Industries

In this new Telephone Consumer Protection Act (TCPA) era, calling your customers isn’t a thing of the past. It’s still okay to reach out to your clients by phone, whether to offer a new product or collect on an overdue bill. But strict compliance with TCPA rules is critical for any business that contacts customers by phone. Some of the very best ways you can protect yourself from TCPA exposure is to follow four steps when creating your dialing strategy: Customer consent: It’s important to maintain and update your customers’ contact preferences and consent to call them. Simply having a phone number on an application isn’t sufficient. Companies are required to have written permission, such as “I consent to calling my cell phone when there’s a problem …” Remember, permission may only be granted by the party who subscribes to the cellular service or who regularly uses that cell phone number. Landline or wireless?: Your database should also include the phone type for the telephone numbers you have for your customers. The dialing rules differ depending on the phone type, so it’s critical to know the type of phone you are calling or texting. Verify ownership: Ownership of cell phones should especially be validated to ensure the number hasn’t been reassigned and that the person who gave consent still owns the phone. One call can be made to a reassigned number with no liability, assuming you have no knowledge the number has changed. Repeating the action could lead to fines from $500 to $1,500 per infraction. Scrub Your Database: Have practices in place to remove any confirmed reassigned phone numbers from your database. This will help to improve your right-party contact rate and save you from potential TCPA headaches. No one disagrees that calling cell numbers is a risky business, but it can be done if you set the proper workflow in motion. Click here to learn more about Experian solutions that will help to reduce your TCPA compliance risk.

With the Oct. 3, 2016 compliance date upon us, many lenders continue to debate how they would like to solve for the Military Lending Act (MLA). With new enhancements, more protections have been granted to members of the military and their dependents when it comes to “consumer credit” products, specifically around the 36% cap on the MAPR. The key then becomes how to identify these individuals. At origination, how can the lender know if an individual is a member of the military, or a service member’s dependent? The answer, of course, lies in verification. Under the new Department of Defense (DOD) rule, lenders will have to check each credit applicant to confirm that they are not a service member, spouse, or the dependent of a service member. The final rule includes a “safe harbor” from liability for lenders who verify the MLA status of a consumer through a nationwide Credit Reporting Agency (CRA) or the DOD’s own database, known as the DMDC. Obviously, lenders will want to have this “safe harbor,” so the question becomes do you opt for the direct or indirect solution? The direct solution is to have the lender access the DMDC on their own. With this option, expected turnaround time is 24 hours for batch searches. The DMDC expects the volume of searches to their servers to increase from 220 million a week to 1.9 billion a week. For some, this feels like a more manual process, but it can be done. The indirect solution involves the CRA accessing the DMDC data on the lender’s behalf. In Experian’s case, this would translate into lenders seeing the MLA indicator on the credit report at point of origination or making a call out for just the MLA indicator. The process is integrated into the credit-pull cycle, so no manual effort is required on the lender’s end. MLA status is simply flagged. The rule also permits the consumer report to be obtained from a reseller that obtains such a report from a nationwide consumer reporting agency. Required data to perform a search includes full legal name, address, social security number and date of birth. This applies to both the credit report add-on and Experian’s standalone solutions. If any of this data is missing from the inquiry, Experian is unable to perform the MLA search. Credit card lenders have until Oct. 3, 2017 to adhere to the new standards, but all other applicable lenders must act now and build out their compliance standards and solutions. Direct or indirect? That is the question. To learn more about MLA or how Experian can help, visit our dedicated-MLA site.

