As a mortgage lender, understanding the intricacies of the New York housing market is crucial, especially when dealing with first-time homebuyers (FTHBs). While the housing market fluctuates nationwide, New York presents unique challenges and opportunities that require a nuanced approach.

Distinguishing NYC from the rest of New York

New York City’s housing market, along with its suburbs, stands distinct from the rest of the state. With a high cost of living and unique lifestyle, NYC demands a tailored mortgage marketing strategy. This article will highlight key factors affecting affordability in New York, providing valuable insights for mortgage lenders working in this market.

Overview of the New York FTHB market

According to Experian Housing’s recent report on first-time homebuyers, the state of New York accounts for nearly 4.9% of all first-time homebuyers nationwide.1 More than half of first-time homebuyers are from Generation Y. When combined with Gen Z, these younger buyers make up just over 67% of the state’s FTHBs, a figure slightly below the national average of 69%.

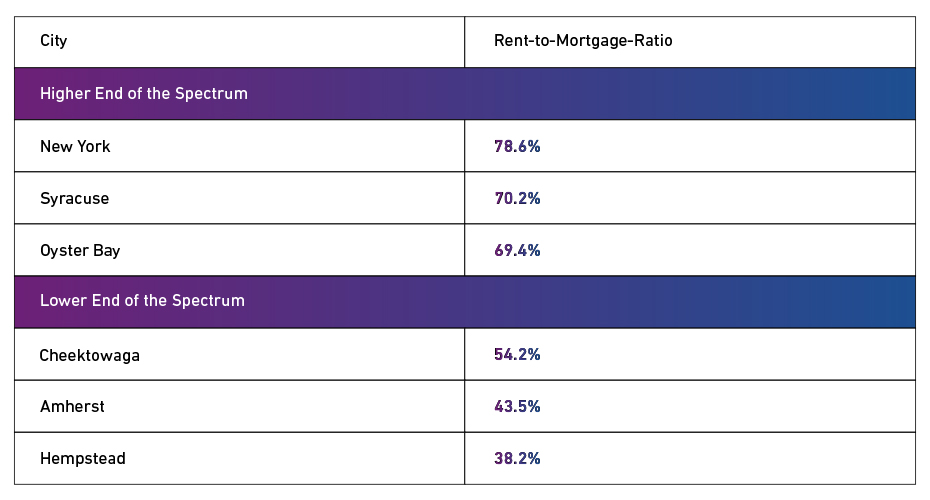

Affordability metrics: The rent-to-mortgage ratio

For many Americans, homeownership represents stability, security, and the future for family, community, and life. However, the decision to buy versus rent often hinges on affordability. Mortgage lenders must understand this dynamic to better assist their clients.

Affordability can be defined in various ways. For the purposes of this study, Experian Housing defined affordability by comparing rental and mortgage payments, known as the rent-to-mortgage ratio (RTM ratio). A higher ratio indicates that buying a home is more economically attractive.

Again, this metric does not consider incomes and debt levels, but simply housing rental prices and mortgage costs.

Based solely on the RTM ratio, the transition from renting to homeownership may be more attractive in New York City, Syracuse, and Oyster Bay, while the transition may be more difficult in Cheektowaga, Amherst, and Hempstead.

For mortgage lenders, understanding local markets and buyer profiles is essential. Building trust through personalized service, such as educating buyers on relevant loan programs and showcasing geographic expertise, can set you apart. With this knowledge, you can help buyers make informed decisions about affordability, whether they prefer living in the city or the suburbs. In some areas, the suburbs may offer more affordable options, while in others, the city center might be more cost-effective.

Additional factors: Income, debt, and down payments

Affordability extends beyond just rent and mortgage payments. Prospective homebuyers must consider their income, monthly expenses, and access to funds for a down payment. Mortgage lenders need to account for these factors when advising first-time homebuyers.

