Market Trends

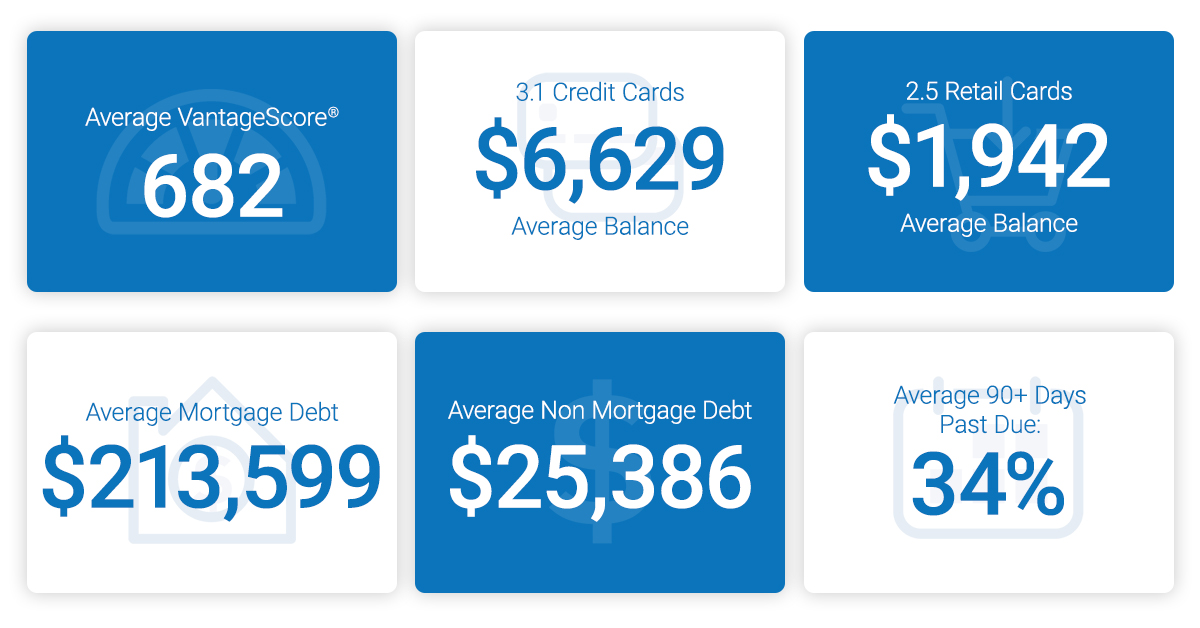

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Fintech is quickly changing. The word itself is synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. The rapid rate at which fintech challengers are becoming established, is in turn, allowing for greater consumer awareness and adoption of fintech platforms. It would be easy to assume that fintech adoption is predominately driven by millennials. However, according to a recent market trend analysis by Experian, adoption is happening across multiple generational segments. That said, it’s important to note the generational segments that represent the largest adoption rates and growth opportunities for fintechs. Here are a few key stats: Members of Gen Y (between 24-37 years old) account for 34.9% of all fintech personal loans, compared to just 24.9% for traditional financial institutions. A similar trend is seen for Gen Z (between 18-23 years old). This group accounts for 5% of all fintech personal loans as compared to 3.1% for traditional Let’s take a closer look at these generational segments… Gen Y represents approximately 19% of the U.S. population. These consumers, often referred to as “millennials,” can be described as digital-centric, raised on the web and luxury shoppers. In total, millennials spend about $600 billion a year. This group has shown a strong desire to improve their credit standing and are continuously increasing their credit utilization. Gen Z represents approximately 26% of the U.S. population. These consumers can be described as digital centric, raised on the social web and frugal. The Gen Z credit universe is growing, presenting a large opportunity to lenders, as the youngest Gen Zers become credit eligible and the oldest start to enter homeownership. What about the underbanked as a fintech opportunity? The CFPB estimates that up to 45 million people, or 24.2 million households, are “thin-filed” or underbanked, meaning they manage their finances through cash transactions and not through financial services such as checking and savings accounts, credit cards or loans. According to Angela Strange, a general partner at Andreessen Horowitz, traditional financial institutions have done a poor job at serving underbanked consumers affordable products. This has, in turn, created a trillion-dollar market opportunity for fintechs offering low-cost, high-tech financial services. Why does all this matter? Fintechs have a unique opportunity to engage, nurture and grow these market segments early on. As the fintech marketplace heats up and the overall economy begins to soften, diversifying revenue streams, building loyalty and tapping into new markets is a strategic move. But what are the best practices for fintechs looking to build trust, engage and retain these unique consumer groups? Join us for a live webinar on November 12 at 10:00 a.m. PST to hear Experian experts discuss financial inclusion trends shaping the fintech industry and tactical tips to create, convert and extend the value of your ideal customers. Register now

