Mortgage lenders looking to attract first-time homebuyers must understand their needs, wants, and finances, especially as the economic environment and evolving generational trends shift. Understanding who this buyer segment is and what they buy unlocks growth potential for today’s attentive mortgage lenders.

Financial diversity defines first-time homebuyers

First-time homebuyers are searching for the attainable, which is not easy today. High interest rates, low housing inventory, and individual financial circumstances contribute to the hardships the housing market presents. Even with ups and downs and difficulties in the marketplace, first-time homebuyers continue to show their grit.

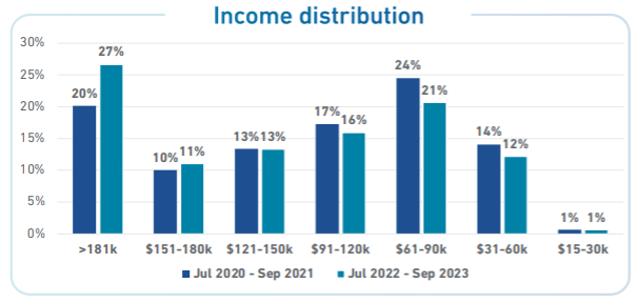

Over two-thirds of first-time homebuyers have an annual household income over $90k, with 27% having household income over $180k.

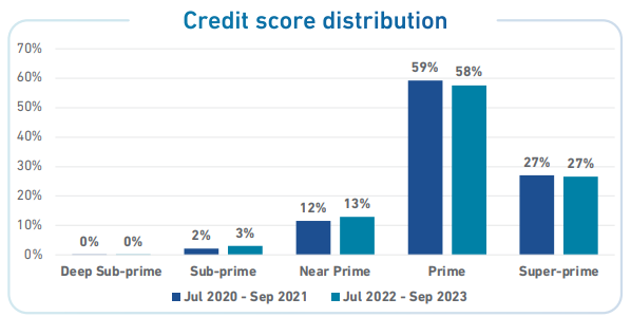

Additionally, Experian Housing research shows that 85% of first-time homebuyers have prime or super-prime credit scores.

While credit and income play critical roles in evaluating borrower risk, they’re not the only factors. The mortgage lending market is slowly leaning into the use of alternative credit data, such as rental payment information, to determine a borrower’s creditworthiness. These changes are crucial in our industry’s effort to support consumers on their journey towards homeownership.

Financial realities impact property choices

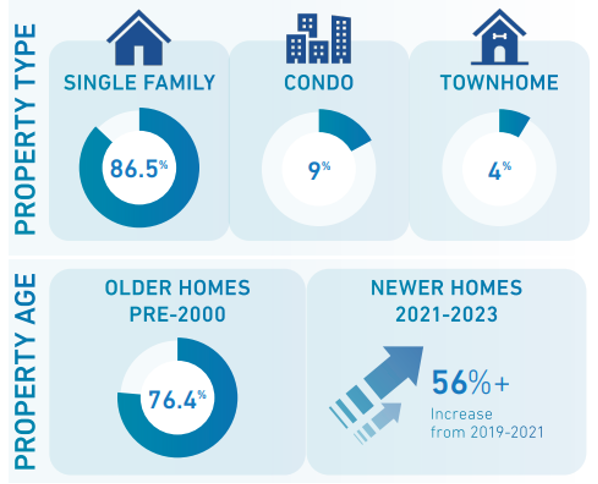

Experian Housing’s recent white paper looking at first-time purchasers shows over 85% buying single-family homes, with roughly 70% of these buyers belonging to Generation Y (Gen Y) and Generation Z (Gen Z). While starter homes suggest impermanence, Gen Y and Gen Z buying habits reflect their values and overall desire for stability.

These motivated buyers that understand the economic woes, are adjusting and looking for options. More than three-fourths of first-time purchases are older homes, built before 2000. However, Experian’s same research showed sales of new construction homes (2021-2023) increased over the prior two years, particularly among first-time buyers. Builder credits and other incentives make new builds more appealing, and lenders leveraging their mortgage market expertise will be able to discuss options customized to the borrower, helping them make the decision best fitting their needs.

Especially among younger generations, first-time homebuyers are considering different housing options in their path to homeownership. From multigenerational housing and co-owning a home with friends and family to smaller homes and moving further away for affordability reasons, options are on the table.1

Untapped potential for savvy lenders

The modern mortgage landscape offers thoughtful lenders opportunities to drive growth. Diversity in the first-time homebuyer profiles means that lenders who distinguish themselves by tailoring their services to the borrower’s needs. This may include, but is certainly not limited to:

- Drawing on their knowledge of first-time homebuyer programs, grants and loans appropriate to the borrower.

- Improving their overall financial well-being with financial literacy education.

- Expertly guiding them through the complex lending process.

- Ensuring as swift and smooth a transaction as possible with timely and responsive communications.

For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online.

Download white paper Learn more

1 “Several Generations Under One Roof,” census.gov; “What to Know About Co-Buying A House,” myhome.freddiemac.com