Industries

It is no news that businesses are increasing their focus on advanced analytics and models. Whether looking to increase resources or focus on artificial intelligence (AI) and machine learning (ML), growth is the name of the game. But how do you maximize impact while minimizing risk? And how can you secure expertise and ROI when budgets are strapped? Does your organization have the knowledge and talent in-house to remain competitive? No matter where you are on the analytics maturity curve, (outlined in detail below), your organization can benefit from making sure your machine learning models solution consists of: Regulatory documentation: Documentation for model and strategy governance is critical, especially as there is more conversation surrounding fair lending and how it relates to machine learning models. How does your organization ensure your models are explainable, well documented and making fair decisions? These are all questions you must be asking of your partners and solutions. Integrated services: For some service providers, “integrated,” is merely a marketing ploy, but it is essential that your solution truly integrates attributes, scores, models and decisions into one another. Not only does this serve as a “checks and balances” system of sorts, but it also is a primary driver for the speed of decisioning, which is crucial in today’s digital-first world. Deep expertise: Models are a major component for your decisioning, but ensuring those models are built and backed by experts is the one-two punch your strategies depend on. Make sure your services are managed by data scientists with extensive experience to take the best approach to solving your business problems. Usability: Does your solution close the loop? To future proof your processes, your solution must analyze the performance of attributes, scores and strategies. On top of that, your solution should make sure the items being built are useable and can be modified when needed. A one-and-done model does not suit the unique needs of your organization, so ensure your solution provides actionable analysis for continual refinement. Does your machine learning model solution check these boxes? Do you want to transform your existing system into a state-of-the-art AI platform? Learn more about how you can take your business challenges head-on by rapidly developing, deploying and monitoring sophisticated models and strategies to more accurately predict risk and achieve better outcomes. Learn more Access infographic More information: What’s the analytics maturity curve? “Analytics” is the discovery, interpretation and communication of meaningful patterns in data; the connective tissue between data and effective decision-making within an organization. You can be along this journey for different decision points you’re making or product types, said Mark Soffietti, Director of Analytics Consulting at Experian, at our recent AI-driven analytics and strategy optimization webinar. Where you are on this curve often depends on your organization’s use of generic versus custom scores, the systems currently engaged to make those decisions and the sophistication of an organization’s models and/or strategies. Here’s a breakdown of each of the four stages: Descriptive Analytics – Descriptive analytics is the first step of the analytics maturity curve. These analytics answer the question “What is happening?” and typically revolve around some form of reporting. An example would be the information that your organization received 100 applications. Diagnostic Analytics – These analytics move from what happened to, “Why did it happen?” By digging into the 100 applications received, diagnostic analytics answer questions like “Who were we targeting?” and “How did those people come into our online portal/branch?” This information helps organizations be more strategic in their practices. Predictive Analytics – Models come into play at this stage as organizations try to predict what will happen. Based on the data set and an understanding of what the organization is doing, effort is put towards automating information to better solve business problems. Prescriptive Analytics – Optimization is key for prescriptive analytics. At this point in the maturity curve, there are multiple models and/or information that may be competing against one another. Prescriptive analytics will attempt to prescribe what an organization is doing and how it can drive more desired behaviors. For more information and to get personalized recommendations throughout your analytics journey, visit our website.

As more consumers turn to the internet to research and purchase preowned vehicles, dealers have focused marketing efforts to the online marketplace to get their vehicles in front of shoppers. According to Think with Google, 95% of vehicle buyers use digital as a source of information and it takes 65% of buyers just three weeks to research vehicles online prior to purchase. With seventy-eight percent of consumers visiting two or more sites during their shopping “journey”1 how do dealers capture their attention, increase lead and sales conversions? Dealers need to share key data in a vehicle history report such as information related to reported accidents, odometer readings, open recalls, and whether the vehicle qualifies for buyback protection. These details help consumers better understand and make informed decisions when shopping. Case Study: How leveraging the AutoCheck VHR subscription increased lead and sales conversions Our integration partner, CarZing, an online auto shopping portal, offered a Free AutoCheck® Vehicle History Report on their Vehicle Detail Page (VDP) which increased lead and sales conversions. Together, we analyzed six months of lead activity on millions of vehicle listings on CarZing focusing on the 200 most popular vehicles by year/make/model. Key findings indicated that vehicle listings offering a Free AutoCheck VHR on the VDPs achieved a higher lead conversion rate than listings for the same year/make/model for vehicles without a Free AutoCheck report. Here’s a few highlights from the full report: Furthermore, when layering in available sales data, sales conversion is higher for vehicles featuring a free VHR available to consumers than vehicle listings that did not. Based on the results, CarZing’s Director of Operations, Frank Merle strongly encourages all AutoCheck clients take advantage of the exponential value that offering a free AutoCheck report brings to dealership VDPs. Dealers with an AutoCheck subscription can list their vehicles for free on AutoCheck.com and CarZing.com. Simply contact your Experian account executive or call 1 888 409 2204. For dealers that are not yet subscribers, here’s a few more things you may not know about Experian AutoCheck Vehicle History Reports. We do not re-market to shoppers, resell VDP leads or offer your competitors’ inventory for consideration on AutoCheck.com. Our goal is to help your dealership sell your inventory. For dealers who are interested in learning more about the benefits of becoming an AutoCheck subscriber contact us today. 1https://www.coxautoinc.com/wp-content/uploads/2021/02/Cox-Automotive-Car-Buyer-Journey-Study-Pandemic-Edition-Summary.pdf