Retailers are already starting to display their Christmas decorations in stores and it’s only early November. Some might think they are putting the cart ahead of the horse, but as I see this happening, I’m reminded of the quote by the New York Yankee’s Yogi Berra who famously said, “It gets late early out there.” It may never be too early to get ready for the next big thing, especially when what’s coming might set the course for years to come. As 2019 comes to an end and we prepare for the excitement and challenges of a new decade, the same can be true for all of us working in the lending and credit space, especially when it comes to how we will approach the use of alternative data in the next decade. Over the last year, alternative data has been a hot topic of discussion. If you typed “alternative data and credit” into a Google search today, you would get more than 200 million results. That’s a lot of conversations, but while nearly everyone seems to be talking about alternative data, we may not have a clear view of how alternative data will be used in the credit economy. How we approach the use of alternative data in the coming decade is going to be one of the most important decisions the lending industry makes. Inaction is not an option, and the time for testing new approaches is starting to run out – as Yogi said, it’s getting late early. And here’s why: millennials. We already know that millennials tend to make up a significant percentage of consumers with so-called “thin-file” credit reports. They “grew up” during the Great Recession and that has had a profound impact on their financial behavior. Unlike their parents, they tend to have only one or two credit cards, they keep a majority of their savings in cash and, in general, they distrust financial institutions. However, they currently account for more than 21 percent of discretionary spend in the U.S. economy, and that percentage is going to expand exponentially in the coming decade. The recession fundamentally changed how lending happens, resulting in more regulation and a snowball effect of other economic challenges. As a result, millennials must work harder to catch up financially and are putting off major life milestones that past generations have historically done earlier in life, such as homeownership. They more often choose to rent and, while they pay their bills, rent and other factors such as utility and phone bill payments are traditionally not calculated in credit scores, ultimately leaving this generation thin-filed or worse, credit invisible. This is not a sustainable scenario as we enter the next decade. One of the biggest market dynamics we can expect to see over the next decade is consumer control. Consumers, especially millennials, want to be in the driver’s seat of their “credit journey” and play an active role in improving their financial situations. We are seeing a greater openness to providing data, which in turn enables lenders to make more informed decisions. This change is disrupting the status quo and bringing new, innovative solutions to the table. At Experian, we have been testing how advanced analytics and machine learning can help accelerate the use of alternative data in credit and lending decisions. And we continue to work to make the process of analyzing this data as simple as possible, making it available to all lenders in all verticals. To help credit invisible and thin-file consumers gain access to fair and affordable credit, we’ve recently announced Experian Lift, a new suite of credit score products that combines exclusive traditional credit, alternative credit and trended data assets to create a more holistic picture of consumer creditworthiness that will be available to lenders in early 2020. This new Experian credit score may improve access to credit for more than 40 million credit invisibles. There are more than 100 million consumers who are restricted by the traditional scoring methods used today. Experian Lift is another step in our commitment to helping improve financial health of consumers everywhere and empowers lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. This isn’t just a trend in the United States. Brazil is using positive data to help drive financial inclusion, as are others around the world. As I said, it’s getting late early. Things are moving fast. Already we are seeing technology companies playing a bigger role in the push for alternative data – often powered by fintech startups. At the same time, there also has been a strong uptick in tech companies entering the banking space. Have you signed up for your Apple credit card yet? It will take all of 15 seconds to apply, and that’s expected to continue over the next decade. All of this is changing how the lending and credit industry must approach decision making, while also creating real-time frictionless experiences that empower the consumer. We saw this with the launch of Experian Boost earlier this year. The results speak for themselves: hundreds of thousands of previously thin-file consumers have seen their credit scores instantly increase. We have also empowered millions of consumers to get more control of their credit by using Experian Boost to contribute new, positive phone, cable and utility payment histories. Through Experian Boost, we’re empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we’re empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. That’s game-changing. Disruptions like Experian Boost and newly announced Experian Lift are going to define the coming decade in credit and lending. Our industry needs to be ready because while it may seem early, it’s getting late.