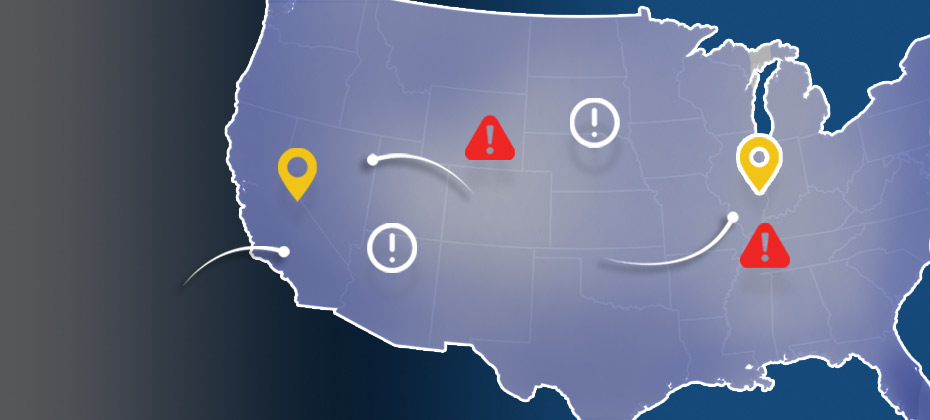

Experian analyzed millions of e-commerce transactions from the first six months of 2016 to identify the latest fraud attack rates across the United States for both shipping and billing locations. As we approach the one-year anniversary of the EMV liability shift, the 2016 e-commerce fraud attack rates look to be at least 15 percent higher than last year’s total. Experian analyzed millions of e-commerce transactions from the first six months of 2016 to identify the latest fraud attack rates across the United States for both shipping and billing locations. Billing fraud rates are associated with the address of the purchaser. Shipping fraud rates are associated with the address where purchased goods are sent. As we approach the one-year anniversary of the EMV liability shift, the 2016 e-commerce fraud attack rates look to be at least 15 percent higher than last year’s total. E-commerce fraud is often an indicator that other fraud activities have already happened, whether a credit card has been stolen, identity fraud has occurred, or personal credentials have been compromised.

In this age of content and increasing financial education available to all, most entities are familiar with credit bureaus, including Experian. They are known for housing enormous amounts of data, delivering credit scores and helping businesses decision on credit. On the consumer side, there are certainly myths about credit scores and the credit report. But myths exist among businesses as well, especially as it pertains to the topic of reporting credit data. How does it work? Who’s responsible? Does reporting matter if you’re a small lender? Let’s tackle three of the most common myths surrounding credit reporting and shine a light on how it really is essential in creating a healthy credit ecosystem. Myth No. 1: Reporting to one bureau is good enough. Well, reporting to one bureau is definitely better than reporting to none, but without reporting to all three bureaus, there could be gaps in a consumer’s profile. Why? When a lender pulls a consumer’s profile to evaluate it for extending additional credit, they ideally would like to see a borrower’s complete credit history. So, if one of their existing trades is not being reported to one bureau, and the lender makes a credit pull from a different bureau to use for evaluation purposes, no knowledge of that trade exists. In cases like these, credit grantors may offer credit to your customer, not knowing the customer already has an obligation to you. This may result in your customer getting over-extended and negatively impacting their ability to pay you. On the other side, in the cases of a thin-file consumer, not having that comprehensive snapshot of all trades could mean they continue to look “thin” to other lenders. The best thing you can do for a consumer is report to all three bureaus, making their profile as robust as it can be, so lenders have the insights they need to make informed credit offers and decisions. Some believe the bureaus are regional, meaning each covers a certain part of the country, but this is false. Each of the bureaus are national and lenders can report to any and all. Myth No. 2: Reporting credit data is hard. Yes, accurate and timely data reporting requires a few steps, but after you get familiar with Metro 2, the industry standard format for consumer data reporting, choose a strategy, and register for e-Oscar, the process is set. The key is to do some testing, and also ensure the data you pass is accurate. Myth No. 3: Reporting credit data is a responsibility for the big institutions –not smaller lenders and companies. For all lenders, credit bureau data is vitally important in making informed risk determinations for consumer and small business loans. Large financial institutions have been contributing to the ecosystem forever. Many smaller regional banks and credit unions have reported consistently as well. But just think how much stronger the consumer credit profile would be if all lenders, utility companies and telecom businesses reported? Then you would get a true, complete view into the credit universe, and consumers benefit by having the most comprehensive profile --- Bottom line is that when comprehensive data on consumer credit histories is readily available, it’s a good thing for consumers and lenders. And the truth is all businesses - big and small - can make this a reality.

