Digital Technology

The challenges facing today’s marketers seem to be mounting and they can feel more pronounced for financial institutions. From customizing messaging and offerings at an individual customer level, increasing conversion rates, moving beyond digital while keeping an eye on traditional channels, and more, financial marketers are having to modernize their approach to customer acquisition. The most forward-thinking financial firms are turning to customer acquisition engines to help them best build, test and optimize their custom channel targeting strategies faster than ever before. But what functionality is right for your company? Here are 5 capabilities you should look for in a modern customer acquisition engine. Advanced Segmentation It’s without question that targeting and segmentation are vital to a successful financial marketing strategy. Make sure you select a tool that allows for advanced segmentation, ensuring the ability to uncover lookalike groups with similar attributes or behaviors and then customize messages or offerings accordingly. With the right customer acquisition engine, you should be able to build filters for targeted segments using a range of data including demographic, past behavior, loyalty or transaction history, offer response and then repurpose these segments across future campaigns. Campaign Design With the right campaign design, your team has the ability to greatly affect customer engagement. The right customer acquisition engine will allow your team to design a specific, optimized customer journey and content for each of the segments you create. When you’re ready to apply your credit criteria to the audience to generate a pre-screen, the best tools will allow you to view the size of your list adjusted in real-time. Make sure to look for an acquisition engine that can do all of this easily with a drag and drop user experience for faster and efficient campaign design. Rapid Deployment Once you finalize your audience for each channel or offer, the clock starts ticking. From bureau processing, data aggregation, targeting and deployment, the data that many firms are currently using for prospecting can be at least 60-days. When searching for a modern customer acquisition engine, make sure you choose a tool that gives you the option to fetch the freshest data (24-48 hours) before you deploy. If you’re sending the campaign to an outside firm to execute, timing is even more important. You’ll also want a system that can encrypt and decrypt lists to send to preferred partners to execute your marketing campaign. Support Whether you have an entire marketing department at your disposal or a lean, start-up style team, you’re going to want the highest level of support when it comes to onboarding, implementation and operational success. The best customer acquisition solution for your company will have a robust onboarding and support model in place to ensure client success. Look for solutions that offer hands-on instruction, flexible online or in-person training and analytical support. The best customer acquisition tool should be able to take your data and get you up and running in less than 30 days. Data, Data and more Data Any customer acquisition engine is only as good as the data you put into it. It should, of course, be able to include your own client data. However, relying exclusively on your own data can lead to incomplete analysis, missed opportunities and reduced impact. When choosing a customer acquisition engine, pick a system that gives your company access to the most local, regional and national credit data, in addition to alternative data and commercial data assets, on top of your own data. The optimum solutions can be fueled by the analytical power of full-file, archived tradeline data, along with attributes and models for the most robust results. Be sure your data partner has accounted for opt-outs, excludes data precluded by legal or regulatory restrictions and also anonymizes data files when linking your customer data. Data accuracy is also imperative here. Choose a marketing and technology partner who is constantly monitoring and correcting discrepancies in customer files across all bureaus. The best partners will have data accuracy rates at or above 99.9%.

