Latest Posts

A recent Experian credit trends analysis of new mortgages and bankcards from Q1 2013 shows a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Providing further evidence of continued economic recovery throughout the nation, mortgage delinquency rates reached multi-year lows and bankcard delinquency rates reached near-record lows.

Despite the improving real-estate market, financial institutions are concerned about lending to consumers who have pursued strategic defaults. In a recent VantageScore Solutions survey, 85 percent of respondents believe that consumers who have pursued strategic defaults pose increased risk, even if they meet the institution’s other lending criteria. More than half of those surveyed said they are not likely to approve strategic defaulters for a mortgage loan in the next 12 months. Source: The Score: Short sales and foreclosures make lenders wary VantageScore® is a registered trademark of VantageScore Solutions, LLC.

By: Joel Pruis So we know we need to determine the overall net yield on assets required to cover the cost of funds and the operating expenses but how? In the movie Moneyball, the Oakland A’s develop a strategy to win 99 games by scoring 814 runs and only allowing 645 runs by the opposition. In order to generate the necessary runs, Peter Brand boils down all the stats into one number, on base percentage. By looking at the on-base percentage of all the players in the league, Brand is able to determine the likelihood of generating runs. There are a few key phrases/quotes from this scene that need to be highlighted: “it’s about getting things down to one number” “People are overlooked for a variety of biased reasons and ‘perceived’ flaws.” “Bill James and mathematics cut straight through that [biased reasons and perceived flaws].” Getting things down to one number is the liberating element for the Oakland A’s and for banking. We have already identified the one number for banking – Net Yield on Assets. Let’s define this a bit further though. For this exercise, net yield means the gross yield (interest income plus fee income) on assets less charge offs. We are looking to see what is going to be the consistent return on the assets less what can be expected net charge off related to the assets. When Billy Beane and Peter Brand got it down to the one number “On Base Percentage” it altered the player selection process and highlighted the biases of the scouts such as: Giambi’s brother was “getting a little thick around the waist” “Old Man” Justice Justice will be “lucky if he hits his weight” in July and August Justice’s “legs are gone Hatteberg “can’t throw” Hatteberg’s “best part of his career is over” Hatteberg “walks a lot” None of the above comments used any facts or data to disprove each player’s on base percentage. Can you imagine if they were underwriters or lenders? What type of compliance issues would we have on our hands with the above comments? Biased against disabilities (Hatteberg with nerve damage); Age Discrimination (“Old Man” Justice), Physical Appearance (Giambi’s brother “getting a little thick around the waist”), these scouts would be a compliance liability let alone obstacles in any type of organizational change. But one can readily see how focusing on one number liberates the thinking and removes the old constraints or ways of thinking. One of the scouts commented that Hatteberg had a high on base percentage because he walks a lot, considering a walk as a negative while a hit is a positive but why? Why is getting on base by being walked a negative but getting on base with a hit is positive? The result is the same as the movie points out. How about in commercial lending? If we focus on net yield on the portfolio as the one number, does that do anything to remove biases? I believe that it does. One example is the perception of charge offs in a portfolio. To this day the notion of a charge off in a commercial portfolio, even in the small business portfolio, is frowned upon and can jeopardize one’s career. Similar to the walk, the charge off is not desired but if we focus on the one number, net yield, it actually removes the stigma of the charge off! If we need at minimum a 6% net asset yield and we are able to generate a gross yield of 9% with an expected loss rate of 2%, we actually exceed our “one number” of a targeted net yield of 6% with an expected net yield of 7%. With that change that removes the biases and flawed perception, can we now start to find opportunities that provide us with the ability to step away from the norm; stop competing with the rest; and generate that higher return that is required? What are the potential biases and flawed perceptions that will need to be addressed? “High Risk” Industries? “Undesired” Loan types? Consumer vs. Commercial? Real Estate Secured vs. Unsecured? Loans vs. Treasuries or other earning asset types? But just as in the movie, you need to be prepared for the response you may get from the traditional ‘seasoned’ lenders in your organization. When Billy Beane puts the new strategy into place at the Oakland A’s, the lead scout responds with: “You don’t put a team together with a computer” “Baseball isn’t just numbers, it isn’t science. If it was anybody could do what we do but they can’t.” “They don’t know what we know. They don’t have our experience and they don’t have our intuition.” Ah, just like the traditional baseball scout is the traditional commercial lender with the years of experience, judgment and intuition. I used to be one and used almost word for word the same argument against credit scoring and small business before I truly understood what it was all about. Don’t get me wrong. Experience, judgment and intuition is valuable and necessary. But that type of judgment tends to get into trouble when it stops looking outside for data and only relies on past personal experience to assess the next moves. Experience is always important but it has to continually review, assess and interpret the data. So let’s start looking at the different types of data. On deck – How do we know how many runs the opposition is going to score? The use of external data.