Prescriptive solutions: Get the Rx for your right course of action By now, everyone is familiar with the phrase “big data” and what it means. As more and more data is generated, businesses need solutions to help analyze data, determine what it means and then assist in decisioning. In the past, solutions were limited to simply describing data by creating attributes for use in decisioning. Building on that, predictive analytics experts developed models to predict behavior, whether that was a risk model for repayment, a propensity model for opening a new account or a model for other purposes. The next evolution is prescriptive solutions, which go beyond describing or predicting behaviors. Prescriptive solutions can synthesize big data, analytics, business rules and strategies into an environment that provides businesses with an optimized workflow of suggested options to reach a final decision. Be prepared — developing prescriptive solutions is not simple. In order to fully harness the value of a prescriptive solution, you must include a series of minimum capabilities: Flexibility — The solution must provide users the ability to make quick changes to strategies to adjust to market forces, allowing an organization to pivot at will to grow the business. A system that lacks agility (for instance, one that relies heavily on IT resources) will not be able to realize the full value, as its recommendations will fall behind current market needs. Expertise — Deep knowledge and a detailed understanding of complex business objectives are necessary to link overall business goals to tactical strategies and decisions made about customers. Analytics — Both descriptive and predictive analytics will play a role here. For instance, the use of a layered score approach in decisioning — what we call dimensional decisioning — can provide significant insight into a target market or customer segment. Data — It is assumed that most businesses have more data than they know what to do with. While largely true, many organizations do not have the ability to access and manage that data for use in decision-making. Data quality is only important if you can actually make full use of it. Let’s elaborate on this last point. Although not intuitive, the data you use in the decision-making process should be the limiting factor for your decisions. By that, I mean that if you get the systems, analytics and strategy components of the equation right, your limitation in making decisions should be data-driven, and not a result of another part of the decision process. If your prescriptive environment is limited by gaps in flexibility, expertise or analytic capabilities, you are not going to be able to extract maximum value from your data. With greater ability to leverage your data — what I call “prescriptive capacity” — you will have the ability to take full advantage of the data you do have. Taking big data from its source through to the execution of a decision is where prescriptive solutions are most valuable. Ultimately, for a business to lead the market and gain a competitive advantage over its competitors — those that have not been able to translate data into meaningful decisions for their business — it takes a combination of the right capabilities and a deep understanding of how to optimize the ecosystem of big data, analytics, business rules and strategies to achieve success.

Experian conducted a joint-survey that uncovered insights into the topic of conversational commerce and voice assistants. The survey audience constituted nearly 1300 smartphone users of smart voice assistant tools. The survey asked about most requested tasks and general consumer satisfaction with the voice-recognition capabilities of Amazon's Alexa relative to other smart voice assistants such as Siri and Google.

