Financial Services

In today’s uncertain economic environment, the question of how to reduce portfolio volatility while still meeting consumers’ needs is on every lender’s mind. With more than 100 million consumers already restricted by traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By leveraging alternative credit data, you can continue to support your borrowers and expand your lending universe. In our most recent podcast, Experian’s Shawn Rife, Director of Risk Scoring and Alpa Lally, Vice President of Data Business, discuss how to enhance your portfolio analysis after an economic downturn, respond to the changing lending marketplace and drive greater access to credit for financially distressed consumers. Topics discussed, include: Making strategic, data-driven decisions across the credit lifecycle Better managing and responding to portfolio risk Predicting consumer behavior in times of extreme uncertainty Listen in on the discussion to learn more. Experian · Effective Lending in the Age of COVID-19

As the COVID-19 pandemic continues to create uncertainty for the U.S. economy, different states and industries have seen many changes with each passing month. In our July edition of the State of the Economy report, written by Principal Economist Joseph Mayans, we’ll be breaking down the data that financial institutions can use to navigate a recovery. Labor markets and state-level employment impact Prior to the pandemic, unemployment in the U.S. was at a 50-year low, at an astonishing rate of 3.5%. Following the start of the pandemic, research shows that unemployment rose from 6.2 million in February to 20.5 million in May 2020, and sent the unemployment rate soaring to 14.7%. However, the data from last month’s State of the Economy Report revealed that the unemployment rate began to decline, with 46 states seeing rises in new job opportunities. Although unemployment started to increase, many states (like Nevada) saw a 25.3% unemployment rate statewide. The numbers for June are much more promising, and reveal a continuous uptick in the number of jobs added. The unemployment rate in the U.S. also fell from 13.3% to 11.1%. The impact to industries COVID-19 had major impacts on every industry in the U.S., with the leisure and hospitality industry being the hardest-hit at 7.7 millions job lost. According to CNBC, “The large number of layoffs in this industry led the U.S. economy to its worst month of job losses in modern history.” However, job growth for the leisure and hospitality industry began to gain momentum in May, with 1.2 million jobs added. This can be attributed to a slow and gradual rollback of stay-at-home orders nationwide. As of June 2020, 4.8 million jobs have been added to this industry. The trade, transportation, and utilities, as well as education and health services, manufacturing, and business services industries also saw improvements in employment. The impact to retail sales Clothing stores, furniture, and sporting goods stores were only a few of the many retailers that saw heavy declines following lockdown orders. After two consecutive months of decline, retail sales finally rebounded by 17.7% in May, with the largest gains occurring in clothing stores (+188%). In June, retail sales continued to rise substantially, resulting in saw a v-shaped bounce. However, with unemployment benefits nearing the expiration date and the number of pandemic cases continuing to increase, recovery remains tentative. Our State of the Economy report also covers manufacturing, homebuilders, consumer sentiments, and more. To see the rest of the data, download our report for July 2020. We’ll be sharing a new report every month, so keep an eye out! Download Now