It seems like artificial intelligence (AI) has been scaring the general public for years – think Terminator and SkyNet. It’s been a topic that’s all the more confounding and downright worrisome to financial institutions. But for the 30% of financial institutions that have successfully deployed AI into their operations, according to Deloitte, the results have been anything but intimidating. Not only are they seeing improved performance but also a more enhanced, positive customer experience and ultimately strong financial returns. For the 70% of financial institutions who haven’t started, are just beginning their journey or are in the middle of implementing AI into their operations, the task can be daunting. AI, machine learning, deep learning, neural networks—what do they all mean? How do they apply to you and how can they be useful to your business? It’s important to demystify the technology and explain how it can present opportunities to the financial industry as a whole. While AI seems to have only crept into mainstream culture and business vernacular in the last decade, it was first coined by John McCarthy in 1956. A researcher at Dartmouth, McCarthy thought that any aspect of learning or intelligence could be taught to a machine. Broadly, AI can be defined as a machine’s ability to perform cognitive functions we associate with humans, i.e. interacting with an environment, perceiving, learning and solving problems. Machine learning vs. AI Machine learning is not the same thing as AI. Machine learning is the application of systems or algorithms to AI to complete various tasks or solve problems. Machine learning algorithms can process data inputs and new experiences to detect patterns and learn how to make the best predictions and recommendations based on that learning, without explicit programming or directives. Moreover, the algorithms can take that learning and adapt and evolve responses and recommendations based on new inputs to improve performance over time. These algorithms provide organizations with a more efficient path to leveraging advanced analytics. Descriptive, predictive, and prescriptive analytics vary in complexity, sophistication, and their resulting capability. In simplistic terms, descriptive algorithms describe what happened, predictive algorithms anticipate what will happen, and prescriptive algorithms can provide recommendations on what to do based on set goals. The last two are the focus of machine learning initiatives used today. Machine learning components - supervised, unsupervised and reinforcement learning Machine learning can be broken down further into three main categories, in order of complexity: supervised, unsupervised and reinforcement learning. As the name might suggest, supervised learning involves human interaction, where data is loaded and defined and the relationship to inputs and outputs is defined. The algorithm is trained to find the relationship of the input data to the output variable. Once it delivers accurately, training is complete, and the algorithm is then applied to new data. In financial services, supervised learning algorithms have a litany of uses, from predicting likelihood of loan repayment to detecting customer churn. With unsupervised learning, there is no human engagement or defined output variable. The algorithm takes the input data and structures it by grouping it based on similar characteristics or behaviors, without a defined output variable. Unsupervised learning models (like K-means and hierarchical clustering) can be used to better segment or group customers by common characteristics, i.e. age, annual income or card loyalty program. Reinforcement learning allows the algorithm more autonomy in the environment. The algorithm learns to perform a task, i.e. optimizing a credit portfolio strategy, by trying to maximize available rewards. It makes decisions and receives a reward if those actions bring the machine closer to achieving the total available rewards, i.e. the highest acquisition rate in a customer category. Over time, the algorithm optimizes itself by correcting actions for the best outcomes. Even more sophisticated, deep learning is a category of machine learning that involves much more complex architecture where software-based calculators (called neurons) are layered together in a network, called a neural network. This framework allows for much broader, complex data ingestion where each layer of the neural network can learn progressively more complex elements of the data. Object classification is a classic example, where the machine ‘learns’ what a duck looks like and then is able to automatically identify and group images of ducks. As you might imagine, deep learning models have proved to be much more efficient and accurate at facial and voice recognition than traditional machine learning methods. Whether your financial institution is already seeing the returns for its AI transformation or is one of the 61% of companies investing in this data initiative in 2019, having a clear picture of what is available and how it can impact your business is imperative. How do you see AI and machine learning impacting your customer acquisition, underwriting and overall customer experience?