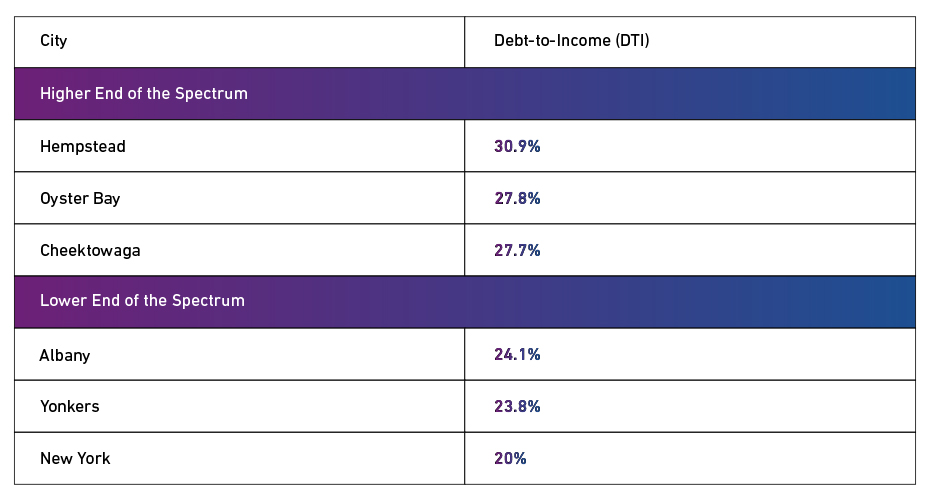

Debt-to-income

Average DTI across the 14 cities observed was 25.6%. The chart below highlights those at the higher and lower end of the spectrum.

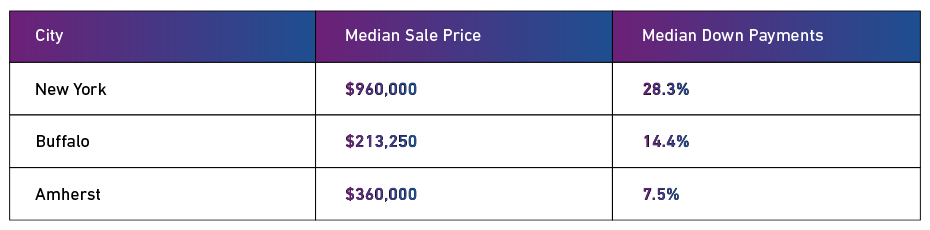

Down payments

Down payments varied greatly, but the median across the cities observed was 16.5%. The chart below highlights an example at the high, mid, and low point.

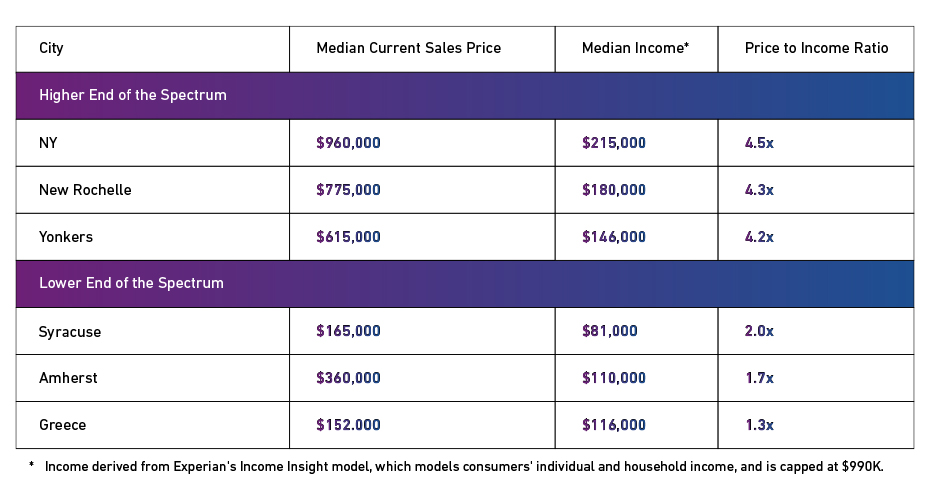

Sale prices and income

Experian Housing analyzed median sales prices and incomes across the U.S., with New York serving as a prime example of the importance of this comparison in assessing affordability. This correlation is crucial; while sales prices may be high, understanding how they align with local incomes helps lenders accurately gauge market dynamics and guide buyers more effectively.

In conclusion, having a deep understanding of the New York housing market is invaluable for mortgage lenders aiming to support first-time homebuyers. By leveraging insights into market dynamics, affordability metrics, and borrower profiles, lenders can offer tailored advice that meets the specific needs of their clients. This not only helps buyers navigate the complexities of homeownership but also builds lasting trust and loyalty. Equipped with these insights, you, as a lender, can play a pivotal role in making the dream of homeownership a reality for first-time buyers in New York. Let’s continue to empower our clients with the knowledge and guidance they need to make informed and confident decisions in their homebuying journey.

For more insights, check out our recent studies on the Florida and Texas markets and download our first-time homebuyer whitepaper.