Chatbots, reduction of manual processes and explainability were all hot topics in a recent discussion between Madhurima Khandelwal, Vice President and Head of DataLabs at American Express®, and Eric Haller, Executive Vice President and head of Experian DataLabs. The importance of AI’s role in innovation in the financial services space was the focus of the recent video interview. In the interview, Khandelwal highlighted some of the latest in what American Express DataLabs is working on to continue to solve complex challenges by building tools driven by AI and Machine Learning: Natural language processing has come a long way in even the last few years. Khandelwal discussed how chat bots and conversational AI can automate the simple to complex to enhance customer experience. Document recognition and processing is another leading-edge innovation that is useful for extracting and analyzing information, which saves staff countless manual hours, Khandelwal said. Fairness and explainability are consistently brought to the forefront especially in financial services as regulators are looking at ways to prevent AI/ML from causing bias for the consumer. Khandelwal showcased how there is extreme rigor in each part of creating their models and how human oversight and training are primary drivers for how they stay on top of this. As for innovation advice, Khandelwal points out that it’s important to be aware that AI and innovation are not always interchangeable, and companies need to think through whether a problem needs to be solved through AI/ML models before charting ahead. Another major key to the equation is the data. In all use cases, the undercurrent of innovation in any form is dependent on the data being used. Learn more about this topic and what Harry Potter has to do with women in data science. Watch the Interview

It’s time for organizations to harness the power artificial intelligence (AI) can bring to digital identity management – quickly and accurately identifying consumers throughout the lifecycle. The rise in crime The acceleration to digital platforms created a perfect storm of new opportunities for fraudsters. Synthetic identity fraud, stimulus-related fraud, and other types of cybercrime have seen huge upticks within the past year and a half. In fact, the Federal Trade Commission revealed that consumers reported over 360,000 complaints, resulting in more than $580 million in COVID-19-related fraud losses as of October 2021. To protect both themselves and consumers, businesses — especially lenders — will have to find and incorporate new strategies to identify customers, deter fraudsters and mitigate cybercrime. The benefits of AI for digital identity In our latest e-book, we explore the impacts of AI on organizations’ digital identity strategies, including: How changing consumer expectations increased the need for speed The challenges associated with both AI and digital identities The path forward for digital identity and AI How to develop the right strategy Building a solution It’s clear that current digital identity and fraud prevention tools are not enough to stop cybercriminals. To stay ahead of fraudsters and keep consumers happy, businesses need to look to new technologies — ones that can intake and compute large data sets in near-real time for better and faster decisions throughout the customer lifecycle. By using AI, businesses will enjoy a fast and consistent decisioning system that automatically routes questionable identities to additional authentication steps, allowing employees to focus on the riskiest cases and maximizing efficiency. Read our latest e-book to dive into the ways artificial intelligence and digital identity interact, and the benefits a clear identity strategy can have for the entire user journey. Download the e-book

