Housing affordability is a pressing concern across the United States, and Florida is no exception. The affordability issue can be particularly crucial for renters looking to become first-time homebuyers (FTHBs).

The desire to live in a sunny location must be measured against the cost of living, particularly housing costs. Experts at Experian Housing carefully examined data from the top 15 Florida cities (by population) to gain insights into the state of housing affordability in Florida.1 Experian examined factors such as mortgage payments, rent prices, income levels, and sales prices to assess affordability.

Overview of the Florida FTHB market

Experian Housing’s recent report on first-time homebuyers ranked Florida the state with the third highest percentage of FTHBs nationwide, at nearly 7.7% of FTHBs.2 It outranked New York, falling behind Texas and California.

In Florida, the younger populations of Generation Y and Z account for 60% of all first-time homebuyers. Nationwide, roughly 70% of FTHBs belong to these populations.

Among younger buyers, affordability is often the deciding factor in whether they continue to rent or become homeowners as they balance housing costs with student loan debt and other expenses.

Let’s look at some key metrics

Comparative monthly mortgage payments and rent prices

How this affects affordability:

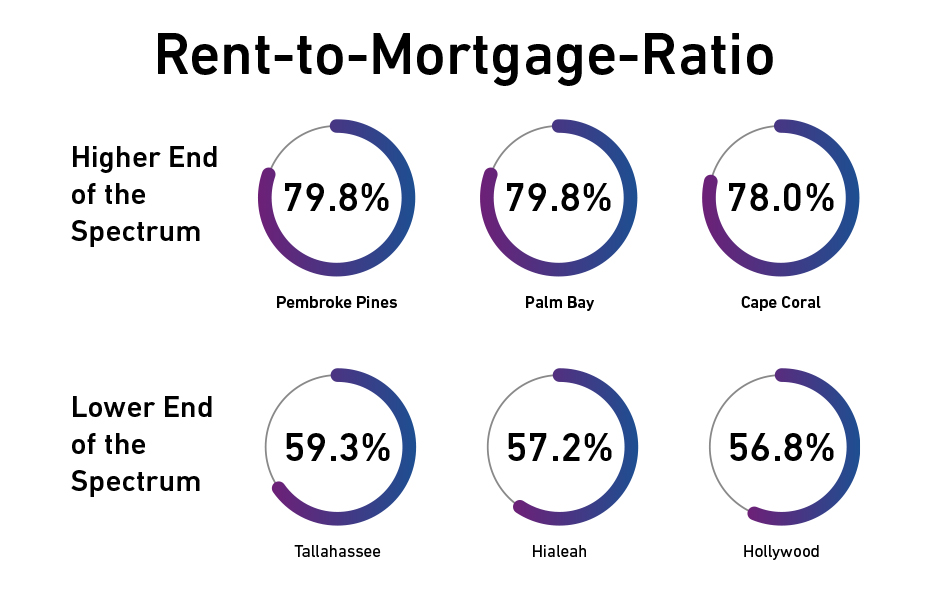