In today’s ever-changing and hypercompetitive environment, the customer experience has taken center-stage – highlighting new expectations in the ways businesses interact with their customers. But studies show financial institutions are falling short. In fact, a recent study revealed that 94% of banking firms can’t deliver on the “personalization promise.” It’s not difficult to see why. Consumer preferences have changed, with many now preferring digital interactions. This has made it difficult for financial institutions to engage with consumers on a personal level. Nevertheless, customers expect seamless, consistent, and personalized experiences – that’s where the power of advanced analytics comes into play. It’s no secret that using advanced analytics can enable businesses to turn rich data into insights that lead to confident business decisions and strategy development. But these business tools can actually help financial institutions deliver on that promise of personalization. According to an Experian study, 90% of organizations say that embracing advanced analytics is critical to their ability to provide an excellent customer experience. By using data and analytics to anticipate and respond to customer behavior, companies can develop new and creative ways to cater to their audiences – revolutionizing the customer experience as a whole. It All Starts With Data Data is the foundation for a successful digital transformation – the lack of clean and cohesive datasets can hinder the ability to implement advanced analytic capabilities. However, 89% of organizations face challenges on how to effectively manage and consolidate their data, according to Experian’s Global Data Management Research Benchmark Report of 2019. Because consumers prefer digital interactions, companies have been able to gather a vast amount of customer data. Technology that uses advanced analytic capabilities (like machine learning and artificial intelligence) are capable of uncovering patterns in this data that may not otherwise be apparent, therefore opening doors to new avenues for companies to generate revenue. To start, companies need a strategy to access all customer data from all channels in a cohesive ecosystem – including data from their own data warehouses and a variety of different data sources. Depending on their needs, the data elements can come from a third party data provider such as: a credit bureau, alternative data, marketing data, data gathered during each customer contact, survey data and more. Once compiled, companies can achieve a more holistic and single view of their customer. With this single view, companies will be able to deliver more relevant and tailored experiences that are in-line with rising customer expectations. From Personalized Experiences to Predicting the Future The most progressive financial institutions have found that using analytics and machine learning to conquer the wide variety of customer data has made it easier to master the customer experience. With advanced analytics, these companies gain deeper insights into their customers and deliver highly relevant and beneficial offers based on the holistic views of their customers. When data is provided, technology with advanced analytic capabilities can transform this information into intelligent outputs, allowing companies to optimize and automate business processes with the customer in mind. Data, analytics and automation are the keys to delivering better customer experiences. Analytics is the process of converting data into actionable information so firms can understand their customers and take decisive action. By leveraging this business intelligence, companies can quickly adapt to consumer demand. Predictive models and forecasts, increasingly powered by machine learning, help lenders and other businesses understand risks and predict future trends and consumer responses. Prescriptive analytics help offer the right products to the right customer at the right time and price. By mastering all of these, businesses can be wherever their customers are. The Experian Advantage With insights into over 270 million customers and a wealth of traditional credit and alternative data, we’re able to drive prescriptive solutions to solve your most complex market and portfolio problems across the customer lifecycle – while reinventing and maintaining an excellent customer experience. If your company is ready for an advanced analytical transformation, Experian can help get you there. Learn More

AI, machine learning, and Big Data – these are no longer just buzzwords. The advanced analytics techniques and analytics-based tools that are available to financial institutions today are powerful but underutilized. And the 30% of banks, credit unions and fintechs successfully deploying them are driving better data-driven decisions, more positive customer experiences and stronger profitability. As the opportunities surrounding advanced analytics continue to grow, more lenders are eager to adopt these capabilities to make the most of their datasets. And it’s understandable that financial institution are excited at the possibilities and insights that advanced analytics can bring to their business. However, there are some key considerations to keep in mind as you begin this important digital transformation. Here are three things you should do as your financial institution begins its advanced analytics journey. Ensure consistent and clean data quality Companies have a plethora of data and information on their customers. The main hurdles that many organizations face is being able to turn this information into a clean and cohesive dataset and formulating an effective and long-term data management strategy. Trying to implement advanced analytic capabilities while lacking an effective data governance strategy is like building a house on a poor foundation – likely to fail. Data quality issues, such as inconsistent data, data gaps, and incomplete and duplicated data, also haunt many organizations, making it difficult to complete their analytics objectives. Ensuring that issues in data quality are managed is the key to gaining the correct insights for your business. Establish and maintain a single view of customers The power of advanced analytics can only be as strong as the data provided. Unfortunately, many companies don’t realize that advanced analytics is much more powerful when companies are able to establish a single view of their customers. Companies need to establish and maintain a single view of customers in order to begin implementing advanced analytic capabilities. According to Experian research, a single customer view is a consistent, accurate and holistic view of your organization’s customers, prospects, and their data. Having full visibility and a 360 view into your customers paves the way for companies to make personalized, relevant, timely and precise decisions. But as many companies have begun to realize, getting this single view of customers is easier said than done. Organizations need to make sure that data should always be up-to-date, unique and available in order to begin a complete digital transformation. Ensure the right resources and commitment for your advanced analytics initiative It’s important to have the top-down commitment within your organization for advanced analytics. From the C-suite down, everyone should be on the same page as to the value analytics will bring and the investment the project might require. Organizations that want to move forward with implementing advanced analytic capabilities need to make sure to set aside the right financial and human resources that will be needed for the journey. This may seem daunting, but it doesn’t have to be. A common myth is that the costs of new hardware, new hires and the costs required to maintain, configure, and set up new technology will make advanced analytics implementation far too expensive and difficult to maintain. However, many organizations don’t realize that it’s not necessary to allocate large capital expenses to implement advanced analytics. All it takes is finding the right-sized solution with configurations to fit the team size and skill level in your organization. Moreover, finding the right partner and team (whether internal or external) can be an efficient way to fill temporary skills gaps on your team. No digital transformation initiative is without its challenges. However, beginning your advanced analytics journey on the right footing can deliver unparalleled growth, profitability and opportunities. Still not sure where to begin? At Experian, we offer a wide range of solutions to help you harness the full power and potential of data and analytics. Our consultants and development teams have been a game-changer for financial institutions, helping them get more value, insight and profitability out of their data and modeling than ever before. Learn More