By: Joel Pruis I am going to take some liberties here. Nowhere in the movie Moneyball does Peter Brand tell us how he got to the magic number of winning 99 games to get to the playoffs. My assumption is that given the way that he evaluates the Oakland A’s, he also evaluations the other teams in their conference. Assessing the competitive landscape provides Brand with the estimated runs their opponents will generate. Now we could take the approach that such analysis would correlate to assessing how your competition is going to perform but I am going to take a different approach. I would compare the conference assessment in Moneyball to be similar to an economic forecast/assessment. We need to assess what are the overall conditions in which we must operate that will allow us to generate the net yield on the assets of our financial institution. Some of the things we need to assess to determine what we will be able to generate related to the net yield on assets would be: Gross yield on assets Current interest rate environment (yield on treasuries, federal home loan bank, etc. Interest rate trends (increasing, declining, trends toward fixed rates, variable rates) Industry information General trend of businesses across the nation How are businesses faring? How well are they paying their creditors? Are they relying more or less on credit? Are new businesses being started? Are they succeeding? Are they failing? General trends (same as above) within your financial institution’s market footprint One such source of the industry information is the Small Business Credit Index generated by Experian & Moody’s Analytics. In the recent release of the Small Business Credit Index, small business is indicating stronger from the prior quarter moving from 104.3 to 109. But this is from a national perspective. Depending on your financial institution, it is important to always get an overall view of the economy but more importantly, what is happening in your particular market footprint. Just as the Oakland A’s in Moneyball maintained an overall perspective of Major League Baseball, their focus for success was targeting their specific conference to reach the playoffs. So as we look at information such as the Small Business Credit Index, we are able to see highlights of regional trends (certain states west of the Mississippi are doing better while certain states along the east coast are not) and specific industry trends. From such data we need to drill down into our specific footprint and current portfolio. We need to review such items as: What industry concentrations do we have that are doing well in the economy and how is our portfolio doing compared to the external data? What industries are we not engaging that may provide a good opportunity for our financial institution? What changes are taking place in the general economy that may impact our ability to achieve our expected results? What external factors must we be monitoring that may impact our strategy (such as the impact of Obamacare and how it will impact the hiring for businesses with more than 50 employees?) Just as in Moneyball, Brand continues to monitor the performance of the overall league (and the individual players for future trades), we need to continually monitor the national, state and local economies to determine what adjustments we will need to make to achieve our strategies. So we have assessed the general environment, on to strategies or “How do we win 99 games with a total payroll of $38 million?”

