Latest Posts

In today’s digital age, call center fraud is a growing threat that businesses can no longer afford to ignore. As fraudsters become increasingly sophisticated, it’s crucial for companies to implement robust security measures to protect both their operations and their consumers. Various forms of call center fraud can have a significant impact on businesses. To prevent this, companies can use effective strategies including multifactor authentication solutions and account takeover prevention techniques. But first, what is call center fraud? Understanding call center fraud Call center fraud occurs when fraudsters exploit vulnerabilities in customer service operations to gain unauthorized access to sensitive information and commit identity theft. This type of fraud can take many forms, including social engineering, which occurs when a fraudster manipulates a call center agent into providing information or access, and phishing, which occurs when fraudsters use deceptive tactics to obtain confidential details from unsuspecting individuals. One of the most concerning tactics used by fraudsters is impersonation, or pretending to be legitimate consumers to gain access to accounts. Once they have access, they can make unauthorized transactions, change account details, or even take over the account entirely—a scenario known as an account takeover. The impact of these fraudulent activities can be devastating, leading to significant financial losses, damage to brand reputation, and a loss of consumer trust. Key strategies for preventing call center fraud According to recent research, account takeover fraud has increased by 330% in the past two years, projecting to cost $6.24 billion globally.[1] In addition, the number of U.S. consumers who have experienced account takeover has increased from 22% in 2021 to 29% in 2023.[2] To effectively combat call center fraud, businesses must adopt a multi-layered approach that includes advanced technological solutions, comprehensive employee training, and real-time monitoring. Here are some of the most effective strategies: 1. Implementing multifactor authentication (MFA) solutions One of the most effective ways to secure consumer interactions is by implementing multifactor authentication (MFA) solutions. MFA requires users to provide two or more verification factors to gain access to an account or complete a transaction. This adds an extra layer of security, making it significantly more difficult for fraudsters to succeed even if they have obtained some of the consumer’s information. MFA can be integrated into call center operations in several ways. For example, businesses can use voice recognition as a biometric factor, requiring consumers to verify their identity through a unique voiceprint. Other methods include sending a one-time code via text message, which the consumer must provide during the call, or using mobile app verification, where consumers approve transactions directly through their smartphones. 2. Account takeover prevention Account takeover is one of the most serious threats to call centers, as they involve fraudsters gaining control of a consumer’s account, often with disastrous consequences. To prevent account takeover, businesses can employ a combination of technological solutions and best practices. First, understanding what account takeover entails is crucial. It typically begins when a fraudster obtains some of the consumer’s personal information—often through phishing, social engineering, or a data breach. They then use this information to impersonate the consumer and convince call center agents to provide them with access to the account. To combat this, businesses can employ several account takeover prevention techniques. Anomaly detection systems can flag unusual activities, such as login attempts from unfamiliar locations or devices, prompting additional verification steps. Behavioral biometrics is another powerful tool, analyzing patterns in how users interact with their devices to detect inconsistencies that may indicate fraud. Continuous authentication, where the system continuously verifies the user’s identity throughout the session, is also effective in catching fraudsters in the act. 3. Training and awareness Technology alone may not be enough to entirely prevent call center fraud—human factors are equally important. Regular training for call center staff is essential to ensure team members can recognize and respond to potential fraud attempts. Employees should be trained to identify common tactics used by fraudsters, such as social engineering, and to follow strict verification procedures before providing any sensitive information. Awareness campaigns can also play a significant role in preventing fraud. Internally, companies should run regular campaigns to remind employees of the importance of adhering to security protocols. Externally, educating consumers about the risks of fraud and encouraging them to use security features like MFA can help reduce the likelihood of successful attacks. 4. Real-time monitoring and analytics Real-time monitoring is a critical component of an effective fraud prevention strategy. By continuously monitoring calls and transactions, businesses can quickly identify and respond to suspicious activities before they escalate. Advanced analytics tools, including voice analytics and behavior analysis, can provide valuable insights into potential fraud, allowing companies to take proactive measures. Voice analytics, for instance, can detect stress or hesitation in a caller’s voice, which may indicate that they are not who they claim to be. Behavior analysis can track how consumers typically interact with their accounts, flagging deviations from the norm as potential fraud. Continuous improvement is key here—regularly reviewing and updating monitoring protocols ensures that businesses stay ahead of evolving threats. Preventing call center fraud in your business By using a multi-layered fraud approach through a variety of authentication solutions, your business can quickly detect call center fraud without disrupting your consumers’ experience. Identify the risk Identity-based risk detection can pinpoint when a specific identity may be in the hands of fraudsters. Device intelligence solutions can recognize the risk associated with a specific device used to attempt online access. Address the risk Knowledge-based authentication (KBA) can quickly authenticate users by asking questions only they can answer, which can deter fraudsters. MFA services can generate and deliver a one-time password to a consumer’s mobile device to verify their identity in real time. Document verification allows your business to collect and verify images of identity documents uploaded from a consumer’s mobile device. Protect your business and your consumers from call center fraud Call center fraud is a significant threat that requires a proactive and comprehensive approach to prevention. By implementing strategies such as multifactor authentication solutions, account takeover prevention techniques, and robust employee training, businesses can significantly reduce their risk of falling victim to fraud. In today’s fast-paced digital world, staying vigilant and proactive is the key to safeguarding your call center against fraud. Act now to protect your business and maintain the trust of your consumers. Enable your call center to detect risk quickly and effectively with our robust fraud prevention solutions. Get started Download our identity and fraud report This article includes content created by an AI language model and is intended to provide general information. [1] Worldmetrics.org, Account Takeover Statistics: Losses to Reach $6.24 Billion Globally, 2024. [2] Security.org, Account Takeover Incidents are Rising: How to Protect Yourself in 2024.

