Industries

For financial marketers, long gone are the days of branded coffee mugs, teddy bears and the occasional print ad. Financial marketers are charged with customizing messaging and offerings at a customer level, increasing conversion rates, and moving beyond digital while keeping an eye on traditional channels. Additionally, financial marketing teams are having to do it all with less; according to CMO Survey, marketing budgets have remained stagnant for the last 6 years. Accordingly, competing in today’s world requires transforming your organization to address rapidly increasing complexity while containing costs. Here are four tactics leading-edge firms are using to respond to changes in the market and better serve customers. More data, fewer problems Financial institutions ingest a mind-boggling variety of data, transaction details, transaction history, credit scores, customer preferences, etc. It can be difficult to know where to start or what to do with what is often terabytes of data. But the savviest teams are mining their unique data, along with bureau data, and other alternative and third-party data for rich decision making that drives differentiation. Getting analytical In financial institutions, advanced analytics has traditionally lived with lenders, underwriters, risk and fraud, departments, etc. But marketers too can find the value in the volume, velocity and variety of new data sources available to financial institutions. Using advanced analytics allows the most forward-thinking financial marketers to better target customers, personalize experiences, respond in near-real-time or even predict actions, and measure the impact of marketing investments. Customized quality time with customers Thanks to the likes of Google and Amazon, consumers have become accustomed to individualized interactions with firms they utilize. And this desire is just as present when it comes to their financial institution. But banks, credit unions and fintechs have been historically slow to respond. According to a recent Capgemini study, 70% of US consumers feel like their financial institution doesn’t understand their needs. The most dynamic financial marketing teams tailor quality experiences that increase consumer engagement and long-term relationships. All the channels, all the time The financial marketer’s job doesn’t stop at creating bespoke experiences for customers. Firms are also having to leverage an omnichannel approach to reach these clients, across an ever-growing number of channels and touchpoints. If that wasn’t enough, campaign cycles are shortening to match consumers changing demands and need for instant gratification—again, thanks Amazon. But the best teams determine which media or interaction resonates most effectively with clients, whether face-to-face, via an app, chatbot, or social media and have conversations across all of them seamlessly. It’s clear, financial firms must transform their approach to address increasing market complexity without increasing costs. Financial marketers are saddled with stagnant marketing budgets, proliferating media channels and shorter campaign cycles, with an expectation to continue delivering results. It’s a very tall order, especially if your financial institution is not leveraging data, analytics and insights as the differentiators they could be. CMOs and their marketing teams must invest in new technologies, strategies and data sources that best reflect the expectations of their customers. How is your bank or credit union responding to these financial marketing challenges? Watch our 2020 Credit Marketing Trends On-Demand Webinar

Do you have 20/20 vision when it comes to the readiness of your organization? How financially healthy are your customers today? They are likely facing some challenges and difficult choices. Based on a study by the Center for Financial Services Innovation (CFSI), almost half of the US adult population - that’s 112.5 million - say they do not have enough savings to cover at least three months of living expenses. With debt rising and a possible recession on the horizon, it’s crucial to have a solid strategy in place for your organization. Here are three easy steps to help you prepare: Anticipate the recession before it arrives Gathering a complete view of your customers can be difficult if you have multiple systems, which can result in subjective, costly and inefficient processes. If you don’t have a full picture of your customers, it’s hard to understand their risk, behavior and ability to pay and to determine the most effective treatment decisions. Having the right data is only the first step. Using analytics to make sense of the data helps you better understand your customers at an individual level, which will increase recovery rates and improve the customer experience. Analytics can provide early-warning indicators that identify customers most likely to miss payments, predict future behavior, and deliver the best treatment option based on a customer’s specific situation or behavior. With a deeper understanding of at-risk customers, you can apply more targeted interventions that are specific to each customer, so you can be confident your collections process is individualized, efficient and fair. The result? A cost-effective, compliant process focused on retaining valuable customers and reducing losses. What to look for: ✔ Know when customers are experiencing negative credit events ✔ View consumer credit trends that may not yet be visible on your own account base ✔ Watch for payment stress – understand the actual payment consumers are making. Is it changing? ✔ See individual trends and take action – are your customers sliding down to a lower score band? ✔ Understand how your client-base is performing within your own portfolio and with other organizations Take immediate and impactful actions around risk mitigation and staffing Every interaction with consumers needs optimizing, from target marketing through to collections and recovery. Organizations that proactively modernize their business to scale and increase effectiveness before the next economic downturn may avoid struggling to address rising delinquencies when the economy corrects itself. This may improve portfolio performance and collection capabilities — significantly increasing recoveries, containing costs and sustaining returns. Identify underperforming products and inefficient processes by staff. Consider reassessing the data used and the manual processes required for making decisions. Optimize product pricing and areas where organizations or staff could automate the decision processes. Areas to focus: ✔ Identity theft protection and account takeover awareness ✔ Improve underwriting strategy and automation ✔ Maximize profitability — drive spend, optimize approvals, line assignment and pricing ✔ Evaluate collection risk strategies and operational efficiencies Design and deploy a strategy to be organizationally and technologically ready for change Communication is key in debt recovery. Failing to contact customers via their preferred channel can cause frustration and reduce the likelihood of recovery. Your customers are looking for a convenient and discreet way to negotiate or repay debt, and if you aren’t providing one, you’re incurring higher collections costs and lower recovery rates. With developments in the digital world, consumer interactions have changed. Most people prefer to communicate via mobile or online, with little to no human interaction. Behavioral analytics help to automate and decide the next best action, so you contact the right customer at the right time through the right channel. In addition, offering a convenient, discreet way to negotiate or repay debt can result in customers who are more engaged and more likely to pay. Online and self-service portals along with AI-powered chatbots use the latest technology to provide a safe and customer-centric experience, creating less time-consuming interactions and higher customer satisfaction. Your digital collections process is more convenient and less stressful for consumers and more profitable and compliant for you. Visualize the future... ✔ Superior customer service is embraced at the end of the customer life cycle as it is in the beginning ✔ Leverage data, analytics, software, and industry expertise to drive an automated collections process with fewer manual interventions ✔ Meet the growing expectation for digital consumer self-service by providing the ability to proactively negotiate and manage debt through preferred contact channels ✔ When economy and market conditions change for the worst, have the right data, analytics, software in place and be prepared to implement relevant collections strategies to remain competitive in the market Don’t wait until the next recession hits. Our collaborative approach to problem solving ensures you have the right solution in place to solve your most complex problems and are ready for market changes. The combination of our data, analytics, fraud tools, decisioning software and consulting services will help you proactively manage your portfolio to minimize the flow of accounts into collections and modernize your collections and recovery processes. Learn More