Tick-tock. Tick-tock. Lenders are just weeks away from the required Military Lending Act compliance date of Oct. 3, yet many are scrambling to find a solution. In fact, officials with CUNA and the American Bankers Association said they were still confused by the rules, and requested a six-month extension from the Department of Defense for compliance. Card holders have until Oct. 3, 2017 to comply, but others are trying to navigate what the rule means and how to introduce new practices to protect and serve military credit consumers. What are the top questions still circulating about this key piece of regulation? Here are a few we’ve been tracking, along with some responses to assist with this shift in compliance. 1. What types of accounts are covered under the Military Lending Act (MLA)? It initially applied to three narrowly-defined “consumer credit” products: Closed-end payday loans; Closed-end auto title loans; and Closed-end tax refund anticipation loans. The new rule, issued in 2015 by the Department of Defense, expands the definition of “consumer credit” covered by the regulation to more closely align with the definition of credit in the Truth in Lending Act and Regulation Z. This means MLA now covers a wide range of credit transactions. It does not apply to residential mortgages and credit secured by personal property, such as vehicle purchase loans. 2. Who are the covered borrowers under the MLA? The DMDC database identifies individuals who meet one of the following criteria: Is on active duty Regular or reserve member of the Army, Navy, Marine Corps, Air Force, or Coast Guard, serving on active duty under a call or order that does not specify a period of 30 days or less, or such a member serving on Active Guard and Reserve duty as that term is defined in 10 u.s.c. 101 (d)(6) The member’s spouse The member’s child defined in 38 USC 101(4), or An individual for whom the member provided more than one-half of the individual’s support for 180 days immediately preceding the extension of consumer credit covered by 32 C.F.R. Part 232 The flag returned from DMDC will not specifically identify the active duty military member, but it will flag if the applicant is a covered borrower. 3. How is MAPR calculated? What additional fees are included? The MAPR includes interest, fees, credit service charges, credit renewal charges, credit insurance premiums and other fees for credit-related products sold in connection with the loan. You should work with your legal/compliance teams for MLA restrictions and applicability. 4. What is the difference between the Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA)? Both regulations are designed to protect U.S. service members and their families, but each focus on different areas. SCRA has been around for decades and was designed to temporarily suspend judicial and administrative proceedings and transactions that may adversely affect service members during their actual military service. In fact, if a service member has a debt before he or she joined the active military service, they can have the interest rate reduced to 6 percent, upon request. If the loan is a mortgage, that rate can also be reduced for the duration the member is in the military, plus one year. Other loans are only reduced for the duration the member is on active duty. MLA, on the other hand, is focused solely on providing specific protections for active duty service members and their dependents in certain consumer credit transactions. It was introduced in 2007, but strengthened in 2015. Specifically, it limits APR to 36 percent on covered products, which was recently expanded to include closed-end payday loans, closed-end auto title loans and closed-end tax refund anticipation loans. Unlike SCRA, where the responsibility to activate these protections falls on the service member, MLA requires creditors to verify active duty status and dependents at origination. 5. Explain the difference between accessing MLA status directly versus indirectly. The Final Rule permits a creditor to use information obtained directly from the Department of Defense’s Database. Information can also be obtained from a nationwide consumer reporting agency to determine whether a consumer applicant is a covered borrower. When working with Experian, the one-stop solution will entail outputting the MLA indicator on the credit report at point of origination. We anticipate this solution will be available in fall 2016. --- Not much is known about what the punishments or fines will look like for infractions, but now is the time to start reviewing business governance and procedures that support compliance. To learn more about MLA and to access an on-demand webinar with industry experts, visit our site.

Consumers want to pay less. This is true in retail and in lending. No big surprise, right? So in order for lenders to capitalize and identify the right consumers for their respective portfolios, they need insights. Lenders want to better understand what rates consumers have. They want to know how much interest their customers pay. They want to know if consumers within their portfolio are at risk of leaving, and they want visibility into new prospects they can market to in an effort to grow. Luckily, lenders can look to trade level fields to be in the know. These inferred data fields, powered by Trended Data, allow lenders to offer products and terms that serve two purposes: First, their use in response models and offer alignment strategies drive better performance, ROI and life-time value. As noted earlier, consumers want to pay less, so if they are offered a better rate or money-saving offer, they’re more likely to respond. Second, they ultimately save consumers money in a way that benefits each consumer’s unique financial situation- overall savings on interest paid over the life of the loan, or consolidation of other debt often combined for a lower monthly payment. These trade level fields allow lenders to dig into various trends and insights surrounding consumers. For example, Experian data can identify big spenders and transactors (those who pay off their purchases every month). Research reveals these individuals love to be rewarded for how they use credit, demanding rewards, airline miles or other goodies for the spending they do. They also really like to be rewarded with higher credit lines, whether they use the increased line or not. Fail to serve these transactors in the right way and lenders could be faced with lackluster performance in the form poor response rates, booking rates, activation rates and early attrition. Thus, a little trade level insight can go a long way in helping lenders personalize products, offers and anticipate future financial needs. Knowing the profitability of a customer across all of their accounts is important, and accessing this intelligence in a seamless way is ideal. The data exists. For lenders, it’s just a matter of unlocking it, making those small, but meaningful changes and keeping a pulse on the portfolio. Together, these strategies can help lenders keep their best customers and acquire new ones that stick around longer.

At the end of July, the Consumer Financial Protection Bureau (CFPB) took a significant step toward reforming the regulatory framework for the debt collection and debt buying industry by announcing an outline of proposals under consideration. The proposals will now be considered by a small business review panel before the CFPB announces a proposed rule for wider industry comment. The CFPB said its proposals will affect only third-party debt collectors pursuant to the Fair Debt Collection Practices Act (FDCPA). However, the CFPB signaled it may consider a separate set of proposals for first-party collectors. The collections industry has long been a focus of the CFPB. In 2012, the bureau designated larger market participants in the debt collections marketplace and placed some of these entities under supervision. In 2013, the CFPB released an Advanced Notice of Proposed Rulemaking covering collections. The focus on debt collection is fueled in part by the large number of consumer complaints it receives about the debt collection market (roughly 35% of total complaints). Moreover, the CFPB’s proposals build upon some of the regulatory and enforcement priorities that the CFPB and Federal Trade Commission have pursued for several years around data quality, consumer communication and disclosures. Here are some of the key takeaways for third party debt collectors from the CFPB’s proposals: Address data quality: Collectors would be required to substantiate claims that a consumer owes a debt in order to begin a collection. Collectors would also be required to pass on information provided by consumers in the course of collections activity. New Validation Notice and Statement of Rights: The CFPB’s draft outline would update the information provided to consumers through the FDCPA validation notice, as well as require disclosure of a consumer statement of rights. Changes to frequency of communications: Debt collectors would be limited to six emails, phone calls or mailings per week, including unanswered calls and voicemails. After reaching the consumer, the debt collector would be allowed either one contact or three attempted contacts per week. There would also be a waiting period of 30 days before contacting the family of a debtor who has died. New disclosures on “out of statute” debt and litigation: In the outline, CFPB proposes having debt collectors provide new disclosures to consumers regarding the possibility of litigation and whether the debt is beyond the statute of limitations. Waiting period before sending collection accounts to a consumer reporting agency: Reporting a person’s debt would be prohibited under the draft outline unless the collector has first communicated directly with the consumer about the debt. The CFPB will next hear comments from a panel of small businesses in the industry, complete an analysis of how its proposals would impact small businesses, and take written comments from the public. Following those steps, the agency will issue a proposed rule for comment.

As regulators continue to warn financial institutions of the looming risk posed by HELOCs reaching end of draw, many bankers are asking: Why should I be concerned? What are some proactive steps I can take now to reduce my risk? This blog addresses these questions and provides clear strategies that will keep your bank on track. Why should I be concerned? Just a quick refresher: HELOCs provide borrowers with access to untapped equity in their residences. The home is taken as collateral and these loans typically have a draw period from five to 10 years. At the end of the draw period, the loan becomes amortized and monthly payments could increase by hundreds of dollars. This payment increase could be debilitating for borrowers already facing financial hardships. The cascading affect on consumer liquidity could also impact both credit card and car loan portfolios as borrowers begin choosing what debt they will pay first. The breadth of the HELOC risk is outlined in an excerpt from a recent Experian white paper. The chart below illustrates the large volume of outstanding loans that were originated from 2005 to 2008. The majority of the loans that originated prior to 2005 are in the repayment phase (as can be seen with the lower amount of dollars outstanding). HELOCs that originated from 2005 to 2008 constitute $236 billion outstanding. This group of loans is nearing the repayment phase, and this analysis examines what will happen to these loans as they enter repayment, and what will happen to consumers’ other loans. What can you do now? The first step is to perform a portfolio review to assess the extent of your exposure. This process is a triage of sorts that will allow you to first address borrowers with higher risk profiles. This process is outlined below in this excerpt from Experian’s HELOC white paper. By segmenting the population, lenders can also identify consumers who may no longer be credit qualified. In turn, they can work to mitigate payment shock and identify opportunities to retain those with the best credit quality. For consumers with good credit but insufficient equity (blue box), lenders can work with the borrowers to extend the terms or provide payment flexibility. For consumers with good credit but sufficient equity (purple box), lenders can work with the borrowers to refinance into a new loan, providing more competitive pricing and a higher level of customer service. For consumers with good credit but insufficient equity (teal box), a loan modification and credit education program might help these borrowers realize any upcoming payment shock while minimizing credit losses. The next step is to determine how you move forward with different customers segments. Here are a couple of options: Loan Modification: This can help borrowers potentially reduce their monthly payments. Workouts and modification arrangements should be consistent with the nature of the borrower’s specific hardship and have sustainable payment requirements. Credit Education: Consumers who can improve their credit profiles have more options for refinancing and general loan approval. This equates to a win-win for both the borrower and lender. HELOCs do not have to pose a significant risk to financial institutions. By being proactive, understanding your portfolio exposure and helping borrowers adjust to payment changes, banks can continue to improve the health of their loan portfolios. Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.