This series will explore our monthly State of the Economy report, which provides a snapshot of the top monthly economic and credit data for financial service professionals to proactively shape their business strategies. During their September meeting, the Federal Reserve made a highly-anticipated announcement to cut rates for the first time since 2020. Fed officials cut rates by 50bps, while also penciling in an additional 50bps of cuts for 2024 and 100bps of cuts in 2025 in their Summary of Economic Projections. While rates are coming down and inflation continues to cool, there were downward revisions to job creation made in August and declining job openings in July. Data highlights from this month’s report include: The Federal Reserve announced a 50bps rate cut during the September meeting. Annual headline inflation cooled from 2.9% to 2.5%, getting closer to the Fed’s 2% goal. Mortgage originations increased 7.0% in August. Check out our report for a deep dive into the rest of this month’s data, including the latest trends in job creation, retail sales, and consumer sentiment. Download September's report As our economy continues to fluctuate, it's critical to stay updated on the latest developments. Subscribe to our new series, The Macro Moment, for economic commentary from Experian North America's Chief Economist, Joseph Mayans, and download our new Lending Conditions Chartbook for additional insights. For more economic trends and market insights, visit Experian Edge.

As a mortgage lender, understanding the intricacies of the New York housing market is crucial, especially when dealing with first-time homebuyers (FTHBs). While the housing market fluctuates nationwide, New York presents unique challenges and opportunities that require a nuanced approach. Distinguishing NYC from the rest of New York New York City's housing market, along with its suburbs, stands distinct from the rest of the state. With a high cost of living and unique lifestyle, NYC demands a tailored mortgage marketing strategy. This article will highlight key factors affecting affordability in New York, providing valuable insights for mortgage lenders working in this market. Overview of the New York FTHB market According to Experian Housing’s recent report on first-time homebuyers, the state of New York accounts for nearly 4.9% of all first-time homebuyers nationwide.1 More than half of first-time homebuyers are from Generation Y. When combined with Gen Z, these younger buyers make up just over 67% of the state's FTHBs, a figure slightly below the national average of 69%. Affordability metrics: The rent-to-mortgage ratio For many Americans, homeownership represents stability, security, and the future for family, community, and life. However, the decision to buy versus rent often hinges on affordability. Mortgage lenders must understand this dynamic to better assist their clients. Affordability can be defined in various ways. For the purposes of this study, Experian Housing defined affordability by comparing rental and mortgage payments, known as the rent-to-mortgage ratio (RTM ratio). A higher ratio indicates that buying a home is more economically attractive. Again, this metric does not consider incomes and debt levels, but simply housing rental prices and mortgage costs. Based solely on the RTM ratio, the transition from renting to homeownership may be more attractive in New York City, Syracuse, and Oyster Bay, while the transition may be more difficult in Cheektowaga, Amherst, and Hempstead. For mortgage lenders, understanding local markets and buyer profiles is essential. Building trust through personalized service, such as educating buyers on relevant loan programs and showcasing geographic expertise, can set you apart. With this knowledge, you can help buyers make informed decisions about affordability, whether they prefer living in the city or the suburbs. In some areas, the suburbs may offer more affordable options, while in others, the city center might be more cost-effective. Additional factors: Income, debt, and down payments Affordability extends beyond just rent and mortgage payments. Prospective homebuyers must consider their income, monthly expenses, and access to funds for a down payment. Mortgage lenders need to account for these factors when advising first-time homebuyers. Debt-to-income Average DTI across the 14 cities observed was 25.6%. The chart below highlights those at the higher and lower end of the spectrum. Down payments Down payments varied greatly, but the median across the cities observed was 16.5%. The chart below highlights an example at the high, mid, and low point. Sale prices and income Experian Housing analyzed median sales prices and incomes across the U.S., with New York serving as a prime example of the importance of this comparison in assessing affordability. This correlation is crucial; while sales prices may be high, understanding how they align with local incomes helps lenders accurately gauge market dynamics and guide buyers more effectively. In conclusion, having a deep understanding of the New York housing market is invaluable for mortgage lenders aiming to support first-time homebuyers. By leveraging insights into market dynamics, affordability metrics, and borrower profiles, lenders can offer tailored advice that meets the specific needs of their clients. This not only helps buyers navigate the complexities of homeownership but also builds lasting trust and loyalty. Equipped with these insights, you, as a lender, can play a pivotal role in making the dream of homeownership a reality for first-time buyers in New York. Let's continue to empower our clients with the knowledge and guidance they need to make informed and confident decisions in their homebuying journey. For more insights, check out our recent studies on the Florida and Texas markets and download our first-time homebuyer whitepaper. Download white paper Learn more

