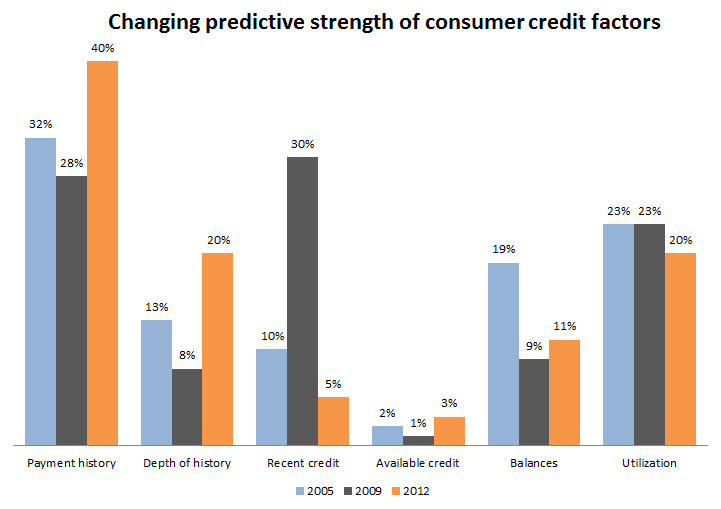

Using a risk model based on older data can result in reduced predictive power. As consumer credit behaviors evolve, the predictive contribution of specific factors changes. For example, in recently developed models, payment history is 25 percent more relevant in terms of predictive contribution than in prerecession models. The following chart details the changes in key contributing factors over time.

**Please click image to enlarge

Risk managers can stay ahead of these changes by regularly validating their risk models and by using scoring models developed on the latest consumer data available.

View the webcast: Implementing a new scoring model: Plug & Play

VantageScore® is a registered trademark of VantageScore Solutions, LLC.