Since 1996, The Internal Revenue Service (IRS) has issued more than 27 million individual taxpayer identification numbers (ITINs) – a 9-digit number used by individuals who are required to file or report taxes in the United States but are not eligible to obtain a Social Security number (SSN).

Across the country, ITIN holders are actively contributing to their communities and the U.S. financial system. They pay bills, build businesses, contribute billions in taxes and manage their finances responsibly. Yet despite their clear engagement, many remain underrepresented within traditional lending models.

Lenders have a meaningful opportunity to bridge the gap between intention and impact. By rethinking how ITIN consumers are evaluated and supported, financial institutions can:

Reduce barriers that have historically held capable borrowers back

Build products that reflect real borrower needs

Foster trust and strengthen community relationships

Drive sustainable, responsible growth

Our latest white paper takes a more holistic look at ITIN consumers, highlighting their credit behaviors, performance patterns and long-term growth potential. The findings reveal a population that is not only financially engaged, but also demonstrating signs of ongoing stability and mobility. A few takeaways include:

ITIN holders maintain a lower debt-to-income ratio than SSN consumers.

ITIN holders exhibit fewer derogatory accounts (180–400 days past due).

After 12 months, 76.9% of ITIN holders remained current on trades, a rate 15% higher than SSN consumers.

With deeper insight into this segment, lenders can make more informed, inclusive decisions. Read the full white paper to uncover the trends and opportunities shaping the future of ITIN lending.

Download white paper

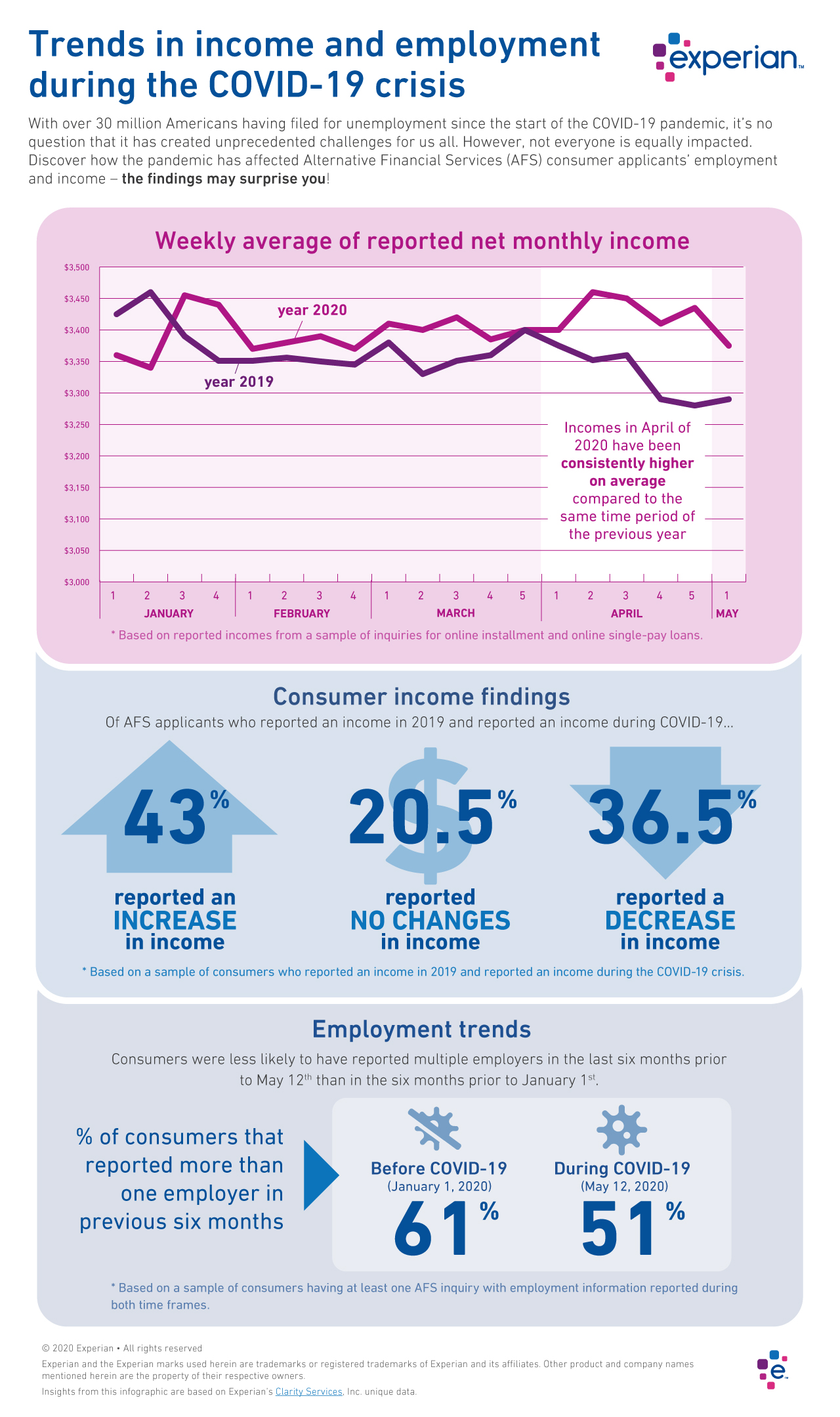

The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture?

The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture?