Industries

With delinquencies on the rise, financial institutions are looking for new tools to evaluate and improve the financial lives of customers and members. As the consumer’s bureau, Experian is also committed to improving the financial well-being of consumers. As part of that commitment, Experian supports the mission of the Center for Financial Services Innovation (CFSI), an organization focused on improving the financial health of Americans, especially the underserved, through innovative financial products and services. Experian recently spoke with CFSI’s Thea Garon, a Director on CFSI’s Program Team to learn more about a new free, open-source tool the organization will be launching in June to help financial institutions drive consumer financial health. Here are some insights she shared about the new tool. Can you provide an overview of the CFSI Financial Health Score™ and how it is calculated? The CFSI Financial Health Score™ is designed to help financial service providers, employers, and other organizations diagnose and measure the financial health of their customers, clients, and employees. The framework provides a holistic, moment-in-time snapshot of an individual’s financial health based on eight multiple-choice questions that align with CFSI’s eight indicators of financial health. It includes one Financial Health Score and four sub-scores (Spend, Save, Borrow, and Plan). A set of nationally representative benchmarks offers comparisons across peer groups. CFSI has designed the framework to be free, open-source, simple, and easy-to-use. It’s intended to be a starting point; a proof point that financial health can be quantified, measured, and ultimately improved. Why did CFSI decide to develop this framework? At CFSI, we believe, and have recently released research to support the concept that financial institutions have a business incentive to help their customers lead financially healthy lives. Financial health comes about when your daily financial systems allow you to be resilient and pursue opportunities over time. As a financial service provider, you can help your customers lead financially healthy lives by helping them spend wisely, build savings, borrow responsibly, and plan for the future. To do this, you need a measurement framework to understand and track your customers’ financial health over time. The CFSI Financial Health Score™ is one way to do this. You can use the methodology to diagnose your customers’ financial needs and use these insights to develop products, programs, and solutions to help them improve their financial health over time. You can also share financial health scores directly with your customers to help them understand the actions they can take to improve their own financial health. Ongoing tracking will allow you to assess whether your company is making a meaningful difference in your customers’ lives over time. Can you provide any early examples of how CFSI Health Network members have adopted and incorporated this framework? Approximately 100 financial service providers have downloaded the framework, representing a diverse range of companies, including banks, credit unions, fintechs, non-profits, payment networks, and B2B technology providers. At least 14 companies are actively using the Financial Health Score to measure and track their customers’ financial health and have committed to sharing data and insights with us through CFSI’s Financial Health Leaders program. Some companies, are using the framework to assess their customers’ financial health for strategic planning purposes. Other companies, such as Wright-Patt Credit Union, are using the financial health score to engage their customers in a dialogue about financial health. The credit union has incorporated the framework into their MoneyMagnifier program, a financial coaching program designed to provide free, one-on-one advice and guidance to members in a judgment-free environment. Financial coaches have been trained to use the framework to start a conversation with members to help them improve their spending, saving, borrowing, and planning behaviors. Coaches help members set goals and develop personalized action plans to achieve those goals toward a better financial future, following up with them after six months to measure improvement and advance the conversation. What have you learned from companies who have started measuring and improving their customers’ financial health with the CFSI Financial Health Score™? While interest in advice is high, uptake can be slow. Making the interaction quick and easy, whether online or in person, is critical. The health check lengthens the interaction, so conducting the health check by appointment rather than with walk-in customers, can help set customer expectations for a lengthier interaction, but may reduce the number of potential participants. Enabling customers to expedite the session by taking the survey online can be helpful, but requires development resources to implement. Many companies are exploring the pros and cons of sharing customers’ scores with them. A single score can help motivate individuals to take action that will improve their financial well-being. However, sharing a low score can also be demoralizing to some, and focusing on the number itself can divert attention from behavioral changes and action steps. Some organizations are choosing to use customers’ response patterns to drive recommendations without sharing the score. Others are opting for a middle ground, sharing an indicator (such as green, yellow, red) instead of a specific number. The most effective measurement and improvement strategies go beyond the CFSI Financial Health Score™. While the framework can help you get started identifying high-level needs, targeted recommendations often require a more nuanced understanding of behaviors and challenges. Combining survey data with account or transaction data can provide a more holistic view into a customer’s full financial life. Each organization must find a balance between the comprehensiveness required to provide meaningful advice and the simplicity required to engage both customers and staff. How can interested companies start using the CFSI Financial Health Score™? We will be publicly releasing the CFSI Financial Health Score™ at the EMERGE: Financial Health Forum (June 6 -8 in Los Angeles). The score will be easy to download and completely free to use. Those who are interested in learning more can also sign up for our newsletter to get an update when the Toolkit is released.

The second full day of Experian Vision 2018 kicked off with an inspirational message from keynote speakers Capt. Mark Kelly and Former Congresswomen Gabby Giffords, rolled into a series of diverse breakout sessions, and concluded with Super Bowl-winning quarterback Aaron Rodgers sharing tales of sports, leadership and winning. Need a recap of some of the headlines from the day? Here you go ... Retail Apocalypse? Not so fast alarmists. Yes, there are media headlines around mergers, closings and consumers adopting new ways to shop, but let me give you three reasons as to why the retail sky is not falling. There were more store openings last year than closings, and that trend is expected to continue this year with an estimated 5,500 openings by December. There continues to be a positive sales trajectory. E-commerce sales are increasing. Big department stores have seen pains, but if brands are focused on connection, relevance and convenience, there is hope. Consumers continue to spend. Subprime auto bubble? Nope. Malinda Zabritski, Sr. Director of Experian Automotive Sales, says the media likes to fixate on the subprime, but subprime financing has been on the decline, reaching record lows. Deep subprime is at .65%. Additionally, delinquency rates have also tapered. The real message? Consumers are relying on auto lenders for financing, largely due to consumer preferences to lease. The market is healthy, and while it has slowed slightly, the market is still at 7% year-over-year growth. Consumer-permissioned data is not just a value-add for thin-file consumers. Take for instance the inclusion of demand deposit accounts (DDAs). David Shellenberger, Sr. Director of Scoring and Predictive Analytics for FICO, says people who have had long relationships with their checking accounts tend to be more stable and generally sport higher credit scores. Consumers with thick, mature files can also benefit with DDA data. Consumer-permissioned data is not just about turning a “no” to a “yes.” It can also take a consumer from near-prime to prime, or from prime to super-prime. Would you want to make a credit decision with less information or more? This was the question Paul DeSaulniers, Experian Sr. Director of Product, posed to the audience as he kicked off the session on alternative data. With an estimated 100 million U.S. consumers falling below “thick-file” credit status, there is a definite need to learn more about these individuals. By leveraging alternative credit data – like short-term lending product use, rental data, public records and consumer-permissioned data – a more holistic view of these consumers is available. A few more facts: While alternative finance users tend to be more subprime, 20% are prime or better. A recent data pull revealed 20% of approved credit card users also had alternative finance data on them as well. About 2/3 of households headed by young adults are rentals. Imagine a world where the mortgage journey takes only seven to 10 days. With data and technology, we are closer than you think. Future products are underway that could master the underwriting phase in just one day, leaving the remaining days dedicated for signing disclosures, documents and wiring funds. Processes need to be firmed up, but a vision has been set. The average 30- to 45-day mortgage journey could soon be a distant memory. 97% of online banking applications that are started are abandoned. Why? Filling out lengthy forms, especially on a mobile device, is not fun. New technology, such as Experian’s Instant Form Fill, is allowing consumers to provide a name, zip and last four numbers of their social security number for an instant form fill of the rest of the application. Additionally, voice assistants are expected to increasingly facilitate research on purchases big and small. A recent study revealed nearly half of consumers perceive voice assistants to be useful. Businesses have more fraud losses than ever before. Not surprising. What is scary? An estimated 54% of businesses said they are not confident in their ability to detect fraud. Another session reported that approximately 20% of credit charge-offs are synthetic IDs, a growing pain point for all businesses. Consumers, on the other hand, say they “want visible signs of security” and “no friction.” Tough to balance, but those are today’s expectations. More Vision 2018 insights can be accessed on #ExperianVision twitter feed. Vision 2019 will be in San Antonio, Texas next May 5-8.