It’s Halloween time – time for trick or treating, costume parties and monsters lurking in the background. But this year, the monsters aren’t just in the background. They’re in your portfolio. This year, “Frankenstein” has another meaning. Much more ominous than the neighbor kid in the costume. “Frankenstein IDs” refer to synthetic identities — a type of fraud carried out by criminals that have created fictitious identities. Just as Dr. Frankenstein’s monster was stitched together from parts, synthetic IDs are stitched together pieces of mismatched identities — some fake, some real, some even deceased. It typically takes fraudsters 12 to 18 months to create and nurture a synthetic identity before it’s ready to "bust out" – the act of building a credit history with the intent of maxing out all available credit and eventually disappearing. That means fraudsters are investing money and time to build numerous tradelines, ensure these "fake" identities are in good credit standing, and ultimately steal the largest amount of money possible. “Wait Master, it might be dangerous . . . you go, first.” — Igor Synthetic identities are a notable challenge for many financial institutions and retail organizations. According to the recently released Federal Reserve Board White Paper, synthetic identity fraud accounts for roughly 20% of all credit losses, and cost U.S. businesses roughly $6 billion in 2016 with an estimated 41% growth over 2 years. 85-95% of applicants identified as potential synthetic are not even flagged by traditional fraud models. The Social Security Administration recently announced plans for the electronic Consent Based Social Security Number Verification service – pilot program scheduled for June 2020. This service is designed to bring efficiency to the process for verifying Social Security numbers directly with the government agency. Once available, this verification could be an important tool in the fight against the elusive “Frankenstein” identity monster. But with the Social Security Administration's pilot program not scheduled for launch until the middle of next year, how can financial institutions and other organizations bridge the gap and adequately prepare for a potential uptick in synthetic identity fraud attacks? It comes down to a multilayered approach that relies on advanced data, analytics, and technology — and focuses on identity. Any significant progress in making synthetic identities easier to detect could cost fraudsters significant time and money. Far too many financial institutions and other organizations depend solely on basic demographic information and snapshots in time to confirm the legitimacy of an identity. These organizations need to think beyond those capabilities. The real value of data in many cases lies between the data points. We have seen this with synthetic identity — where a seemingly legitimate identity only shows risk when we can analyze its connections and relationships to other individuals and characteristics. In addition to our High Risk Fraud Score, we now have a Synthetic Fraud Risk Level Indicator available on credit profiles. These advanced detection capabilities are delivered via the simplicity of a straightforward indicator returned on the credit profile which lenders can use to trigger additional identity verification processes. While there are programs and initiatives in the works to help financial institutions and other organizations combat synthetic identity fraud, it's important to keep in mind there's no silver bullet, or stake to the heart, to completely keep these Frankenstein IDs out. Oh, and don’t forget… “It’s pronounced ‘Fronkensteen.’ ” — Dr. Frankenstein

