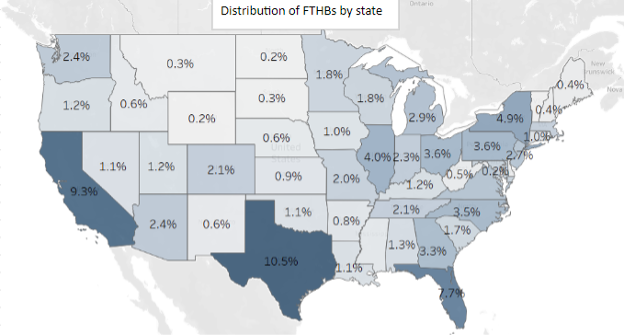

First-time homebuyers (FTHBs) represent a significant portion of the homebuying market across the United States, particularly in Texas where we see the largest proportion. While an overall diverse market segment, affordability is paramount to all. Experian Housing recently examined the mortgage landscape, looking at who is buying, where, and why, uncovering both expected and surprising insights.

Texas at a glance

Eight of the top ten fastest-growing US cities are in Texas. Lately, Texas business growth has included large employers, such as Amazon, Oracle, Caterpillar, Chevron, and Schwab, moving or expanding to the state. Looking for a more affordable life, consumers have also made the move. No state income tax, no corporate taxes, overall lower business taxes, business incentives, and a generally favorable cost of living make it very attractive to individuals and businesses.

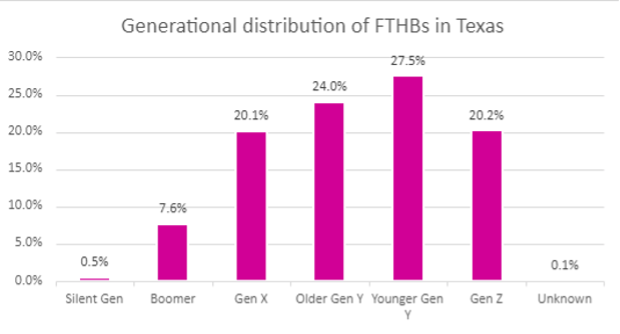

Recent research by Experian Housing revealed Texas accounts for the largest percentage of FTHBs in the US at nearly 10.5%, based on those getting a mortgage. Among these buyers, ~72% are Generation Y (Gen Y) and Generation Z (Gen Z), meaning they are in their early 40s and younger.

Defining and measuring affordability

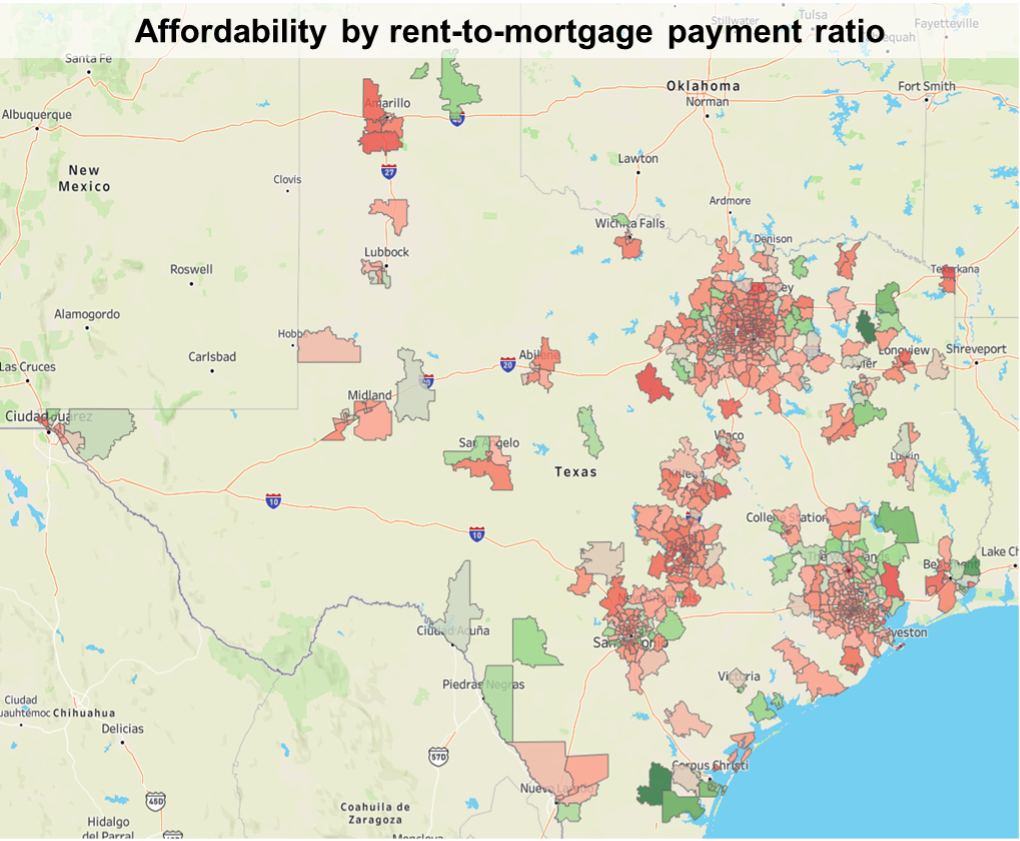

Affordability often tips the scale for prospective first-time homebuyers, particularly younger buyers, deciding to rent or buy. Texas mortgage lenders familiar with the geography of their local markets will likely have an advantage with these consumers if they understand affordability from a citywide perspective and at a hyper-focused neighborhood or zip code level.

What determines affordability? Affordability can be assessed through various metrics. For the purposes of this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio. This involves comparing monthly rent payments to monthly mortgage payments. A higher rent-to-mortgage ratio suggests renters may find mortgage payments more feasible, potentially making home buying a more appealing option.

According to Experian’s latest 2023 rental market report, Gen Z and Gen Y made up nearly 70% of the U.S. rental sector. When considered with their first-time homebuyer numbers in Texas and across the U.S., their importance in defining the market trend stands out. The rent-to-mortgage analysis provides important insights into whether these buyers may look to buy now or continue renting.

Texas by the numbers

Experian Housing examined affordability at the city and more granular, localized levels. Among those analyzed for affordability, Experian findings included:

- Lubbock is the most affordable city with a rent-to-mortgage ratio of 67%.

- Following Lubbock were Fort Worth (64%), San Antonio (63%), andEl Paso (62%) are the next cities.

- Among metro areas, Houston (58%), Arlington (56%), Dallas (52%) and Austin (49%).

In these cities, the low to high average current home sales price rankings tracked the rent-to-mortgage ratios except for El Paso, with the 2nd lowest average sales price, but coming in 4th in the affordability metric.

- Lubbock had the lowest average home sales price at $212,812.

- El Paso had the next lowest average sales price ($216,424), then San Antonio ($269,232) and Fort Worth ($312,579).

- Next came Houston ($317,882), Arlington ($345,077), Dallas ($402,830), and Austin ($598,431).

Is the city center or are the suburbs more affordable?

A look at the city level only tells part of the story. Examining the area by zip code reveals more insights into where loan officers might direct first-time buyer prospects.

In general, based on the median rent-to-mortgage payment ratio, the farther away from the city center (outer suburbs), the more affordable buying is for first-time buyers. San Antonio proved to be the notable exception where prices trended higher in the suburbs.

Mortgage lenders who are savvy about these inner-market differences, set themselves up for a greater likelihood of attracting first-time homebuyers and keeping them as loyal customers.

For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online.