When sales are going relatively well, do you immediately look to conquesting? Are your key vendors encouraging you to do so? There’s absolutely nothing wrong with being out to conquer the world. No matter how you define conquesting – stealing market share from your competitors on their turf, making inroads on a cross-shopped make, or expanding your sales radius – chances are, you shouldn’t be focused on doing it. At least not until you’ve created some high barriers to prevent competitors from encroaching into your territory. Luckily, it’s easy to know when to stop conquesting and start getting defensive. All you need to answer is one simple question: Do you own your backyard? Even when it feels like all is going well in terms of sales and market penetration, it’s worth taking another look. You might be doing lots of volume in your immediate vicinity, but still be missing out on a lot of potential sales that are going to your competitors. We suggest that most dealers shouldn’t be happy with anything less than 90% market share of new, on-make models in surrounding ZIP Codes™. If you’re not regularly tracking your “backyard” market share, it’s a good practice to get in. Here’s why you should care about totally shutting out the competition in your local area: You’ve got physical brand presence. Buyers in your ZIP code and the surrounding towns drive by your sign every day. Your name should be the first they that comes to mind when they think of your make. You should own hometown SEO. Do you own search terms like “Honda dealers in Lakeland”? If you’re not the number one organic search result for your town, you’ve got some work to do. These are your most likely service customers. Every local deal you walk away from is a potential – and profitable – service customer lost. If you don’t own your backyard, what should you do about it? Aside from making sure you’ve got your SEO and SEM in good shape, it may well be an inventory problem: Are you stocking the models that buyers in your area are looking for? Here’s where looking at data from outside your four walls can be helpful. Demand data which aggregates online search activity to determine what models shoppers are likely to be buying in the next six weeks – can be a great resource to determine what’s going to be hot. This can certainly assist you in acquiring in-demand used inventory, and while you don’t always have control over your new allocations, a grasp of local purchase trends can help you figure out where and how to successfully market the models you do have on your lot. You may find that one or two problem models are dragging down your total market share – either because you have a large volume of them in stock and they aren’t moving, or they are hot sellers and you don’t have enough of them to meet demand. Once you’ve got the basics covered and you’ve identified any inventory gaps, let’s get granular about your strategy to dominate market share. A great way to do that is to look at the models and zip codes where you’re losing market share, starting with your bread and butter models. Dig in and look at your market share, by ZIP code, for each of your high-volume models. If you’re well under that 90% threshold on Focuses or 3-series, for example, that’s a good place to start targeting your marketing efforts in your backyard. So how do you sell more cars into the Zip codes you’ve identified? By understanding the prospective buyers of your chosen model and laser-targeting your marketing to appeal to them. Demographic data from the likes of Experian Automotive can provide a rich array of details on the values and preferences of buyers who are most likely to be interested in your specific vehicles. From the advertising channels that reach them, to the types of offers and benefits they prefer to hear about, there’s a plethora of valuable information available to inform successful campaigns. Armed with this data, it’s possible to hone your messaging to appeal to those individual buyers, especially when undertaking campaigns that can be targeted down to the ZIP code level, such as PPC and direct mail. If you’re not already buying your PPC by ZIP code, and creating model-specific landing pages with customized messaging for each area, we highly recommend it for a dramatic effect on conversion. We’ve seen rates rise from 2% to 8%, and inventory engagement rates rise from 50 to 90%, just by employing these techniques. By employing your marketing dollars more strategically and creating messaging that better resonates with consumers, you’ll be well on your way to consistently achieving dominant market share in your own backyard. But once accomplished, the work is not done! Be sure to experiment with conquesting against competitive makes – and do so in a controlled and measurable way. Here are some considerations as you set your strategy: Choose just one make to take on… but avoid conventional wisdom. If you’re a Honda dealer, conventional wisdom says conquest Toyota – since they consistently show up in the list of cross-shopped makes for Honda, regardless of market. But Toyota buyers are highly loyal… how much are you going to have to spend to convince them to leave their tried and true models? Why not go after Kia or Hyundai instead? Stick with your bread and butter models. You might be all excited about that shipment of new electric vehicles you just got in stock, but those “specialty” buyers are going to seek you out. For the highest impact, spend your conquesting dollars where you’re doing the most volume. For example, , if you’re a BMW dealer, put your 3-series up against the Lexus IS. Choose 3-4 ZIP codes in your PMA where demand is highest. It may be tempting to try to lure buyers who are farther afield, but you are more likely to lose on the front and back end of every sale that’s over 20 miles from your dealership. Remember, we’re looking for buyers that are easy to lure and have a good shot at becoming loyal service customers These techniques can be used persistently to ensure that you own your backyard, dominate your PMA and steal market share from your competitors. All it takes is knowledge of your market. Your gut will lead you in the right direction most of the time, but look at the data to verify your instinct, and be open to being surprised. Take the time to wait for results before moving on to the next campaign. You’re guaranteed to learn something that will make you better next time. And there’s no need to go it alone. All this data and the accompanying visualizations can be found in Experian’s Dealer Positioning System®, or DPS, a dealership intelligence platform created expressly for auto retail. The DPS can surface recommendations on the models and ZIP Codes with the most opportunity, and a monthly Market Guidance call with one of our Performance Managers who can help you crystallize your strategy, track results, and hold you and your extended team accountable. Experian also has a growing list of agency partners who use the DPS to help clients like you shape and execute on effective marketing and advertising campaigns.

Alternative credit data. Enhanced digital credit marketing. Faster, integrated decisioning. Fraud and identity protections. The latest in technology innovation. These were the themes Craig Boundy, Experian’s CEO of North America, imparted to an audience of 800-plus Vision guests on Monday morning. “Technology, innovation and new sources of data are fusing to create an unprecedented number of new ways to solve pressing business challenges,” said Boundy. “We’re leveraging the power of data to help people and businesses thrive in the digital economy.” Main stage product demos took the shape of dark web scans, data visualization, and the latest in biometric fraud scanning. Additionally, a diverse group of breakout sessions showcased all-new technology solutions and telling stats about how the economy is faring in 2018, as well as consumer credit trends and preferences. A few interesting storylines of the day … Regulatory Under the Trump administration, everyone is talking about deregulation, but how far will the pendulum swing? Experian Sr. Director of Regulatory Affairs Liz Oesterle told audience members that Congress will likely pass a bill within the next few days, offering relief to small and mid-sized banks and credit unions. Under the new regulations, these smaller players will no longer have to hold as much capital to cover losses on their balance sheets, nor will they be required to have plans in place to be safely dismantled if they fail. That trigger, now set at $50 billion in assets, is expected to rise to $250 billion. Fraud Alex Lintner, Experian’s President of Consumer Information Services, reported there were 16.7 million identity theft victims in 2017, resulting in $16.8 billion in losses. Need more to fear? There is also a reported 323k new malware samples found each day. Multiple sessions touched on evolving best practices in authentication, which are quickly shifting to biometrics-based solutions. Personal identifiable information (PII) must be strengthened. Driver’s licenses, social security numbers, date of birth – these formats are no longer enough. Get ready for eye scans, as well as voice and photo recognition. Emerging Consumers The quest to understand the up-and-coming Millennials continues. Several noteworthy stats: 42% of Millennials said they would conduct more online transactions if there weren’t so many security hurdles to overcome. So, while businesses and lenders are trying to do more to authenticate and strengthen security, it’s a delicate balance for Millennials who still expect an easy and turnkey customer experience. Gen Z, also known as Centennials, are now the largest generation with 28% of the population. While they are just coming onto the credit scene, these digital natives will shape the credit scene for decades to come. More than ever, think mobile-first. And consider this … it's estimated that 25% of shopping malls will be closed within five years. Gen Z isn’t shopping the mall scene. Retail is changing rapidly! Economy Mortgage originations are trending up. Consumer confidence, investor confidence, interest rates and home sales are all positive. Unemployment remains low. Bankcard originations have now surpassed the 2007 peak. Experian’s Vice President of Analytics Michele Raneri had glowing remarks on the U.S. economy, with all signs pointing to a positive 2018 across the board. Small business loan volumes are also up 10% year-to-date versus the same time last year. Keynote presenters speculate there could be three to four rate hikes within the year, but after years of no hikes, it’s time. Data There are 2.5 quintillion pieces of data created daily. And 80% of what we know about a consumer today is the result of data generated within the past year. While there is no denying there is a LOT of data, presenters throughout the day talked about the importance of access and speed. Value comes with more APIs to seamlessly connect, as well as data visualization solutions like Tableau to make the data easier to understand. More Vision news to come. Gain insights and news throughout the day by following #ExperianVision on Twitter.

