Click here to watch our recent webinar on first-time homebuyers.

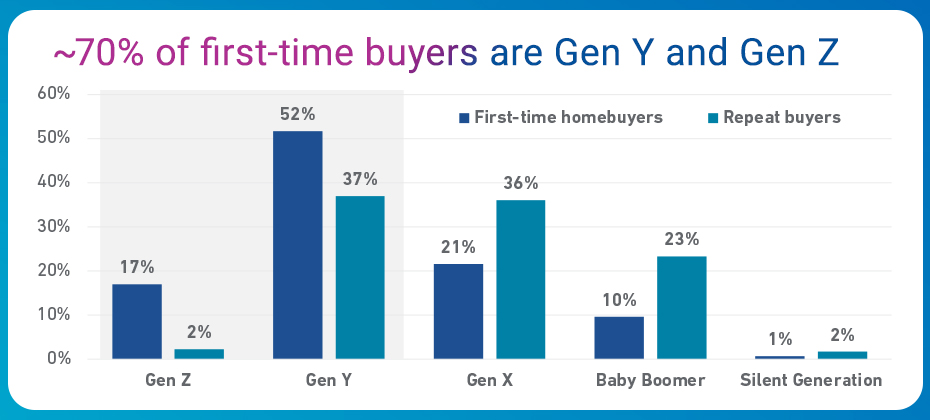

The younger generations comprise nearly 70% of first-time homebuyers, according to recent Experian Mortgage research. Understanding the generational traits of first-time homebuyers, particularly motivated younger generations, is critical to building highly targeted marketing strategies. Gen Z and Gen Y are essential in the first-time homebuyer market and represent close to 40% of repeat buyers, indicating they consider homeownership important beyond just their first purchase.

Generation Y borrowers lead the pack

Generation Y borrowers see homeownership as part of the American Dream but have waited longer than previous generations to purchase their first home.1 Additionally, as digital natives, they have grown up in a world with online resources and digital tools, making the home buying process more convenient for them. They can effortlessly research homes, compare mortgage rates, and even complete paperwork without leaving their home – a time and cost-saving advantage.

With their desire for stability and their technological proficiency, it comes as no surprise that Gen Y borrowers are at the forefront of the homebuying market, accounting for 52% of all first-time buyers.

Keep your eye on the next wave: Generation Z borrowers

Although Generation Z is the youngest group with both young adults and those entering adulthood, they should not be overlooked in the real estate market. Despite their age, Gen Z possesses characteristics and tendencies that make them legitimate potential first-time homebuyers.

Having grown up in an era characterized by technical advancements and economic instability, Gen Z has observed various challenges, such as the impact of the 2008 financial crisis on their families. They have also witnessed their parents and older siblings navigating student loan debt and a volatile job market. As a result, Gen Z individuals tend to approach life decisions with a cautious mindset.

However, it is important to note that Gen Z is a generation known for their ambition and determination. They have an entrepreneurial spirit. A strong desire for stability. According to a recent survey conducted by Chase2, homeownership holds an important place in the dreams of nearly 90% of Generation Z individuals. This unwavering aspiration for owning a home and increasing purchasing power establishes Generation Z as a significant influence in the real estate market.

Market to each generation where they are most comfortable, for Y and Z it is online and on the go

To get the attention of these younger generations, mortgage lenders must understand that for these groups, digital technology is the norm, integrated into all aspects of their lives. They rely heavily on social media, online reviews, and mobile apps for research and communication. Therefore, it is crucial for lenders to implement a marketing strategy that encompasses social media platforms and personalized email, and, increasingly, text communications, to resonate with the tech savvy nature of these generations. That said, there is nuance in every population, and we see this when observing communication preferences across generations. We know, for example, that first-time homebuyers are considerably more likely than the general public to respond to e-mail offers. Understanding communication preferences for each prospect is important for tailoring your omni-channel marketing approach.

Growing up in a world where technology is constantly advancing, Generations Y and Z are accustomed to having immediate access to information and services at their fingertips. As a result, they expect an efficient mortgage lending process that uses online, smartphone-enabled tools and platforms. They count on the ability to complete applications and paperwork online, receive updates and notifications via email or text, and have access to resources and tools to track and manage their mortgage journey.

Lenders embracing these realities about Gen Y and Gen Z and connecting with them where they are, will be better positioned to serve this demographic and grow their own business.

For more information about the lending possibilities for first-time homebuyers, download our latest white paper.

1 “Bank of America’s 2023 Homebuyer Insights Report Explores How Hopeful Buyers are Forging Ahead,” bankofamerica.com.

2 “Millennial and Gen Z Adults Still See American Dream Within Reach Despite Challenges,” chase.com.