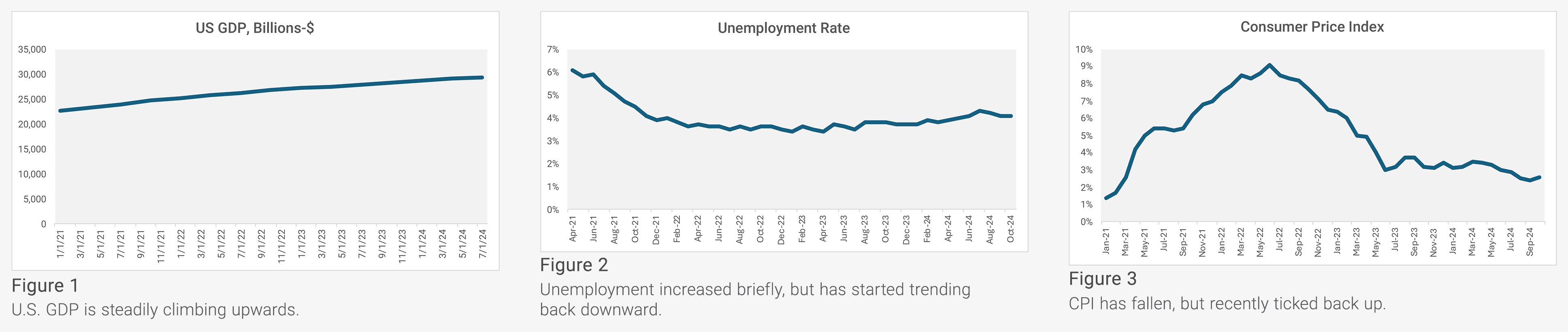

In 2024, the housing market defied recession fears, with mortgage and home equity growth driven by briefly lower interest rates, strong equity positions, generally positive economic indicators, and stock market appreciation. This performance is notable because, in 2023, economists’ favorite hobby was predicting a recession in 2024. Following a period of elevated inflation, driven largely by loose monetary policy, expansionary fiscal policy, and supply chain disruptions brought on by COVID, economists were certain that the US economy would shrink. However, the economy continued outperforming expectations, even as unemployment rose modestly (Figure 2) and inflation cooled (Figure 3).

Source: FRED (Figure 1, Figure 2, Figure 3).

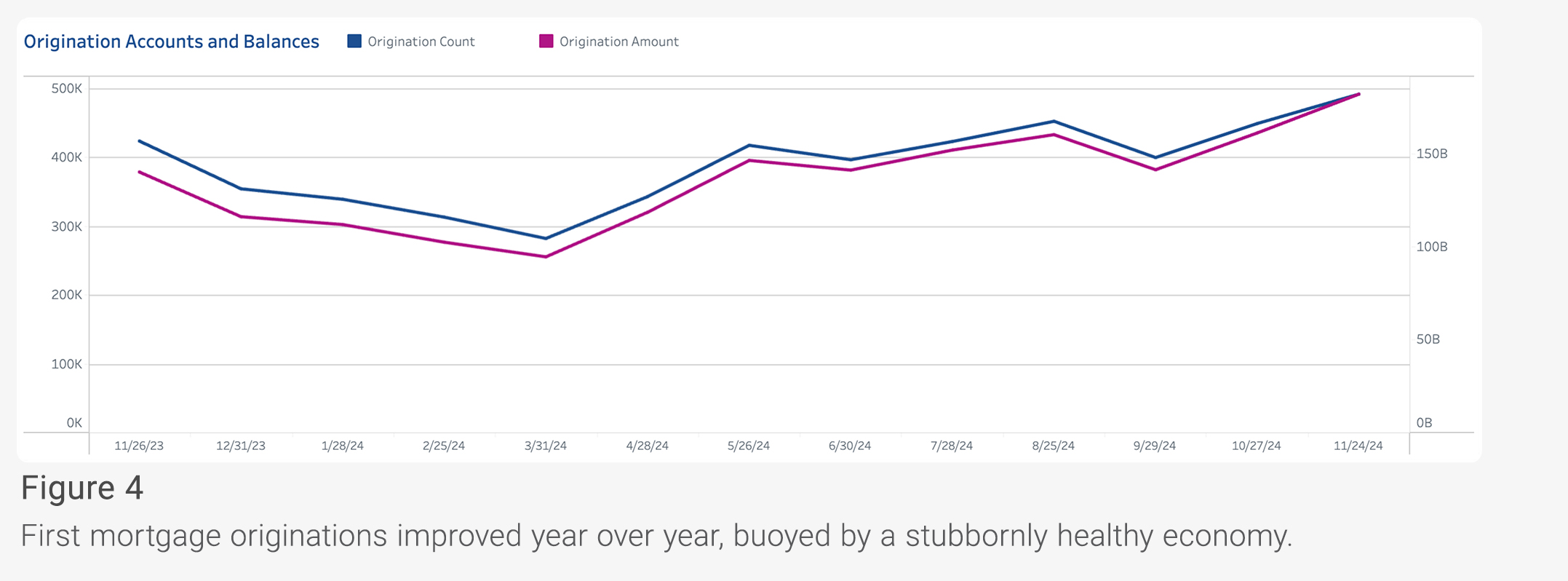

So, a good economy is good for the mortgage and home equity markets, right? Generally speaking, this statement was true. As monitored by Experian’s credit database, mortgage originations increased by approximately thirty percent year over year as of November 2024 (Figure 4), and Q3 ’24 pre-tax profit for Independent Mortgage Banks (IMBs) averaged $701 per loan.1 So, business in home lending is good — certainly better than it was during the period when the Fed was raising rates, origination volumes shrank as opposed to grew, and IMB profit per loan turned negative.

Source: Experian Ascend Insights Dashboard.

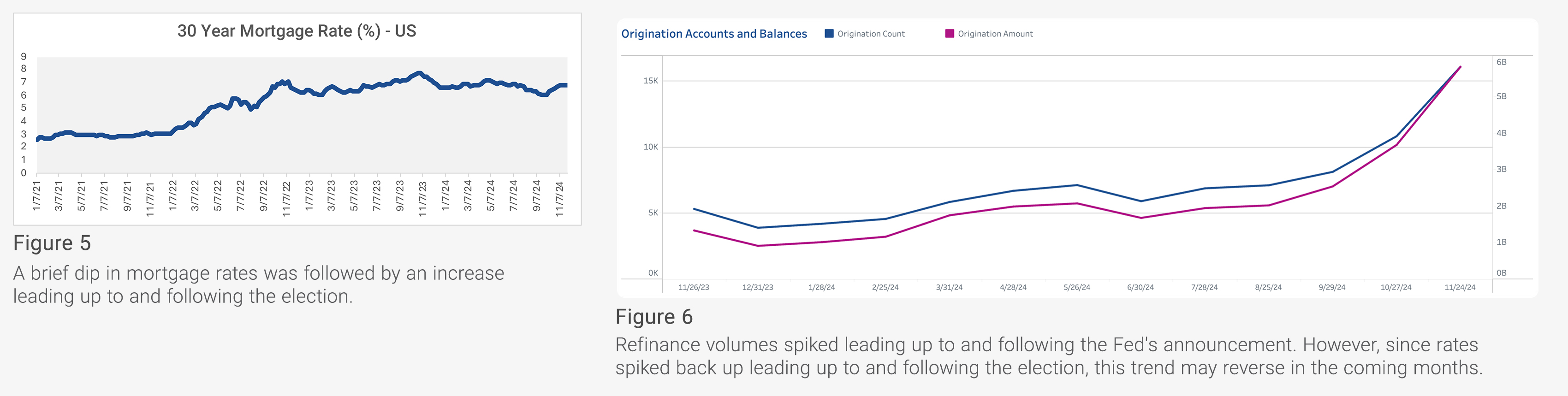

What constituted this growth in mortgage lending? As we all know, the Fed has lowered interest rates by 100bps since they started reducing rates in September. The market had priced in the September cut weeks prior to the actual announcement (Figure 5), and the market enjoyed a spike in refinance volume as a result (Figure 6). However, in the lead-up to and following the US presidential election, interest rates spiked back up due to the market’s expectations around future economic activity, which will dampen pressure on refinance volumes even after the recent additional rate drop. The impact of further rate drops on mortgage rates is unclear, and refinance volume still constitutes only around three percent of overall origination volume.

Source: Figure 5, Figure 6 (Experian Ascend Insights Dashboard).

The shift to a purchase-driven housing market

What does this all mean? Our view is that pockets of refinance volume (rate and term, VA, FHA, cashout) are available to those lenders with a sophisticated targeting strategy. However, the data also very clearly indicates that this market is still very much a purchase market in terms of opportunity for originations growth. This position should not surprise long-time mortgage lenders, given that purchase volume has always constituted a significant majority of origination volume. However, this market is a different purchase market than lenders may be used to.

This purchase market is different because of unprecedented statistics about the housing market itself. The average age of a first-time homebuyer recently reached a record high of 38. The average age of overall homebuyers in November of this year similarly jumped to a new record high of 56, with homes being “wildly unaffordable for young people.” Twenty-six percent of home purchases are all-cash, another record high, and homeowners have an aggregate net equity position of $17.6 trillion, fueling those all-cash purchases. The market is expensive both from an interest rate perspective and a housing price-level perspective, and those trends are driving who is buying homes and how they are buying them.2

Opportunities for lenders in 2025

What do these housing market dynamics mean for lenders? To begin with, lenders should not spend money marketing mortgages to consumers in their 50s and 60s with large equity positions. These consumers are likely to be in the 26 percent all-cash buyer cohort, and that money will be wasted since mortgages are no longer so cheap that even cash-rich buyers would take them. Further, this equity-rich generation has children, and nearly 40% of those children borrow from the bank of mom and dad to purchase their first home. Since roughly a quarter (albeit a shrinking quarter) of homebuyers are first-time homebuyers, and since 40% of those rely on help from parents to facilitate that purchase, it may make sense for lenders to identify those consumers with 1) children and 2) significant equity positions and to offer products like cash-out refinances or home equity loans/lines to help facilitate those first-time purchases.