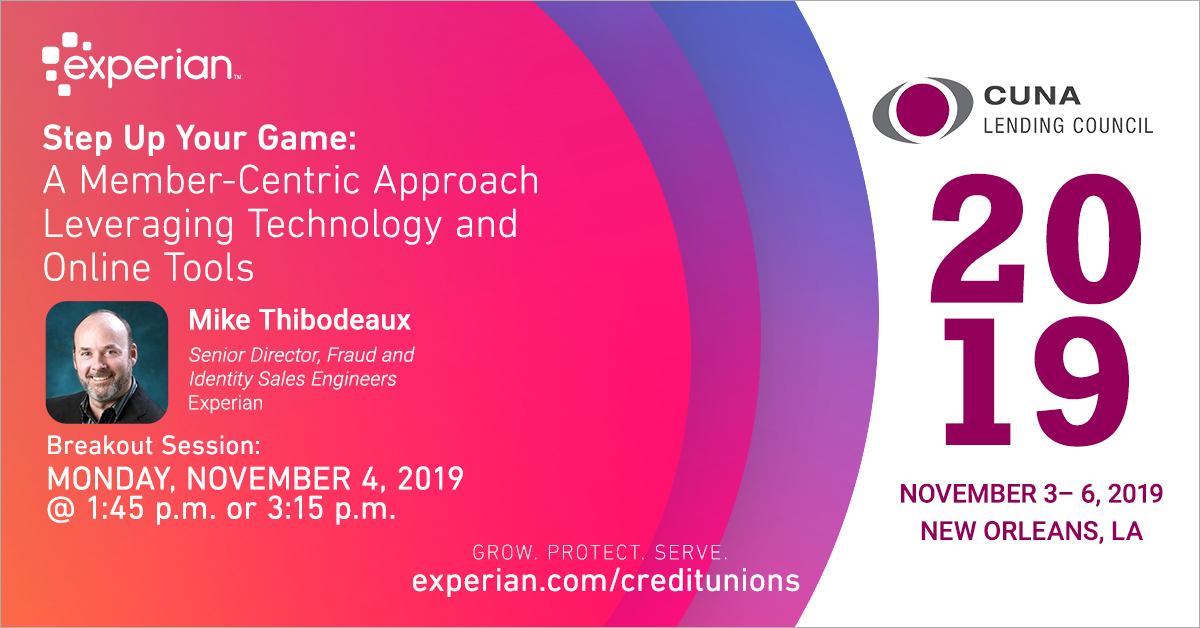

As credit unions look to grow their loan portfolios and acquire new members, improving the member experience is critical to the process and remains a primary focus. In order to compete in the lending universe, financial tools that empower and enable a positive experience are critical to meeting these requirements. That being said, an Experian study reveals that 90% of executives agree that embracing a digital transformation is critical to providing excellent experiences. In this connected, data-driven world, digital transformations are opening the door for better and greater opportunities. With data and analytics, credit unions will be able to gain data-driven insights, to identify key channels of member engagement, create complete member views and further maximize growth and lending strategies. Data-driven organizations that can anticipate their members’ needs and preferences will be able to deepen relationships and maintain relevance – gaining an edge in a highly-competitive environment. The digital revolution is happening now – and it’s time for future-focused credit unions to adapt to changing expectations. However, according to an Experian report, 39% of organizations lack the customer insight and data required to provide these member experiences. That’s where Experian comes in. Join Mike Thibodeaux, Experian’s Senior Director, Fraud and Identity Sales Engineers, for a breakout session at CUNA Lending 2019 on Monday, Nov. 4 at 1:45 p.m. or 3:15 p.m. He will take a closer look at best practices and digital tools that credit unions can use to maximize credit union membership growth, while managing and mitigating fraud. The discussion will revolve around multiple topics, critical to the member experience conversation, including: Increasing profitable loan growth Lending deeper to the underserved Levering digital services and tools for your credit union Minimizing fraud activity (specifically synthetic identity fraud) and credit losses Enhancing and maintaining positive member experiences Experian is excited to once again take part in the 2019 CUNA Lending Council Conference, an event that brings together the credit union movement’s best and brightest in lending. If you’re attending, make sure to engage and connect with our thought leaders at our booth and learn how we’re dedicated to helping credit unions of all sizes advance their decisioning and services. Our team is committed to being a trusted partner – providing solutions that enable you to further grow, protect and serve within your field of membership. Learn More

