As credit unions look to grow their loan portfolios and acquire new members, improving the member experience is critical to the process and remains a primary focus. In order to compete in the lending universe, financial tools that empower and enable a positive experience are critical to meeting these requirements. That being said, an Experian study reveals that 90% of executives agree that embracing a digital transformation is critical to providing excellent experiences.

In this connected, data-driven world, digital transformations are opening the door for better and greater opportunities. With data and analytics, credit unions will be able to gain data-driven insights, to identify key channels of member engagement, create complete member views and further maximize growth and lending strategies.

Data-driven organizations that can anticipate their members’ needs and preferences will be able to deepen relationships and maintain relevance – gaining an edge in a highly-competitive environment.

The digital revolution is happening now – and it’s time for future-focused credit unions to adapt to changing expectations. However, according to an Experian report, 39% of organizations lack the customer insight and data required to provide these member experiences.

That’s where Experian comes in.

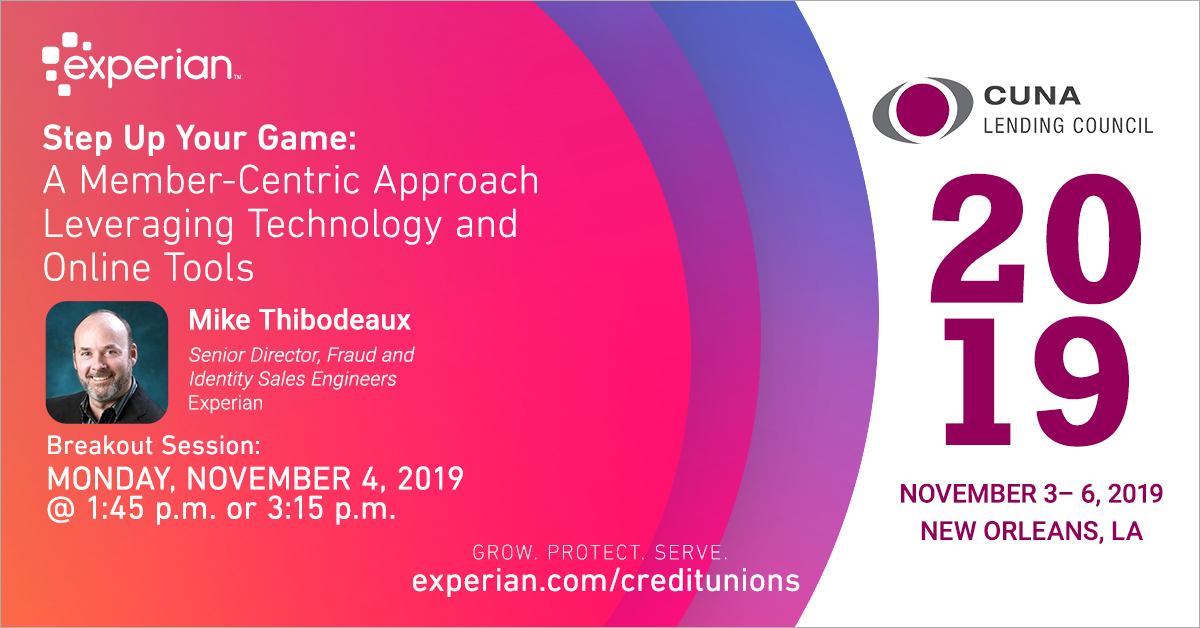

Join Mike Thibodeaux, Experian’s Senior Director, Fraud and Identity Sales Engineers, for a breakout session at CUNA Lending 2019 on Monday, Nov. 4 at 1:45 p.m. or 3:15 p.m. He will take a closer look at best practices and digital tools that credit unions can use to maximize credit union membership growth, while managing and mitigating fraud.

The discussion will revolve around multiple topics, critical to the member experience conversation, including:

- Increasing profitable loan growth

- Lending deeper to the underserved

- Levering digital services and tools for your credit union

- Minimizing fraud activity (specifically synthetic identity fraud) and credit losses

- Enhancing and maintaining positive member experiences

Experian is excited to once again take part in the 2019 CUNA Lending Council Conference, an event that brings together the credit union movement’s best and brightest in lending. If you’re attending, make sure to engage and connect with our thought leaders at our booth and learn how we’re dedicated to helping credit unions of all sizes advance their decisioning and services.

Our team is committed to being a trusted partner – providing solutions that enable you to further grow, protect and serve within your field of membership.