Credit reports provide a wealth of information. But did you know credit attributes are the key to extracting critical intelligence from each credit report? Adding attributes into your decisioning enables you to:

- Improve acquisition strategies and implement policy rules with precision.

- Segment your scored population for more refined risk assessment.

- Design more enticing offers and increase book rates.

Attributes can help you make more informed decisions by providing a more granular picture of the consumer. And that can make all the difference when it comes to smart lending decisions.

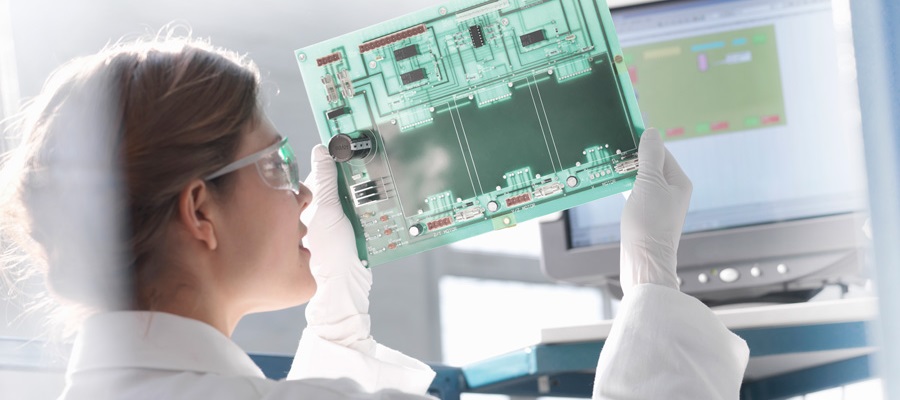

Video: Making better decisions with credit attributes