It may be a new decade of disruption, but one thing remains constant – the consumer is king. As such, customer experience (and continually evolving digital transformations necessary to keep up), digital expansion and all things identity will also reign supreme as we enter this new set of Roaring 20s. Here are seven of the top trends to keep tabs of through 2020 and beyond. 1. Data that does more – 100 million borrowers and counting Traditional, alternative, public record, consumer-permissioned, small business, big business, big, bigger, best – data has a lot of adjectives preceding it. But no matter how we define, categorize and collate data, the truth is there’s a lot of it that’s untapped, which is keeping financial institutions from operating at their max efficiency levels. Looking for ways to be bigger and bolder? Start with data to engage your credit-worthy consumer universe and beyond. Across the entire lending lifecycle, data offers endless opportunities – from prospecting and acquisitions to fraud and risk management. It fuels any technology solution you have or may want to implement over the coming year. Additionally, Experian is doing their part to create a more holistic picture of consumer creditworthiness with the launch of Experian LiftTM in November. The new suite of credit score products combines exclusive traditional credit, alternative credit and trended data assets, intended to help credit invisible and thin-file consumers gain access to fair and affordable credit. "We're committed to improving financial access while helping lenders make more informed decisions. Experian Lift is our latest example of this commitment brought to life,” said Greg Wright, Executive Vice President and Chief Product Officer for Experian Consumer Information Services. “Through Experian Boost, we're empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we're empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem,” he said. 2. Identity boom for the next generation Increasingly digital lifestyles have put personalization and frictionless transactions on hyperdrive. They are the expectation, not a nice-to-have. Having customer intelligence will become a necessary survival strategy for those in the market wanting to compete. Identity is not just for marketing purposes; it must be leveraged across the lending lifecycle and every customer interaction. Fragmented customer identities are more than flawed for decisioning purposes, which could potentially lead to losses. And, of course, the conversation around identity would be incomplete without a nod to privacy and security considerations. With the roll-out of the California Consumer Privacy Act (CCPA) earlier this month, we will wait to see if the other states follow suit. Regardless, consumers will continue to demand security and trust. 3. All about artificial intelligence and machine learning We get it – we all want the fastest, smartest, most efficient processes on limited – and/or shrinking – budgets. But implementing advanced analytics for your financial institution doesn’t have to break the bank. And, when it comes to delivering services and messaging to customers the way they want it, how to do that means digital transformation – specifically, leveraging big data and actionable analytics to evaluate risk, uncover industry intel and improve decisioning. One thing’s for certain, financial institutions looking to compete, gain traction and pull away from the competition in this next decade will need to do so by leveraging a future-facing partner’s expertise, platforms and data. AI and machine learning model development will go into hyperdrive to add accuracy, efficiency, and all-out speed. Real-time transactional processing is where it’s at. 4. Customer experience drives decisioning and everything Faster, better, more frictionless. 2020 and the decade will be all about making better decisions faster, catering to the continually quickening pace of consumer attention and need. Platforms and computing language aside, how do you increase processing speed at the same time as increasing risk mitigation? Implementing decisioning environments that cater to consumer preferences, coupled with best-in-class data are the first two steps to making this happen. This can facilitate instant decisioning within financial institutions. Looking beyond digital transformation, the next frontier is digital expansion. Open platforms enable financial institutions to readily add solutions from numerous providers so that they can connect, access and orchestrate decisions across multiple systems. Flexible APIs, single integrations and better strategy and design build the foundation of the framework to be implemented to enhance and elevate customer experience as it’s known today. 5. Credit marketing that keeps up with the digital, instant-gratification age Know your customer may be a common acronym for the financial services industry, but it should also be a baseline for determining whether to send a specific message to clients and prospects. From the basics, like prescreen, to omni-channel marketing campaigns, financial institutions need to leverage the communication channels that consumers prefer. From point of sale to mobile – there are endless possibilities to fit into your consumers’ credit journey. Marketing is clearly not a one-and-done tactic, and therefore multi-channel prequalification offers and other strategies will light the path for acquisitions and cross-sell/up-sell opportunities to come. By developing insights from customer data, financial institutions have a clear line of sight into determining optimal strategies for customer acquisition and increasing customer lifetime value. And, at the pinnacle, the modern customer acquisition engine will continue to help financial institutions best build, test and optimize their customer channel targeting strategies faster than ever before. From segmentation to deployment, and the right data across it all, today and tomorrow’s technology can solve many of financial organizations’ age-old customer acquisition challenges. 6. Three Rs: Recession, regulatory and residents of the White House Last March, the yield curve inverted for the first time since 2007. Though the timing of the next economic correction is debated, messaging is consistent around making a plan of action now. Whether it’s arming your collections department, building new systems, updating existing systems, or adjusting rules and strategy, there are gaps every organization needs to fill. By leveraging the stability of the economy now, financial institutions can put strategies in place to maximize profitability, manage risk, reduce bad debt/charge-offs, and ensure regulatory compliance among their list of to-do’s, ultimately resulting in a more efficient, better-performing program. Also, as we near the election later this year, the regulatory landscape will likely change more than the usual amount. Additionally, we will witness the first accounts of what CECL looks like for SEC-filing financial institutions (and if that will suggest anything for how non-SEC-filing institutions may fare as their deadline inches closer), as well as see the initial implications of the CCPA roll out and whether it will pave a path for other states to follow. As system sophistication continues to evolve, so do the risks (like security breaches) and new regulatory standards (like GDPR and CCPA) which provide reasons for organizations to transform. 7. Focus on fraud (in all forms) With evolving technology, comes evolved fraudsters. Whether it’s loyalty and rewards programs, account openings, breaches, there are so many angles and entry points. Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is estimated to grow to $1.2 billion by 2020, according to the Aite Group. To ensure the best protection for your business and your customers, a layered, risk-based approach to fraud management provides the highest levels of confidence in the industry. Balance is key – while being compliant with regulatory requirements and conscious of user experience, ensuring consumers’ peace of mind is priority one. Not a new trend, but recognizing fraud and recognizing good consumers will save continue to save financial institutions money and reputational harm, driving significant improvement in key performance indicators. Using the right data (and aggregating multiple data sets) and digital device intelligence tools is the one-two punch to protect your bottom line. For all your needs in 2020 and throughout the next decade, Experian has you covered. Learn more