Effective collection strategies are critical for the financial health of credit unions. Unlike traditional banks, credit unions often emphasize member relationships and community values, making the collection process more tactful. Crafting a strategy that balances the need for financial stability with member-centric values is essential. Here’s a step-by-step guide on how to create an effective credit union collection strategy. 1. Understand your members The foundation of an effective credit union collection strategy is understanding your members. Credit unions often serve specific communities or groups, and members may face unique financial challenges. By analyzing member demographics, financial behavior, and common reasons for delinquency, you can tailor your approach to be more vigilant and effective. Segment members: Group members based on factors like loan type, payment history, and financial behavior. This allows for targeted communications and outreach strategies. Member communication preferences: Determine how your members prefer to be contacted—whether by phone, email, or in person. This can increase engagement and responsiveness. 2. Prioritize compliance Compliance with regulations is non-negotiable in the collections process. Ensure that your strategy adheres to all relevant laws and guidelines. Fair Debt Collection Practices Act (FDCPA): Ensure that your team is fully trained on the FDCPA and that your practices comply with its requirements. State and local regulations: Be aware of any state or local regulations that may impact your collections process. This could include restrictions on contact methods or times. Internal audits: Regularly conduct internal audits to ensure compliance and identify any areas of risk. 3. Leverage technology for efficiency Technology can streamline the collection process, making it more efficient and a better member experience. Automated reminders: Use automated systems to send reminders before and after payment due dates. This reduces the likelihood of missed payments due to forgetfulness. Data analytics: Use data analytics to identify trends in member behavior, establish a collections prioritization strategy, and predict potential delinquencies. This allows your team to be proactive rather than reactive. Digital communication channels: Implement digital communication options, such as text messages or chatbots to make it easier for members to interact with the credit union. 4. Establish clear communication protocols Early and frequent communication is key to preventing delinquency and managing it when it occurs. Create clear protocols for member communication that prioritize empathy and treatment plans over demands. Early intervention: Reach out to members as soon as they miss a payment. Early intervention can prevent minor issues from escalating. Consistent communication: Ensure that your communication is consistent across all channels. Whether a member receives a call, an email, or a letter, the message should be clear and aligned with the credit union’s values. Human understanding: Train your collections team to use a compassionate tone. Members are more likely to respond positively when they feel understood and respected. 5. Offer flexible payment solutions Flexibility is crucial when working with members who are struggling financially. Offering a range of payment solutions can help members stay on track and reduce the likelihood of default. Customized treatment plans: Offer customizable payment plans that fit the member’s financial situation. This could include lower payments over a longer term or temporary payment deferrals. Loan modifications: In some cases, modifying the terms of the loan—such as extending the repayment period or lowering the interest rate—may be necessary to help the member succeed. Debt consolidation options: If a member has multiple loans, consider offering debt consolidation to simplify their payments and reduce their overall financial burden. 6. Train your collection team Your collection team is the frontline of your strategy. Providing them with the right training and tools is essential for success. Ongoing training: Regularly update your team on the latest regulations, best practices, and communication techniques. This keeps them informed and prepared to handle various situations. Better decision making: Empower your team to make decisions that align with the credit union’s values. This could include offering payment extensions or waiving late fees in certain situations. Regular support: Working in collections can be complex. Provide resources and support to help your team manage stress and maintain a positive attitude. 7. Monitor and adjust your strategy A successful credit union collection strategy is dynamic. Regularly monitor its performance and adjust as needed. Key performance indicators (KPIs): Track KPIs such as delinquency rates, recovery rates, roll-rates and member satisfaction to gauge the effectiveness of your strategy. Member feedback: Survey members who have gone through the collections process. Their insights can help you identify areas for improvement. Continuous improvement: Use data and feedback to continuously refine your strategy. What worked last year may not be as effective today, so staying adaptable is key. Creating an effective credit union collections strategy requires a balance of empathy, effective communication, and compliance. By understanding your members, communicating clearly, offering flexible solutions, leveraging technology, and continuously improving your approach, you can develop a strategy that not only reduces delinquency but also strengthens member relationships. In today’s fiercely competitive landscape, where efficiency and efficacy stand paramount, working with the right partner equipped with innovative credit union solutions can dramatically transform your outcomes. Choosing us for your debt collection needs signifies an investment in premier analytics, advanced debt recovery tools, and unmatched support. Learn more Watch credit union collection chat This article includes content created by an AI language model and is intended to provide general information.