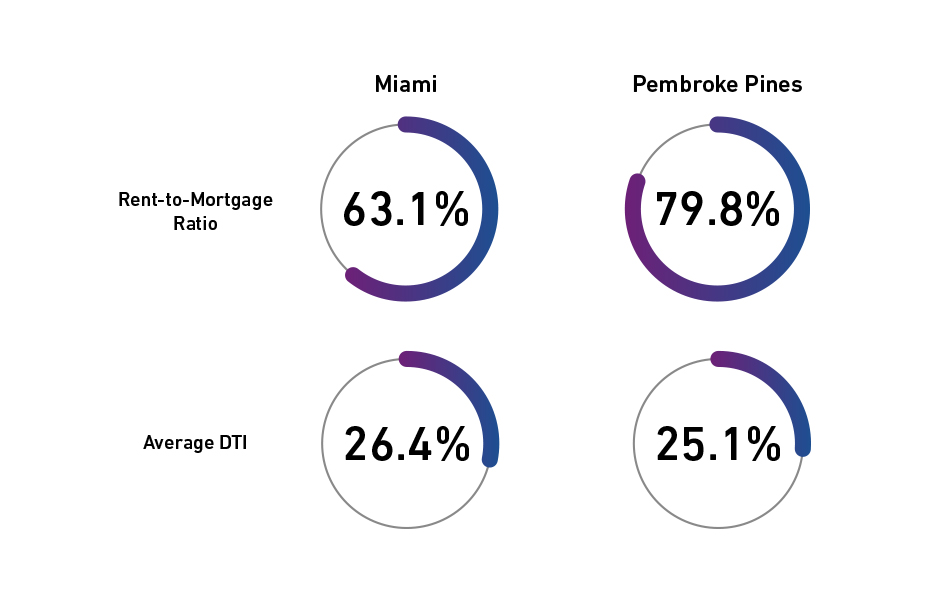

The bottom line for prospective homebuyers often comes down to whether it’s more affordable to continue to rent or purchase a home. While the metrics discussed all contribute to the picture of affordability, for this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio, a comparison of monthly rental payments to monthly mortgage payments. Homebuying becomes more attractive to renters when the rent-to-mortgage ratio is higher because mortgage payments are more economically practical.

Experian Housing found that Pembroke Pines, Palm Bay, and Cape Coral have the highest rent-to-mortgage ratio in Florida, at nearly 80%. In other words, for example, if the average mortgage payment is $1,000, the average rental payment is ~$800. Compare this to Tallahassee, Hialeah, and Hollywood, where the rent-to-mortgage ratio is <60%.

These numbers illustrate the varying home purchase and rental market trends across the state.

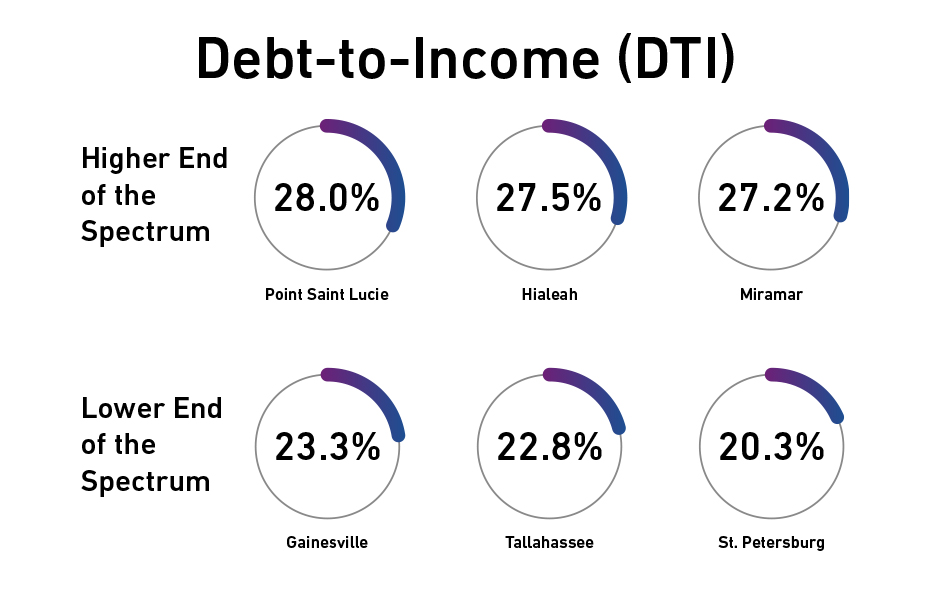

Debt-to-income

How this affects affordability:

This metric compares monthly debt responsibilities, including mortgages, car loans, student loans, and minimum credit card payments, to monthly income. A high debt-to-income ratio indicates a significant portion of income is dedicated to paying debt, leaving little room for other essential living costs and discretionary spending.

