Hackers are playing the game of data compromise, and they are winning. At this point, companies of all sizes, from all industries, know that consumers have a growing desire totake control of their data and digital privacy. In case you missed the latestwebinarandwhitepaperrelease from Javelin Strategy & Research, it makes three things clear about consumers’ current attitudes about fraud and its impact on businesses.

1. Consumers are much more privacy-aware

In 2020, consumers turned to social media and telecommunicating platforms to work, stay in touch with friends and family networks and learn. While the broad-scale increase provided a way for global commerce and connections to continue during the worldwide pandemic, it also accelerated cybercrime. The influx of internet traffic created a ready-made environment for fraudsters to profit from consumers in a big way, primarily through scams. Scams were so profitable that they accounted for $43 billion of the $56 billion reported ID fraud losses last year.1

2. Consumers blame Financial Institutions for fraud. It’s the main reason they leave.

When consumers experience fraud, they blame their financial institutions, even if the loss has nothing to do with the institution or its business’s responsibility to the consumer. This attitude shows that consumers hold FIs accountable for their data protection. And when they don’t get it, they take their expectations and their business elsewhere. The data shows the proof. In 2020, 38% of consumers closed a bank account affected by fraud, with 69% saying their primary FIs did not resolve their fraud concerns or losses.1As the saying goes, perception is reality, and in the case of fraud, consumer thoughts have real consequences for organizations.

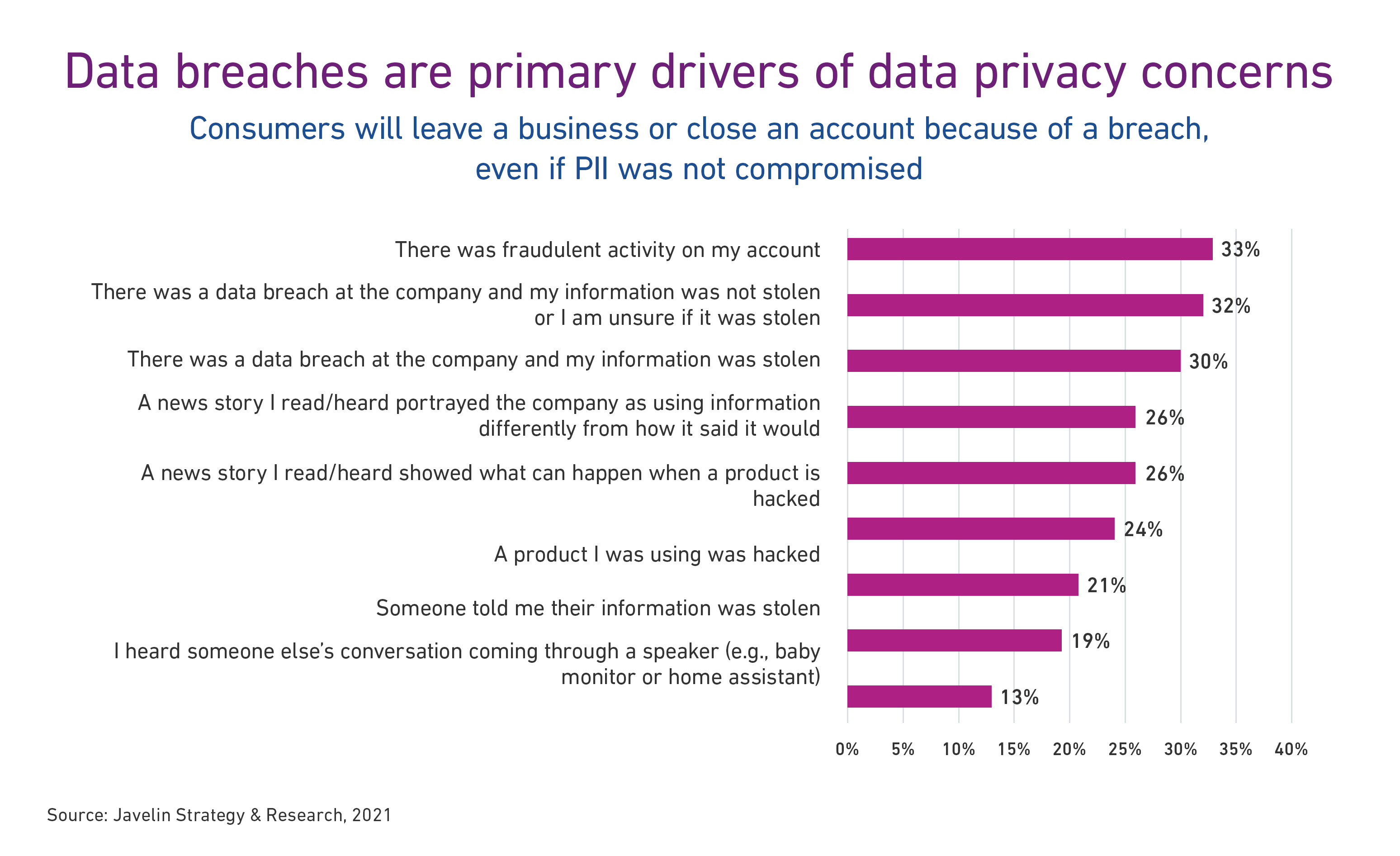

3. Consumers leave when breaches happen

This point is simple: consumers leave even when personally identifiable information (PII) or other data is not stolen.

Be prepared with a playbook or be ready to lose consumer trust

To improve the customer experience, build trust and reduce risk, companies need a playbook—a fraud resolution and breach response playbook—a solid plan that falls under their existing business and continuity disaster recovery plan. Why? Because consumers need to know and, more importantly, trust that companies are prepared to react quickly and deliver resolution when a network intrusion occurs.

According to Javelin Strategy & Research data, fraud resolution is the best way to retain customers and members. In addition, consumer perception of cybersecurity plays a significant role in consumer attrition and retention. Again, even if personal information is protected, if your organization is attacked, consumers are more likely to stop doing business with your organization, even if no data was compromised. This means cybersecurity and fraud prevention empowerment is a game-changer, driving 22% of consumers’ satisfaction ratings with online banking.2

When building your playbook, consider two core things:

1. Make sure it’s well-developed

A comprehensive fraud resolution and breach response should include a solid approach to collaborate with consumers when fraud occurs. Ensuring your plan includes fraud, cyber, and marketing communications teams will help your company act swiftly and build consumer confidence.

2. Don’t just encrypt data; strengthen perimeter security.

Strong perimeter security will ensure safe interactions with consumers. Even if personal information is protected, consumers will perceive a penetration of the network as a breach and will be more apt to stop doing business with your company.

At Experian, preparedness is our business. We know how important fraud resolution and breach response is to your customer’s experience. Developing a solid playbook is key to that experience, building trust and reducing risk.

To learn more, read theGiving Consumers Control and Enhancing Fraud Preventionwhitepaper,watch theEmpowerment and Fraud Prevention are Keywebinarand find out how to protect your business withExperian’s Global Data Breach Solutions.