In today’s age, where speed and convenience are paramount, lenders must transform their digital income verification experience to meet customer expectations. Leveraging the benefits of instant verification is crucial to delivering a seamless experience. However, there are situations where instant verification may not be available or unable to verify customers. This is where the value of incorporating user-permissioned verification into your workflow becomes evident.

Let’s explore the advantages of using a combination of instant and permissioned verification and how they can synergistically enhance coverage, reduce costs, improve efficiency, and deliver an exceptional customer experience.

Instant verification: The epitome of efficiency and experience

Instant verification technology enables lenders to access real-time customer data, making it the pinnacle of verification efficiency. Its ability to deliver immediate insights facilitates quick decision-making, ensuring a seamless and frictionless experience for lenders and customers. There are several benefits to streamlining your verification process, including:

- Speed and efficiency: Eliminate the time-consuming process of manually gathering and analyzing data to expedite loan approvals and reduce customer waiting times.

- Enhanced user experience: With real-time results, customers can complete their applications quickly and effortlessly, leading to increased satisfaction and higher conversion rates.

- Reduced risk: Assess applicant information promptly, maintaining the security and integrity of lending processes.

Permissioned verification: Expanding coverage and engaging customers

While instant verification technology offers numerous advantages, it may not always be available or suitable for every customer. This is where permissioned verification plays a vital role. By integrating permissioned verification into the verification workflow, lenders can expand coverage and keep customers engaged in a digital channel, reducing abandonment rates. The benefits of leveraging permissioned verification include:

- Convenience and speed: By granting permissioned access, customers avoid the hassle of uploading or submitting documents manually. This saves time and effort, resulting in a faster verification process.

- Increased coverage and reduced abandonment: Permissioned verification ensures a higher coverage rate by minimizing the potential for customer abandonment during the application process. Since the information is retrieved seamlessly, customers are more likely to complete the application without frustration.

- Privacy and control: Customers retain control over their data by explicitly granting permission for access. This enhances transparency and empowers individuals to manage their financial information securely.

Creating a verification “waterfall” for optimal results

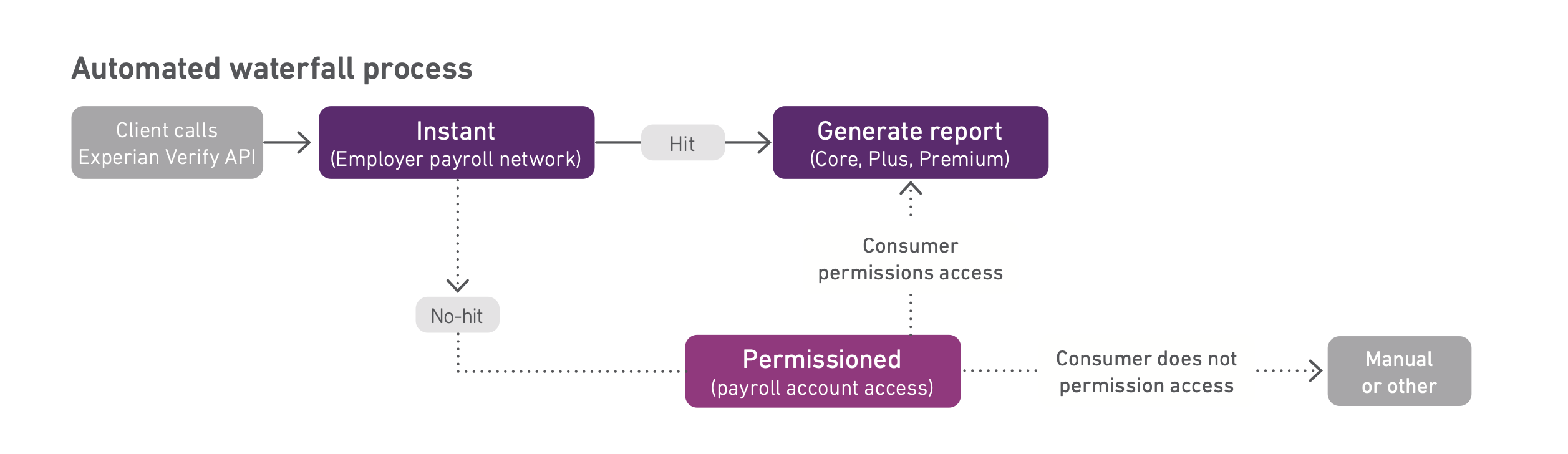

To harness the combined power of instant and permissioned verification, lenders can establish a verification “waterfall” approach. This approach involves a cascading verification process where instant verification is the first step, followed by permissioned verification if instant verification is not available or unable to verify the customer.

Example of Experian Verify’s automated verification waterfall.

There are numerous advantages to adopting a “waterfall” approach, including:

- Cost efficiency: Lenders who prioritize instant verification save on operational costs associated with manual verification processes. The seamless transition to permissioned verification reduces the need for manual intervention, minimizing expenses and improving efficiency.

- Improved verification success rate: A verification waterfall ensures that alternative verification methods are readily available if the initial instant verification is unsuccessful. This increases the overall success rate of verifying customer data and reduces the likelihood of losing potential borrowers.

- Enhanced customer experience: The combination of instant and permissioned verification creates a streamlined and frictionless customer experience. Customers can progress seamlessly through the verification process, reducing frustration and increasing satisfaction levels.

Propelling your business forward

In the dynamic landscape of lending, a combination of instant and permissioned verification technologies provides significant value to lenders and customers. While instant verification delivers unparalleled efficiency and experience, incorporating permissioned verification ensures expanded coverage, reduced abandonment rates, and a seamless digital journey for customers. By implementing a verification “waterfall” approach, lenders can optimize verification processes, reduce costs, improve efficiency, and ultimately deliver an exceptional customer experience.

Learn more about our solutions The advantages of instant and permissioned verification

*This article leverages/includes content created by an AI language model and is intended to provide general information.