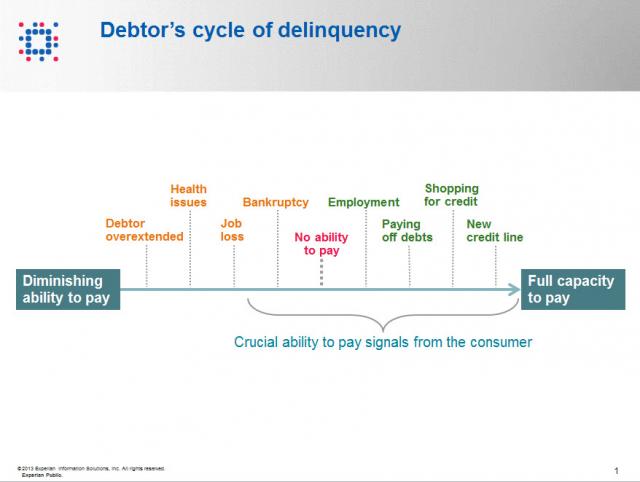

Contact information such as phone numbers and addresses are fundamental to being able to reach a debtor, but knowing when to reach out to the debtor is also a crucial factor impacting success or failure in getting payment. As referenced in the chart below, when a consumer enters the debtor life cycle, they often avoid talking with you about the debt because they do not have the ability to pay. When the debtor begins to recover financially, you want to be sure you are among the first to reach out to them so you can be the first to be paid. According to Don Taylor, President of Automated Collection Services, they have seen a lift of more than 12% of consumers with trigger hits entering repayment, and this on an aged portfolio that has already been actively worked by debt collection staff. Monitoring for a few key changes on the credit profiles of debtors provides the passive monitoring that is needed to tell you the optimal time to reach back to the consumer for payment. Experian compiled several recent collection studies and found that a debtor paying off an account that was previously past due provided a 710% increase in the average payment. Positive improvement on a consumers’ credit profile is one of those vital indicators that the consumer is beginning to recover financially and could have the will—and ability—to pay bad debts. The collection industry is not like the big warehouse stores—quantity and value do not always work hand in hand for the debt collection industry. Targeting the high value credit events that are proven to increase collection amounts is the key to value, and Experian has the expertise, analytics and data to help you collect in the most effective manner. Be sure to check out our other debt collection blog posts to learn how to recover debt more quickly and efficiently.

By: Joel Pruis What is it we as bankers are trying to accomplish? If you have been in the industry for 20+ years, this question may sound ridiculous! We do what we do! We are bankers! What do you mean define what are we trying to do? But that is the question, what is it we are trying to do? I am going to propose we boil it down to the basic/fundamental element – Banks aggregate money from various sources and redeploy these funds to earn a return for the shareholders. Ultimately, our objective is to generate an appropriate return for the shareholders Getting back to the movie Moneyball, Billy Beane and Peter Brand define the objective of the Oakland A’s for the season in terms of projecting the number of wins that are needed to assure, with all probability, that the team makes the playoffs (this would be similar to the objective of banking to generate an appropriate return for the shareholders). But Peter Brand quickly moves into very specific targets that are required for the A’s to make it to the playoffs, namely win 99 regular season games. In order to win 99 regular season games, the A’s offense will need to score 814 runs in the season and defensively only allow 645 runs. Plain and simple. Very objective, very measurable and it is all based upon data, data, data. Let’s break this down. Based upon their conference, the teams in their conference along with the overall schedule, Peter Brand projects that 99 wins are necessary to land a spot in the playoffs. No gut check, no darts or crystal ball but rather historical data that when analyzed provides the benchmark of 99 wins to statistically assure the Oakland A’s that they will make the playoffs. So let’s apply this to banking. Our objective is to generate the appropriate return for our shareholders or the old Return on Equity. So, for example, if our targeted return on equity is 20% (making the playoffs) we need to make sure we generate enough net income (99 wins) through producing the necessary gross yield on assets (814 runs generated by the Oakland A’s offense) less the expected charge offs (645 runs allowed by the Oakland A’s defense). For a quick dive into details, our data would provide for a margin of error on the variable to provide for statistical assurance of achieving the objective (Return on Equity). In the movie there is no guaranty that the 814 runs will win the conference but at the same time there is no guaranty that the Oakland A’s opponents will score 645 runs. Never in the movie does the coach, Billy Beane or Peter Brand tell the team, “You only have to score X number of runs this game, don’t score anymore.” Or even crazier, “You are not letting the other team score enough runs, they need to score 645!” No, the strategy is still to generate as many runs as possible while minimizing the number of runs scored by the opposition. Rather it is the review of the total amount of earning assets of the financial institution and the overall credit quality that we must understand and control to determine our ability to generate the net yield on assets required to generate the return on equity that is required. If we assume too much risk in the portfolio in order to generate the required yield it would be similar to having a poor pitching staff projected to allow 10 runs a game requiring the team to produce 11 runs a game in order to win. It just is not realistic. So basically we need to assess at the high level, are we appropriately structured to allow for the generation of enough profit to provide the appropriate return on equity. At this point, we do not need to complicate it any further than that. Now let’s take a look at the constraints. We know we have them in banking, let’s take a look at probably the single biggest constraint imposed on Billy Beane and the Oakland A’s. In the movie, before Billy Beane is even aware of the Moneyball concept, his is given his constraint by the owner. Beane asks for more money to ‘buy players’ and is flat out rejected by the owner. The owner, in fact, cuts Beane off by asking, “is there anything else I can do for you?”. Net result is that the Oakland A’s have $38 million dollars for payroll vs. the New York Yankees at $120 million. Seriously it does not seem fair. How can you attract the needed talent when you cannot pay the type of salary needed to get the necessary players to win a championship? Let’s rephrases this for banking… How can a bank be expected to deploy its assets when such a high rate of return is required? Boiling it down to a specific example, “How can I originate a commercial loan at this rate of interest when the competition is ½ to 1% lower than our rates?” Up next – Why will 99 games get us to the playoffs? How do we assess the environment?