Fraud-as-a-Service (FaaS) represents an emerging and increasingly sophisticated business model within cybercrime. In this model, malicious actors commercialize their expertise, tools, and infrastructure, enabling others to perpetrate fraud more easily and efficiently. These FaaS offerings are often accessible via dark web marketplaces or underground forums, streamlining and automating fraud processes, such as large-scale phishing campaigns. This enables the creation of convincing counterfeit websites and the distribution of bulk emails, allowing cybercriminals to harvest credentials and personal information en masse. Organized cybercrime syndicates leverage account creation bots to establish hundreds of fraudulent accounts across various platforms, bypassing standard security protocols and scaling their illicit activities seamlessly. A fraudster no longer requires deep technical skills or detailed knowledge of complex verification techniques, such as liveness detection. Instead, they can acquire turnkey FaaS solutions that, for instance, inject pre-recorded video footage to spoof verification processes, enabling the rapid creation of thousands of fraudulent accounts. The commoditization of fraud has effectively democratized it, lowering the barriers to entry. Previously accessible to a select few, FaaS has developed sophisticated techniques and is now available to a broader and less technically adept audience. Now, even individuals with basic computer skills can access these services and initiate fraudulent schemes with minimal effort. Key tools in the FaaS arsenal Central to the success of fraud-as-a-service is the ability to create fraudulent accounts while evading detection. This process can be alarmingly straightforward, even for companies adhering to industry-recognized best practices. Widely available programs, such as app cloners, enable fraudsters to generate multiple instances of the same application on a single device, modifying its source code to bypass security measures to detect such activities. The generalization of artifical intelligence (AI) and increased access to technology have provided cybercriminals with new tools to launch sophisticated scams, such as Pig Butchering and Authorized Push Payment (APP) scams. Similarly, image injection tools facilitate the insertion of manipulated images to deceive verification systems, while emulators simulate legitimate device activity at scale, making detection more challenging. Techniques such as location spoofing allow fraudsters to alter the perceived geographical location of a device, thereby evading location-based security checks and allowing their scams to remain undetected. Once fraudulent accounts are established, cybercriminals focus on monetizing their efforts. Industries like food delivery and ride-hailing are particularly vulnerable to promotional abuse. Fraudsters exploit promotional offers intended for new customers by using cloned apps, injected images, and emulators to create multiple fake accounts, redeem discounts, and resell them for profit. AI-driven automation and advanced communication technologies lower the barriers for these scams, enabling criminals to operate at a larger scale and with greater efficiency. This has made scams more pervasive and difficult for individuals and institutions to detect. In the ride-hailing industry, these tactics are used to manipulate fare structures and incentives. Fraudsters operate multiple driver or rider accounts on the same device to earn referral bonuses and other promotional rewards. Emulators can simulate rides with fabricated start and end points, while location spoofing tools manipulate GPS data, inflating fares, and earnings. Such fraudulent activities result in significant financial losses for companies and degrade service quality for legitimate users, as resources are diverted from genuine transactions and logistical algorithms are disrupted. The implications of FaaS for businesses The commercialization of fraud poses a substantial threat to businesses, not only by democratizing fraud but also by enabling it to rapidly scale. . Fraudsters can experiment with multiple schemes simultaneously, sharing feedback and accelerating their learning curve. A single tool developed by one individual can be deployed by numerous bad actors to perpetrate fraud on a large scale, with remarkable speed. This ease of execution allows fraudsters to overwhelm companies with a barrage of attacks, maximizing their financial gains while exacerbating the challenges of fraud prevention for targeted organizations. Developing a FaaS-Resilient fraud prevention strategy To effectively combat fraud-as-a-service, businesses must adopt AI fraud strategies that mirror the operational sophistication of fraudsters. These cybercriminals treat their activities as profitable enterprises, continually optimizing their return on investment through scalable and adaptable tactics. By deeply understanding the methodologies employed by fraudsters, companies can develop more effective fraud prevention measures that disrupt fraudulent operations without inconveniencing legitimate users. Proactive fraud prevention strategies are essential in countering FaaS tactics. Effective measures rely on robust data collection and analysis. Regular reviews of key performance indicators (KPIs) and velocity checks, which monitor the rate at which users complete transactions, can help identify irregular behaviors. Passive signals, such as device fingerprinting and location intelligence, are also invaluable in detecting suspicious activities. By scrutinizing data related to app tampering or device emulation, businesses can more accurately determine whether a genuine user is accessing their platform or if a fraudster is attempting to bypass detection. Given the dynamic nature of FaaS, adaptation is crucial. Fraud prevention strategies must evolve continually to keep pace with emerging threats. Advanced technologies offer nuanced insights into user behavior, enabling businesses to identify and thwart fraud attempts with greater precision. Moreover, cutting-edge risk monitoring tools can help avoid false positives, ensuring that legitimate users are not unduly impacted. As fraudsters persist in innovating and refining their tactics, organizations must remain vigilant, stay informed about emerging trends, invest in advanced fraud prevention and detection technologies, and cultivate a culture of security and awareness. While it may be tempting to underestimate fraudsters due to the illicit nature of their activities, it is important to recognize that many approach their work with a level of professionalism comparable to legitimate businesses. Understanding this reality offers valuable insights into how companies can effectively counteract fraud and protect their monetary interests. Learn more This article includes content created by an AI language model and is intended to provide general information.