Do consumers pay certain types of credit accounts before others during financial distress? For instance, do they prioritize paying mortgage bills over credit card bills or personal loans? During the Great Recession, the traditional notion of payment priority among multiple credit accounts was upended, throwing strategies employed by financial institutions into disarray. Similarly, current circumstances in the context of COVID-19 might cause sudden shifts in prioritization of payments which might have a dramatic impact on your credit portfolio. Financial institutions would be better able to forecast and control exposure to credit risk, and to optimize servicing practices such as forbearance and collections treatments if they could understand changing customer payment behaviors and priorities of their existing customers across all open trades. Unfortunately, financial institutions’ data—including their own behavioral data and refreshed credit bureau data--are limited to information about their own portfolio. Experian data provides insight which complements the financial institutions’ data expanding understanding of consumer payment behavior and priorities spanning all trades. Experian recently completed a study aimed at providing financial institutions valuable insights about their customer portfolios prior to COVID-19 and during the initial months of COVID-19. Using the Experian Ascend Technology Platform™, our data scientists evaluated a random 10% sample of U.S. consumers from its national credit file. Data from multiple vintages were pulled (June 2006, June 2008 and February 2018) and the payment trends were studied over the subsequent performance period. Experian tabulated the counts of consumers who had various combinations of open and active trade types and selected several trade type combinations with volume to differentiate performance by trade type. The selected combinations collectively span a variety of scenarios involving six trade types (Auto Loans, Bankcard, Student Loan, Unsecured Personal Loans, Retail Cards and First Mortgages). The trade combinations selected accommodate a variety of lenders offering different products. For each of the consumer groups identified, Experian calculated default rates associated with each trade type across several performance periods. For brevity, this blog will focus on customers identified as of February 2018 and their subsequent performance through February 2020. As the recession evolves and when the economy eventually recovers, we will continue to monitor the impacts of COVID-19 on consumer payment behavior and priorities and share updates to this analysis. Consumers with Bankcard, Mortgage, Auto and Retail accounts Among consumers having open and recently active Bankcard, Mortgage, Auto and Retail accounts, bankcard delinquency was highest throughout the 24-month performance window, followed by Retail. Delinquency rates for Auto and Mortgage were the lowest. During the pre-COVID-19 period, consumers paid their secured loans before their unsecured loans. As demonstrated in the table below, customer payment priority was stable across the entire 24-month period, with no significant shift in payment priorities between trade types. Consumers with Unsecured Personal Loan, Retail Card and Bankcard accounts. Among consumers having open and recently active Unsecured Personal Loan, Retail Card and Bankcard accounts, consumers are likely to pay unsecured personal loans first when in financial distress. Retail is the second priority, followed by Bankcard. KEY FINDINGS From February 2018 through April 2020, relative payment priority by trade type has been stable Auto and Mortgage trades, when present, show very high payment priority Download the full Payment Hierarchy Report here. Download Now Learn more about how Experian can create a custom payment hierarchy for the customers in your own portfolio, contact your Experian Account Executive, or visit our website.

Experian’s Chris Ryan and Bobbie Paul recently re-joined David Mattei from Aite to discuss how emerging fraud trends and changes in consumer behavior will have long-term impacts on businesses. Chris, Bobbie, and David have combined experience of more than 60 years in the world of fraud prevention. In this discussion, they bring that experience to bear as they review how businesses should revise their long-term fraud strategy in response to COVID-19 and the subsequent economic shifts, including: The requirements to authenticate a digital customer Businesses’ technology challenges Differentiating between first party and third party fraud The importance of businesses’ technology investment How to build a roadmap for the next 90 days and beyond Experian · Make Your Fraud Plan Recession-Ready: Your 90 Day and Beyond Plan

Pre COVID-19, operations functions for retailers and financial institutions had not typically consisted of a remote (stay at home) workforce. Some organizations were better prepared than others, but there is a firm belief that retail and banking have changed for good as a result of the pandemic and resulting economic and workforce shifts. Market trends and implications When stay at home orders were issued, non-essential brick and mortar businesses closed unexpectedly. What were retailers to do with no traffic coming through the doors at their physical locations? The impact on big-box retailers like Best Buy, Dick’s Sporting goods, Sears, JCPenney, Nike, Starbucks, Macy’s, Neiman Marcus, Nordstrom, Kohl’s to name a few, has been unprecedented; some have had to shut their doors for good. Over the past several months global retail has seen e-commerce sales grow over 81% compared to the same period last year, according to Card Not Present. Some sectors have seen triple-digit growth year over year. Most online retailers have been ill-prepared to handle this increase in transactional volume in such a short amount of time, which has resulted in rapid fraud loss increases. A recent white paper from Aite Group reported that prior to COVID-19, a large financial institution forecasted an 8% decrease in fraud for 2020, but has since revised the projection to increase 10-15%. What does this all mean? Bad actors are taking advantage of the pandemic to exploit the online retail channel. The increased remote channel usage—online, mobile, and contact centers in particular—continues to be an area where retailers are exposed. Account takeover, through phishing and relaxed call center controls, is rising as well. Increases in phishing attacks are leading to compromised and stolen identities and synthetic identity fraud. Account takeover (ATO) fraud has increased 347% since 2019 according to PYMNTS.com. A recent survey found more than a quarter of merchants (27%) admit that they don’t have measures to prevent ATO. 24% of merchants can’t identify an ATO during a purchase. 14% of merchants say they are not even aware that an ATO has occurred unless a customer contacts them. When criminals use these compromised accounts to make fraudulent purchases, the merchant loses revenue and the value of the goods. They can also suffer from damage to brand reputation and a loss of customer confidence. A lack of account security can have lasting effects as 65% of customers surveyed say they would likely stop buying from a merchant if their account was compromised, according to that same Card Not Present study. So how can retailers start to identify bad actors with malicious intent? This will be a constant struggle for retailers. Rather than a one size fits all solution, retailers must move toward a strategy that is nimble and dynamic and can address multiple areas of exposure. A fraudster could easily slip by one verification method—for instance with a stolen credential—only to be foiled by a secondary authentication tactic like device identity. A layered fraud strategy continues to be the industry best practice, where both passive and active authentication methods are leveraged to frustrate fraudsters without applying undue friction to “good” consumers. The layered solution should also utilize device risk, identity verification and fraud analytics, with tailoring to each businesses’ needs, risk tolerance, and customer profiles. Learn more about how to build a layered fraud strategy today. Learn more