What we observed:

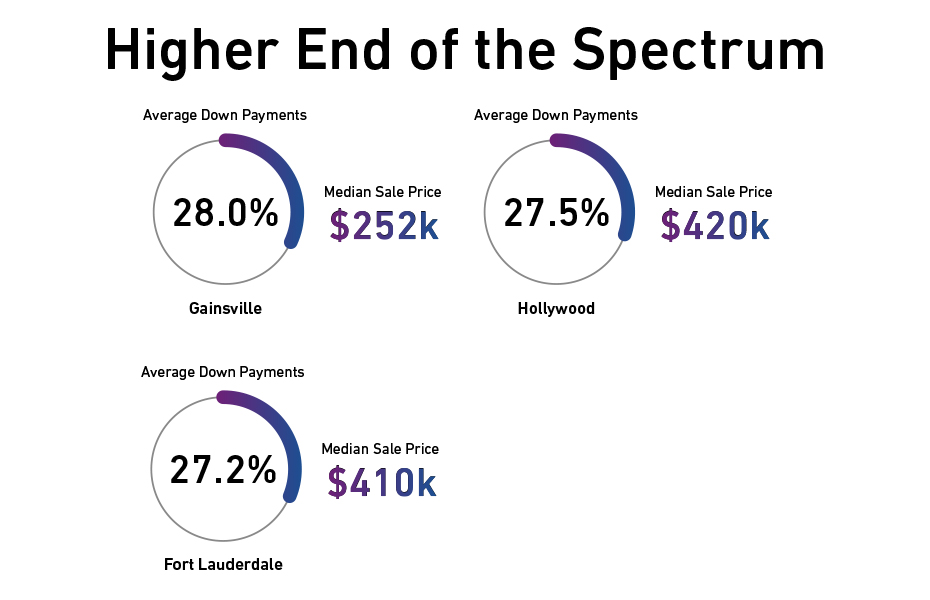

Down payments

How this affects affordability:

A higher down payment can also assist buyers, especially first-time buyers, by increasing attractive financing options. Importantly, a down payment of 20% avoids the need for private mortgage insurance (PMI), which is insurance for the lender, protecting the lender against loss should a foreclosure occur. PMI typically costs between 0.5% and 2% of the loan amount, annually.

What we observed:

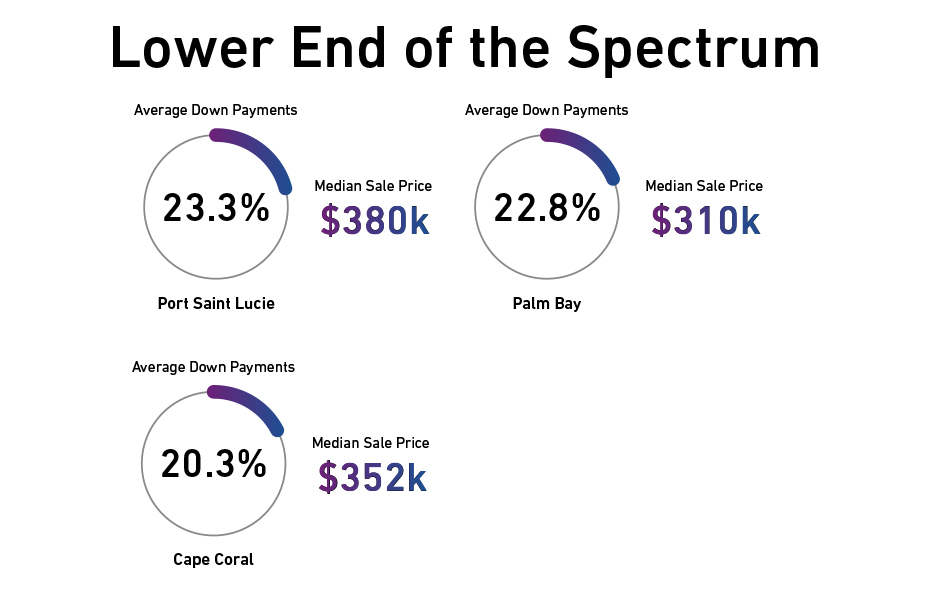

Sale prices and financial hurdles

How this affects affordability:

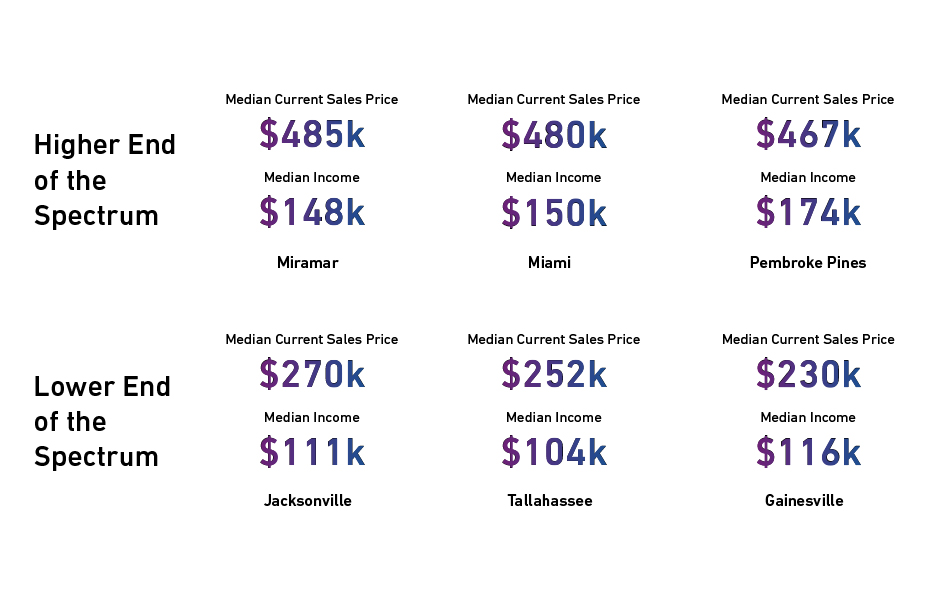

In comparing home affordability across Florida, first-time homebuyers should consider home prices in relation to income. While other considerations, including an individual’s debt level and other expenses, contribute to the bottom line, this gives an indication of how much income will be consumed by the home purchase.

What we observed:

Experian Housing examined the median sales prices and median. Comparison is essential because sales prices may be higher in a given area, but correlation with income helps determine affordability.

A Florida housing opportunity, up close: Miami metropolitan area

The Miami metropolitan area is an example of an area where mortgage lenders who understand their clients and the area they seek to live may well attract first-time homebuyers, loyal clients, and more word-of-mouth business.

The Miami suburb of Pembroke Pines, roughly 20 miles from Miami, offers a more affordable housing market. With Florida sunshine, nearby beaches, and access to three main highways, mortgage lenders whose knowledge base is not limited to the Miami city center may have an opportunity to turn a renter into a homeowner.

Florida residents navigate the cost of living in the Sunshine State

Analysis from Experian Housing highlights the diversity in housing markets and the opportunities to enhance financial well-being for residents in Florida. These insights are crucial for lenders to identify affordable opportunities for all residents.

Experian’s data system offers unique value to lenders given the ability to take a more comprehensive look at a borrower’s financial behavior. Experian uses credit, property, rental, and other alternative data sources to capture the borrower profile. Access to such data also gives Experian a unique ability to conduct research for reports like this one and the recent Texas affordability study.

For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online.

Download white paper Learn more

1 The analysis is based on the trade and rental data reported to Experian and considered first-time homebuyers during the period between November 2022 and January 2024.

2 Based on those getting a mortgage.