Ten years after homeowners took advantage of a thriving real-estate market to borrow against their homes, many are falling behind on payments, potentially leaving banks with millions of dollars in losses tied to housing. Most banks likely have homeowners with home-equity lines of credit (HELOCs) nearing end-of-draw within their portfolio, as more than $236 billion remain outstanding on loans originated between 2004 and 2007. The reality is many consumers are unprepared to repay their HELOCs. In 2014, borrowers who signed up for HELOCs in 2004 were 30 or more days late on $1.8 billion worth of outstanding balances just four months after principal payments began, reported RealtyTrac. That accounts for 4.3 percent of the balance on outstanding 2004 HELOCs. In practice, this is what an average consumer faces at end-of-draw: A borrower has $100,000 in HELOC debt. During the draw period, he makes just interest-only payments. If the interest rate is 6 percent, then the monthly payment is $500. Fast forward 10 years to the pay-down period. The borrower still has the $100,000 debt and five years to repay the loan. If the interest rate is 6 percent, then the monthly payment for principal and interest is $1,933 – nearly four times the draw payment. For many borrowers, such a massive additional monthly payment is unmanageable, leaving many with the belief that they are unable to repay the loan. The Experian study also revealed consumer behaviors in the HELOC end-of-draw universe: People delinquent on their HELOC are also more likely to be delinquent on other types of debt. If consumers are 90 days past due on their HELOC at end of draw, there is a 112 percent, 48.5 percent and 24 percent increase in delinquency on their mortgage, auto loan and credit cards, respectively People with HELOCs at end-of-draw are more likely to both close and open other HELOCs in the next 12 months That same group is also more likely to open or close a mortgage in the next 12 months. Now is the time to assess borrowers’ ability to repay their HELOC, and to give them solutions for repayment to minimize their payment stress. Identify borrowers with HELOCs nearing end of term and the loan terms to determine their potential payment stress Find opportunities to keep borrowers with the best credit quality. This could mean working with borrowers to extend the loan terms or providing payment flexibility Consider the opportunities. Consumers who have the ability to pay may also seek another HELOC as their loan comes to an end or they may shop for other credit products, such as a personal loan.