Every few months we hear in the news about a fraud ring that has been busted here in the U.S. or in another part of the world. In May, I read about a fraud ring based in Georgia and Louisiana that bought 13,000 stolen identities of children who were on the Louisiana Medicaid program and billed the government for services not rendered. This group defrauded the Medicaid program of more than $500,000. This is just one of many stories that we hear about fraud rings, and given the rapidly changing economic environment, now is the time for businesses to think about how to protect against fraud rings. There are a number of challenges that organizations may have when it comes to sharing trends and collaborations, understanding the ways to tie fraud rings together, creating treatments for identifying fraud rings and ways to store and catalogue fraud ring experiences so they can be easily recognized. The trouble with identifying fraud rings It’s important to understand the challenges that organizations have because they see the fraud rings through their own internal lens. Here are a few of the top things businesses should work on: Think like a fraudster. This will help businesses become more creative in their approach to fraud prevention. Facilitate internal collaboration. Share with in-organization partners. Sometimes this can be difficult due to organizational structure. Promote external collaboration. Intel-sharing groups are a great way for businesses to network within their industries and learn about the fraud that others are seeing. An organization that I’ve worked with in the past is the National Cyber Forensic and Training Alliance (NCFTA). Putting the pieces together How do businesses identify a fraud ring? There are three steps to get started. The first is reviewing and understanding the data. Fraudsters are lazy and want to replicate the process over and over again, and because of this there is always some piece of information that is repeated. It could be a name, an email address, device fingerprint, or similar. The second step is tying the fraud ring together. This is done by creating rules to help identify the trends. Having rules in place to identify fraud rings allows businesses to easily pull stats together for their leadership. Lastly, applying an acronym or name to the particular fraud ring and adding comments to the cases associated with a particular ring will help with post-investigation analysis. Learning from the past Before I became a consultant, I remember identifying a fraud ring that was submitting events with the same language pack and where the device fingerprint was staying consistent. Those events were being referred out for review and marked with the same note. At a post-mortem review, I was able to talk to the fraud ring we had seen, and it was easy to pull all events associated with this fraud ring because my team had marked the events with the same comments. Another fraud ring example happened a few years ago. A client called me and said that they were under a fraud attack and this fraud ring was rotating the email handle. I reviewed the data and came up with a rule to catch this activity. Fraud rings will use email handle rotation to help them keep track of accounts that are opened or what emails they used in the past. By coupling the email handle rotation with an email verification service like Emailage, this insight could be very telling. I would assume that when fraud rings use email handle rotation these emails are new and have just been created. These are just a few of the many fraud rings that I’ve encountered over the course of my career and I’m sure there will be a lot more in the years to come. The best advice I can give to anyone that reads this post is to understand the data that you are reviewing, look for anomalies within the data, ask questions and test your theories by running queries on the data that you’re reviewing. I would love to hear about the different fraud rings that you’ve encountered over your career. Stay safe. Contact us