If you’ve been on the dating scene in the last few years, you’re probably familiar with ghosting. For those of you who aren’t, I’ll save you the trip to Urban Dictionary. “Ghosting” is when the person you’re dating disappears. No calls. No texts. No DMs. They just vanish, never to be heard from again. As troublesome as this can be, there’s a much more nefarious type of ghosting to be wary of – credit ghosting. Wait, what’s credit ghosting? Credit ghosting refers to the theft of a deceased person’s identity. According to the IRS, 2.5 million deceased identities are stolen each year. The theft often occurs shortly after someone dies, before the death is widely reported to the necessary agencies and businesses. This is because it can take months after a person dies before the Social Security Administration (SSA) and IRS receive, share, or register death records. Additionally, credit ghosting thefts can go unnoticed for months or even years if the family of the deceased does not check their credit report for activity after death. Opportunistic fraudsters check obituaries and other publicly available death records for information on the deceased. Obituaries often include a person’s birthday, address or hometown, parents’ names, occupation, and other information regularly used in identity verification. With this information fraudsters can use the deceased person’s identity and take advantage of their credit rating rather than taking the time to build it up as they would have to with other types of fraud. Criminals will apply for credit cards, loans, lines of credit, or even sign up for a cell phone plan and rack up charges before disappearing. Where did this type of identity theft come from? Credit ghosting is the result of a few issues. One traces back to a discrepancy noted by the Social Security’s inspector general. In an audit, they found that 6.5 million Social Security numbers for people born before June 16, 1901, did not have a date of death on record in the administration’s Numident (numerical identification) system – an electronic database containing Social Security number records assigned to each citizen since 1936. Without a date of death properly noted in the database, government agencies and other entities inquiring won’t necessarily know an individual is deceased, making it possible for criminals to implement credit ghosting schemes. Additionally, unreported deaths leave further holes in the system, leading to opportunity for fraudsters. When financial institutions run checks on the identity information supplied by a fraudster, it can seem legitimate. If the deceased’s credit is in good standing, the fraudster now appears to be a good customer—much like a synthetic identity—but now with the added twist that all of the information is from the same person instead of stitched together from multiple sources. It can take months before the financial institution discovers that the account has been compromised, giving fraudsters ample time to bust out and make off with the funds they’ve stolen. How can you defend against credit ghosting? Luckily, unlike your dating pipeline, there are ways to guard against ghosting in your business’ pipeline. Frontline Defense: Start by educating your customers. It’s never pleasant to consider your own passing or that of a loved one, but it’s imperative to have a plan in place for both the short and long term. Remind your customers that they should contact lenders and other financial institutions in the event of a death and continue monitoring those accounts into the future. Relatives of the deceased don’t tend to check credit reports after an estate has been settled. If the proper steps aren’t taken by the family to notify the appropriate creditors of the death, the deceased flag may not be added to their credit report before the estate is closed, leaving the deceased’s information vulnerable to fraud. By offering your customers assistance and steps to take, you can help ensure that they’re not dealing with the fallout of credit ghosting—like dealing with calls from creditors following up after the fraudster’s bust-out—on top of grieving. Backend Defense: Ensure you have the correct tools in place to spot credit ghosts when they try to enter your pipeline. Experian’s Fraud Shield includes high risk indicators and provides a deceased indicator flag so you can easily weed them out. Additionally, you can track other risk indicators like previous uses of a particular Social Security number and identify potential credit-boosting schemes. Speak to an Experian associate today about how you can increase your defenses against credit ghosting. Let's talk

