Today’s mortgage market is challenging. Mortgage lenders and servicers will need to focus on product expansion to continue to grow their business. In a recent Q&A session, Susan Allen, Head of Product for Experian Mortgage, shared best practices for leveraging data for profitable growth.

Q: At a high level, how can mortgage lenders and servicers grow their businesses?

A: There are a lot of options to increase pipeline. One best practice we’re seeing now is to consider expanding both your product suite and your footprint. Very few lenders offer a comprehensive set of solutions in a national footprint. But demand is strong for solutions that go beyond traditional 30-year fixed-rate mortgages, including options to tap home equity. These types of products can help you grow your business by exposing you to new borrowers and broadening your relationships with clients. For example, we see several clients, even non-banks, venturing into credit cards and personal loans to meet their customers’ broader financial needs.

Q: You mentioned demand for home equity solutions is strong. What should lenders consider when it comes to home equity loan growth strategies?

A: The current record level of untapped equity makes home equity lines of credit (HELOCs) attractive for borrowers to use for debt consolidation, remodeling or to add to their rainy-day fund. For lenders to decide whether HELOCs would be profitable for their business, they should look broadly at data about borrowers, volumes and indicators of profitability, such as credit lines and utilization.

Q: It’s one thing to talk about the HELOC market, but does Experian have any home equity data to show what’s happening in this space?

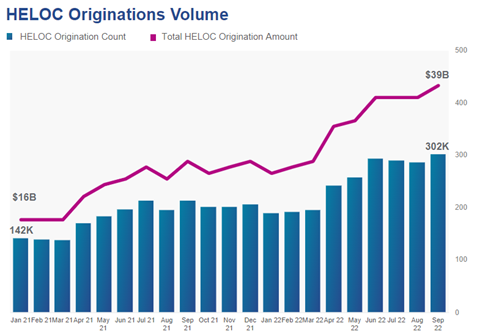

A: Absolutely. We’re seeing several things when it comes to home equity data. First, HELOC volumes have doubled since January 2021, which indicates strong borrower interest.

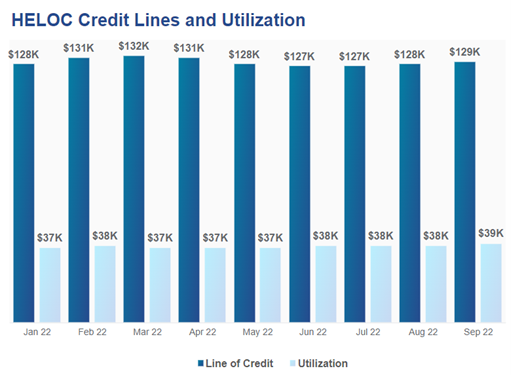

Second, we know that home prices are at record highs across the board, and we see this record of “tappable” equity translating into credit lines well over $100,000. What’s more, we’re seeing borrowers drawing down consistently at $37,000 on average, which is a healthy and profitable utilization rate.

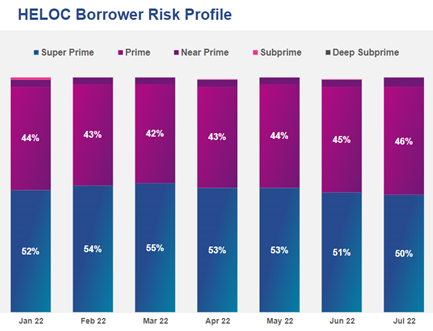

Lastly, greater than 90% of HELOC borrowers have a prime or super prime credit score. Our data shows HELOC borrowers have higher credit scores than new purchase borrowers.

Additionally, conventional wisdom says that HELOCs are for seasoned homeowners, but according to the data, the younger generation of homeowners has tripled their HELOC originations. I’ve been in this industry for a long time, and to be honest, this shocked me. This makes it clear that it’s always important (especially for industry veterans) to constantly update our understanding of current market dynamics.

Q: Wow, it sounds like expansion into home equity solutions is a no-brainer. What am I missing?

A: HELOCs are a strong and growing market segment. But it’s not sufficient to look only at opportunity. We must also use the best data at our disposal to evaluate risk. With HELOC performance impacted by property values, recent concern over the stability of home prices is causing some lenders to pause. Clients tell us they would like to expand their HELOC offerings but aren’t sure when or where to start.

Q: So, what’s the answer here?

A: Data is key to taking the guesswork out of decisions. When it comes to HELOC expansion, lenders voice concern specifically about home price forecasts. Although it is notoriously hard to forecast home prices, you can use actual, current data to inform decisions about where and when to expand a home equity portfolio. For example, lenders can use listing data to gauge markets shifting from a “seller’s market” to a “buyer’s market.”

Q: Susan, this has been a great discussion. Any final thoughts?

A: As I’ve shared, great opportunities exist. With best-in-class data and analytics, lenders can find these opportunities and propel their businesses forward.

Be sure to read the other blog posts in this series:

Getting Ahead with a Proactive Mortgage Outreach and Engagement Strategy

Lead Conversion Through Tailored Messaging and a Multichannel Mortgage Marketing Strategy

To learn about Experian Mortgage solution offerings, click here.