Fraudsters invited into bank branches The days of sending an invitation in the mail have for the most part gone by the wayside. Aside from special invitations for weddings and milestone anniversaries, electronic and email invitations have become the norm. However, one major party planner has refused to change practices — banks inviting fraudsters into their banking centers. As a fraud consultant I have the privilege of meeting many banking professionals, and I hear the same issues and struggles over and over again. It’s clear that the rapid increase of fraudulent account-opening applications are top of mind to many. What the executives making policy don’t realize is they’re facing fraud because they’re literally inviting the fraudsters into their branches. Think I’m exaggerating? Let me explain. I often encounter bank policymakers who explain their practice of directing a suspicious person into a banking center. Yes, many banks still direct applicants who cannot be properly verified over the phone or online into their banking center to show proof of identity. Directing or inviting criminals into your bank instead of trying to keep them out is an outdated, high-risk practice — what good can possibly come of it? The argument I typically hear from non-fraud banking professionals: “The bad guys know that if they come into the bank we will have them on film.” Other arguments include that the bad guys are not typically bold enough to actually come into the banking center or that their physical security guards monitor high-traffic banking centers. But often that is where bank policies and employee training ends. Based on my years of experience dealing with banks of all sizes, from the top three global card issuers to small regional banks, let me poke a few holes in the theory that it is a good deterrent to invite perpetrators into your banking center. Let’s role-play how my conversation goes: Me: “When an underwriter with limited fraud training making the decision to direct a suspicious applicant into a banking center, what is the policy criteria to do so?” Bank policymaker: (typical response) “What do you mean?” Me: “What high-risk authentication was used by the underwriter to make the decision to extend an invitation to a high-risk applicant to come into the banking center? If the applicant failed your high-risk authentication questions and you were not able to properly identify them, what authentication tools do the branch managers have that the underwriters do not?” Bank: “Nothing, but they can usually tell when someone is nervous or seems suspicious.” Me: “Then what training do they receive to identify suspicious behaviors?” (You guessed it …) Bank: “None.” (I then switch to the importance of customer experience.) Me: “How do you notify the banking center in advance that the suspicious applicant was invited to come in to provide additional verification?” Bank: “We do not have a policy to notify the banking center in advance.” Me: “What is considered acceptable documentation? And are banking center employees trained on how to review utility statements, state ID cards, drivers’ licenses or other accepted media?“ Bank: “We do not have a list of acceptable documentation that can be used for verification; it is up to the discretion of the banking center representative.” Me: “How do you ensure the physical safety of your employees and customers when you knowingly invite fraudsters and criminals into your banking center? How do you turn down or ask the suspicious person to leave because they do not have sufficient documentation to move forward with the original application for credit? If a suspicious person provides your employee with a possible stolen identification card, is that employee expected to keep it and notify police or return it to the applicant? Are employees expected to make a photocopy of the documentation provided?” The response that I usually receive is, “I am not really sure.” I hope by now you are seeing the risk of these types of outdated practices on suspicious credit applications. The fact is that technology has allowed criminals to make fairly convincing identification at a very low cost. If employees in banking centers are not equipped, properly trained, and well-documented procedures do not exist in your fraud program — perhaps it’s time to reconsider the practice or seek the advice of industry experts. I have spent two decades trying to keep bad guys out of banks, but I can’t help but wonder — why do some still send open invitations to criminals to come visit their bank? If you are not yet ready to stop this type of bad behavior, at the very least you must develop comprehensive end-to-end policies to properly handle such events. This fraud prevention tactic to invite perpetrators into banks was adopted long before the age of real-time decisions, robust fraud scores, big data, decision analytics, knowledge-based authentication, one-time passcodes, mobile banking and biometrics. The world we bank in has changed dramatically in the past five years; customers expect more and tolerate less. If a seamless customer experience and reducing account-opening and first-party fraud are part of your strategic plan, then it is time to consider Experian fraud solutions and consulting.

Time heals countless things, including credit scores. Many of the seven million people who saw their VantageScore® credit scores drop to sub-prime levels after suffering a foreclosure or short sale during the Great Recession have recovered and are back in the housing market. These Boomerang Buyers — people who foreclosed or short sold between 2007 and 2014 and have opened a new mortgage — will be an important segment of the real estate market in the coming years. According to Experian data, through June 2016 roughly 800,000 people had boomeranged, with Los Angeles, Phoenix, and Sacramento housing the most buyers. Some analysts believe more than three million Americans will become eligible for a home over the next three years. Are potential Boomerang Buyers a great opportunity to boost market share or a high risk for a portfolio? Early trends are positive. The majority of Boomerang Buyers who opened mortgages between 2011 and June 2016 are current on their debts. An Experian study revealed more than 29 percent of those who short sold have boomeranged, and just 1.5 percent are delinquent on their mortgage —falling below the national average of 2.8 percent. This group is also ahead of or even with the national average for delinquency on auto loans (1.2 percent vs. the national average of 2.2 percent), bankcards (3 percent vs. 4.3 percent) and retail (even at 2.7 percent). For those Boomerang Buyers who had foreclosed, the numbers are also strong. More than 12 percent have boomeranged, with just 3 percent delinquent on their mortgage. They also match or are below national average delinquency rates on auto loans (1.9 percent) and bankcards (4.1 percent), and have a slightly higher delinquency rate for retail (3.5 percent). Due to their positive credit behaviors, Boomerang Buyers also have higher VantageScore® credit scores than before. On average, the overall non-boomerang group’s credit score sunk during a foreclosure but went up 10 percent higher than before the foreclosure, and Boomerang Buyers rose by nearly 14 percent. For people who previously had a prime credit score, their number dropped by nearly 5 percent, while those who boomeranged returned to the score they had prior to the foreclosure. By comparison, the overall non-boomerang and boomerang group saw their credit score drop during a short sale and increase more than 11 percent from before the short sale. For people who previously had prime credit, they dropped 2 percent while those who boomeranged were almost flat to where they were before the short sale. Another part of the equation is the stabilized housing market and relatively low loan-to-value (LTV) limits that lenders have maintained. In the past, borrowers most often strategically defaulted on their mortgages when their LTV ratios were well over 100 percent. So as long as lenders maintain relatively low LTV limits and the housing market remains strong, strategic default is unlikely to re-emerge as a risk.