In this article...What is reject inference? How can reject inference enhance underwriting? Techniques in reject inference Enhancing reject inference design for better classification How Experian can assist with reject inference In the lending world, making precise underwriting decisions is key to minimizing risks and optimizing returns. One valuable yet often overlooked technique that can significantly enhance your credit underwriting process is reject inferencing. This blog post offers insights into what reject inference is, how it can improve underwriting, and various reject inference methods. What is reject inference? Reject inference is a statistical method used to predict the potential performance of applicants who were rejected for a loan or credit — or approved but did not book. In essence, it helps lenders and financial institutions gauge how rejected or non-booked applicants might have performed had they been accepted or booked. By incorporating reject inference, you gain a more comprehensive view of the applicant pool, which leads to more informed underwriting decisions. Utilizing reject inference helps reduce biases in your models, as decisions are based on a complete set of data, including those who were initially rejected. This technique is crucial for refining credit risk models, leading to more accurate predictions and improved financial outcomes. How can reject inference enhance underwriting? Incorporating reject inference into your underwriting process offers several advantages: Identifying high-potential customers: By understanding the potential behavior of rejected applicants, you can uncover high-potential customers who might have been overlooked before. Improved risk assessment: Considering the full spectrum of applicants provides a clearer picture of the overall risk landscape, allowing for more informed lending decisions. This can help reduce default rates and enhance portfolio performance. Optimizing credit decisioning models: Including inferred data from rejected and non-booked applicants makes your credit scoring models more representative of the entire applicant population. This results in more robust and reliable predictions. Techniques in reject inference Several techniques are employed in reject inference, each with unique strengths and applications. Understanding these techniques is crucial for effectively implementing reject inference in your underwriting process. Let's discuss three commonly used techniques: Parceling: This technique involves segmenting rejected applicants based on their characteristics and behaviors, creating a more detailed view of the applicant pool for more precise predictions. Augmentation: This method adds inferred data to the dataset of approved applicants, producing a more comprehensive model that includes both approved and inferred rejected applicants, leading to better predictions. Reweighting: This technique adjusts the weights of approved applicants to reflect the characteristics of rejected applicants, minimizing bias towards the approved applicants and improving prediction accuracy. Pre-diction method The pre-diction method is a common approach in reject inference that uses data collected at the time of application to predict the performance of rejected applicants. The advantage of this method is its reliance on real-time data, making it highly relevant and current. For example, pre-diction data can include credit bureau attributes from the time of application. This method helps develop a model that predicts the outcomes of rejected applicants based on performance data from approved applicants. However, it may not capture long-term trends and could be less effective for applicants with unique characteristics. Post-diction method The post-diction method uses data collected after the performance window to predict the performance of rejected applicants. Leveraging historical data, this method is ideal for capturing long-term trends and behaviors. Post-diction data may include credit bureau attributes from the end of the performance window. This method helps develop a model based on historical performance data, which is beneficial for applicants with unique characteristics and can lead to higher performance metrics. However, it may be less timely and require more complex data processing compared to pre-diction. Enhancing reject inference design for better classification To optimize your reject inference design, focus on creating a model that accurately classifies the performance of rejected and non-booked applicants. Utilize a combination of pre-diction and post-diction data to capture both real-time and historical trends. Start by developing a parceling model using pre-diction data, such as credit bureau attributes from the time of application, to predict rejected applicants' outcomes. Regularly update your model with the latest data to maintain its relevance. Next, incorporate post-diction data, including attributes from the end of the performance window, to capture long-term trends. Combining both data types will result in a more comprehensive model. Consider leveraging advanced analytics techniques like machine learning and artificial intelligence to refine your model further, identifying hidden patterns and relationships for more accurate predictions. How Experian can assist with reject inference Reject inference is a powerful tool for enhancing your underwriting process. By predicting the potential performance of rejected and non-booked applicants, you can make more inclusive and accurate decisions, leading to improved risk assessment and optimized credit scoring models. Experian offers various services and solutions to help financial institutions and lenders effectively implement reject inference into their decisioning strategy. Our solutions include comprehensive and high-quality datasets, which empower you to build models that are more representative of the entire applicant population. Additionally, our advanced analytics tools simplify data analysis and model development, enabling you to implement reject inference efficiently without extensive technical expertise. Ready to elevate your underwriting process? Contact us today to learn more about our suite of advanced analytics solutions or hear what our experts have to say in this webinar. Watch Webinar Learn More This article includes content created by an AI language model and is intended to provide general information.