Experian’s own Chris Ryan and Bobbie Paul recently joined David Mattei from Aite to discuss the latest research and insights into emerging fraud schemes and how businesses can combat them in light of COVID-19 and the resulting economic changes. Between them, Chris, Bobbie, and David have more than 60 years of experience in the world of fraud prevention. Listen in as they discuss how businesses can shape their fraud prevention plan in the short term, including: The impacts of the health crisis and physical distancing The rise of e-commerce and consumer digital engagement Changes in criminal activity Fraud attack vectors 2020 fraud loss projections Critical next steps for the 30-60 day time frame Experian · Make Your Fraud Plan Recession-Ready: 2020 Fraud Trends

Account management is a critical strategy during any type of economy (pro-cycle, counter-cycle, cycle neutral). In times like these, marked by economic volatility, it is an effective way to identify which parts of your portfolio and which of your consumers need the most attention. Check out this podcast where Cyndy Chang, Senior Director of Product Management, and Craig Wilson, Senior Director of Consulting, discuss the foundational elements of account management, best practices and use cases. Account management today looks very different than what it has been during over a decade of growth proactive; account review is a critical part of navigating the path forward. Questions that need to be addressed include: Do you have the right data? Are you monitoring between data loads? Are you reviewing accounts at the frequency that today’s changing demands require? Listen in on the discussion to learn more. Experian · Look Ahead Podcast

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to help lenders make better decisions – during COVID-19 and beyond – with customized forecasts and macroeconomic data. Phrases like “the new normal,” “unprecedented times,” and “extreme economic volatility” have flooded not only media for the last few months, but also financial institutions’ strategic discussions regarding plans to move forward. What has largely been crisis response is quickly shifting to an urgent need to answer the many questions around “Will we survive this crisis?,” let alone “What’s next?” And arguably, we’ve entered a new era of loss forecasting. After the longest period of economic growth in post-war U.S. history, previously built models are not sufficient for the unprecedented and sudden changes in economic conditions due to COVID-19. Lenders need instant insights to assess impact and losses to their portfolios. The Ascend Portfolio Loss Forecaster combines advanced modeling from Oliver Wyman, pandemic-specific insights and macroeconomic scenarios from Oxford Economics, and Experian’s quality data to analyze and produce accurate loan loss forecasts. Additionally, all of the data, including the forecasts and models, are regularly updated as macroeconomic conditions change. “Experian’s agility and innovative technologies allow us to help lenders make informed decisions in real time to mitigate future risk,” said Greg Wright, chief product officer of Experian’s Consumer Information Services, in a recent press release. “We’re proud to work with our partners, Oxford Economics and Oliver Wyman, to bring lenders a product powered by machine learning, comprehensive data and macroeconomic forecast scenarios.” Built using advanced modeling and expert scenarios, the web-based application maximizes the more than 15 years of Experian’s loan-level data, including VantageScore® credit score, bankruptcy scores and customer-level attributes. Financial institutions can gauge loan portfolio performance under various scenarios. “It is important that the banks take into account the evolving credit behaviors due to the COVID-19 pandemic, in addition to the robust modeling technique for their loss forecasting and strategic decisioning,” said Anshul Verma, senior director of products at Oliver Wyman, also in the release. “With the Ascend Portfolio Loss Forecaster, lenders get robust models that work in the current conditions and take into account evolving consumer behaviors,” Verma said. To watch Experian’s webinar on portfolio loss forecasting, please click here and to learn more about the Ascend Portfolio Loss Forecaster, click the button below. Learn More