The traditional credit score has ruled the financial services space for decades, but it‘s clear the way in which consumers are managing their money and credit has evolved. Today’s consumers are utilizing different types of credit via various channels. Think fintech. Think short-term loans. Think cash-checking services and payday. So, how do lenders gain more visibility to a consumer’s credit worthiness in 2018? Alternative credit data has surfaced to provide a more holistic view of all consumers – those on the traditional file and those who are credit invisibles and emerging. In an all-new report, Experian dives into “The State of Alternative Credit Data,” providing in-depth coverage on how alternative credit data is defined, regulatory implications, consumer personas attached to the alternative financial services industry, and how this data complements traditional credit data files. “Alternative credit data can take the shape of alternative finance data, rental, utility and telecom payments, and various other data sources,” said Paul DeSaulniers, Experian’s senior director of Risk Scoring and Trended/Alternative Data and attributes. “What we’ve seen is that when this data becomes visible to a lender, suddenly a much more comprehensive consumer profile is formed. In some instances, this helps them offer consumers new credit opportunities, and in other cases it might illuminate risk.” In a national Experian survey, 53% of consumers said they believe some of these alternative sources like utility bill payment history, savings and checking account transactions, and mobile phone payments would have a positive effect on their credit score. Of the lenders surveyed, 80% said they rely on a credit report, plus additional information when making a lending decision. They cited assessing a consumer’s ability to pay, underwriting insights and being able to expand their lending universe as the top three benefits to using alternative credit data. The paper goes on to show how layering in alternative finance data could allow lenders to identify the consumers they would like to target, as well as suppress those that are higher risk. “Additional data fields prove to deliver a more complete view of today’s credit consumer,” said DeSaulniers. “For the credit invisible, the data can show lenders should take a chance on them. They may suddenly see a steady payment behavior that indicates they are worthy of expanded credit opportunities.” An “unscoreable” individual is not necessarily a high credit risk — rather they are an unknown credit risk. Many of these individuals pay rent on time and in full each month and could be great candidates for traditional credit. They just don’t have a credit history yet. The in-depth report also explores the future of alternative credit data. With more than 90 percent of the data in the world having been generated in just the past five years, there is no doubt more data sources will emerge in the coming years. Not all will make sense in assessing credit decisions, but there will definitely be new ways to capture consumer-permissioned data to benefit both consumer and lender. Read Full Report

Experian’s annual Vision Conference kicks off on Sunday to a sold-out crowd in Scottsdale, Ariz., bringing together some of the industry’s top thought leaders in financial services, technology, data science and information security. The conference, now in its 37th year, will run through Tuesday evening and showcase 55-plus breakout sessions and several all-star keynotes. “We take great pride in offering our guests the cutting-edge data and insights they need to keep advancing and evolving their own businesses,” said Reshma Peck, Experian’s senior vice president of marketing. “But what makes Vision really special is the networking and collaboration we witness throughout the conference – leaders connect and leave inspired – ready to make strides in a world that is evolving at breakneck speed.” A few session spotlights include: A look at data visualization tools and the ability to access anonymized credit data on 220 million U.S. credit consumers A deep dive into machine learning and artificial intelligence, showcasing how advancements in technology are improving credit risk scores and fraud detection Multiple breakouts on trends attached to Milliennials, Gen Z, the economy, automotive finance, small business performance and fraud How alternative credit data is providing deeper insights to uncover opportunities with both thin-file and thick-file credit consumers Digital credit advancements in mobile, voice and targeting. Beyond the traditional breakouts, featured speakers will punctuate each day. On Monday, Dr. Janet Yellen, former chair of the Federal Reserve, will deliver one of her first speeches since retiring her influential role in February 2018. On Tuesday, Gabby Giffords and Captain Mark Kelly will take the stage to talk about the importance of community, service and perseverance. Finally, NFL Quarterback Aaron Rodgers will share leadership lessons and sports highlights on Tuesday afternoon. An exclusive Tech Showcase will additionally run throughout the conference, delivering first-hand demos for participants to experience the latest in technology tools associated with fraud, voice and data analytics and access. Stats, insights and event highlights will be shared on multiple social media platforms throughout the three-day conference. Follow along with #ExperianVision.