Experian estimates card-to-card consumer balance transfer activity to be between $35 and $40 billion a year, representing a sizeable opportunity for proactive lenders seeking to grow their revolving product line. This opportunity, however, is a threat for reactive lenders that only measure portfolio attrition instead of working to retain current customers. While billions of dollars are transferred every year, this activity represents only a small percentage of the total card population. And given the expense of direct marketing, lenders seeking to capitalize on and protect their portfolio from balance transfer activity must leverage data insights to make more informed decisions. Predicting a consumer’s future propensity to engage in card-to-card balance transfers starts with trended data. A credit score is a snapshot in time, but doesn’t reveal deep insights about a consumer’s past balance transfer activity. Lenders that rely only on current utilization will group large populations of balance revolvers into one bucket – and many of these individuals will have no intention of transferring to another product in the near future. Still, balance transfer activity can be identified and predicted by utilizing trended data. By analyzing the spend and payment data over time to see when one (or multiple) trade’s payment approximately matches another trade’s spend, we have the logic that suggests there has been a card-to-card transfer. What most people don’t realize is that trended data is difficult to work with. With 24 months of history on five fields, a single trade includes 120 data points. That’s 720 data points for a consumer with six trades on file and 72,000,000 for a file with 100,000 records, not to mention the other data fields in the file. It’s easy to see why even the most sophisticated organizations become paralyzed working with trended data. While teams of analysts get buried in the data, projects drag, costs swell, and eventually the world changes as rates climb and fall. By the time the analysis is complete, it must be recalibrated. But there is a solution. Experian has developed powerful predictions tools that combine past balance transfer history, historical transfer amounts, current trades carried and utilized, payments, and spend. Combined, these data fields can help identify consumers who are most likely to transfer a balance in the future. With Experian’s Balance Transfer Index the highest scoring 10 percent of consumers capture nearly 70 percent of total balance transfer dollars. Imagine the impact on ROI of reducing 90 percent of the marketing cost of your next balance transfer campaign and still reaching 70 percent of the balance transfer activity. Balance transfer activity represents a meaningful dollar opportunity for growth, but is concentrated in a small percentage of the population making predictive analytics key to success. Trended data is essential for identifying those opportunities, but financial institutions must assess their capabilities when it comes to managing the massive data attached. The good news is that regardless of financial institution size, solutions now exist to capture the analytics and provide meaningful and actionable insights to lenders of all sizes.

We are excited to announce that Experian Fraud and Identity Solutions is presenting at FinovateFall 2016! Finovate conferences showcase cutting-edge banking and financial technology in a unique demo-only format. Held twice a year, the conferences bring together the leaders from top financial institutions, fintech companies, investors from around the globe, and fintech media to share and promote the most innovative financial technology solutions. "Experian’s Fraud and Identity Solutions is a leader in customer-centric identity and fraud solutions, providing fraud management solutions to some of the world’s largest brands in financial services, insurance, and retail," said Adam Fingersh, general manager and senior vice president of Fraud and Identity Solutions in North America. "We will introduce our Fraud and Identity Solutions and promote our newly released CrossCore platform. CrossCore puts more control in the hands of fraud teams to adapt and deploy strategies that keep up with the pace of fraud while reducing burdens on IT and data science teams." Fingersh and John Sarreal, senior director of Fraud and Identity product management at Experian, are presenting the 7-minute demo focusing on the key CrossCore capabilities, and how CrossCore manages fraud and identity services through its flexible API; open, plug-and-play platform; and powerful workflow and strategy design capabilities. In Forrester’s 2016 “Vendor Landscape: Mobile Fraud Management”, Experian Fraud and Identity Solutions was cited as having the most capabilities and one of the highest estimated revenues in total fraud management in the market, between $200 million and $250 million. Join us for the event on September 8-9 in New York. Experian also has an exclusive 20% off discount code (Experian20FF16) to get even more savings! For more information on the event or to view videos of previous demos, please visit finovate.com.