The COVID-19 pandemic and resulting rush to transition to a remote lifestyle made it clear that many businesses need a refreshed digital authentication and fraud prevention strategy that includes an investment in technology and provides consumer assurance. This is particularly important when it comes to identity, as many of the standard in-person verification methods and tools are currently unavailable. The meaning of identity is growing and shifting Technology trends are intersecting with social trends to create heightened awareness, and a whole new public conversation has emerged around customer trust and privacy. Attitudes and ideas are changing—even to the point of what we mean by “identity.” An identity is no longer just a name, date of birth, and SSN. Now, there are digital manifestations everywhere you look: screen names, email addresses, mobile phone numbers, device identifiers, and the other “exhaust” we leave behind as we travel the internet. This leads to concerns about what an identity is, who owns it, and who manages and protects it. Businesses have to be able to prove to their ability to protect their customers’ identities through investment in technology and a robust fraud strategy. Consumer attitudes are changing Several years ago, consumers were excited by all the new digital capabilities and the speed, ease, and convenience they provided. Last year, Experian found that consumers still wanted those things, with 70% willing to provide more information to businesses if there was a perceived benefit. However, they also wanted more security in the balance. In Experian’s most recent Global Identity and Fraud Report, we found that 74% of consumers say that security is the most important factor when deciding to engage with a business. Consumers are particularly more tolerant of friction during the enrollment process—as a means of building trust. But, when they return to the app or website, they want to be recognized. This means achieving a balance by using layered technologies, some of which are active and visible to the consumer, and some of which are invisibly working in the background to confirm the identity of returning consumers. Consumer attitudes vs. regulatory pressure The drivers behind the business changes are twofold: shifting consumer attitudes and regulatory changes. While regulations are becoming stricter on a national and global level, they’re not keeping pace with technology and social change. The digital world is evolving at a rapid pace, opening up more new ways for companies to collect information about consumers and use it to identify and verify, and also to target goods and services. With all of this data available, it’s important for businesses to use the tools in the market to help protect identity information. Next steps in technology The bottom line is, businesses can’t wait for regulations to dictate how best to protect information. Instead, they should be looking to technologies like physical and behavioral biometrics to help provide identity authentication and protection – layering those solutions with information from the user and from third parties to give a holistic consumer view. Businesses should adopt a platform approach for identity and fraud in order to be able to adapt quickly, whether to incorporate new kinds of technology or to prevent emerging types of fraud. By investing in technology now, even in the midst of the COVID-19 pandemic, businesses can build the flexibility needed to respond to future crises and help offset future fraud losses. In turn, those fraud-loss savings can then be used to help grow the business in the future. Learn more about Experian’s commitment to helping businesses maximize their investment in technology to safeguard against fraud. Learn more

To combat the growing threat of synthetic identity fraud, Experian recently announced the launch of Sure ProfileTM, a revolutionary change to the credit profile that gives lenders peace of mind with Experian’s commitment to share in losses that result from an identity we’ve assured. “Experian has always been a leader in combatting fraud, and with Sure Profile, we’re proud to deliver an industry-first fraud offering integrated into the credit profile that mitigates lender losses while protecting millions of consumers’ identities,” said Robert Boxberger, President of Decision Analytics, Experian North America. Synthetic identity fraud is expected to drive $48 billion in annual online payment fraud losses by 2023. Between opportunistic fraudsters and a lack of a unified definition for synthetic identity theft it can be nearly impossible to detect—and therefore prevent—this type of fraud. This breakthrough solution provides a composite history of a consumer’s identification, public record, and credit information and determines the risk of synthetic fraud associated with that consumer. It’s not just a fraud tool, it’s a comprehensive credit profile that utilizes premium data so lenders can make positive credit decisions. Sure Profile leverages the capabilities of the Experian Ascend Identity PlatformTM and uses Experian’s industry-leading data assets and data quality to drive advanced analytics that set a higher level of protection for lenders. It’s powered by newly-developed machine learning and AI models. And it offers a streamlined approach to define and detect synthetic identities early in the originations process. Most importantly, Sure Profile differentiates between real people and potentially risky applicants so lenders can increase application approvals with greater assurance and less risk. “Experian can confidently define and help detect synthetic fraud. That's why we can help stop it,” said Craig Boundy, CEO of Experian North America. “Experian stands behind our data with assurance given to our clients. It’s better for lenders and it’s better for consumers.” Sure Profile is a complement to our robust set of identity protection and fraud management capabilities, which are designed to address fraud and identity challenges including account openings, account takeovers, e-commerce fraud and more. This first-of-its kind profile is the future of underwriting and portfolio protection and it’s here now. Read press release Learn More About Sure Profile