Generation Z has money on their minds, and as their appetite for personal finance grows, financial institutions better be ready. Accounting for 40% of all U.S. consumers, Gen Z is comprised of digital natives with little to no memory of the world as it existed before smartphones, social media and the internet. Aside from growing up in a tech-saturated world, Gen Zers are also socially conscious and determined to take control of their financial futures. According to Credit Union Times, Gen Zers wield a purchasing power of more than $143 billion, which is projected to increase by more than 70% in the next five years. What do these insights mean for financial institutions? As the newest and soon-to-be largest cohort of consumers, Gen Zers represent an enormous opportunity for growth. While establishing a relationship with Gen Z now is key to creating lifelong customers, the same approaches used to capture previous generations may not be as effective with this younger cohort. To successfully reach and acquire Gen Z consumers, financial institutions must recognize their unique needs, preferences and experiences. Here are some key trends and preferences to consider: They live and breathe social media. According to Mintel, 99% of Gen Z adults and teens are active social media users. Despite this percentage of Gen Zers on social media, credit card issuers spent 94% of their media budget on direct mail from January 2019 to May 2021. This highlights the need for financial institutions to recognize social media as a powerful and necessary marketing vehicle. As a fast-growing consumer group with massive spending power, Gen Z makes for valuable customers, but are being missed by current marketing strategies. While direct mail is popular among millennials, financial institutions must recognize Gen Z’s preference for social media and pivot themselves to effectively reach them. By leveraging both social media and direct mail, financial institutions can dramatically increase their reach and acquire a wider pool of consumers. They want to be financially literate. Concepts like budgeting, investing and credit building can seem daunting to Gen Zers, especially if they lack the proper guidance and resources to get started. According to a NerdWallet survey, 41% of Gen Zers feel anxious about their personal finances, while 40% feel nervous and confused. To add onto their worries, older Gen Z members may have witnessed their parents struggle financially during the Great Recession or have seen millennials burdened with student loan debt. For fear of facing the same challenges as their predecessors, Gen Zers have shown great interest in taking control of their financial lives and becoming financially literate. In response to this desire for financial education, many banks and credit card issuers have taken an educational approach in their marketing by using infographics and ‘how-to’ guides to teach Gen Z about the basics of personal finance. Offering educational resources not only gives Gen Zers the confidence to make financial decisions, but it gives financial institutions the opportunity to build an early connection with this consumer group. Many banks and credit card issuers are also positioning themselves as companies Gen Zers can “grow with.” By not limiting their products to a specific life stage, these financial institutions seek to grow alongside the consumer so that they remain loyal customers even when their needs and lifestyles change. They care about what brands stand for. According to Mintel Trend Buydeology, Gen Z consumers are passionate about the causes close to their hearts and are more likely than other generation to pay a higher price for brands that support the causes they care about. With this in mind, financial institutions must prove they are authentic, socially responsible and committed to serving their communities. To resonate with Gen Z consumers and align with their preferences, financial institutions should educate themselves about social issues, take part in meaningful discussions both on and offline, and develop innovative strategies to drive real impact and change. Ready to win over Gen Z? Financial institutions have a massive opportunity to build lasting relationships with Gen Z consumers and having a pulse on what this fast-growing segment wants is a must. To learn more, check out our efforts to help marginalized and underserved communities or join our upcoming webinar on November 3, 2021. Learn more Register for webinar

In Experian’s Automotive Market Trends Review: Q2 2021, we looked at the data to better understand EV and internal combustion engine registration trends.

Although 2021’s continued focus is Americans learning to co-exist with COVID-19, automotive manufacturers and dealers will likely remember 2021 as the year of the chip. The semiconductor chip shortage is now expected to cost the global automotive industry $210 billion in revenue in 2021 and it is now forecasted that 7.7 million units of production will be lost in 2021, up from 3.9 million in the May forecast.1 Most experts agree that the shortage will likely extend into 2022. Chip Shortage Creates Additional Challenge for Dealers The current shortage in semiconductors has automotive manufacturers and dealers questioning whether to continue advertising or pull back. Some dealers view the increase in profits due to reduced inventory a signal to pull back on advertising spend. Other dealers, however, are thinking about long-term marketing strategy—and are continuing to advertise to help maintain brand exposure to customers. Foreword-thinking dealers and agencies should use this time to evaluate advertising strategies and plan for life after the chip shortage. Staying visible to customers in the interim is critical, so any advertising needs to be strategic in audience, medium and message. Here are three recommendations to help keep your brand in front of current and future consumers while using marketing dollars wisely. Identify Your Audience: Be Sure to Market to the Right People Knowing which consumers are most likely to purchase your vehicles is a key element of targeting with the promise of saving money by marketing only to those who are most likely to result in a sale. By evaluating prior purchase, demographic, and psychographic trends, including specific life events, dealership marketers can more effectively pinpoint demand as well as foster positive relationships. For example, knowing that a consumer recently added a new child to the family would be a great reason to send a coupon or make a call. Experian’s Automotive Intelligence Engine™ (AIE) will send “events” to your CRM to alert you of life events that can help develop and deepen relationships that lead to future vehicle sales. Additionally, AIE’s Market Insights enable dealers to grow market share by identifying the best prospects and matching them with the right messages. Strategically targeting both conquest and loyal customers with appropriate messaging keeps consumers engaged so they will remember your brand when they buy next. Leverage Your Brand Reputation Keeping your brand front and center has been the cornerstone of your marketing efforts and that shouldn’t change. Much like looking at family photos or reading an article about your favorite team, exposure to positive advertisements reinforces a consumer’s relationship with your brand. Whether the goal is to leverage your OEM driven brand awareness or support the consumer relationship with your dealership, positive messages from local dealers perpetuate ongoing loyalty. Experian’s Automotive Intelligence Engine generates powerful marketing strategies and efficient data-driven, omni-channel media plans with engaging, brand-specific messaging direction that resonates with consumers. Dealers and agencies use AIE to generate custom marketing plans that leverage data-driven market analysis, strategic audience creation, and powerful marketing strategy, creating messages that effectively reach the right prospects, with the right message, on the right channel. This end-to-end solution will reach consumer mailboxes, inboxes, screens, and computers where your best audiences spend their time. Continue to Foster a Positive Relationship with Consumers Marketing is more than selling a story. Marketing initiates the consumer experience, especially in the digital world. From effective OTT ads to strategic social posts, successful dealerships often put their relationship with the community at the heart of their message. Simple images of your dealership delivering meals to local first responders and essential workers or posts showing the local high school marching band loading instruments into one of your trucks can convey a strong sense of community pride to your brand. This sort of promotion impacts future consumer purchases well beyond any chip shortage. While the chip shortage has had a profound impact on how dealerships approach vehicle acquisition, price structures and marketing, it will eventually be resolved. The decisions you make now can have a big impact on your success when the shortage ends. Learn more about Experian’s Automotive Intelligence Engine™ (AIE). https://www.cnbc.com/2021/09/23/chip-shortage-expected-to-cost-auto-industry-210-billion-in-2021.html