According to Experian’s Q3 2019 State of the Automotive Finance Market report, used vehicle financing increased across all credit tiers.

This article was updated on September 11, 2023. According to research, only 15% of American consumers have swapped out their go-to credit card in the past year and spend more money both online and offline with the card they designate as their top-of-wallet card. With over 578 million existing credit card accounts in the U.S., here are four top-of-wallet strategies to keep your card top of mind: Go digital In today’s digital world, the rules of customer engagement are changing – and card issuers must develop their digital capabilities, including identity resolution, to keep pace. Cardholders enjoy (and expect) the convenience of being able to apply for credit, track their purchases, make payments and view their monthly statements on-the-go. Another popular phenomenon? Digital wallets. Also known as e-wallets, these house digital versions of credit or debit cards and are stored in an app or a mobile device. Digital wallets can be used in conjunction with mobile payment systems, allowing customers to store digital coupons and pay for purchases with their smartphones. Financial institutions that digitally transform and adapt to these new dynamics can more efficiently service and retain their customers. Prioritize fraud prevention As customers’ affinity for e-commerce rises and cyberthieves grow smarter and more sophisticated, card issuers must improve their security measures and increase their focus on cutting-edge fraud management solutions. Not only should you be familiar with the many ways that criminals steal customer payment information, but you should ensure customers that you have multiple lines of defense against cyber threats. Many financial institutions have added digital “on/off switches,” allowing customers to remotely turn off their credit or debit card should they have misplaced it or suspect that they’re a victim of identity theft. With credit card fraud being the most prevalent in identity theft cases, failing to properly safeguard your customers impacts not only their experience but also your ability to grow revenue. Create a single customer view A single customer view is a consolidated, consistent and holistic representation of the data known by an organization about its customers. And according to Experian research, 68% of businesses are currently attempting to implement this type of strategy. By achieving a consolidated customer view, you can attain better consumer insight and fully understand your cardmembers’ needs and buying preferences. Careful tracking of all customer interactions enables you to target more accurately and implement effective marketing strategies. Provide incentives According to Experian research, 58% of consumers select credit cards based on rewards. The top incentives when selecting a rewards card include cashback, gas rewards and retail gift cards. Rewarding loyalty with ongoing benefits goes a long way to encourage customers to keep your credit card top of wallet but it’s also important to figure out what works – and what doesn’t. Bonus tip: Optimize credit limit management Managing credit limits is just as important as setting optimal credit limits from the get-go. Consumer credit needs will evolve over time along with their income and ability to pay. The key here is being able to identify qualified customers who can take on higher spending limits and also have a need. Leveraging advanced analytics models and a proactive credit limit management strategy can help you uncover areas of opportunity to increase wallet share and push your card toward that coveted top-of-wallet spot — or remain there. We recommend reviewing your credit limits at a regular cadence, but especially ahead of periods of increased spending such as the holiday season. In today’s competitive marketplace, getting your credit card top of wallet isn’t easy. That’s why we’re here to help. Experian’s comprehensive view of consumer credit data and best-in-class account management solutions help you target higher-spending customers and promote top-of-wallet use. Learn more