Rays of hope are beginning to shine in the economy that suggest the U.S. may have moved beyond the most acute phase of the economic crisis. The housing sector, in particular, looks poised to regain momentum and perhaps lead the path towards stabilization in the second half of 2020. A “V-Shaped” rebound in mortgage applications Despite record levels of unemployment and widespread economic uncertainty, homebuyers have returned to the market with conviction. After shelter-in-place restrictions curtailed open-house visits and crimped buyer demand in early April, applications to purchase a home have risen for six consecutive weeks, according to the Mortgage Bankers Association. The latest data for the week of May 22nd, indicate that purchase applications were 9% higher than during the same period in 2019. If this trend continues, it will show that significant pent-up demand exists in the housing market that may be able to offset some of the lost spring buying season. April new home sales far exceed expectations After declining by 13.7% in March, new home sales rose a modest 0.6% in April. While this was only a slight gain, it was considerably above economists’ projections of a fall of 20% and may mark the turning point in the downtrend. Since the recording of new home sales data occurs when the purchase contract is signed or a deposit is accepted – and is typically for a house that hasn’t been built yet or is currently under construction – it provides a gauge of how buyers feel about their future economic prospects. Building a home also requires hiring new construction workers, buying building supplies, and supporting a host of ancillary industries, thus making it an indicator of further economic activity. Some of the increase in demand for new homes may have been driven by coronavirus quirks. The number of existing homes on the market is at record lows and many people may have been reluctant to put their home up for sale and have buyers tour as health concerns remain. Buyers, as well, may have preferred to steer clear of occupied homes or were unable to make in-person visits due to shelter-in-place restrictions. This lack of options for home buyers, coupled with record-low mortgage rates, likely drove sales of new homes higher. However, for the same reasons why new home sales rose, pending sales for existing homes fell sharply. In April, the National Association of Realtors reported that sales declined by 21.8%, which is the largest drop in ten years. Home prices continue to gain ground Even with shelter-in-place restrictions dampening buyer demand in early April, home values have continued to rise. This is because the supply of homes on the market also contracted, resulting in a simultaneous drop of demand and supply. According to Zillow Research, the total inventory of homes for sale is down roughly 20% from this time last year. With fewer competing homes on the market, sellers have been reluctant to slash prices and are betting that the lack of options and low mortgage rates will keep buyers on the hook. In April, U.S. home values rose 4.3% from the year before. The states with the strongest growth were Idaho (9.8%), Arizona (8.5%), Maine (7.6%), and Washington (7.4%). It will be interesting to see if this pattern of growth changes as newly implemented work from home policies may shift where people prefer to live and work. Why it matters The housing market has an outsized influence on the overall direction of the U.S. economy. Housing is not only is a big contributor to economic growth, but many owners have a large portion of their wealth tied up in their home. If the housing market can find its footing in the second half of 2020, then it could set the stage for an eventual economic recovery. Learn more