Quick Answer: A new consumer survey reveals that 90% of survey respondents would like to have more than one Vehicle History Report when shopping for a used car. Offering an Experian AutoCheck® VHR as a second Vehicle History Report is a smart, simple strategy to help you close more deals. In today’s used car market, standing out from the crowd is more important than ever. As buyers become savvier and more informed, dealerships need to find new ways to build trust and close sales. One simple yet effective strategy? Offering a second Vehicle History Report (VHR) to your customers. Why VHRs Matter So Much Let’s face it—buying a car is a big deal. Most people don’t just walk onto a lot and pick the first car they see. They do their homework, and a big part of that research involves Vehicle History Reports. In fact, a recent survey found that 70% of people used a VHR the last time they bought a car. And it’s not just a one-time thing—83% of buyers say they’ll use a VHR for their next purchase too. Why? Because these reports provide crucial details like accident history, mileage accuracy, and service records that give buyers confidence in their decisions. The Case for Offering Multiple VHRs Here’s something that might surprise you: 90% of surveyed car buyers said they’d like to see more than one VHR when shopping for a used car. Think about that for a second. People want that extra layer of reassurance that only comes from cross-checking information. This is especially true for those who prefer buying from dealerships—these customers expect comprehensive, reliable data before they make a decision. How Multiple VHRs Can Give Your Dealership an Edge So, what’s the big deal about offering more than one VHR? It’s all about trust and transparency. Just like banks look at multiple credit reports before approving a loan, offering multiple VHRs can help you provide a fuller, more accurate picture of a vehicle’s history. This can reduce your liability and protect your dealership’s reputation. We have done some digging into this, and the results are eye-opening. For instance, in one case study, a dealership found additional damage events through an Experian AutoCheck® VHR that weren’t picked up by other VHRs. This kind of discrepancy shows just how valuable it can be to provide that second report—it helps ensure that all the facts are on the table, which protects both you and your customers. Meeting and Exceeding Customer Expectations Here’s something else to keep in mind: people expect dealerships to go the extra mile. The survey found that 86% of used car buyers believe VHRs should be provided for free by the dealership. By offering multiple reports at no additional cost, you’re not just meeting their expectations—you’re exceeding them. And that’s a surefire way to boost customer confidence, satisfaction, and, ultimately, your sales. What You Can Do Today Offering a second Vehicle History Report is a smart, simple strategy to help you close more deals. It shows your customers that you’re committed to transparency and that you care about providing them with all the information they need to make a confident decision. In a competitive market, it’s the little things like this that can make a big difference. Your customers—and your bottom line—will thank you. Experian Automotive is here to help you with your vehicle history data needs. If you’d like to learn more about our AutoCheck solution and how we can support you, click below to have someone from our team contact you.

Replay attacks may threaten your customers’ online security Today, consumer online security is more important than ever. This year, the FTC has already received nearly six million reports of fraud, and 1.4 million of those cases were specifically identity theft.[1] In addition, a recent study reported that losses due to identity fraud amounted to almost $23 billion in 2023.[2] And consumers aren’t the only ones at risk. According to CyberArk’s global research report, 93% of organizations had two or more identity-related breaches in the past year.[3] This means it’s not only up to consumers to protect themselves against identity theft. It’s also up to businesses to protect themselves and their customers from the threat of fraud. As security technology advances, so do the tactics of hackers attempting to steal information such as usernames, account numbers, and passwords from innocent online users. One method that hackers use to obtain this information is called a replay attack, which can pose a serious threat to your customers’ online security. What is a replay attack? A replay attack is a network-based security hack in which a hacker intercepts legitimate data transmission and then fraudulently repeats it to gain access to a network or system. These attacks are designed to fool the victim into believing the hacker is a genuine user, and they happen in three steps: Eavesdropping: The hacker listens in on secure network communications, such as information sent through a Virtual Private Network (VPN), to learn about the activity happening on that network. Interception: The hacker intercepts legitimate user information – usernames, user activity, computer specs, passwords, etc. Replay: The hacker illegally resends (or “replays”) the valid information they gathered to trick the receiver into thinking that they are a genuine user. Here’s an example: John transfers funds from one online banking account to another. A hacker illegally captures that transaction message (which is often accompanied by a digital signature or token) and “replays” that same transaction message multiple times to trigger additional fund transfers, all without the genuine user’s knowledge or permission. The bank doesn’t recognize a problem because the “replayed” transaction messages includes the legitimate digital signature/token, so the bank approves the additional transfers. Replay attacks aren’t just used for banking transactions. They can be used for various activities, such as: Internet of Things (IoT) device attacks: IoT devices include a multitude of “smart home” devices such as smart plugs, cameras, locks, appliances, speakers, lights, and more. Vulnerabilities in these devices can allow hackers to replicate commands to these devices that seem legitimate, such as turning on cameras, unlocking doors, and disabling security systems.[4] Remote keyless entry systems for vehicles: Most vehicles use a remote key fob to lock and unlock the doors. This key fob usually uses radio waves to send the lock/unlock signal to the car. Hackers can use a device to receive and transmit radio waves near a person’s vehicle that mimic that same lock/unlock signal, and then “replay” that signal to unlock the person’s car themselves.