A recent study comparing financial differences between men and women found that, overall, women are better at managing money and debt. Differences between the two populations include:

By: Joel Pruis Times are definitely different in the banking world today. Regulations, competition from other areas, specialized lenders, different lending methods resulting in the competitive landscape we have today. One area that is significantly different today, and for the better, is the availability of data. Data from our core accounting systems, data from our loan origination systems, data from the credit bureaus for consumer and for business. You name it, there is likely a data source that at least touches on the area if not provides full coverage. But what are we doing with all this data? How are we using it to improve our business model in the banking environment? Does it even factor into the equation when we are making tactical or strategic decisions affecting our business? Unfortunately, I see too often where business decisions are being made based upon anecdotal evidence and not considering the actual data. Let’s take, for example, Major League Baseball. How much statistics have been gathered on baseball? I remember as a boy keeping the stats while attending a Detroit Tigers game, writing down the line up, what happened when each player was up to bat, strikes, balls, hits, outs, etc. A lot of stats but were they the right stats? How did these stats correlate to whether the team won or lost, does the performance in one game translate into predictable performance of an entire season for a player or a team? Obviously one game does not determine an entire season but how often do we reference a single event as the basis for a strategic decision? How often do we make decisions based upon traditional methods without questioning why? Do we even reference traditional stats when making strategic decisions? Or do we make decisions based upon other factors as the scouts of the Oakland A’s were doing in the movie Moneyball? In one scene of the Movie, Billy Beane, general manager of the A’s, is asking his team of scouts to define the problem they are trying to solve. The responses are all very subjective in nature and only correlate to how to replace “talented” players that were lost due to contract negotiations, etc. Nowhere in this scene do any of the scouts provide any true stats for who they want to pursue to replace the players they just lost. Everything that the scouts are talking about relates to singular assessments of traits that have not been demonstrated to correlate to a team making the playoffs let alone win a single game. The scouts with all of their experience focus on the player’s swing, ability to throw, running speed, etc. At one point the scouts even talk about the appearance of the player’s girlfriends! But what if we changed how we looked at the sport of baseball? What if we modified the stats used to compile a team; determine how much to pay for an individual player? The movie Moneyball highlights this assessment of the conventional stats and their impact or correlation to a team actually winning games and more importantly the overall regular season. Bill James is given the credit in the movie for developing the methodology ultimately used by the Oakland A’s in the movie. This methodology is also referred to as Sabermetrics. In another scene, Peter Brand, explains how baseball is stuck in the old style of thinking. The traditional perspective is to buy ‘players’. In viewing baseball as buying players, the traditional baseball industry has created a model/profile of what is a successful or valuable player. Buy the right talent and then hopefully the team will win. Instead, Brand changes the buy from players to buying wins. Buying wins which require buying runs, in other words, buy enough average runs per game and you should outscore your opponent and win enough games to win your conference. But why does that mean we would have to change the way that we look at the individual players? Doesn’t a high batting average have some correlation to the number of runs scored? Don’t RBI’s (runs batted in) have some level of correlation to runs? I’m sure there is some correlation but as you start to look at the entire team or development of the line up for any give game, do these stats/metrics have the best correlation to lead to greater predictability of a win or more specifically the predictability of a winning season? Similarly, regardless of how we as bankers have made strategic decisions in the past, it is clear that we have to first figure out what it is exactly we are trying to solve, what we are trying to accomplish. We have the buzz words, the traditional responses, the non-specific high level descriptions that ultimately leave us with no specific direction. Ultimately it allows us to just continue the business as usual approach and hope for the best. In the next few upcoming blogs, we will continue to use the movie Moneyball as the back drop for how we need to stir things up, identify exactly what it is we are trying to solve and figure out how to best approach the solution.