Over the years, businesses have gathered a plethora of datasets on their customers. However, there is no value in data alone. The true value comes from the insights gained and actions that can be derived from these datasets. Advanced analytics is the key to understanding the data and extracting the critical information needed to unlock these insights. AI and machine learning in particular, are two emerging technologies with advanced analytics capabilities that can help companies achieve their business goals. According to an IBM survey, 61% of company executives indicated that machine learning and AI are their company’s most significant data initiatives in 2019. These leaders recognize that advanced analytics is transforming the way companies traditionally operate. It is no longer just a want, but a must. With a proper strategy, advanced analytics can be a competitive differentiator for your financial institution. Here are some ways that advanced analytics can empower your organization: Provide Personalized Customer Experiences Business leaders know that their customers want personalized, frictionless and enhanced experiences. That’s why improving the customer experience is the number one priority for 80 percent of executives globally, according to an Experian study. The data is already there – companies have insights into what products their customers like, the channels they use to communicate, and other preferences. By utilizing the capabilities of advanced analytics, companies can extract more value from this data and gain better insights to help create more meaningful, personalized and profitable lending decisions. Reduce Costs Advanced analytics allows companies to deploy new models and strategies more efficiently – reducing expenses associated with managing models for multiple lending products and bureaus. For example, OneMain Financial, was able to successfully drive down risk modeling expenses after implementing a solution with advanced analytics capabilities. Improve Accuracy and Speed to Market To stay ahead of the competition, companies need to maintain fast-moving environments. The speed, accuracy and power of a company’s predictive models and forecasts are crucial for success. Being able to respond to changing market conditions with insights derived from advanced analytics is a key differentiator for future-forward companies. Advanced analytic capabilities empower companies to anticipate new trends and drive rapid development and deployment, creating an agile environment of continual improvement. Drive Growth and Expand Your Customer Base With the rise of AI, machine learning and big data, the opportunities to expand the credit universe is greater than ever. Advanced analytic capabilities allow companies to scale datasets and get a bird’s eye view into a consumer’s true financial position – regardless of whether they have a credit history. The insights derived from advanced analytics opens doors for thin file or credit invisible customers to be seen – effectively allowing lenders to expand their customer base. Meet Compliance Requirements Staying on top of model risk and governance should always remain top of mind for any institution. Analytical processing aggregates and pulls new information from a wide range of data sources, allowing your institution to make more accurate and faster decisions. This enables lenders to lend more fairly, manage models that stand up to regulatory scrutiny, and keep up with changes in reporting practices and regulations. Better, faster and smarter decisions. It all starts with advanced analytics. Businesses must take advantage of the opportunities that come with implementing advanced analytics, or risk losing their customers to more future-forward organizations. At Experian, we believe that using big data can help power opportunities for your company. Learn how we can help you leverage your data faster and more effectively. Learn More

To provide consumers with clear-cut protections against disturbance by debt collectors, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA) earlier this year. Among many other things, the proposal would set strict limits on the number of calls debt collectors may place to reach consumers weekly and clarify requirements for consumer-facing debt collection disclosures. A bigger discussion Deliberation of the debt collection proposal was originally scheduled to begin on August 18, 2019. However, to allow commenters to further consider the issues raised in the NPRM and gather data, the comment period was extended by 20 days to September 18, 2019. It is currently still being debated, as many argue that the proposed rule does not account for modern consumer preferences and hinders the free flow of information used to help consumers access credit and services. The Association of Credit and Collection Professionals (ACA International) and US House lawmakers continue to challenge the proposal, stating that it doesn’t ensure that debt collectors’ calls to consumers are warranted, nor does it do enough to protect consumers’ privacy. Many consumer advocates have expressed doubts about how effective the proposed measures will be in protecting debtors from debt collector harassment and see the seven-calls-a-week limit on phone contact as being too high. In fact, it’s difficult to find a group of people in full support of the proposal, despite the CFPB stating that it will help clarify the FDCPA, protect lenders from litigation and bring consumer protection regulation into the 21st century. What does this mean? Although we don’t know when, or if, the proposed rule will go into effect, it’s important to prepare. According to the Federal Register, there are key ways that the new regulation would affect debt collection through the use of newer technologies, required disclosures and limited consumer contact. Not only will the proposed rules apply to debt collectors, but its provisions will also impact creditors and servicers, making it imperative for everyone in the financial services space to keep watch on the regulation’s status and carefully analyze its proposed rules. At Experian, our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to connect with consumers while staying compliant. Our best-in-class data and analytics will play a key role in helping you reach the right consumer, in the right place, at the right time. Learn more