Shri Santhanam, Executive Vice President and General Manager of Global Analytics and Artificial Intelligence (AI) was recently featured on Lendit’s ‘Fintech One-on-One’ podcast. Shri and podcast creator, Peter Renton, discussed advanced analytics and AI’s role in lending and how Experian is helping lenders during what he calls the ‘digital lending revolution.’ Digital lending revolution “Over the last decade and a half, the notion of digital tools, decisioning, analytics and underwriting has come into play. The COVID-19 pandemic has dramatically accelerated that, and we’re seeing three big trends shake up the financial services industry,” said Shri. A shift in consumer expectations More than ever before, there is a deep focus on the customer experience. Five or six years ago, consumers and businesses were more accepting of waiting several days, sometimes even weeks, for loan approvals and decisions. However, the expectation has dramatically changed. In today’s digital world, consumers expect lending institutions to make quick approvals and real-time decisions. Fintechs being quick to act Fintech lenders have been disrupting the traditional financial services space in ways that positively impacts consumers. They’ve made it easier for borrowers to access credit – particularly those who have been traditional excluded or denied – and are quick to identify, develop and distribute market solutions. An increased adoption of machine learning, advanced analytics and AI Fintechs and financial institutions of all sizes are further exploring using AI-powered solutions to unlock growth and improve operational efficiencies. AI-driven strategies, which were once a ‘nice-to-have,’ have become a necessity. To help organizations reduce the resources and costs associated with building in-house models, Experian has launched Ascend Intelligence Services™, an analytics solution delivered on a modern tech AI platform. Ascend Intelligence Services helps streamline model builds and increases decision automation and approval rates. The future of lending: will all lending be done via AI, and what will it take to get there? According to Shri, lending in AI is inevitable. The biggest challenge the lending industry may face is trust in advanced analytics and AI decisioning to ensure lending is fair and transparent. Can AI-based lending help solve for biases in credit decisioning? We believe so, with the right frameworks and rules in place. Want to learn more? Explore our fintech solutions or click below. Listen to Podcast Learn more about Ascend Intelligence Services