It’s Halloween time – time for trick or treating, costume parties and monsters lurking in the background. But this year, the monsters aren’t just in the background. They’re in your portfolio. This year, “Frankenstein” has another meaning. Much more ominous than the neighbor kid in the costume. “Frankenstein IDs” refer to synthetic identities — a type of fraud carried out by criminals that have created fictitious identities. Just as Dr. Frankenstein’s monster was stitched together from parts, synthetic IDs are stitched together pieces of mismatched identities — some fake, some real, some even deceased. It typically takes fraudsters 12 to 18 months to create and nurture a synthetic identity before it’s ready to "bust out" – the act of building a credit history with the intent of maxing out all available credit and eventually disappearing. That means fraudsters are investing money and time to build numerous tradelines, ensure these "fake" identities are in good credit standing, and ultimately steal the largest amount of money possible. “Wait Master, it might be dangerous . . . you go, first.” — Igor Synthetic identities are a notable challenge for many financial institutions and retail organizations. According to the recently released Federal Reserve Board White Paper, synthetic identity fraud accounts for roughly 20% of all credit losses, and cost U.S. businesses roughly $6 billion in 2016 with an estimated 41% growth over 2 years. 85-95% of applicants identified as potential synthetic are not even flagged by traditional fraud models. The Social Security Administration recently announced plans for the electronic Consent Based Social Security Number Verification service – pilot program scheduled for June 2020. This service is designed to bring efficiency to the process for verifying Social Security numbers directly with the government agency. Once available, this verification could be an important tool in the fight against the elusive “Frankenstein” identity monster. But with the Social Security Administration's pilot program not scheduled for launch until the middle of next year, how can financial institutions and other organizations bridge the gap and adequately prepare for a potential uptick in synthetic identity fraud attacks? It comes down to a multilayered approach that relies on advanced data, analytics, and technology — and focuses on identity. Any significant progress in making synthetic identities easier to detect could cost fraudsters significant time and money. Far too many financial institutions and other organizations depend solely on basic demographic information and snapshots in time to confirm the legitimacy of an identity. These organizations need to think beyond those capabilities. The real value of data in many cases lies between the data points. We have seen this with synthetic identity — where a seemingly legitimate identity only shows risk when we can analyze its connections and relationships to other individuals and characteristics. In addition to our High Risk Fraud Score, we now have a Synthetic Fraud Risk Level Indicator available on credit profiles. These advanced detection capabilities are delivered via the simplicity of a straightforward indicator returned on the credit profile which lenders can use to trigger additional identity verification processes. While there are programs and initiatives in the works to help financial institutions and other organizations combat synthetic identity fraud, it's important to keep in mind there's no silver bullet, or stake to the heart, to completely keep these Frankenstein IDs out. Oh, and don’t forget… “It’s pronounced ‘Fronkensteen.’ ” — Dr. Frankenstein