By: Matt Sifferlen Ah, fraudulent behavior is currently enjoying a bright shiny moment in the sun in today's pop culture, particularly in the world of sports. Whether it's a college athlete being duped for months by telephone conversations with a non-existent girlfriend, or the world's best known cyclist coming clean on a lifetime of deceit, in both cases we're left shaking our heads and laughing, crying, or cringing while telling ourselves "I'm glad I'm too smart to fall for any of this." But are you just kidding yourself? In the case of the college football player, most of us have been scratching our heads wondering how any adult could possibly get strung along for such an extended period of time by such a scam. But if you take a closer look at the interaction between the athlete and the fraudster, you'll see that the fraudster deployed some typical tactics that allowed him to keep the scam living and breathing. In particular, he continuously kept communicating with the athlete via phone and social media, reinforcing the perception that he's aboveboard and genuinely interested in the athlete's life. We see this in commercial fraud interactions too, where the commercial fraudster will perform expected, normal tasks and activities (e.g. making small payments on loans, placing phone calls to lender support staff) that will reinforce the lender's perception that the fraudster is just another normal client. But unlike the athlete's scenario where the fraudster's story unraveled due to no logical conclusion being planned, commercial fraudsters will string lenders along until they get what they want -- then they vanish. Lenders can't get too complacent in their fraud prevention efforts, assuming that the mere presence of normal account activity equates to a validation of a client's authenticity. To complicate things, while electronic communication methods like text messages, emails, and Twitter or Facebook messages offer many convenience advantages, they are ripe for manipulation by fraudsters who certainly find these methods preferable to any awkward face to face encounters with someone they're victimizing. The cyclist that admitted to a lifetime of lies also shines the light on some other tactics that commercial fraudsters might use -- using perceived image and reputation to deceive. Fraudsters will often steal identities of licensed professionals (think physicians, dentists) with favorable credit profiles and use their information to apply for commercial credit or services, knowing that they will likely be viewed favorably due to their impressive profiles, at least on paper. In today's world where lightly staffed underwriting teams struggle to keep up with their workloads, it's easy to see why this tactic can help increase the odds that an application might escape closer scrutiny. After all, it's a doctor's office so what could possibly go wrong? A lot, if you're approving someone who really isn't the doctor! An objective evaluation and screening process where underwriting and analyst staff consistently verify all applicant data and not just cherry pick the ones that look suspicious on paper can go a long way towards avoiding this typical trap set by commercial fraudsters. And in the final scenario of art imitating life, there is the recent release of a major motion picture comedy about identify theft. I'm sure anyone who has been a victim of identity theft won't find hilarity in the scenes of the victim's life getting turned upside down, suddenly unable to use his credit cards at the gas station and being asked about transactions that took place somewhere else in the country that he's never visited. But undoubtedly many folks will find this humor hilarious because we probably know of some horror story that a friend or acquaintance has shared with us that is similar to one of the wacky scenarios covered in this movie. So we'll laugh and take comfort in the fact that we're too smart to get scammed like this, but if the FTC is stating that identity theft will affect 1 in 6 people each year then we're fooling ourselves in thinking that our number won't be up at some point soon. So what can be learned from these high profile pop culture events? I think a couple things. First, know your customers (or athletes, heroes, girlfriends). It sounds simple, but make sure they are who they say they are. Whether you're lending to a business or a consumer, there are tools out there that can enable you to objectively screen your applicants and minimize any bias that might get exploited by fraudsters in a manual review heavy process. If you're not cautious and get burnt, you might not have to go on Oprah or Dr. Phil to explain to your management team where things went horribly wrong, but the level of financial and reputational damage inflicted could be a painful lesson for you and your institution. Or if you're really (un)lucky, maybe they'll make a movie about your story -- wouldn't that be hilarious? (sarcasm intended)