Retail banking leaders in a variety of industries (including risk management, credit, information technology and other departments) want to incorporate more data into their business strategies. By doing so, consumer banks and other financial companies benefit by expanding their markets, controlling risk, improving compliance and the customer experience. However, many companies don’t know how or where to start. The challenges? There’s just too much data – and it’s overwhelming. Technical integration issues Maintaining regulatory data and attribute governance and compliance The slow speed of adoption Join Jim Bander, PhD, analytics and optimization leader at Experian, in an upcoming webinar with the Consumer Bankers Association on Tuesday, Oct. 1, 2019 at 9:00-10:00 a.m. PT. The webinar will discuss how some of the country’s best banks – big and small – are making better, faster and more profitable decisions by using the right set of data sources, while avoiding data overload. Key topics will include: Technology Trends: Discover how the latest technology, including the cloud and machine learning, makes it easier than ever to access data, define and manage attributes throughout the enterprise and perform complex calculations in real time. Time to Market: Discover how consumer banks and other financial companies that have mastered data and attribute management are able to integrate data and attributes quickly and seamlessly. Business Benefits: Understand how advanced analytics helps financial institutions of all sizes make better business decisions. This includes growing their portfolios, mitigating fraud and credit risk, controlling operating expenses, improving compliance and enhancing the customer experience. Critical Success Factors: Learn how to stay ahead of ever-evolving business and data requirements and continuously improve your lending operations. Join us as we unveil the secrets to avoiding data overload in consumer banking. Special Offer For non-current CBA members, this webinar costs $95 to attend. However, with special discount code: EX1001, non-CBA members can attend for FREE. Register Now

The future is, factually speaking, uncertain. We don't know if we'll find a cure for cancer, the economic outlook, if we'll be living in an algorithmic world or if our work cubical mate will soon be replaced by a robot. While futurists can dish out some exciting and downright scary visions for the future of technology and science, there are no future facts. However, the uncertainty presents opportunity. Technology in today's world From the moment you wake up, to the moment you go back to sleep, technology is everywhere. The highly digital life we live and the development of our technological world have become the new normal. According to The International Telecommunication Union (ITU), almost 50% of the world's population uses the internet, leading to over 3.5 billion daily searches on Google and more than 570 new websites being launched each minute. And even more mind-boggling? Over 90% of the world's data has been created in just the last couple of years. With data growing faster than ever before, the future of technology is even more interesting than what is happening now. We're just at the beginning of a revolution that will touch every business and every life on this planet. By 2020, at least a third of all data will pass through the cloud, and within five years, there will be over 50 billion smart connected devices in the world. Keeping pace with digital transformation At the rate at which data and our ability to analyze it are growing, businesses of all sizes will be forced to modify how they operate. Businesses that digitally transform, will be able to offer customers a seamless and frictionless experience, and as a result, claim a greater share of profit in their sectors. Take, for example, the financial services industry - specifically banking. Whereas most banking used to be done at a local branch, recent reports show that 40% of Americans have not stepped through the door of a bank or credit union within the last six months, largely due to the rise of online and mobile banking. According to Citi's 2018 Mobile Banking Study, mobile banking is one of the top three most-used apps by Americans. Similarly, the Federal Reserve reported that more than half of U.S. adults with bank accounts have used a mobile app to access their accounts in the last year, presenting forward-looking banks with an incredible opportunity to increase the number of relationship touchpoints they have with their customers by introducing a wider array of banking products via mobile. Be part of the movement Rather than viewing digital disruption as worrisome and challenging, embrace the uncertainty and potential that advances in new technologies, data analytics and artificial intelligence will bring. The pressure to innovate amid technological progress poses an opportunity for us all to rethink the work we do and the way we do it. Are you ready? Learn more about powering your digital transformation in our latest eBook. Download eBook Are you an innovation junkie? Join us at Vision 2020 for future-facing sessions like: - Cloud and beyond - transforming technologies - ML and AI - real-world expandability and compliance

In today’s age of digital transformation, consumers have easy access to a variety of innovative financial products and services. From lending to payments to wealth management and more, there is no shortage in the breadth of financial products gaining popularity with consumers. But one market segment in particular – unsecured personal loans – has grown exceptionally fast. According to a recent Experian study, personal loan originations have increased 97% over the past four years, with fintech share rapidly increasing from 22.4% of total loans originated to 49.4%. Arguably, the rapid acceleration in personal loans is heavily driven by the rise in digital-first lending options, which have grown in popularity due to fintech challengers. Fintechs have earned their position in the market by leveraging data, advanced analytics and technology to disrupt existing financial models. Meanwhile, traditional financial institutions (FIs) have taken notice and are beginning to adopt some of the same methods and alternative credit approaches. With this evolution of technology fused with financial services, how are fintechs faring against traditional FIs? The below infographic uncovers industry trends and key metrics in unsecured personal installment loans: Still curious? Click here to download our latest eBook, which further uncovers emerging trends in personal loans through side-by-side comparisons of fintech and traditional FI market share, portfolio composition, customer profiles and more. Download now

Experian has been named one of the 10 participants, and only credit bureau, in the initial rollout of the SSA's new eCBSV service.