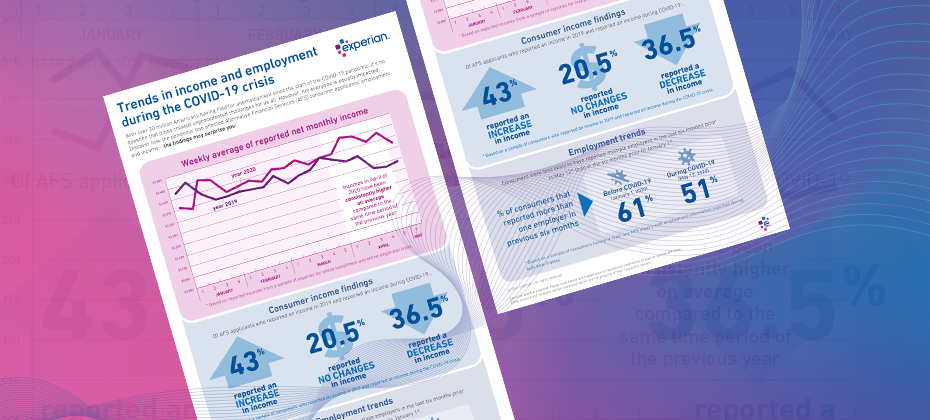

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

The COVID-19 pandemic has created unprecedented challenges for the utilities industry. This includes the need to plan for – and be prepared to respond to – changing behaviors and a sudden uptick in collections activities. As part of our recently launched Q&A perspective series, Mark Soffietti, Experian’s Senior Manager of Analytics Consulting and Tom Hanson, Senior Energy Consultant, provided insight on how utility providers can evolve and refine their collections and recovery processes. Check out what they had to say: Q: How has COVID-19 impacted payment behavior and debt collections? TH: Consumer payment behavior is changing. For example, those who paid as agreed, may not currently have the means to pay and are now distressed borrowers. Or those who were sloppy payers before the pandemic may now be defaulting on a more consistent basis. MS: As we saw with the last recession when faced with economic stress, consumer and commercial payment behavior changes based on their needs and current cash flow. For example, people prioritize their car, as they need it to get to and from work, so they’ll likely pay their auto bills on time. The same goes for their credit cards, which they need to make ends meet. We expect this will also be true with COVID-19. The commercial segment will face more dramatic and challenging circumstances, where complete or partial business closures and lack of federal relief could have severe ramifications. Q: What new restrictions have been put in place surrounding debt collection efforts and outbound calls? TH: To protect consumers who may be experiencing financial distress, most states have imposed new, stringent restrictions to prevent utilities from engaging in certain collections activities. Utilities are currently not charging any late payment fees and are instead structuring payment plans. Additionally, all outbound collections efforts have been suspended and there is fieldwork being executed of services for both commercial and consumer properties. As of now, consumer and commercial fieldwork will likely not commence until after the first year or when the winter moratorium concludes. MS: The new restrictions imposed upon collections activities will likely drive consumer payment behavior. If consumers know that their utilities (i.e. energy and water) will not be shut off if they miss a payment, they will make these bills less of a priority. This will dramatically increase the amount owed when these restrictions are lifted next year. Q: Can we predict how the utilities industry will fare post-COVID-19? TH: The volume of accounts in collections and eligible for disconnect will be overwhelming. Many utility providers fear the unpaid balances consumers and commercial entities accumulate will be nearly impossible to fit into a repayment schedule. Both analyzing internal payment segments and overlaying external factors may be the best way to optimize the most critical go-forward plan. MS: The amount of people who fall into collections is going to greatly increase and utility providers need to start planning for it now to weather the storm. They will need to use data, analytics and tools to help them optimize their tasks, so they can be more efficient with their resources. Like many other industries, the utilities sector will look to increasing digitalization of their processes and having less social interaction where possible. This could mean the need and drive for expediting current smart meter programs where possible to enable remote fieldwork to assist in managing this unprecedented level of activity that is sure to overwhelm field operations (where allowed by state regulators). Q: What should utility providers be doing to plan for an uptick in collections activities post-COVID-19? TH: With regulatory mandated suspensions of collections activities for utility providers and self-selected reductions due to stay at home orders and staff protection, the backlog of payments, calls and inquiries once business resumes as normal is set to overwhelm existing capacity. More than ever, self-service options (text/web), Q&A and alternative communication methods will be needed to shepherd consumers through the collections process and minimize the strain on call center agents. Many utility providers are asking for external data points to segment their consumers by industry or by those whose employment would have been adversely impacted by COVID-19. MS: Utility providers should be monitoring consumer data in order to prepare for when they are able to collect. This will help them strategize the number of resources they will need in their call centers and out in the field performing shut off activities. Given that the rise in cases will be more volume than their call centers can handle, they will need to use their resources wisely and plan to use them efficiently when they are able to resume collections. Q: How can Experian help utility providers reduce collections costs and maximize recovery? TH: Experian can help revise collections tactics and segmentation strategies by providing insight on how consumers are paying other creditors and identifying new segmentation opportunities as we emerge from the freeze on collections activities. Collections cases will be complex, and many factors and constraints will need to balanced against changing goals, making optimization key. MS: Utilizing Experian’s credit data and models can help ensure that resources are being used efficiently (i.e. making successful calls). There is also a need to leverage ability to pay models as well as prioritization models. By using these models and tools, utility providers can optimize their treatment strategies, reduce costs and maximize dollars collected. Learn more About our Experts: Tom Hanson, Senior Energy Consultant, Experian CEM, North America Tom is a Senior Consultant within the Energy Vertical at Experian, supporting regulated energy companies throughout the U.S. He brings over 25 years of experience in the energy field and supports his clients throughout the customer lifecycle, providing expertise in ID verification, account treatment, fraud solutions, analytics, consulting and final bill/field optimization strategies and techniques. Mark Soffietti, Analytics Consulting Senior Manager, Experian Decision Analytics, North America Mark has over 15 years of experience transforming data into actionable knowledge for effective decision management. Mark’s expertise includes solution development for consumer and commercial lending across the credit spectrum – from marketing to collections.