[5] Text-dependent speaker verification: Some people use voice recognition to verify their identity when accessing an account or system. Hackers can record a person’s voice when the person speaks to verify their identity, and then “replay” that voice recording to fraudulently access the account.[6] How to prevent replay attacks Replay attacks are dangerous because they are often unnoticed or overlooked until the damage has already been done. Fortunately, there are ways to stop hackers from using replay attacks to access your customers’ personal information. Device intelligence: By leveraging unique intelligence about the device being used, replay attacks can be thwarted even when fraudsters are using authentic, but stolen, information. Time stamping: By forcing a timestamp on all sent and received messages, you can prevent hackers from sending repeated messages with legitimate information obtained illegally. Geolocation review: By identifying suspicious language and/or time zones, you can compare access routes to confirm customers are authentic and secure. Why it matters for your business Consumers in the U.S. value network security more than ever, with 70% rating security a top priority, even over personalization and convenience.[7] People want to feel safe online, and if they experience a threat of identity theft or fraud, they’ll need to find a reliable resource to keep their personal information secure. Successful replay attacks allow fraudsters to impersonate real users and potentially gain partial or full access to their personal online accounts. If your customers fall victim to these kinds of attacks, the resulting stress may have a negative impact on your relationship with them. With our fraud management solutions, your business can strengthen your customers’ trust and security by leveraging highly trained fraud analysts to help uncover suspicious activity that might not be noticed otherwise. Lower fraud losses and achieve fraud capture rates that exceed industry averages. Protect your customers by using a covert, frictionless solution the reduces false positives. Improve operational efficiency by prioritizing resources across the board. Protect your consumers with powerful fraud management solutions 63% of consumers say it’s important for businesses to be able to recognize them online, and 81% say they are more trusting of businesses that can accomplish easy and accurate identification.[8] While replay attacks can cause consumers stress and anxiety, taking action to prevent them can fortify a strong, trusting relationship between your business and your customers. Protect your customers and prevent replay attacks with our powerful fraud management solutions. Get started [1] IdentityTheft.org, 2024 Identity Theft Facts and Statistics. [2] Javelin, 2024 Identity Fraud Study: Resolving the Shattered Identity Crisis. [3] CyberArk, Report: 93% of Organizations Had Two or More Identity-Related Breaches in the Past Year, May 2024. [4] Hackster.io, IoT Devices May Be Susceptible to Replay Attacks with a Raspberry Pi and RTL-SDR Dongle, 2017. [5] Automotive World, How to mitigate vulnerabilities in keyless entry systems, 2023. [6] Antispoofing, Audio Replay Attacks and Countermeasures Against Them, 2022. [7] 2018 Experian® Global Fraud Report [8] Experian® 2024 Identity and Fraud Report Highlights Evolving Fraud Landscape This article includes content created by an AI language model and is intended to provide general information.

At Experian, we believe in fostering innovation and collaboration to solve complex challenges. Recently, Ivan Ahmed, one of our talented product management leaders at Experian Housing, had the opportunity to participate in the FHFA 2024 TechSprint, where his team won the award for the best Risk Management and Compliance idea. In this article, we share Ivan's experience as he reflects on the TechSprint, the inspiration behind his team's project, and the valuable lessons learned. Can you share your experience participating in the FHFA 2024 TechSprint? What was the atmosphere like, and how did it feel to be recognized for the best Risk Management and Compliance idea? Let me start by explaining what a TechSprint is. It is a fast-paced, high-energy collaborative workshop where diverse experts and stakeholders come together to design technological solutions to complex problems. Each team is given a high-level problem and use case. From there, stakeholders and domain experts must develop a proof of concept within 3 days to best address the problem. On the last and final day, called the “Demo Day,” teams must showcase their solution in front of a panel of judges. It’s a fun, high-energy, challenging, and rewarding experience. A TechSprint is a convergence of everything I love – technology, business, and design and I think FHFA did a wonderful job orchestrating the event. Each team consisted of representatives from different functions in the housing ecosystem, including lenders, technologists, product managers, and regulators. We were given access to a room, whiteboards, and, most importantly, delicious snacks. We were also given access to industry subject matter experts outside our teams, including representatives from Fannie Mae and Freddie Mac, FHFA, and leaders from top companies. What I found the most impactful was the ability to pressure test our ideas and solutions against these industry subject matter experts. Ideating in a vacuum can be challenging, so being able to stress test things rapidly with these experts allowed us to change course quickly as new information was introduced. Winning the best Risk Management and Compliance idea award was rewarding, especially as we were able to ideate a solution to such a critical accessibility issue. Ultimately, our goal was to help create a fairer, more equitable, and inclusive housing finance system. A big shoutout to my teammates, Wemimo Abbey, Joseph Karbowski, Will Regenauer, and Eddy Atkins. What inspired Team Arsenal to focus on identifying potential gaps in ADA compliance within multifamily buildings, and what were some of the key challenges your team faced during the process? My mother has suffered from several disabilities most of her life. With age, she has become more wheelchair-dependent, and traveling has become a major challenge. On a recent family trip, the entry to our hotel building wasn’t ADA-compliant, and I had to carry her up a flight of stairs. It was frustrating to deal with. I later went down a rabbit hole around