Electric vehicles have 2.08 percent of total VIO share through September 30, 2019

The challenges facing today’s marketers seem to be mounting and they can feel more pronounced for financial institutions. From customizing messaging and offerings at an individual customer level, increasing conversion rates, moving beyond digital while keeping an eye on traditional channels, and more, financial marketers are having to modernize their approach to customer acquisition. The most forward-thinking financial firms are turning to customer acquisition engines to help them best build, test and optimize their custom channel targeting strategies faster than ever before. But what functionality is right for your company? Here are 5 capabilities you should look for in a modern customer acquisition engine. Advanced Segmentation It’s without question that targeting and segmentation are vital to a successful financial marketing strategy. Make sure you select a tool that allows for advanced segmentation, ensuring the ability to uncover lookalike groups with similar attributes or behaviors and then customize messages or offerings accordingly. With the right customer acquisition engine, you should be able to build filters for targeted segments using a range of data including demographic, past behavior, loyalty or transaction history, offer response and then repurpose these segments across future campaigns. Campaign Design With the right campaign design, your team has the ability to greatly affect customer engagement. The right customer acquisition engine will allow your team to design a specific, optimized customer journey and content for each of the segments you create. When you’re ready to apply your credit criteria to the audience to generate a pre-screen, the best tools will allow you to view the size of your list adjusted in real-time. Make sure to look for an acquisition engine that can do all of this easily with a drag and drop user experience for faster and efficient campaign design. Rapid Deployment Once you finalize your audience for each channel or offer, the clock starts ticking. From bureau processing, data aggregation, targeting and deployment, the data that many firms are currently using for prospecting can be at least 60-days. When searching for a modern customer acquisition engine, make sure you choose a tool that gives you the option to fetch the freshest data (24-48 hours) before you deploy. If you’re sending the campaign to an outside firm to execute, timing is even more important. You’ll also want a system that can encrypt and decrypt lists to send to preferred partners to execute your marketing campaign. Support Whether you have an entire marketing department at your disposal or a lean, start-up style team, you’re going to want the highest level of support when it comes to onboarding, implementation and operational success. The best customer acquisition solution for your company will have a robust onboarding and support model in place to ensure client success. Look for solutions that offer hands-on instruction, flexible online or in-person training and analytical support. The best customer acquisition tool should be able to take your data and get you up and running in less than 30 days. Data, Data and more Data Any customer acquisition engine is only as good as the data you put into it. It should, of course, be able to include your own client data. However, relying exclusively on your own data can lead to incomplete analysis, missed opportunities and reduced impact. When choosing a customer acquisition engine, pick a system that gives your company access to the most local, regional and national credit data, in addition to alternative data and commercial data assets, on top of your own data. The optimum solutions can be fueled by the analytical power of full-file, archived tradeline data, along with attributes and models for the most robust results. Be sure your data partner has accounted for opt-outs, excludes data precluded by legal or regulatory restrictions and also anonymizes data files when linking your customer data. Data accuracy is also imperative here. Choose a marketing and technology partner who is constantly monitoring and correcting discrepancies in customer files across all bureaus. The best partners will have data accuracy rates at or above 99.9%.