When we look at how automotive manufacturers and dealers have marketed vehicles over the last few decades, we can see how through every decade, and every learning, it has led to data-driven marketing strategies that are powering success today. Let’s take a look: Strategic marketing in the 1990’s In the 1990’s dealership marketing included mainly newspaper and radio advertisements complimented by occasional direct mail pieces mailing to every home in a zip code. OEMs purchased ad time on popular Television and their dealer associations and local dealers had an option to do the same. Because the 1990’s was the age of “mass media,” marketing was based off geography. There was less attention on channel or audience and a good deal of spending! Cars were sold. Strategic marketing in the 2000’s The new millennium brought advancements in computers and databases. Dealerships explored the exciting world of internet promotion and email marketing and continued using traditional newspaper, radio and television to drive traffic. mail programs such as the “scratch and win” or the “key to a car you can win” efforts were common, resulting in massive mail-based marketing campaigns. Then came 2008, when many dealers drastically cut back on spending and were focused mainly on surviving the Great Recession. As we all know, many dealers, and even vehicle makes, did not. Strategic marketing in the 2010’s In the beginning of the decade, manufacturers and dealers were still recovering from the recession but were slowly feeling more optimistic about the economy. If there is one thing the industry learned from the recession, it was to be much more strategic when it came to spending. During this decade, ad technology advanced, as did the ability to evaluate marketing spend. Dealers became aware of the true cost of their traditional marketing ways and embarked on new paths of marketing to a smaller but more specific audience. Equity mining and greatly advanced revolutionized the direct mail and related online arena. As the decade drew to a close, marketers leveraged solutions where merge fields enabled customization and personalization for both direct mail and email marketing. With the ability to deliver massive volumes at a lower cost, email blasts grew in popularity. Social media platforms emerged as a force, and dealers experimented to invent new ways to leverage them. Television marketing underwent a massive facelift as consumers left cable for streaming services resulting in new advertising strategies such as addressable and connected TV, OTT (Over The Top) advertising. Strategic marketing in 2020 2020 will forever be remembered as the year of the pandemic. In automotive marketing, it was also the year of reinvention! With many showroom closures, dealers and OEMs found themselves with a reduced advertising budget and a greater need to find more targeted audiences with more effective marketing messaging. How do I master my market share? Who is in-market for my vehicles? How is my website performing? Which customers are in equity? Which customers have added a child to the household? How do I reach them in a digital world? This is where Experian has helped both manufacturers and dealers. Experian’s automotive marketing solutions help marketers utilize vehicle, consumer, lender, and market data to leverage market insights, target the right audience, develop effective messaging strategies, and measure outcomes to continually optimize results. Over the last four decades, automotive marketing strategies have become much more data driven, so having a solution that uses data insights to help retain loyal customers and win new conquest customers, all while reducing total marketing spend, is a key requirement for success in this decade…and beyond. If you're a marketer at a Dealership, learn more about our marketing solutions here. If you're an Auto OEM marketer, learn more about our marketing solutions here.

The AutoCheck FREE Flood Risk Check site has been updated with Hurricane Ida information New cars have been in short supply due to the worldwide microchip shortage, so consumers quickly turned their attention to used cars. Unfortunately, dealers continue to struggle with obtaining enough used car inventory to meet demand. To add to an already challenging year, Hurricane Ida hit the gulf coast in August resulting in an estimated 250,000 cars sustaining flood damage. It’s more important than ever that dealers be careful about obtaining pre-owned cars that could potentially have flood damage. The best way to mitigate the risk of purchasing a flood damaged vehicle is to start by running an AutoCheck Free Flood Risk Check. Visitors simply enter any vehicle's 17-digit VIN and the tool will check for flood brands and provide information if the vehicle was registered in a region impacted by a FEMA disaster declaration. Two levels of reporting available The first level of reporting determines whether the vehicle has been titled/registered 12 months prior in a county that has been identified as requiring public and individual assistance (FEMA categories A and B) for a FEMA-declared major disaster. This would yield a “Yes” result. For instance, you would get a “Yes” result if the vehicle was registered in an impacted area during the time of a FEMA-declared major disaster like Hurricane Ida. The “Yes” result should not be interpreted as confirmation of flood damage or even possible flood damage. The data is provided merely as information regarding the location of the vehicle’s registration/title history so users can be aware of risk exposure. For example, the Hurricane Ida region had thousands of damaged cars, but some cars in the region may not have been damaged by the hurricane — the owner could have driven the car when they evacuated, or a child or other family member may have been out of town with the car when the hurricane hit. The second level of reporting is based on search results from Experian data such as flood title and problem records, including flood State title brands, auction flood announcements, salvage auction flood designations, and other vehicle records determined by Experian to relate to or suggest an increased likelihood of flood damage or risk exposure. It takes time for claims and updates to vehicle title information to appear on a vehicle’s history and although the DMV requires that title brands be issued for vehicles damaged by floods, not every vehicle flood event is reported by car owners. Unreported flood events may not appear on an AutoCheck Flood Risk Check or AutoCheck Vehicle History Report. Although Experian provides flood related records from available data sources, we cannot provide assurance that an AutoCheck Flood Risk Check that does not produce any records means that the subject vehicle has not experienced flood damage. That’s why it’s important to review a full AutoCheck Vehicle History Report, which—in addition to potential flood damage—includes reported accidents, branded titles, recalls, number of owners and more. Once you run the full Vehicle History Report we recommend an independent evaluation and inspection of the vehicle to determine and confirm a vehicle’s condition prior to purchase. Try the AutoCheck Flood Risk Check today to help mitigate the risk of purchasing flood damaged vehicles. Not an AutoCheck subscriber? Contact us to become an AutoCheck client.