The purpose of any type of insurance is to protect your most valuable assets. To combat the prevalence of cyber attacks and data breaches, an increasing number of businesses in the health-care, financial services and technology industries have purchased cyber insurance policies to protect themselves from the crippling cost of a data breach. This is especially popular among start-up tech companies in Silicon Valley in order to safeguard their intellectual property (IP) since their IP is the backbone of their livelihood1. Since small businesses generally don’t have a risk manager and IT department dedicated to data security, a good cyber insurance policy can help mitigate cyber security risks. Although accepted in some sectors, cyber insurance is still not an established part of many companies’ IT data security strategies. This is commonly due to a lack of agreed risk management standards and the challenge of substantiating and quantifying losses, in addition to finding objective data to back up cyber insurance claims. Some security experts feel that the federal government needs to kick start growth in this market by requiring government contractors to purchase cyber insurance to set a standard for other businesses, sending a message that any company who has cyber security insurance is a signal that the company is competently managing its data security. As the cyber insurance industry evolves, here is a list of what the policies generally cover and what to look for: First-party claims – Costs incurred by the loss of trade secrets and intellectual property. Third-party claims – Damages a business must pay to customers who sue them for lost or compromised personal information. Business interruption coverage – In the event a data breach incident prevents the company from operating or functioning, the company would receive payment reimbursement for expenses incurred due to loss of business. A forensic IT investigation – Policies can cover the cost of an examination into how the data breach occurred and some may even cover the costs of regulatory fines and penalties in addition to the crisis management control which includes data breach notification letters. Security professionals stress that cyber insurance is not meant to be a substitute for data protection and security policies. In fact, before underwriting a policy, an insurance company will be hyper vigilant in determining that their customers have proper protections and policies in place since the insurance company will want to reduce its own risk. And since insurance has been a positive influence on other industries to improve performance and safety due to risk mitigation, the theory is if a company has cyber insurance, the hope is they will implement proper preventative measures to ensure that they will never have to use it. Learn more about our Data Breach solutions 1http://www3.cfo.com/article/2013/4/data-security_cyber-attacks-cybersecurity-liability-insurance-smb-growth-companies-risk-hogan-lovells

Financial institutions are revisiting their policies and thresholds for lending to small businesses and are slowly loosening restrictions. In a recent survey by the Federal Reserve Board, 9.2 percent of senior loan officers said they have "somewhat" eased their standards for lending to small firms and provided commercial borrowers more leeway, in the form of slightly bigger credit lines and longer maturity terms.

By: Maria Moynihan Cybersecurity, identity management and fraud are common and prevalent challenges across both the public sector and private sector. Industries as diverse as credit card issuers, retail banking, telecom service providers and eCommerce merchants are faced with fraud threats ranging from first party fraud, commercial fraud to identity theft. If you think that the problem isn't as bad as it seems, the statistics speak for themselves: Fraud accounts for 19% of the $600 billion to $800 billion in waste in the U.S. healthcare system annually Medical identity theft makes up about 3% of 8.3 million overall victims of identity theft In 2011, there were 431 million adult victims of cybercrime in 24 countries In fiscal year 2012, the IRS’ specialized identity theft unit saw a 78% spike from last year in the number of ID theft cases submitted The public sector can easily apply the same best practices found in the private sector for ID verification, fraud detection and risk mitigation. Here are four sure fire ways to get ahead of the problem: Implement a risk-based authentication process in citizen enrollment and account management programs Include the right depth and breadth of data through public and private sources to best identity proof businesses or citizens Offer real-time identity verification while ensuring security and privacy of information Provide a Knowledge Based Authentication (KBA) software solution that asks applicants approved random questions based on “out-of-wallet” data What fraud protection tactics has your organization implemented? See what industry experts suggest as best practices for fraud protection and stay tuned as I share more on this topic in future posts. You can view past Public Sector blog posts here.

Providing more evidence of a housing recovery, Q1 2013 mortgage originations increased 16 percent year over year to $471 billion. The Midwest region delivered the strongest annual gain, with a 29 percent increase over the previous year.

A recent survey that polled Americans on credit scores found that while nearly half of respondents (49 percent) check their credit scores at least once per year, the rest check once every two years or less, including a worrisome 22 percent who never check. The most common reasons for checking a credit score include purchasing a home (31 percent) or an automobile (32 percent).

VantageScore Solutions’ analysts recently examined how many accounts consumers with prime credit scores typically have in their credit file. Consumers who generally qualify for loans have an average of 13 loans in their credit files, and typically the oldest loan is more than 15 years old.