When dealerships market a particular make or model, they may only think of targeting by geography. In a previous article, we talked about hitting the mark for effectively geo-targeting down to the ZIP Code™ level. The trouble is this is only one half of the puzzle. You may know where you should target but might not know whom to target. What is the best way to create campaigns tailored to the individuals within the specific area you are targeting? If you already use Experian’s Dealer Positioning System (DPS), you have a leg up on this. Since we already talked about targeting by ZIP Codes, the next step finding out household attributions and profiles in those areas. The above example is a ZIP Code in Sun City West, Arizona. We see three different lifestyle segments sourced from Experian’s Mosaic®, a system that classifies households into 71 unique types and provides information about consumer’s choices, habits, and preferences. Within the 1,702 households in this Zip Code that registered a vehicle within a defined timeframe, we can determine the three primary types of household segments. As we can see, Footloose and Family Free dominates this area at 66%. This group consists of elderly couples and widowed individuals living active and comfortable lifestyles. Gold Carts and Gourmets, upscale retirees and empty-nesters in comfortable communities comes in at 20%. The remainder is Booming and Consuming, older empty-nesting couples and singles enjoying relaxed lives in small towns. This information gives us insight into the people living in various types of households within this particular ZIP Code and. These also show personal preferences for purchasing such as clothing, accessories, electronics, and so on, household marital status, and what types of vehicles they usually purchase. From this information, for Sun City West, Arizona, we can see that the average income in this ZIP Code is $67,000. After we look at the Mosaic profile of households, we can look at advertising propensity and channel dominance. These demonstrate how vehicles buyers in this ZIP Code were influenced in their purchase decision and shows what advertising influenced them the most. Traditional advertising such as newspaper, TV, or radio was more effective versus Direct Mail in this area with a ratio of 8:7. The difference between Email and Direct Mail for channel dominance is 1:1. That’s good because it means consumers here were equally responsive to both emails and direct mail. The left side of the table displays the type of households you can target, but the right side is all about how to best market to them. “Messaging Attributes” indicates the top key messaging that influenced the people in this ZIP Code’s buying decision. For this ZIP Code, Buy American is the top attribute. Consumers in this segment would like to know the history of your dealership, and details of your community involvement, and if your vehicles are made in America. If we go 9% lower, we see Look at me Now. This messaging focuses on customer relationships, dealership reputation, and gifts for going on test drives. Finally, there is On the Road Again. Here, focus is on customer testimonials, base trim levels of vehicles, and simple, value-focused messaging. As a dealer, you have three effective messaging attributes that you can use to bring consumers from this ZIP Code into your store. Effectively marketing your vehicle to consumers is easier once you know to whom you’re marketing. By using the Lifestyle Cluster and Mosaic lifestyle segmentation system, you can see not only who you are targeting but what kind of marketing they prefer. Along with idenitfying which ZIP Codes to target, figuring out what marketing attributes resonate with these consumers means you’ll provide the right message in the right place to the right consumer.

Hispanics are not only the fastest growing minority in the United States, but according to the Hispanic Wealth Project’s (HWP) 2017 State of Hispanic Homeownership Report, they would prefer to own a home rather than rent. Hispanic Millennials—who are entering their home-buying years—are particularly eager for homeownership. This group is educated, are entrepreneurs and business owners that over index on mobile use, and 9 of 10 say wanting to own a home is part of their Hispanic DNA. For them, it’s not a matter of if but when and how they will become homeowners. An optimistic outlook is also a trait of Hispanic Millennials, who generally are more positive about the future than the average Millennial. They are also confident in their ability to handle different types of tasks that are part of their day-to-day lives. And at 35 percent, the share of bilingual Hispanic Millennials with a household income of $100,000 or more is consistent with U.S. Millennials as a whole Homeownership challenges Yet, despite their optimism and goal of homeownership, Hispanic homeownership at 46.2 percent lags when compared to the overall U.S. home ownership rate of 63.9 percent in 2017. There are signs the gap could narrow; Hispanics are the only demographic to have increased their rate of homeownership for the past three years. Moreover, the report shows Hispanics are responsible for 46.5 percent of net U.S. homeownership gains since 2000. Still, the 2017 State of Hispanic Homeownership Report notes that a shortage of affordable housing, prolonged natural disasters in states with a significant Hispanic presence (California, Florida, Texas), and uncertainty over immigration policy could hinder Hispanic homeownership growth. An opportunity to reach Hispanics It seems most Hispanic Millennials will strive for homeownership at some point in their life, as they believe owning a home is best for their family’s future. With no convincing needed, there is a tremendous opportunity for mortgage providers to look deeper into the reasons behind Hispanic Millennials’ optimism to determine how to insert themselves into that dynamic. Research highlights the importance of creating interest in financial advice and making this a potential means of gaining trust. Hispanic Millennials who gain a better understanding of the benefits—not only for them but for generations to come—and costs of owning a home may translate their confidence into action.