Despite used vehicle prices rising, loan-to-value (LTVs) ratios are dropping. Ultimately, lower LTVs are a positive trend for consumers because it puts them into positive equity on their vehicle faster.

Experian recently announced that it has made the IDC 2021 Fintech Rankings Top 100, highlighting the best global providers of financial technology. Experian is ranked number 11, rising 33 places from its 2020 ranking. IDC also refers to Experian as a ‘rising star.’ The robust data assets of Experian, combined with best-in-class modeling, decisioning and technology are powering new and innovative solutions. Experian has invested heavily in new technologies and infrastructures to deliver the freshest insights at the right time, to make the best decision. For example, Experian's Ascend Intelligence Services™ provides data, analytics, strategy, and performance monitoring, delivered on a modern-tech AI platform. With the investment in Ascend Intelligence Services, Experian has been able to streamline the delivery speed of analytical solutions to clients, improve decision automation rates and increase approval rates, in some cases by double digits. “Recognition in the top 20 of IDC FinTech Rankings demonstrates Experian’s commitment to the success of its financial clients,” said Marc DeCastro, research director at IDC Financial Insights. “We congratulate Experian for being ranked 11th in the 2021 IDC FinTech Rankings Top 100 list.” View the IDC Fintech Rankings list in its entirety here. Focus on Data, Advanced Analytics and Decisioning Creates Winning Strategy for Experian Experian’s focus on data, advanced analytics and decisioning has continued to gain recognition from various notable programs that acknowledge Fintech industry leaders and breakthrough technologies worldwide. Beyond the IDC Fintech Rankings Top 100, Experian won honors from the 2021 FinTech Breakthrough Awards, the 2021 CIO 100 Awards and was most recently shortlisted in the CeFPro Global Fintech Leaders List for 2022 in the categories of advanced analytics, anti-fraud, credit risk and core banking/back-end system technologies. “At Experian, we are committed to supporting the Fintech community. It’s great to see our continued efforts and investments driving positive impacts for our clients and their consumers. We will continue to invest and innovate to help our clients solve problems, create opportunities and support their customer-first missions,” said Jon Bailey, Vice President for Fintech at Experian. Learn more about how Experian can help advance your business goals with our Fintech Solutions and Ascend Intelligence Services. Explore fintech solutions Learn more about AIS

Artificial intelligence is here to stay, and businesses who are adopting the newest AI technology are ahead of the game. From targeting the right prospects to designing effective collections efforts, AI-driven strategies across the entire customer lifecycle are no longer a nice to have - they are a must. Many organizations are late to the game of AI and/or are spending too much time and money designing and redesigning models and deploying them over weeks and months. By the time these models are deployed, markets may have already shifted again, forcing strategy teams to go back to the drawing board. And if these models and strategies are not being continuously monitored, they can become less effective over time and lead to missed opportunities and lost revenue. By implementing artificial intelligence in predictive modeling and strategy optimization, financial institutions and lenders can design and deploy their decisioning strategies faster than ever before and make incremental changes on the fly to adapt to evolving market trends. While most organizations say they want to incorporate artificial intelligence and machine learning into their business strategy, many do not know where to start. Targeting, portfolio management, and collections are some of the top use cases for AI/ML strategy initiatives. Targeting One way businesses are using AI-driven modeling is for targeting the audiences that will most likely meet their credit criteria and respond to their offers. Financial institutions need to have the right data to inform a decisioning strategy that recognizes credit criteria, can respond immediately when prospects meet that criteria and can be adjusted quickly when those factors change. AI-driven response models and optimized decision strategies perform these functions seamlessly, giving businesses the advantage of targeting the right prospects at the right time. Credit portfolio management Risk models optimized with artificial intelligence and machine learning, built on comprehensive data sets, are being used by credit lenders to acquire new revenue and set appropriate balance limits. Strategies built around AI-driven risk models enable businesses to send new offers and cross-sell offers to current customers, while appropriately setting initial credit limits and managing limits over time for increased wallet share and reduced risk. Collections AI- and ML-driven analytics models are also optimizing collections strategies to improve recovery rates. Employing AI-powered balance and response models, credit lenders can make smarter collections decisions based on the most predictive and accurate information available. For lending businesses who are already tight on resources, or those whose IT teams cannot meet the demand of quickly adapting to ever-changing market conditions and decisioning criteria, a managed service for AI-powered models and strategy design might be the best option. Managed service teams work closely with businesses to determine specific use cases, develop models to meet those use cases, deploy models quickly, and monitor models to ensure they keep producing and predicting optimally. Experian offers Ascend Intelligence Services, the only managed service solution to provide data, analytics, strategy and performance monitoring. Experian’s data scientists provide expert guidance as they collaborate with businesses in developing and deploying models and strategies around targeting, acquisitions, limit-setting, and collections. Once those strategies are deployed, Experian continually monitors model health to ensure scores are still predictive and presents challenger models so credit lenders can always have the most accurate decisioning models for their business. Ascend Intelligence Services provides an online dashboard for easy visibility, documentation for regulatory compliance, and cloud capabilities to deliver scores and decisions in real-time. Experian’s Ascend Intelligence Services makes getting into the AI game easy. Start realizing the power of data and AI-driven analytics models by using our ROI calculator below: initIframe('611ea3adb1ab9f5149cf694e'); For more information about Ascend Intelligence Services, visit our webpage or join our upcoming webinar on October 21, 2021. Learn more Register for webinar