To provide consumers with clear-cut protections against disturbance by debt collectors, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA) earlier this year. Among many other things, the proposal would set strict limits on the number of calls debt collectors may place to reach consumers weekly and clarify requirements for consumer-facing debt collection disclosures. A bigger discussion Deliberation of the debt collection proposal was originally scheduled to begin on August 18, 2019. However, to allow commenters to further consider the issues raised in the NPRM and gather data, the comment period was extended by 20 days to September 18, 2019. It is currently still being debated, as many argue that the proposed rule does not account for modern consumer preferences and hinders the free flow of information used to help consumers access credit and services. The Association of Credit and Collection Professionals (ACA International) and US House lawmakers continue to challenge the proposal, stating that it doesn’t ensure that debt collectors’ calls to consumers are warranted, nor does it do enough to protect consumers’ privacy. Many consumer advocates have expressed doubts about how effective the proposed measures will be in protecting debtors from debt collector harassment and see the seven-calls-a-week limit on phone contact as being too high. In fact, it’s difficult to find a group of people in full support of the proposal, despite the CFPB stating that it will help clarify the FDCPA, protect lenders from litigation and bring consumer protection regulation into the 21st century. What does this mean? Although we don’t know when, or if, the proposed rule will go into effect, it’s important to prepare. According to the Federal Register, there are key ways that the new regulation would affect debt collection through the use of newer technologies, required disclosures and limited consumer contact. Not only will the proposed rules apply to debt collectors, but its provisions will also impact creditors and servicers, making it imperative for everyone in the financial services space to keep watch on the regulation’s status and carefully analyze its proposed rules. At Experian, our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to connect with consumers while staying compliant. Our best-in-class data and analytics will play a key role in helping you reach the right consumer, in the right place, at the right time. Learn more

Retail banking leaders in a variety of industries (including risk management, credit, information technology and other departments) want to incorporate more data into their business strategies. By doing so, consumer banks and other financial companies benefit by expanding their markets, controlling risk, improving compliance and the customer experience. However, many companies don’t know how or where to start. The challenges? There’s just too much data – and it’s overwhelming. Technical integration issues Maintaining regulatory data and attribute governance and compliance The slow speed of adoption Join Jim Bander, PhD, analytics and optimization leader at Experian, in an upcoming webinar with the Consumer Bankers Association on Tuesday, Oct. 1, 2019 at 9:00-10:00 a.m. PT. The webinar will discuss how some of the country’s best banks – big and small – are making better, faster and more profitable decisions by using the right set of data sources, while avoiding data overload. Key topics will include: Technology Trends: Discover how the latest technology, including the cloud and machine learning, makes it easier than ever to access data, define and manage attributes throughout the enterprise and perform complex calculations in real time. Time to Market: Discover how consumer banks and other financial companies that have mastered data and attribute management are able to integrate data and attributes quickly and seamlessly. Business Benefits: Understand how advanced analytics helps financial institutions of all sizes make better business decisions. This includes growing their portfolios, mitigating fraud and credit risk, controlling operating expenses, improving compliance and enhancing the customer experience. Critical Success Factors: Learn how to stay ahead of ever-evolving business and data requirements and continuously improve your lending operations. Join us as we unveil the secrets to avoiding data overload in consumer banking. Special Offer For non-current CBA members, this webinar costs $95 to attend. However, with special discount code: EX1001, non-CBA members can attend for FREE. Register Now

The average new vehicle loan hit $32,119 in Q2 2019. Average used vehicle loan amounts reached $20,156 in Q2 2019.

The future is, factually speaking, uncertain. We don't know if we'll find a cure for cancer, the economic outlook, if we'll be living in an algorithmic world or if our work cubical mate will soon be replaced by a robot. While futurists can dish out some exciting and downright scary visions for the future of technology and science, there are no future facts. However, the uncertainty presents opportunity. Technology in today's world From the moment you wake up, to the moment you go back to sleep, technology is everywhere. The highly digital life we live and the development of our technological world have become the new normal. According to The International Telecommunication Union (ITU), almost 50% of the world's population uses the internet, leading to over 3.5 billion daily searches on Google and more than 570 new websites being launched each minute. And even more mind-boggling? Over 90% of the world's data has been created in just the last couple of years. With data growing faster than ever before, the future of technology is even more interesting than what is happening now. We're just at the beginning of a revolution that will touch every business and every life on this planet. By 2020, at least a third of all data will pass through the cloud, and within five years, there will be over 50 billion smart connected devices in the world. Keeping pace with digital transformation At the rate at which data and our ability to analyze it are growing, businesses of all sizes will be forced to modify how they operate. Businesses that digitally transform, will be able to offer customers a seamless and frictionless experience, and as a result, claim a greater share of profit in their sectors. Take, for example, the financial services industry - specifically banking. Whereas most banking used to be done at a local branch, recent reports show that 40% of Americans have not stepped through the door of a bank or credit union within the last six months, largely due to the rise of online and mobile banking. According to Citi's 2018 Mobile Banking Study, mobile banking is one of the top three most-used apps by Americans. Similarly, the Federal Reserve reported that more than half of U.S. adults with bank accounts have used a mobile app to access their accounts in the last year, presenting forward-looking banks with an incredible opportunity to increase the number of relationship touchpoints they have with their customers by introducing a wider array of banking products via mobile. Be part of the movement Rather than viewing digital disruption as worrisome and challenging, embrace the uncertainty and potential that advances in new technologies, data analytics and artificial intelligence will bring. The pressure to innovate amid technological progress poses an opportunity for us all to rethink the work we do and the way we do it. Are you ready? Learn more about powering your digital transformation in our latest eBook. Download eBook Are you an innovation junkie? Join us at Vision 2020 for future-facing sessions like: - Cloud and beyond - transforming technologies - ML and AI - real-world expandability and compliance