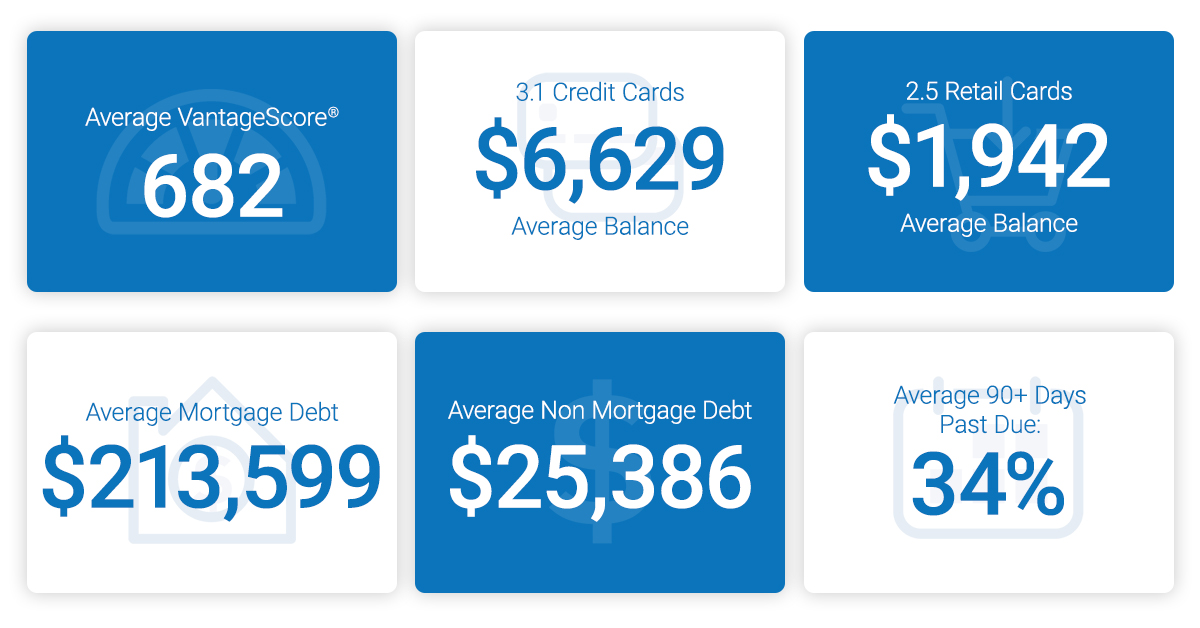

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

Sometimes, the best offense is a good defense. That’s certainly true when it comes to detecting synthetic identities, which by their very nature become harder to find the longer they’ve been around. To launch an offense against synthetic identity fraud, you need to defend yourself from it at the top of your new customer funnel. Once fraudsters embed their fake identity into your portfolio, they become nearly impossible to detect. The Challenge Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is hard to determine because it’s not always caught or reported, but the amounts are staggering. According to the Aite Group, it was estimated to total at least $820 million in 2017 and grow to $1.2 billion by 2020. This type of theft begins when individual thieves and large-scale crime rings use a combination of compromised personal information—like unused social security numbers—and fabricated data to stitch together increasingly sophisticated personas. These well-crafted synthetic identities are hard to differentiate from the real deal. They often pass Know Your Customer, Customer Identification Program and other onboarding checks both in person and online. This puts the burden on you to develop new defense strategies or pay the price. Additionally, increasing pressure to grow deposits and expand loan portfolios may coincide with the relaxation of new customer criteria, allowing even more fraudsters to slip through the cracks. Because fraudsters nurture their fake identities by making payments on time and don’t exhibit other risk factors as their credit limits increase, detecting synthetic identities becomes nearly impossible, as does defending against them. How This Impacts Your Bottom Line Synthetic identity theft is sometimes viewed as a victimless crime, since no single individual has their entire identity compromised. But it’s not victimless. When undetected fraudsters finally max out their credit lines before vanishing, the financial institution is usually stuck footing the bill. These same fraudsters know that many financial institutions will automatically settle fraud claims below a specific threshold. They capitalize on this by disputing transactions just below it, keeping the goods or services they purchased without paying. Fraudsters can double-dip on a single identity bust-out by claiming identity theft to have charges removed or by using fake checks to pay off balances before maxing out the credit again and defaulting. The cost of not detecting synthetic identities doesn’t stop at the initial loss. It flows outward like ripples, including: Damage to your reputation as a trusted organization Fines for noncompliance with Know Your Customer Account opening and maintenance costs that are not recouped as they would be with a legitimate customer Mistakenly classifying fraudsters as bad debt write offs Monetary loss from fraudsters’ unpaid balances Rising collections costs as you try to track down people who don’t exist Less advantageous rates for customers in the future as your margins grow thinner These losses add up, continuing to impact your bottom line over and over again. Defensive Strategies So what can you do? Tools like eCBSV that will assist with detecting synthetic identities are coming but they’re not here yet. And once they’re in place, they won’t be an instant fix. Implementing an overly cautious fraud detection strategy on your own will cause a high number of false positives, meaning you miss out on revenue from genuine customers. Your best defense requires finding a partner to help you implement a multi-layered fraud detection strategy throughout the customer lifecycle. Detecting synthetic identities entails looking at more than a single factor (like length of credit history). You need to aggregate multiple data sets and connect multiple customer characteristics to effectively defend against synthetic identity fraud. Experian’s synthetic identity prevention tools include Synthetic Identity High Risk Score to incorporate the history and past relationships between individuals to detect anomalies. Additionally, our digital device intelligence tools perform link analyses to connect identities that seem otherwise separate. We help our partners pinpoint false identities not associated with an actual person and decrease charge offs, protecting your bottom line and helping you let good customers in while keeping false personas out. Find out how to get your synthetic identity defense in place today.