The largest industry disruptor was a surprise to everyone. Where bets may have been placed on digital transformation, automated decisioning, or better omnichannel programs, no one foresaw the global pandemic of COVID-19 and the corresponding economic fall out that ensued. As financial institutions have spent the past two months scattered and then regrouping, whether with pivoted downturn contingency strategies or with a business-focused Hail Mary, some might argue that the dust is beginning to settle. While the world and the majority of businesses are working to manage and stabilize a new normal against a background of some form of chaos, once federal and state regulations are loosened, the world – and financial institutions in particular – will need a plan forward. So, what comes after COVID-19? With stimulus checks and what everyone hopes will soon be a re-stimulating of the economy, consumers will seek credit. And when that influx comes, there will be a need to strategize what is the right offer for the right consumer. How do you take on more customers while minimizing risk? Non-existent and/or shrinking budgets Many marketing budgets were already small prior to the global pandemic, so coming out of it, to say every marketing dollar counts is an understatement. Traditional prescreen, while a pillar in acquisition operations, is an antiquated strategy. Using hyper-segmentation via a true end-to-end marketing service, pumped up by the right data for decision making, enables financial institutions to not only build the right audience but tailor quality experiences that increase engagement and loyalty. That means ultimately reducing operating costs while improving experiences and take rates. Work from home turned life from home Going virtual has gone viral. Seemingly overnight, most brick and mortar operations went online. Some versions of digital transformation became a need to have, versus a nice to have, and the gap between the financial institutions who were equipped to pivot online, versus those who were not, spread further. As the vast majority of consumers are at home – whether by way of work from home or furlough – our society has quickly embraced everything being online. Reach your consumers where they are, in the digital-first channels to which they have become familiar with and accustomed. As consumers are at the center of every marketing strategy, engaging omnichannel delivery enhances reach across critical touchpoints. Inclusive of social media, email, direct mail, TV, and more, the campaign should provide a seamless experience, all working together in a synchronized fashion. Consistency has always been key, but especially during these volatile times, to reflect stability, empathy and constant messaging is an undertone that can only help strengthen consumers’ view of your organization. Learn fast, grow faster For marketing financial products, it’s a matter of connecting the dots between consumer touchpoints and results data. By making these critical connections, financial institutions will be better positioned to identify the most effective elements in the campaign. By gleaning more insights from campaign performance, organizations can optimize future campaigns and minimize wasted ad spend. These key learnings, delivered at the end of every campaign cycle, help your organization to remain nimble, pivot quickly and execute campaigns that get increasingly better ROI as you hone in on the nuances revealed by data on consumer behavior, preferences, motivations and more. Changing times and even faster-changing needs There’s always been a need for faster decisioning and more results with increasingly fewer resources. The need for speed has been put on hyperdrive as the economy has entered the current environment. How do you keep up with the changing needs of your consumers? Get your marketing right from the start and see results through to the end. Incorporating the right data, advanced analytics and constant access ultimately enable more strategic focus and shorter campaign cycles. As we all navigate the ever-changing “normal,” offering the right support to your consumers is the right thing to do for them and for you. Managing rising consumer needs, while also minimizing risk to your bottom line, is also the right thing to do for your business. Once plans move from managing business operations through the crisis to moving forward, make sure your marketing – how you are reaching out to existing customers and prospective customers for the next steps in their financial journey – is data-driven. To learn more about how Experian can help you execute data-driven marketing that fuels customer acquisition, visit our website. Learn More