There’s no shortage of buzz around fintechs shifting from marketplace challengers to industry collaborators.

There’s no shortage of buzz around fintechs shifting from marketplace challengers to industry collaborators.

Regardless of fintech’s general reputation as market disruptors, a case can certainly be made for building partnerships with traditional financial institutions by leveraging the individual strengths of each organization.

According to the World FinTech Report 2018, 75.5% of fintechs surveyed selected “collaborate with traditional firms” as their main objective.

Whereas fintechs have agility, a singular focus on the customer, and an absence of legacy systems, traditional Financial Institutions have embedded infrastructure, scale, reach, and are well-versed with regulatory requirements.

By partnering together, fintechs and other Financial Institutions can combine strengths to generate real business results and impact the customer experience. New stories are emerging – stories that illustrate positive outcomes beyond efforts exerted by one side alone.

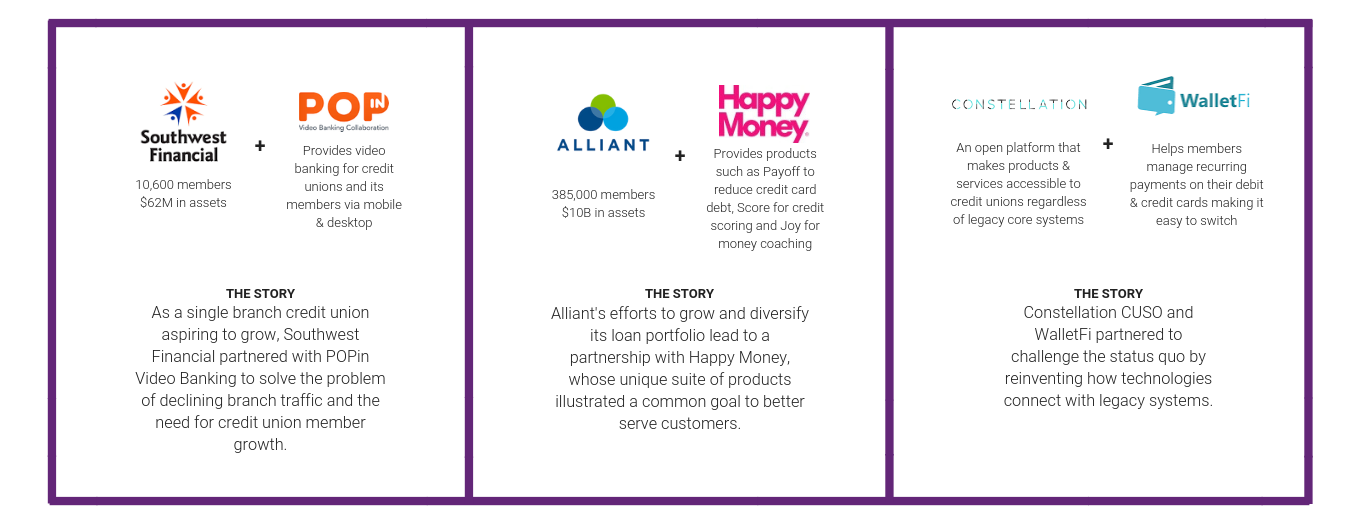

A recent report sponsored by Experian and conducted by the Filene Research Institute further explores the results of fintech and traditional FI partnerships by examining the experiences of six organizations:

The outcomes of these relationships are sure to encourage more collaborative partnerships. And while leveraging each organization’s strength is a critical component, there’s much more to consider when developing a strategic approach.

In the fast-moving, disruptive world of fintech, just what are the key elements to building a successful collaboration with traditional Financial Institutions? Click here to learn more.