Today is National Fintech Day – a day that recognizes the ever-important role that fintech companies play in revolutionizing the customer experience and altering the financial services landscape. Fintech. The word itself has become synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. Fintech challengers are disrupting existing financial models by leveraging data, advanced analytics and technology – both inspiring traditional financial institutions in their digital transformation strategies and giving consumers access to a variety of innovative financial products and services. But to us at Experian, National Fintech Day means more than just financial disruption. National Fintech Day represents the partnerships we have carefully fostered with our fintech clients to drive financial inclusion for millions of people around the globe and provide consumers with greater control and more opportunities to access the quality credit they deserve. “We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can’t do it alone,” said Experian North American CEO, Craig Boundy in a recent blog article on Experian’s fintech partnerships. “That’s why over the last year, we have built out an entire team of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We’ve made significant strides that will help us pave the way for the next generation of lending while improving the financial health of people around the world.” At Experian, we understand the challenges fintechs face – and our real-world solutions help fintech clients stay ahead of constantly changing market conditions and demands. “Experian’s pace of innovation is very impressive – we are helping both lenders and consumers by delivering technological solutions that make the lending ecosystem more efficient,” said Experian Senior Account Executive Warren Linde. “Financial technology is arguably the most important type of tech out there, it is an honor to be a part of Experian’s fintech team and help to create a better tomorrow.” If you’d like to learn more about Experian’s fintech solutions, visit us at Experian.com/Fintech.

Earlier this year, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA). The proposal, which will go into deliberation in September and won't be finalized until after that date at the earliest, would provide consumers with clear-cut protections against disturbance by debt collectors and straightforward options to address or dispute debts. Additionally, the NPRM would set strict limits on the number of calls debt collectors may place to reach consumers weekly, as well as clarify how collectors may communicate lawfully using technologies developed after the FDCPA’s passage in 1977. So, what does this mean for collectors? The compliance conundrum is ever present, especially in the debt collection industry. Debt collectors are expected to continuously adapt to changing regulations, forcing them to spend time, energy and resources on maintaining compliance. As the most recent onslaught of developments and proposed new rules have been pushed out to the financial community, compliance professionals are once again working to implement changes. According to the Federal Register, here are some key ways the new regulation would affect debt collection: Limited to seven calls: Debt collectors would be limited to attempting to reach out to consumers by phone about a specific debt no more than seven times per week. Ability to unsubscribe: Consumers who do not wish to be contacted via newer technologies, including voicemails, emails and text messages must be given the option to opt-out of future communications. Use of newer technologies: Newer communication technologies, such as emails and text messages, may be used in debt collection, with certain limitations to protect consumer privacy. Required disclosures: Debt collectors will be obligated to send consumers a disclosure with certain information about the debt and related consumer protections. Limited contact: Consumers will be able to limit ways debt collectors contact them, for example at a specific telephone number, while they are at work or during certain hours. Now that you know the details, how can you prepare? At Experian, we understand the importance of an effective collections strategy. Our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to reach consumers while staying compliant. Powerful locating solution: Locate past-due consumers more accurately, efficiently and effectively. TrueTraceSM adds value to each contact by increasing your right-party contact rate. Exclusive contact information: Mitigate your compliance risk with a seamless and unparalleled solution. With Phone Number IDTM, you can identify who a phone is registered to, the phone type, carrier and the activation date. If you aren’t ready for the new CFPB regulation, what are you waiting for? Learn more Note: Click here for an update on the CFPB's proposal.