Throughout the year, there are certain models that are incredibly popular. SUVs and crossovers fly off the shelves during the wintertime while down south, the pickup-truck is the sales king. There are times when less popular vehicles flood your inventory, creating stress for your sales team to try and get them into the hands of customers. The good news for dealers is that you don’t need to panic when strange bonus programs are floated out by the manufacturer. Data-driven methods can be used to find potential buyers. The upshot of this is dealers don’t have to wait for buyers to waltz into their showroom. Although you can pick a specific model based on incentives, it is a good idea to review your model goals to confirm they are realistic. Based on the models you are trying to move, identify the sales trends by unit and geography. This analysis may help you discover the vehicle margin opportunity isn’t worth the advertising investment. On the other hand, you may learn competitors are selling a plethora of that model and there is plenty of room to conquest market share. Always let data be your guide. Checking a vehicle’s popularity can determine if you should market it. If the model’s popularity in your geography is growing, it will be easier since potential consumers are going into showrooms, asking questions, and doing research online. On the flip side, a vehicle with declining popularity is more difficult, and therefore more expensive, to market. As vehicles become unpopular or out-of-season, aggressive pricing may be in-store. In the past, the “spray and pray” method was what dealers and marketers would use, simply hoping that your campaign would find your target. Today, the best practice is to pinpoint the demand for your model by analyzing your pre-determined market radius to identify those ZIP Codes™ which show the most interest. For example, narrowing down to neighborhoods showing recent sales of your model can help identify future purchase demand. When combined with demographic, psychographic, web analytics, and your CRM data, the formula for determining model-specific demand becomes a precise science. Determining where to market is one thing, but identifying the in-market customer is another thing altogether. To identify the persona for potential purchasers of your models, utilize a system like Experian’s Dealer Positioning System. It helps determine the demographics and psychographics of consumers along with various buying patterns. This persona will include what interests consumers of your model and what they value in a marketing message. While creating the persona, think about what kind of marketing would be the most effective. Are your customers on social media and would they prefer digital advertising? Perhaps a more traditional approach with direct mail or by phone? Understanding their preferences will indicate which approach will most effectively resonate with them. Now campaigns for your model of choice can begin. Use the ZIP Codes and demographics of your highest potential customers to create an effective media plan. Based on the data, craft out digital, traditional, or other campaign types that can be run successfully. Focus on the features that will most appeal to your key demographic– all-wheel-drive, navigation, advanced safety features, made in America, etc. Moving that model off the lot and onto the customer’s driveway does not have to be difficult. If the model is not popular in the first place or it isn’t the right time to market it, you may not want to spend money trying to promote it. With the methods we stated earlier, selling a vehicle to customers based on geotargeting and specific marketing messages make moving even the most unwanted vehicle easier. Also, remember the where, who, and what. Where are you targeting your customers, who are your customers, and what medium are you going to use? Using this can help to move that model and grant you sales success.

In my first blog post on the topic of customer segmentation, I shared with readers that segmentation is the process of dividing customers or prospects into groupings based on similar behaviors. The more similar or homogeneous the customer grouping, the less variation across the customer segments are included in each segment’s custom model development. A thoughtful segmentation analysis contains two phases: generation of potential segments, and the evaluation of those segments. Although several potential segments may be identified, not all segments will necessarily require a separate scorecard. Separate scorecards should be built only if there is real benefit to be gained through the use of multiple scorecards applied to partitioned portions of the population. The meaningful evaluation of the potential segments is therefore an essential step. There are many ways to evaluate the performance of a multiple-scorecard scheme compared with a single-scorecard scheme. Regardless of the method used, separate scorecards are only justified if a segment-based scorecard significantly outperforms a scorecard based on a broader population. To do this, Experian® builds a scorecard for each potential segment and evaluates the performance improvement compared with the broader population scorecard. This step is then repeated for each potential segmentation scheme. Once potential customer segments have been evaluated and the segmentation scheme finalized, the next step is to begin the model development. Learn more about how Experian Decision Analytics can help you with your segmentation or custom model development needs.

Marketers are keenly aware of how important it is to “Know thy customer.” Yet customer knowledge isn’t restricted to the marketing-savvy. It’s also essential to credit risk managers and model developers. Identifying and separating customers into distinct groups based on various types of behavior is foundational to building effective custom models. This integral part of custom model development is known as segmentation analysis. Segmentation is the process of dividing customers or prospects into groupings based on similar behaviors such as length of time as a customer or payment patterns like credit card revolvers versus transactors. The more similar or homogeneous the customer grouping, the less variation across the customer segments are included in each segment’s custom model development. So how many scorecards are needed to aptly score and mitigate credit risk? There are several general principles we’ve learned over the course of developing hundreds of models that help determine whether multiple scorecards are warranted and, if so, how many. A robust segmentation analysis contains two components. The first is the generation of potential segments, and the second is the evaluation of such segments. Here I’ll discuss the generation of potential segments within a segmentation scheme. A second blog post will continue with a discussion on evaluation of such segments. When generating a customer segmentation scheme, several approaches are worth considering: heuristic, empirical and combined. A heuristic approach considers business learnings obtained through trial and error or experimental design. Portfolio managers will have insight on how segments of their portfolio behave differently that can and often should be included within a segmentation analysis. An empirical approach is data-driven and involves the use of quantitative techniques to evaluate potential customer segmentation splits. During this approach, statistical analysis is performed to identify forms of behavior across the customer population. Different interactive behavior for different segments of the overall population will correspond to different predictive patterns for these predictor variables, signifying that separate segment scorecards will be beneficial. Finally, a combination of heuristic and empirical approaches considers both the business needs and data-driven results. Once the set of potential customer segments has been identified, the next step in a segmentation analysis is the evaluation of those segments. Stay tuned as we look further into this topic. Learn more about how Experian Decision Analytics can help you with your segmentation or custom model development needs.