In today’s age of digital transformation, consumers have easy access to a variety of innovative financial products and services. From lending to payments to wealth management and more, there is no shortage in the breadth of financial products gaining popularity with consumers. But one market segment in particular – unsecured personal loans – has grown exceptionally fast. According to a recent Experian study, personal loan originations have increased 97% over the past four years, with fintech share rapidly increasing from 22.4% of total loans originated to 49.4%. Arguably, the rapid acceleration in personal loans is heavily driven by the rise in digital-first lending options, which have grown in popularity due to fintech challengers. Fintechs have earned their position in the market by leveraging data, advanced analytics and technology to disrupt existing financial models. Meanwhile, traditional financial institutions (FIs) have taken notice and are beginning to adopt some of the same methods and alternative credit approaches. With this evolution of technology fused with financial services, how are fintechs faring against traditional FIs? The below infographic uncovers industry trends and key metrics in unsecured personal installment loans: Still curious? Click here to download our latest eBook, which further uncovers emerging trends in personal loans through side-by-side comparisons of fintech and traditional FI market share, portfolio composition, customer profiles and more. Download now

What do movie actors Adam Sandler and Hugh Grant, jazz singer Michael Bublé, Russian literary giant Leo Tolstoy, and Colonel Sanders, the founder of KFC, have in common? Hint, it’s not a Nobel Prize for Literature, a Golden Globe, a Grammy Award, a trademark goatee, or a “finger-lickin’ good” bucket of chicken. Instead, they were all born on September 9, the most common birth date in the U.S. Baby Boom According to real birth data compiled from 20 years of American births, September is the most popular month to give birth to a child in America – and December, the most popular time to make one. With nine of the top 10 days to give birth falling between September 9 and September 20, one may wonder why the birth month is so common. Here are some theories: Those who get to choose their child’s birthday due to induced and elective births tend to stay away from the hospital during understaffed holiday periods and may plan their birth date around the start of the school year. Several of the most common birth dates in September correspond with average conception periods around the holidays, where couples likely have more time to spend together. Some studies within the scientific community suggest that our bodies may actually be biologically disposed to winter conceptions. While you may not be feeling that special if you were born in September, the actual differences in birth numbers between common and less common birthdays are often within just a few thousand babies. For example, September 10, the fifth most common birthday of the year, has an average birth rate of 12,143 babies. Meanwhile, April 20, the 328th most common birthday, has an average birth rate of 10,714 newborns. Surprisingly, the least common birthdays fall on Christmas Eve, Christmas Day and New Year’s Day, with Thanksgiving and Independence Day also ranking low on the list. Time to Celebrate – but Watch out! Statistically, there’s a pretty good chance that someone reading this article will soon be celebrating their birthday. And while you should be getting ready to party, you should also be on the lookout for fraudsters attempting to ruin your big day. It’s a well-known fact that cybercriminals can use your birth date as a piece of the puzzle to capture your identity and commit identity theft – which becomes a lot easier when it’s being advertised all over social media. It’s also important for employers to safeguard their organization from fraudsters who may use this information to break into corporate accounts. While sharing your birthday with a lot of people could be a good or bad thing depending on how much undivided attention you enjoy – you’re in great company! Not only can you plan a joint party with Michelle Williams, Afrojack, Cam from Modern Family, four people I went to high school with on Facebook and a handful of YouTube stars that I’m too old to know anything about, but there will be more people ringing in your birthday than any other day of the year! And that’s pretty cool.