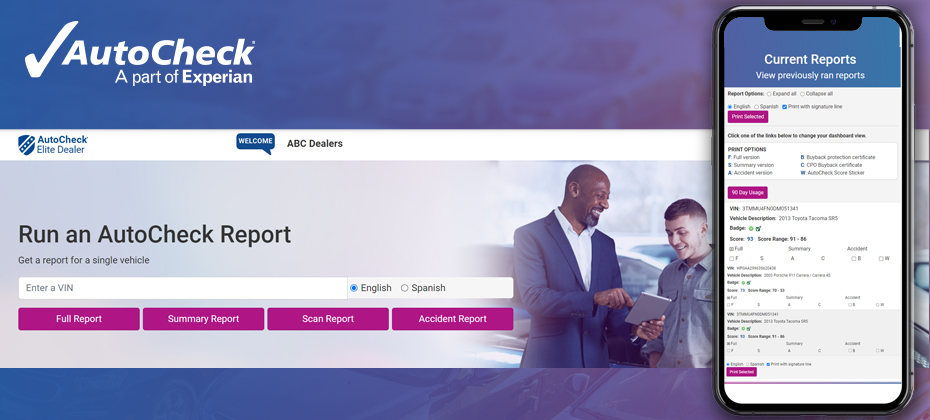

We’re excited to announce that the AutoCheck Member Website has received a facelift! AutoCheck has always been the industrial strength Vehicle History Report that automotive professionals trust to help manage risk and confidently buy and sell the right vehicles. We’ve made this great solution even greater by improving our Member Site user experience. Based on extensive research and user feedback, we’ve added many visual and workflow enhancements which make it easier for users to use the site. One noticeable change to the Member Website is the addition of Experian’s brand and color scheme. You’ll know right away that you’re accessing AutoCheck data backed by Experian, the industry experts for reliable data. The entire site is now mobile responsive—optimizing the experience for tablet and mobile users to provide even more shopping convenience. The new site will allow full functionality from a tablet or mobile device. As always, subscribers can continue to access AutoCheck reports via our mobile app or AutoCheck Fast Link℠ integration within their DMS, CRM, inventory management, online vehicle listings or many other integrated solutions. In addition, the AutoCheck Member Website is now WCAG 2.1 compliant. Web Content Accessibility Guidelines (WCAG) were developed to make web content more accessible to people with disabilities. This ‘web content’ usually refers to text, images and sounds on a webpage or web application. It also may include code that defines structure and presentation of the page of application. While a generated AutoCheck was already WCAG2.1 compliant, the entire member site now also meets the accessibility guidelines. AutoCheck Members can expect the same great functionality once they have signed into the site: Run single or multiple reports Print and email AutoCheck reports Print the Buyback Protection Certificate and the AutoCheck Score Sticker View the Track their 90-day usage Access AutoCheck brand materials including logos, videos and showroom materials Review Best Practices and Frequently Asked Questions Update account information …and much more! Below are a couple of examples which highlight the new user experience. Already an AutoCheck Member? Contact us or call us at 1.888.409.2204 if you have any questions about navigating the redesigned website. Not an AutoCheck subscriber? Contact us to become an AutoCheck client and take advantage of all the benefits.