With the growing need for authentication and security, fintechs must manage risk with minimal impact to customer experience. When implementing tactical approaches for fraud risk strategy operations, keeping up with the pace of fraud is another critical consideration. How can fintechs be proactive about future-proofing fraud strategies to stay ahead of savvy fraudsters while maintaining customer expectations? I sat down with Chris Ryan, Senior Fraud Solutions Business Consultant with Experian Decision Analytics, to tap into some of his insights. Here’s what he had to say: How have changes in technology added to increased fraud risk for businesses operating in the online space? Technology introduces many risks in the online space. As it pertains to the fintech world, two stand out. First, the explosion in mobile technology. The same capabilities that make fintech products broadly accessible makes them vulnerable. Anyone with a mobile device can attempt to access a fintech and try their hand at committing fraud with very little risk of being caught or punished. Second, the evolution of an interconnected, digital ‘marketplace’ for stolen data. There’s an entire underground economy that’s focused on connecting the once-disparate pieces of information about a specific individual stolen from multiple, unrelated data breaches. Criminal misrepresentations are more complete and more convincing than ever before. What are the major market drivers and trends that have attributed to the increased risk of fraud? Ultimately, the major market drivers and trends that drive fraud risk for fintechs are customer convenience and growth. In terms of customer convenience, it’s a race to meet customer needs in real time, in a single online interaction, with a minimally invasive request for information. But, serving the demands of good customers opens opportunities for identity misuse. In terms of growth, the pressure to find new pockets of potential customers may lead fintechs into markets where consumer information is more limited, so naturally, there are some risks baked in. Are fintechs really more at risk for fraud? If so, how are fintechs responding to this dynamic threat? The challenge for many fintechs has been the prioritization of fraud as a risk that needs to be addressed. It’s understandable that fintech’s initial emphasis had to be the establishment of viable products that meet the needs of their customers. Obviously, without customers using a product, nothing else matters. Now that fintechs are hitting their stride in terms of attracting customers, they’re allocating more of their attention and innovative spirit to other areas, like fraud. With the right partner, it’s not hard for fintechs to protect themselves from fraud. They simply need to acquire reliable data that provides identity assurance without negatively impacting the customer experience. For example, fintechs can utilize data points that can be extracted from the communications channel, like device intelligence for example, or non-PII unique identifiers like phone and email account data. These are valuable risk indicators that can be collected and evaluated in real time without adding friction to the customer experience. What are the major fraud risks to fintechs and what are some of the strategies that Risk Managers can implement to protect their business? The trends we’ve talked about so far today have focused more on identity theft and other third-party fraud risks, but it’s equally important for fintechs to be mindful of first party fraud types where the owner of the identity is the culprit. There is no single solution, so the best strategy recommendation is to plan to be flexible. Fintechs demonstrate an incredible willingness to innovate, and they need to make sure the fraud platforms they pick are flexible enough to keep pace with their needs. From your perspective, what is the future of fraud and what should fintechs consider as they evolve their products? Fraud will continue to be a challenge whenever something of value is made available, particularly when the transaction is remote and the risk of any sort of prosecution is very low. Criminals will continue to revise their tactics to outwit the tools that fintechs are using, so the best long-term defense is flexibility. Being able to layer defenses, explore new data and analytics, and deploy flexible and dynamic strategies that allow highly tailored decisions is the best way for fintechs to protect themselves. Digital commerce and the online lending landscape will continue to grow at an increasing pace – hand-in-hand with the opportunities for fraud. To stay ahead of fraudsters, fintechs must be proactive about future-proofing their fraud strategies and toolkits. Experian can help. Our Fintech Digital Onboarding Bundle provides a solid baseline of cutting-edge fraud tools that protect fintechs against fraud in the digital space, via a seamless, low-friction customer experience. More importantly, the Fintech Digital Onboarding Bundle is delivered through Experian’s CrossCore platform—the premier platform in the industry recognized specifically for enabling the expansion of fraud tools across a wide range of Experian and third-party partner solutions. Click here to learn more or to speak with an Experian representative. Learn More About Chris Ryan: Christopher Ryan is a Senior Fraud Solutions Business Consultant. He delivers expertise that helps clients make the most from data, technology and investigative resources to combat and mitigate fraud risks across the industries that Experian serves. Ryan provides clients with strategies that reduce losses attributable to fraudulent activity. He has an impressive track record of stopping fraud in retail banking, auto lending, deposits, consumer and student lending sectors, and government identity proofing. Ryan is a subject matter expert in consumer identity verification, fraud scoring and knowledge-based authentication. His expertise is his ability to understand fraud issues and how they impact customer acquisition, customer management and collections. He routinely helps clients review workflow processes, analyze redundancies and identify opportunities for process improvements. Ryan recognizes the importance of products and services that limit fraud losses, balancing expense and the customer impact that can result from trying to prevent fraud.