Pickups are the most common vehicle in operation at 20% share today and hold 16.5% of new vehicle registrations in the market in Q1 2019.

Today is National Fintech Day – a day that recognizes the ever-important role that fintech companies play in revolutionizing the customer experience and altering the financial services landscape. Fintech. The word itself has become synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. Fintech challengers are disrupting existing financial models by leveraging data, advanced analytics and technology – both inspiring traditional financial institutions in their digital transformation strategies and giving consumers access to a variety of innovative financial products and services. But to us at Experian, National Fintech Day means more than just financial disruption. National Fintech Day represents the partnerships we have carefully fostered with our fintech clients to drive financial inclusion for millions of people around the globe and provide consumers with greater control and more opportunities to access the quality credit they deserve. “We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can’t do it alone,” said Experian North American CEO, Craig Boundy in a recent blog article on Experian’s fintech partnerships. “That’s why over the last year, we have built out an entire team of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We’ve made significant strides that will help us pave the way for the next generation of lending while improving the financial health of people around the world.” At Experian, we understand the challenges fintechs face – and our real-world solutions help fintech clients stay ahead of constantly changing market conditions and demands. “Experian’s pace of innovation is very impressive – we are helping both lenders and consumers by delivering technological solutions that make the lending ecosystem more efficient,” said Experian Senior Account Executive Warren Linde. “Financial technology is arguably the most important type of tech out there, it is an honor to be a part of Experian’s fintech team and help to create a better tomorrow.” If you’d like to learn more about Experian’s fintech solutions, visit us at Experian.com/Fintech.

Earlier this year, the Consumer Financial Protection Bureau (CFPB) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA). The proposal, which will go into deliberation in September and won't be finalized until after that date at the earliest, would provide consumers with clear-cut protections against disturbance by debt collectors and straightforward options to address or dispute debts. Additionally, the NPRM would set strict limits on the number of calls debt collectors may place to reach consumers weekly, as well as clarify how collectors may communicate lawfully using technologies developed after the FDCPA’s passage in 1977. So, what does this mean for collectors? The compliance conundrum is ever present, especially in the debt collection industry. Debt collectors are expected to continuously adapt to changing regulations, forcing them to spend time, energy and resources on maintaining compliance. As the most recent onslaught of developments and proposed new rules have been pushed out to the financial community, compliance professionals are once again working to implement changes. According to the Federal Register, here are some key ways the new regulation would affect debt collection: Limited to seven calls: Debt collectors would be limited to attempting to reach out to consumers by phone about a specific debt no more than seven times per week. Ability to unsubscribe: Consumers who do not wish to be contacted via newer technologies, including voicemails, emails and text messages must be given the option to opt-out of future communications. Use of newer technologies: Newer communication technologies, such as emails and text messages, may be used in debt collection, with certain limitations to protect consumer privacy. Required disclosures: Debt collectors will be obligated to send consumers a disclosure with certain information about the debt and related consumer protections. Limited contact: Consumers will be able to limit ways debt collectors contact them, for example at a specific telephone number, while they are at work or during certain hours. Now that you know the details, how can you prepare? At Experian, we understand the importance of an effective collections strategy. Our debt collection solutions automate and moderate dialogues and negotiations between consumers and collectors, making it easier for collection agencies to reach consumers while staying compliant. Powerful locating solution: Locate past-due consumers more accurately, efficiently and effectively. TrueTraceSM adds value to each contact by increasing your right-party contact rate. Exclusive contact information: Mitigate your compliance risk with a seamless and unparalleled solution. With Phone Number IDTM, you can identify who a phone is registered to, the phone type, carrier and the activation date. If you aren’t ready for the new CFPB regulation, what are you waiting for? Learn more Note: Click here for an update on the CFPB's proposal.