In the credit game, the space is deep and diverse. From super prime to prime to subprime consumers, there is much to be learned about how different segments are utilizing credit and navigating the financial services arena. With 78 percent of full-time workers saying they live paycheck-to-paycheck and 71 percent of U.S. workers responding that they live in debt, it is not surprising a sudden life event can plunge a solid credit consumer from prime to subprime within months. Think lost job, divorce or unexpected medical bill. This population is not going away, and they are seeking ways to make ends meet and obtain finances for needs big and small. In many instances, alternative credit data can shed a light on new opportunities for traditional lenders, fintech players and those in the alternative financial space when servicing this specific consumer segment. In a new study, Clarity analyzed the trends and financial behavior of subprime loan users by looking at application and loan data in Clarity’s database, as well as overlaying VantageScore® credit score insights from Experian from 2013 to 2017. Clarity conducted this subprime trends report last year, but this is the first time it factored in VantageScore® credit score data, providing a different lens as to where consumers fall within the credit score tiers. Among the study highlights: Storefront single pay loan customers are becoming more comfortable with applying for online loans, with a growing percentage seeking installment products. For the first time in five years, online single pay lending (payday) saw a reduction in total credit utilization per customer. Online installment, on the other hand, saw an increase. While the number of online installment loans increased by 12 percent and the number of borrowers by only 9 percent, the dollar value grew by 30 percent. Online installment lenders had the greatest percentage increase in average loan amount. California and Texas remain the most significant markets for online lenders, ranking first and second for five years in a row due to population size. There has also been growth in the Midwest. The in-depth report additionally delves into demographics, indicators of financial stability among the subprime market and comparisons between storefront and online product use and performance. “Every year, there are more financial lenders and products emerging to serve this population,” said Andy Sheehan, president of Clarity Services. “It’s important to understand the trends and data associated with these individuals and how they are maneuvering throughout the credit spectrum. As we know, it is often not a linear journey.” The inclusion of the VantageScore® credit score showcased additional findings around prime versus subprime financial behaviors and looks at generational trends. Access Full Report

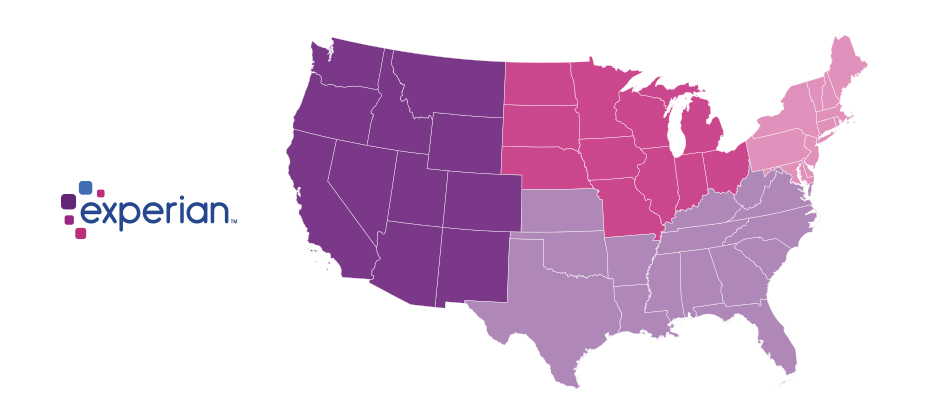

With 16.7 million reported victims of identity fraud in 2017 (that’s 6.64 percent of the U.S. population), it was another record year for the number of fraud victims. And as online and mobile transaction growth continued to significantly outpace brick-and-mortar growth, criminal attacks also grew rapidly. This past year, we saw an increase of more than 30 percent in e-commerce fraud attacks compared with 2016. As we’ve done over the past three years, Experian® analyzed millions of online transactions to identify fraud attack rates for both shipping and billing locations across the United States. We looked at several data points, including geography and IP address, to help businesses better understand how and where fraud is being perpetrated so they can better protect against it. The 2017 e-commerce fraud attack rate analysis shows: Delaware and Oregon continue to be the riskiest states for both billing and shipping fraud. Delaware; Oregon; Washington, D.C.; Florida; and Georgia are the top five riskiest states for billing fraud. Delaware, Oregon, Florida, New York and California are the top five riskiest states for shipping fraud, accounting for 50 percent of total fraud attacks. South El Monte, Calif., is the riskiest city overall, with an increase in shipping fraud of approximately 230 percent. Shipping fraud most often occurs near major airports and seaports due to reshippers and freight forwarders that receive domestic goods and often send them overseas. When a transaction originates from an international IP address, shipping fraud is 6.7 times likelier than the average, while billing fraud becomes 7.1 times likelier. Where is e-commerce fraud happening? Typically, the highest-risk areas for fraud are in ZIP™ codes and cities near large ports of entry or airports. These are ideal locations to reship fraudulent merchandise, enabling criminals to move stolen goods more effectively. Top 10 riskiest billing ZIP™ codes Top 10 riskiest shipping ZIP™ codes 97252 Portland, OR 97079 Beaverton, OR 33198 Miami, FL 33122 Miami, FL 33166 Miami, FL 91733 South El Monte, CA 33122 Miami, FL 97251 Portland, OR 77060 Houston, TX 97250 Portland, OR 33195 Miami, FL 33166 Miami, FL 97250 Portland, OR 97252 Portland, OR 97251 Portland, OR 33198 Miami, FL 33191 Miami, FL 33195 Miami, FL 97253 Portland, OR 33192 Miami, FL Source: Experian.com Source: Experian.com What’s more, many of the riskiest ZIP™ codes and cities experience a high volume of transactions originating from international IP addresses. In fact, the top 10 riskiest ZIP codes overall tend to experience fraudulent activity from numerous countries overseas, including China, Venezuela, Taiwan and Hong Kong, and Argentina. These fraudsters tend to implement complex fraud schemes that can cost businesses millions of dollars in fraud losses. Additionally, the analysis shows that traffic coming from a proxy server — which could originate from domestic and international IP addresses — is 74 times riskier than the average transaction. The problem The increase in e-commerce fraud attacks shouldn’t come as a huge surprise. The uptick in data breaches, merchants’ continued adoption of EMV-enabled terminals to protect against counterfeit card fraud and the abundance of consumer data on the dark web means that information is even more accessible to criminals. This enables them to open fraudulent accounts, take over legitimate accounts and submit fraudulent transactions. Another reason for the increase is automation. In the past, criminals needed a strong understanding of fraud methods and technology, but they can now bring down an entire organization by simply downloading a file and automating the submission of thousands of applications or transactions simultaneously. Since fraudsters need to make these transactions appear as normal as possible, they often leverage the cardholder’s actual billing details with slight differences, such as e-mail address or shipping location. Unfortunately, the mass availability of compromised data and the abundance of fraudsters makes it increasingly challenging to identify and separate legitimate customers from attackers across the country. Because of the widespread prevalence of fraud and data compromises, we don’t see billing fraud concentrated in just one region of the country. In fact, the top five states for billing fraud make up only about 18 percent of overall fraud attacks. Top 5 riskiest billing fraud states Top 5 riskiest shipping fraud states State Fraud attack rate State Fraud attack rate Delaware 93.4 Delaware 195.9 Oregon 86.1 Oregon 170.1 Washington, D.C. 46.5 Florida 45.1 Florida 39.2 New York 37.3 Georgia 31.5 California 32.6 Source: Experian.com Source: Experian.com Prevention and protection need to be the priority As businesses get a better understanding of how and where fraud is perpetrated, they can implement proactive strategies to detect and prevent attacks, as well as protect payment information. While no one single strategy can address the entire scope of fraud, there are advanced data sets and technology — such as device intelligence, behavioral and physical biometrics, document verification and entity resolution — that can help businesses make better fraud decisions. Fortunately, consumers can also play a major role in safeguarding their information. In addition to regularly checking their credit reports and bank/credit card statements for fraudulent activity, consumers can limit the data they share on social networking sites, where attackers often begin when perpetrating identity fraud. While we continue to help both organizations and consumers limit their exposure to e-commerce fraud, we anticipate that criminals will attempt more sophisticated fraud schemes. But businesses can stay ahead of the curve. This comes down to having a keen understanding of how fraud is being perpetrated, as well as leveraging data, technology and multiple layered strategies to better recognize legitimate customers and make more precise fraud decisions. View our e-commerce fraud heat map and download the top 100 riskiest ZIP codes in the United States. Experian is a nonexclusive full-service provider licensee of the United States Postal Service®. The following trademark is owned by the United States Postal Service®: ZIP. The price for Experian’s services is not established, controlled or approved by the United States Postal Service.

