Consumers want to pay less. This is true in retail and in lending. No big surprise, right?

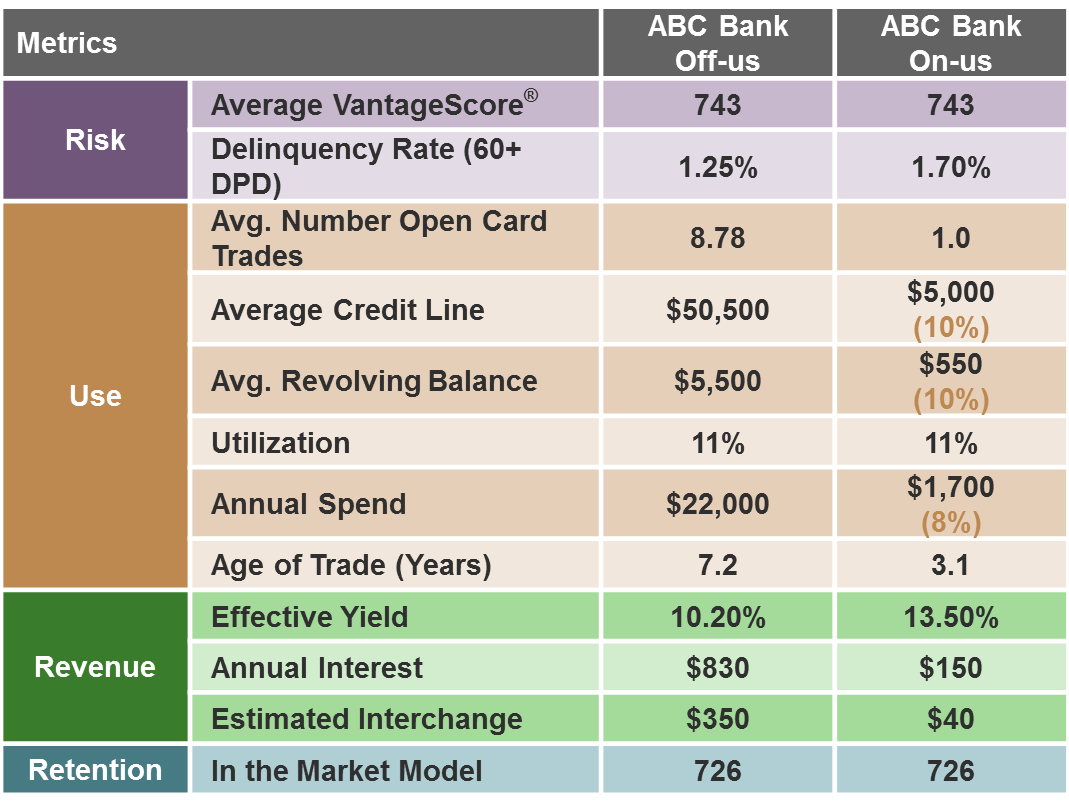

So in order for lenders to capitalize and identify the right consumers for their respective portfolios, they need insights. Lenders want to better understand what rates consumers have. They want to know how much interest their customers pay. They want to know if consumers within their portfolio are at risk of leaving, and they want visibility into new prospects they can market to in an effort to grow.

Luckily, lenders can look to trade level fields to be in the know. These inferred data fields, powered by Trended Data, allow lenders to offer products and terms that serve two purposes:

- First, their use in response models and offer alignment strategies drive better performance, ROI and life-time value. As noted earlier, consumers want to pay less, so if they are offered a better rate or money-saving offer, they’re more likely to respond.

- Second, they ultimately save consumers money in a way that benefits each consumer’s unique financial situation- overall savings on interest paid over the life of the loan, or consolidation of other debt often combined for a lower monthly payment.

These trade level fields allow lenders to dig into various trends and insights surrounding consumers. For example, Experian data can identif y big spenders and transactors (those who pay off their purchases every month). Research reveals these individuals love to be rewarded for how they use credit, demanding rewards, airline miles or other goodies for the spending they do. They also really like to be rewarded with higher credit lines, whether they use the increased line or not. Fail to serve these transactors in the right way and lenders could be faced with lackluster performance in the form poor response rates, booking rates, activation rates and early attrition. Thus, a little trade level insight can go a long way in helping lenders personalize products, offers and anticipate future financial needs.

y big spenders and transactors (those who pay off their purchases every month). Research reveals these individuals love to be rewarded for how they use credit, demanding rewards, airline miles or other goodies for the spending they do. They also really like to be rewarded with higher credit lines, whether they use the increased line or not. Fail to serve these transactors in the right way and lenders could be faced with lackluster performance in the form poor response rates, booking rates, activation rates and early attrition. Thus, a little trade level insight can go a long way in helping lenders personalize products, offers and anticipate future financial needs.

Knowing the profitability of a customer across all of their accounts is important, and accessing this intelligence in a seamless way is ideal. The data exists. For lenders, it’s just a matter of unlocking it, making those small, but meaningful changes and keeping a pulse on the portfolio. Together, these strategies can help lenders keep their best customers and acquire new ones that stick around longer.