Big Data, once thought to be overhyped consultant-speak, is now a term and business model so ubiquitous it underpins billions of dollars in revenue across nearly every industry. Similarly, the advanced analytics derived from big data are key to staying relevant in an everchanging global economy and to consumers with expanding expectations. But for many financial institutions, using big data and advanced analytics seemed to only be in reach for big banks with large, advanced data teams. With the expansion of the Experian Ascend Technology PlatformTM, the conversation is changing. Financial institutions of all sizes can now leverage advanced analytics, artificial intelligence and machine learning with new configurations in the award-winning platform. In a release earlier this week, Experian announced new tools and configurations in the Ascend Analytical SandboxTM to fit teams of every size and skill level. Now fintechs, banks and credit unions of every size can have access to Experian’s one-stop source for advanced analytics, business intelligence and ultimately, better decisions. The secure hybrid-cloud environment allows users to combine their own data sets with Experian’s exclusive data assets, including credit, alternative, commercial, auto and more. From there, users can build and test models across different stages of the lending cycle, including originations, prescreen, account management and collections, and seamlessly put their models into production. Experian’s Ascend Analytical Sandbox also allows users to benchmark their portfolios against the industry, identify credit trends and explore new product opportunities. All the insights gathered through the Ascend Analytical Sandbox can be viewed and shared through interactive dashboards and customizable reports that can be pulled in near real time. Additional use cases include: Reject inferencing – refine models, scorecards and strategies by analyzing trades opened by previous applicants who were rejected or approved but did not move forward Prescreen campaigns – design prescreen campaigns, evaluate results and improve strategies Cross-sell – identify cross-sell opportunities for existing customers and identify how they may be working with other lenders Collections strategies, stress testing and loss forecasting – build stronger models to identify customers that have ability and willingness to pay debts, stress test and forecast loss Peer benchmarking and industry trends – compare current portfolio against peers and the industry Recession planning – identify areas to adjust your portfolio to prepare for an economic downturn OneMain Financial, a large provider of personal installment loans serving 10 million total customers across more than 1,700 branches, turned to Experian to improve its risk modeling and credit portfolio management capabilities with the Ascend Analytical Sandbox. Since using the solution, the company has seen significant improvements in reject inferencing – a process that is traditionally expensive, manually-intensive and time consuming. According to OneMain Financial, the Ascend Analytical Sandbox has shortened the process to less than two weeks from up to 180 days. "Experian's Ascend Technology Platform and Analytical Sandbox is an industry gamechanger," said Michael Kortering, OneMain Financial's Senior Managing Director and Head of Model Development. "We're completing analyses that just weren't possible before and we're getting decisions to our clients faster, without compromising risk.” For more information on Ascend Analytical Sandbox SX – the latest solution for financial institutions of all sizes – or other enterprise-wide capabilities of the Experian Ascend Technology Platform, click here.

The fact that the last recession started right as smartphones were introduced to the world gives some perspective into how technology has changed over the past decade. Organizations need to leverage the same technological advancements, such as artificial intelligence and machine learning, to improve their collections strategies. These advanced analytics platforms and technologies can be used to gauge customer preferences, as well as automate the collections process. When faced with higher volumes of delinquent loans, some organizations rapidly hire inexperienced staff. With new analytical advancements, organizations can reduce overhead and maintain compliance through the collections process. Additionally, advanced analytics and technology can help manage customers throughout the customer life cycle. Let’s explore further: Why use advanced analytics in collections? Collections strategies demand diverse approaches, which is where analytics-based strategies and collections models come into play. As each customer and situation differs, machine learning techniques and constraint-based optimization can open doors for your organization. By rethinking collections outreach beyond static classifications (such as the stage of account delinquency) and instead prioritizing accounts most likely to respond to each collections treatment, you can create an improved collections experience. How does collections analytics empower your customers? Customer engagement, carefully considered, perhaps comprises the most critical aspect of a collections program—especially given historical perceptions of the collections process. Experian recently analyzed the impact of traditional collections methods and found that three percent of card portfolios closed their accounts after paying their balances in full. And 75 percent of those closures occurred shortly after the account became current. Under traditional methods, a bank may collect outstanding debt but will probably miss out on long-term customer loyalty and future revenue opportunities. Only effective technology, modeling and analytics can move us from a linear collections approach towards a more customer-focused treatment while controlling costs and meeting other business objectives. Advanced analytics and machine learning represent the most important advances in collections. Furthermore, powerful digital innovations such as better criteria for customer segmentation and more effective contact strategies can transform collections operations, while improving performance and raising customer service standards at a lower cost. Empowering consumers in a digital, safe and consumer-centric environment affects the complete collections agenda—beginning with prevention and management of bad debt and extending through internal and external account resolution. When should I get started? It’s never too early to assess and modernize technology within collections—as well as customer engagement strategies—to produce an efficient, innovative game plan. Smarter decisions lead to higher recovery rates, automation and self-service tools reduce costs and a more comprehensive customer view enhances relationships. An investment today can minimize the negative impacts of the delinquency challenges posed by a potential recession. Collections transformation has already begun, with organizations assembling data and developing algorithms to improve their existing collections processes. In advance of the next recession, two options present themselves: to scramble in a reactive manner or approach collections proactively. Which do you choose? Get started