Managing your customer accounts at the identity level is ambitious and necessary, but possible Identity-related fraud exposure and losses continue to grow. The underlying schemes have elevated in complexity. Because it’s more difficult to perpetrate “card present” fraud in the post–chip-and-signature rollout here in the United States, bad guys are more motivated and getting better at identity theft and synthetic identity attacks. Their organized nefarious response takes the form of alternate attack vectors and methodologies — which means you need to stamp out any detected exposure point in your fraud prevention strategies as soon as it’s detected. Experian’s recently published 2018 Global Fraud and Identity Report suggests two-thirds, or 7 out of every ten, consumers want to see visible security protocols when they transact. But an ever-growing percentage of them, fueled in no small part by those tech-savvy millennials, expect to be recognized with little or no friction. In fact, 42 percent of the surveyed consumers who stated they would do more transactions online if there weren’t so many security hurdles to overcome were — you guessed it — millennials. So how do you implement identity and account management procedures that are effective and, in some cases, even obvious while being passive enough to not add friction to the user experience? In other words, from the consumer’s perspective, “Let me know you know me and are protecting me but not making it too difficult for me when I want to access or manage my account.” Let’s get one thing out of the way first. This isn’t a one-time project or effort. It is, however, a commitment to the continued informing of your account management strategies with updated identity intelligence. You need to make better decisions on when to let a low-risk account transaction (monetary or nonmonetary) pass and when to double down a bit and step up authentication or risk assessment checks. I’d suggest this is most easily accomplished through a single, real-time access point to myriad services that should, at the very least, include: Identity verification and reverification checks for ongoing reaffirmation of your customer identity data quality and accuracy. Know Your Customer program requirements, anyone? Targeted identity risk scores and underlying attributes designed to isolate identity theft, first-party fraud and synthetic identity. Fraud risk comes in many flavors. So must your analytics. Device intelligence and risk assessment. A customer identity is no longer just their name, address, Social Security number and date of birth. It’s their phone number, email address and the various devices they use to access your services as well. Knowing how that combination of elements presents itself over time is critical. Layered passive or more active authentication options such as document verification, biometrics, behavioral metrics, knowledge-based verification and alternative data sources. Ongoing identity monitoring and proactive alerting and segmentation of customers whose identity risk has shifted to the point of required treatment. Orchestration, workflow and decisioning capabilities that allow your team to make sense of the many innovative options available in customer recognition and risk assessment — without a “throw the kitchen sink at this problem” approach that will undoubtedly be way too costly in dollars spent and good customers annoyed. Fraud attacks are dynamic. Your customers’ perceptions and expectations will continue to evolve. The markets you address and the services you provide will vary in risk and reward. An innovative marketplace of identity management services can overwhelm. Make sure your strategic identity management partner has good answers to all of this and enables you to future-proof your investments.