Despite an unprecedented 18 months since the pandemic was in full force and many Americans were sent home, financial wellness continues to be on the up and up. Consumers continue to manage credit well and the average credit score climbed seven points since 2020 to 695, the highest point in more than 13 years. In Experian’s 12th annual State of Credit report, the headlines are hopeful regarding how Americans are managing personal finances in the face of the pandemic. The report provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report features data from 2019 pre-pandemic, the 2020 pandemic year, and the start of 2021. “The findings from this year’s report show something I’ve always believed: Americans are resilient, for the most part they make smart decisions in the face of adversity and they are agile in adjusting their financial habits when the environment or circumstances change,” said Alex Lintner, President, Experian Consumer Information Services. Highlights of Experian’s State of Credit report: 2021 State of Credit Report 2019 2020 2021 Average VantageScore® credit score [1] 682 688 695 Median VantageScore® credit score 687 697 707 Average number of credit cards 3.0 3.0 3.0 Average credit card balance $6,494 $5,897 $5,525 Average revolving utilization rate 30% 26% 25% Average number of retail credit cards 2.50 2.42 2.33 Average retail credit card balance $1,930 $2,044 $1,887 Average nonmortgage debt $25,057 $25,483 $25,112 Average mortgage debt $210,263 $215,655 $229,242 Average auto loan or lease $19,034 $19,462 $20,505 Average 30–59 days past due delinquency rates 3.8% 2.4% 2.3% Average 60–89 days past due delinquency rates 1.9% 1.3% 1.0% Average 90–180 days past due delinquency rates 6.6% 3.8% 2.5% We asked Joseph Mayans, Principal Economist at Advantage Economics, LLC, for his reactions to the findings: “The State of Credit Report captures the three central themes of the pandemic. First, it shows the overwhelming success of the fiscal support packages. By far, the most striking example of this is the broad based and significant decline in delinquencies during a time when millions of people were out of work. Second, the report showcases the resiliency of American households. People used their stimulus dollars to stay on top of their bills and pay down debt, which boosted average credit scores across all generations. And third, it highlights the unique behavioral shifts brought on by the pandemic. We can see these changes in the rise of housing and auto debt as people bought larger homes and sought to drive rather than ride public transportation.” Generational Trends As indicated in the findings, consumers across all generations except Gen Z saw decreased utilization rates and decreased credit card balances year over year. Consumers are also missing fewer payments with notable improvements seen among the youngest consumers. Mortgage debt was up across every generation, which may correlate with the record low interest rates on mortgages, refinances and moves. According to the CBRE, “the pandemic accelerated several long-standing American migration patterns” as evidenced by more than 15.9 million people filing change-of-address requests with the United States Postal Service. Compared with 2019, 2020 change-of-address requests show a 4% increase in total movers, 2% increase in permanent movers and 27% increase in temporary movers, according to a study by MyMove. Mayans also made note of the mortgage trends. “It’s becoming clearer that millennials are stepping into the homebuying phase in a big way. Once thought to be the generation of apartments and urban revival, many older millennials are now buying homes and moving to the suburbs much like their parents before them,” Mayans said. “This will have significant implications for the post-pandemic world, especially as work from home becomes more prevalent.” State Trends The states with the highest and lowest average credit score remained unchanged from last year with the highest average score of 726 held by Minnesota and an average score of 666 held by Mississippi. New Jersey had the highest number of credit cards and retail cards at 3.37 and 2.54 respectively, and Alaska had the highest credit card debt at $7,089 (U.S. average is $5,525) and Texas had the highest retail debt at $2,248 (U.S. average is $1,888). What Lies Ahead Some have argued that the past year of the pandemic and quarantine forced a lot of time for reflection. The continued positive trends of consumer behavior seem to indicate some of that effort was put toward better financial health practices. That said, like any sourdough bread recipe or DIY home glow-up, there’s always more to learn and opportunities to seize when it comes to financial health. “We are committed to working with lenders and the industry to help consumers gain access to credit, driving broader financial inclusion, while also teaching consumers how to responsibly build and use credit responsibly,” Lintner said. In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com. Additional credit education resources and tools Join Experian’s #creditchat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time. Bilingual and Spanish speakers are also invited to join Experian’s monthly #ChatdeCredito hosted on Twitter at 3 p.m. Eastern time beginning September 16. Visit the Ask Experian blog for answers to common questions, advice and education about credit. Add positive telecom, utility and streaming service payments to your Experian credit report for an opportunity to improve your credit scores by visiting experian.com/boost[2] For additional resources, visit https://www.experian.com/consumereducation To see all the findings, download the 2021 State of Credit Report. Download the full report [1] VantageScore® is a registered trademark of VantageScore Solutions, LLC. VantageScore® credit score range is 300 to 850. [2] Results may vary. See Experian.com for details