Which part of the country has bragging rights when it comes to sporting the best consumer credit scores?

Drum roll please …

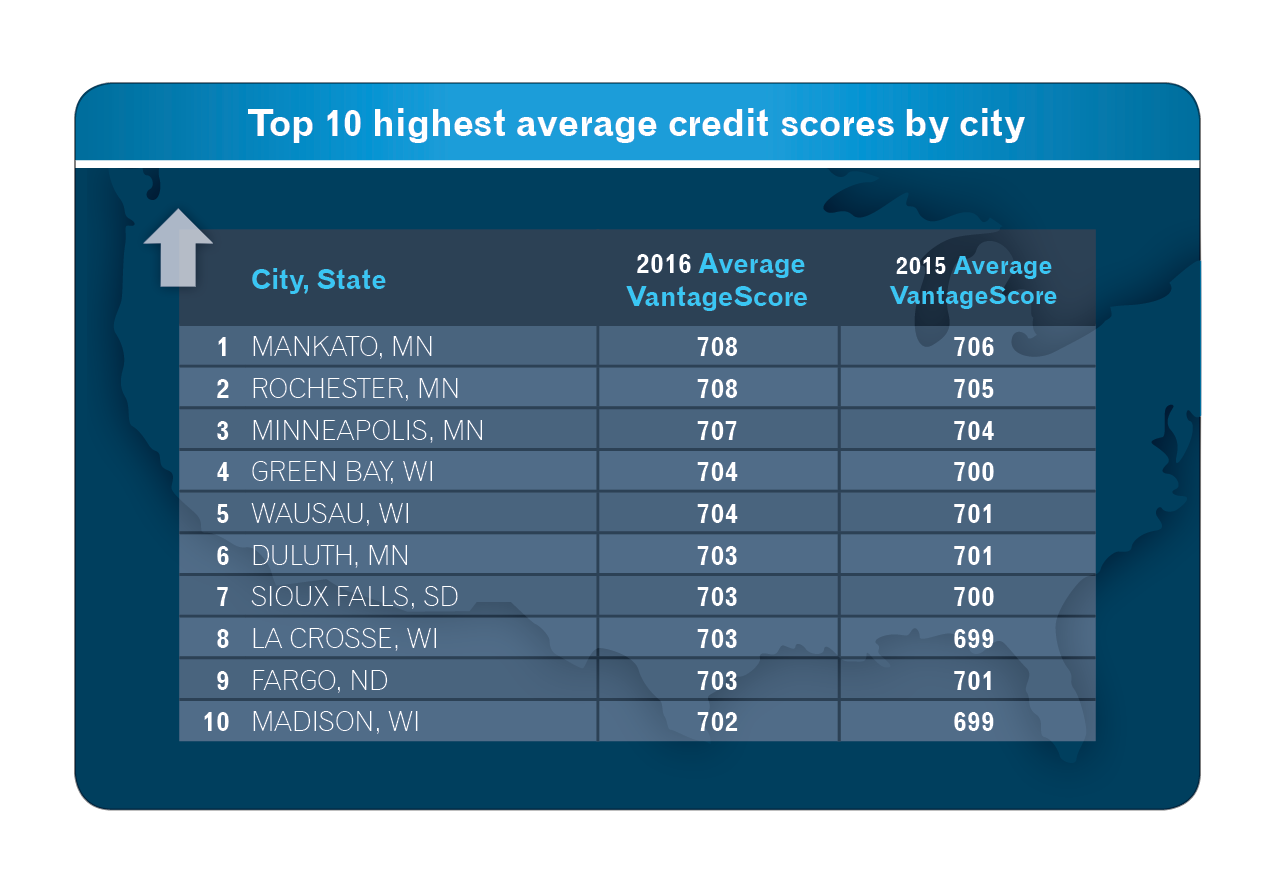

Honors go to the Midwest. In fact, eight of the 10 cities with the highest consumer credit scores heralded from Minnesota and Wisconsin.

Mankato, Minn., earned the highest ranking with an average credit score of 708 and Greenwood, Miss., placed last with an average credit score of 622.

Even better news is that the nation’s average credit score is up four points; 669 to 673 from last year and is only six points away from the 2007 average of 679, which is a promising sign as the economy continues to rebound.

Experian’s annual study ranks American cities by credit score and reveals which cities are the best and worst at managing their credit, along with a glimpse at how the nation and each generation is faring.

managing their credit, along with a glimpse at how the nation and each generation is faring.

“All credit indicators suggest consumers are not as ‘credit stressed’ — credit card balances and average debt are up while utilization rates remained consistent at 30 percent,” said Michele Raneri, vice president of analytics and new business development at Experian.

As for the generational victors, the Silents have an average 730, Boomers come in with 700, Gen X with 655 and Gen Y with 634. We’re also starting to see Gen Z emerge for the first time in the credit ranks with an average score of 631.

Couple this news with other favorable economic indicators and it appears the country is humming along in a positive direction.

The stock market reached record highs post-election.

Bankcard originations and balances continue to grow, dominated by the prime borrower.

And the housing market is healthy with boomerang borrowers re-emerging. An estimated 2.5 million Americans will see a foreclosure fall of their credit report between June 2016 and June 2017, creating a new pool of potential buyers with improved credit profiles.

More than 12 percent who foreclosed back in the Great Recession have already boomeranged to become homeowners again, while 29 percent who experienced a short sale during that same time have also recently taken on a mortgage.

“We are seeing the positive effects of economic recovery with the rise in income and low unemployment reflected in how Americans are managing their credit,” said Raneri.

Which means all is good in the world of credit. Of course there is always room for improvement, but this year’s 7th annual state of credit reveals there is much to be thankful for in 2016.