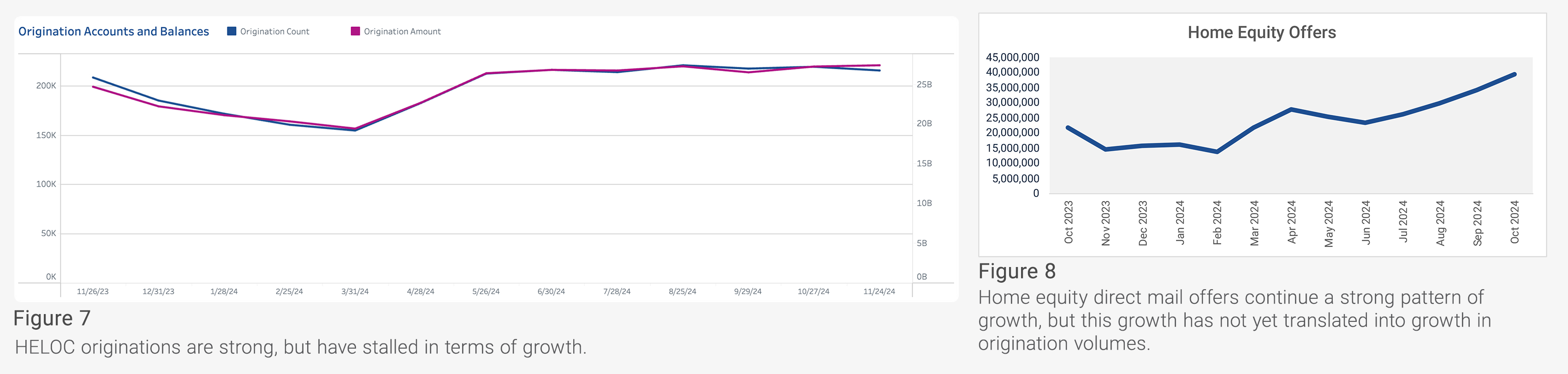

Data is critical to executing these kinds of novel marketing strategies. It is one thing to develop these marketing and growth strategies in principle and another entirely to efficiently find the consumers that meet the criteria and give them a compelling offer. Consider home equity originations. As Figure 7 illustrates, HELOC originations are strong but have completely stalled from a growth rate perspective. As Figure 8 illustrates, this is despite the market’s continued growth in direct mail marketing investment. Although HELOC origination volumes are a fraction of mortgage—around $27b per month for HELOC versus $182b per month for mortgage—there are significantly more home equity direct mail offers being sent per month (39 million) for home equity products as there are for mortgage (31 million) as of October ’24.3 This all means that although many lenders have wised up to the home equity opportunity to the point of saturating the market with offers, few have successfully leveraged targeting data and analytics to craft sufficiently compelling offers to those consumers to convert those marketing leads into booked loans.

Source: Figure 7 (Experian Ascend Insights Dashboard), Figure 8 (Mintel).

Adapting to a resilient housing market

In summary, the housing market, comprised of mortgage and home equity products, has experienced persistent growth over the past year. Many who are reading this note will have benefitted from that growth. However, as we have identified, in many respects housing market growth has 1) been concentrated to some key borrower demographics and 2) many lenders are investing in marketing campaigns that are not efficiently reaching or convincing that key housing demographic to book loans, whether it be a home equity or mortgage product. As such, as we move into 2025, Experian advises our clients to focus on the following three themes to ensure they benefit from this trend of growth into the new year:

- Ensure you effectively differentiate your marketing targeting, collateral, and offers for the various demographics in the market.

- Ensure your origination experiences for mortgage and home equity products are modern and efficient. Lenders who force all borrowers through a painful, manual legacy process will waste marketing dollars and experience pipeline fallout.

- Although the market is growing, other lenders are coming for your current customers. They could be coming for purchase activity, refinance opportunities, or they may be using home equity products to encroach on your existing mortgage relationship. As such, capitalizing on growth in 2025 is not merely about gaining new customers; it is also about retaining your existing book of business using high-quality data and analytics.

1 Although December numbers are available for year-over-year comparison, we excluded them due to the holiday period’s strong seasonality patterns.

2 The Case-Shiller index recently topped out at record levels.

3 Mintel/Comperemedia data.