of new EV retail registrations over the same period. Similarly, millennials accounted for 24.5% of new retail registrations, yet made up 30.6% of new EV retail registrations in 2023; the only two generational demographics to over index on EV purchases. As professionals in the automotive industry find ways to stay ahead of the evolving EV landscape, leveraging data will enable them to understand and identify emerging opportunities to tailor their marketing strategies to a consumer’s needs. To learn more about EV trends, view the full Electric Vehicles 2023 Year in Review.

As the evolution of the automotive industry continues to unfold, certain vehicles retain their prominence, offering not only versatility but adaptability. In particular, vans have long embodied myriad lifestyles and needs—painting an intriguing picture of consumer preferences and economic trends. For instance, data from Experian’s Automotive Consumer Trends Report: Q4 2023 found there are currently more than 18 million vans in operation in the United States. Furthermore, there were over 245,000 new van retail registrations in the last 12 months—with mini vans such as the Honda Odyssey accounting for 79.4% of new van retail registrations and full-size vans including the Mercedes-Benz Sprinter making up the remaining 20.5%. Diving into the details, Honda comprised 27.3% of the market share by make in Q4 2023, followed by Toyota (19.3%), KIA (16.7%), Chrysler (13.7%), and Mercedes-Benz (9.0%). When looking at the most sought after vans, the Honda Odyssey led the market share by model this quarter—coming in at 27.3%. The Toyota Sienna trailed behind at 19.3%, followed by KIA Carnival at 16.7%, Chrysler Pacifica (13.5%), and Mercedes-Benz Sprinter (9.3%). While understanding the broader trends in van registrations is important for automotive professionals, exploring the demographics more in depth will help tailor marketing strategies effectively and personalize guidance to those who are in the market for a vehicle. For example, Gen X made up the largest portion of retail van registrations in Q4 2023 at 36.0%, followed by Millennials at 27.6%, Boomers (25.3%), Gen Z (7.5%), and Silent (3.3%). In order to align their strategies with the needs and preferences of van buyers, professionals throughout the automotive industry should delve into the nuances of who is buying and the models they’re interested in. This will also enable them to sustain the foundation for success in the dynamic automotive landscape. To learn more about vans, view the full Automotive Consumer Trends Report: Q4 2023 presentation.

From consumers seeking versatility and additional cargo space to more models becoming available—a discernible trend the automotive industry has seen in recent years is the shift towards utility vehicles such as SUVs and crossover utility vehicles (CUVs). In fact, Experian’s Automotive Market Trends Report: Q4 2023 found that utility vehicles were a significant driver in new vehicle registrations, coming in at 57.3%, up from 56.2% through Q4 2022. Meanwhile, pickup trucks declined from 18.5% last year to 17.2% this quarter and sedans went from 17.1% to 16.5% in the same time frame. Optimizing vehicle maintenance post-manufacturer warranty Despite utility vehicles making up the majority of new vehicle registrations through Q4 2023, passenger vehicles (85.1%) and light trucks (82.7%) had the most vehicles that were outside of the general manufacturer warranty this quarter—mostly due to a high volume of registrations in previous years. By comparison, 67.1% of all utility vehicles were outside the general manufacturer warranty. Understanding the current status of these vehicles enables aftermarket professionals to tailor their service recommendations accordingly. Furthermore, it will be important to monitor this trend over the next few years as the vehicles that are currently under manufacturer warranty will likely need maintenance after it expires. !function(e,n,i,s){var d="InfogramEmbeds";var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,"script","infogram-async","https://e.infogram.com/js/dist/embed-loader-min.js"); Vehicle registrations and aftermarket sweet spot When looking at overall registration trends, new vehicles increased 12.5% from last year—reaching 15.3 million through Q4 2023 and used vehicles declined 1.5% year-over-year to 38.2 million this quarter. While monitoring vehicle registration trends helps aftermarket professionals properly assist consumers now and in the future, identifying and understanding the aftermarket “sweet spot” allows them to stay ahead of the curve and adapt to changes as the market continues to evolve. Vehicles in the sweet spot are generally between six- to 12-model-years-old and have aged out of general OEM manufacturer warranties for any repairs. Through Q4 2023, 35.5% of all vehicles in operation landed in the sweet spot, marking a 3.6% year-over-year increase. Though, the aftermarket sweet spot volume is expected to hit its peak in the next few months at nearly 116 million vehicles—considering the record high was 104 million through 2011 and the sweet spot volume reached 102.4 million through Q4 2023. As aftermarket professionals look for ways to reach the right audience, leveraging registration data and the types of vehicles entering the market enables them to adjust their marketing strategies accordingly and plan their services effectively. To learn more about vehicle market trends, view the full Automotive Market Trends Report: Q4 2023 presentation on demand.

This series will dive into our monthly State of the Economy report, providing a snapshot of the top monthly economic and credit data for those in financial services to proactively shape their business strategies. As we near the end of the first quarter, the U.S. economy has maintained its solid standing. We're also starting to see some easing in a few areas. This month saw a slight uptick in unemployment, slowed spending growth, and a slight increase in annual headline inflation. At the same time, job creation was robust, incomes continued to grow, and annual core inflation cooled. In light of the mixed economic landscape, this month’s upcoming Federal Reserve meeting and their refreshed Summary of Economic Projections should shine some light on what’s in store in the coming months. Data highlights from this month’s report include: Annual headline inflation increased from 3.1% to 3.2%, while annual core inflation cooled from 3.9% to 3.8%. Job creation remained solid, with 275,000 jobs added this month. Unemployment increased to 3.9% from 3.7% three months prior. Mortgage delinquencies rose for accounts (2.3%) and balances (1.8%) in February, contributing to overall delinquencies across product types. Check out our report for a deep dive into the rest of March’s data, including consumer spending, the housing market, and originations. To have a holistic view of our current environment, we must understand our economic past, present, and future. Check out our annual chartbook for a comprehensive view of the past year and download our latest forecasting report for a look at the year ahead. Download March's State of the Economy report Download latest forecast For more economic trends and market insights, visit Experian Edge.