As the holiday shopping season kicks off, it’s prime time for fraudsters to prey on consumers who are racking up rewards points as they spend. Find out how fraud trends in loyalty and rewards programs can impact your business: Are you ready to prevent fraud this holiday season? Get started today

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Time – it’s the only resource we can’t get more of, which is why we tend to obsess over saving it. Despite this obsession, it can be hard for us to identify time-wasting activities. From morning habits to credit decisioning, processes and routines that seem, well, routine, can get in the way of maximizing how we use our time. Identifying the Problem Every morning, I used to turn on my coffee maker, walk to the bathroom to take my multivitamin, then walk back into the kitchen to finish making my coffee. This required maybe twenty steps to the bathroom and twenty steps back, and while this isn’t a huge amount of time—half a minute at best—it’s not insignificant, especially in the morning when time feels particularly precious. One day, I realized I could eliminate the waste by moving my multivitamin to the cabinet above my coffeemaker. What if we could all make minor changes to enhance our efficiency both at home and at work? Imagine how much time we could save by cutting out unnecessary steps. And how saving that time could help drive significant revenue increases. Time Equals Money When businesses waste time with unnecessary steps, that’s money from their bottom line, and out of the pockets of people who are connected to them. Over the last several years, a new time saver has emerged – Application Programming Interface (API). APIs allow application programs to communicate with other operating systems or control programs through a series of server requests or API calls, enabling seamless interaction, data sharing and decisioning. Experian’s partners utilize our ever-growing suite of APIs to quickly access better data, making existing processes more effective and routines more efficient. In the past, banks and other partners had to send files back and forth to Experian when they needed decisioning on a customer’s credit-worthiness prior to approving a new loan or extending a credit limit increase. Now, partners can have their origination system call an Experian API and send their data through that. Our system processes it and sends it back in milliseconds, giving the lenders real-time decisioning rather than shuttling information back and forth unnecessarily. Instead of effectively walking away from one process (assisting the customer/making coffee) to start another (retrieving credit info/walking down the hall to take the multivitamin), our partners are able to link these processes up and save time, allowing them to capitalize on the presence and interest of their customer. The Proof When Washington State Employees Credit Union, the second-largest credit union in the state, realized they needed to make a change to keep pace with increasing competition, they turned to Experian. With our solution, the credit union is now able to provide its members with instant credit decisioning through their online banking platform. This real-time decisioning at the point of member-initiated contact increased the credit union’s loan and credit applications by 25%. Additionally, member satisfaction increased, with 90% of members finding the simplified prequalification process to be more efficient. By accessing Experian’s decisioning services through your existing connection, lenders can to save time and match consumers with the products that match their credit profile before they apply – increasing approval rates once the application is submitted. Best of all, the entire process with the consumers is completed within seconds. Find out how Experian’s solutions can help you improve your existing processes and cut out unnecessary steps. Get started

Fintech is quickly changing. The word itself is synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. The rapid rate at which fintech challengers are becoming established, is in turn, allowing for greater consumer awareness and adoption of fintech platforms. It would be easy to assume that fintech adoption is predominately driven by millennials. However, according to a recent market trend analysis by Experian, adoption is happening across multiple generational segments. That said, it’s important to note the generational segments that represent the largest adoption rates and growth opportunities for fintechs. Here are a few key stats: Members of Gen Y (between 24-37 years old) account for 34.9% of all fintech personal loans, compared to just 24.9% for traditional financial institutions. A similar trend is seen for Gen Z (between 18-23 years old). This group accounts for 5% of all fintech personal loans as compared to 3.1% for traditional Let’s take a closer look at these generational segments… Gen Y represents approximately 19% of the U.S. population. These consumers, often referred to as “millennials,” can be described as digital-centric, raised on the web and luxury shoppers. In total, millennials spend about $600 billion a year. This group has shown a strong desire to improve their credit standing and are continuously increasing their credit utilization. Gen Z represents approximately 26% of the U.S. population. These consumers can be described as digital centric, raised on the social web and frugal. The Gen Z credit universe is growing, presenting a large opportunity to lenders, as the youngest Gen Zers become credit eligible and the oldest start to enter homeownership. What about the underbanked as a fintech opportunity? The CFPB estimates that up to 45 million people, or 24.2 million households, are “thin-filed” or underbanked, meaning they manage their finances through cash transactions and not through financial services such as checking and savings accounts, credit cards or loans. According to Angela Strange, a general partner at Andreessen Horowitz, traditional financial institutions have done a poor job at serving underbanked consumers affordable products. This has, in turn, created a trillion-dollar market opportunity for fintechs offering low-cost, high-tech financial services. Why does all this matter? Fintechs have a unique opportunity to engage, nurture and grow these market segments early on. As the fintech marketplace heats up and the overall economy begins to soften, diversifying revenue streams, building loyalty and tapping into new markets is a strategic move. But what are the best practices for fintechs looking to build trust, engage and retain these unique consumer groups? Join us for a live webinar on November 12 at 10:00 a.m. PST to hear Experian experts discuss financial inclusion trends shaping the fintech industry and tactical tips to create, convert and extend the value of your ideal customers. Register now