ADA compliance and, much to my surprise, learned that only 0.15% of all homes in the U.S. are wheelchair accessible! As we explored the problem space further as a team, we learned how difficult it is to ensure that new and existing rental homes are ADA-compliant. We hypothesized that a solution is needed to establish incentives for borrowers, lenders, and GSEs to meet compliance. A technological solution could more easily enable multi-family lenders and builders to identify rental units that are non-ADA compliant and could provide ways to address the gaps. We noticed two primary challenges: an enforcement gap and an incentive gap. We learned that agency loans (Fannie Mae and Freddie Mac) account for most multi-family home loan originations. If we could tackle the enforcement challenge at the GSE level, we could set up the proper incentives for all players in the multi-family lending process. By providing tools to both the borrower and the GSE’s, we could help foster a more inclusive and accessible rental housing market. How do you envision your AI-driven solution impacting the rental housing market and improving ADA compliance for multifamily buildings? We wanted to ensure that we leveraged the true power of Generative AI, which meant that our solution could take multimodal inputs and produce multimodal outputs. For example, we could train the Generative AI model on photos of interior multi-family rental units and structured or unstructured text like building sketches, site layouts, and local building codes. We could then incorporate ADA design requirements and analyze discrepancies. The result would be a compliance report or tool outlining the adherence level to ADA design requirements and providing tips and recommendations on remediation. The solution could be delivered as a free tool by the GSEs, who could incentivize its usage by offering price concessions to borrowers. Developers could also use the tool to evaluate whether new or existing builds were ADA-compliant. How did your background and experience with Experian contribute to developing your team's winning idea at the FHFA TechSprint? Much of my role at Experian has involved exploring ways to leverage proprietary and public record property data for marketing, account review, and analytical use cases. I work very closely with property data at Experian, so I was very familiar with the types of input fields of property data that would be the most relevant to improving a generative AI model output. Specifically, in our use case, we wanted to train the model to better identify homes and features that were non-compliant with ADA and provide clear remediation steps. We knew that public record property information was available from various sources and could be leveraged as additional third-party input data to improve our model accuracy. What advice would you give to other teams or individuals looking to participate in future TechSprint events, especially those aiming to tackle complex issues like risk management and compliance? It’s important to remember that an ideal solution is both impactful and practical. Practicality is achieved when the solution has both business and technical viability. Therefore, it’s crucial to carefully vet problems and solutions by understanding their viability. Working as a team to solve the problem means leveraging the expertise of subject matter experts around you. Each team member should draw on their strengths, making the collective effort stronger than individual contribution. Most importantly, fairness, inclusivity, and accessibility matter. An effective solution should strive to have a positive social impact in addition to other considerations. Winning with purpose Ivan’s journey through the FHFA 2024 TechSprint exemplifies the innovative and collaborative spirit that drives our team at Experian. His reflections highlight the impact of well-designed technological solutions on critical issues like ADA-compliance in multifamily housing. We hope Ivan’s experience inspires others to explore their potential in solving complex problems and to participate in future TechSprints, where innovative thinking and a commitment to social good can lead to meaningful change.

Driven by a range of appealing factors including lower monthly payments and a wider array of models—due to the continuous rise in new vehicle inventory—leasing has reappeared as an optimal choice for consumers who are in the market for a vehicle. According to Experian’s State of the Automotive Finance Market Report: Q2 2024, leasing increased to 25.35%, up from 21.14% in Q2 2023 and 19.30% the year prior. While the average monthly payment and interest rate for a new loan modestly increased year-over-year, leasing is increasingly becoming a more attractive option for those leaning towards flexibility and affordability. For example, the average monthly payment on a leased vehicle was $148 less than a loan this quarter. What’s more, it seems consumers are leaning towards larger vehicles. For instance, the Honda CR-V (2.98%) continued to lead the top leased models in Q2 2024, and it was followed closely by the Tesla Model Y (2.61%). Rounding out the top five were the Honda Civic (2.29%), Ford F-150 (2.02%), and Chevrolet Silverado 1500 (1.86%). Prime financing grows and lease payments decline across all segments When looking at risk distribution trends in Q2 2024, prime consumers accounted for nearly 70% of the total finance market—with prime coming in at 37.82%, down from 39.84% last year and super prime increasing from 28.98% to 31.59% year-over-year. Subprime also saw a slight increase, going from 13% to 13.06% during the same period. It’s notable that all risk segments experienced a decrease in average monthly payments for leased vehicles, as super prime went from $601 in Q2 2023 to $586 in Q2 2024, prime declined to $583 this quarter, from $596 last year, and subprime was at $597, from $611. With the average monthly payments declining year-over-year for majority of shoppers, it can potentially create a more competitive market and drive more consumers towards this finance option—something automotive professionals should keep a close eye on. New and used vehicle finance market overview Data in Q2 2024 found that new vehicle loan amounts increased slightly, reaching $40,927, up from $40,743 last year, and the average interest rate went from 6.78% to 6.84% year-over-year. Despite the increases, the average monthly payment for a new vehicle only experienced a $1 growth to $734 this quarter. On the used side, the average loan amount declined from $27,316 Q2 2023 to $26,248 in Q2 2024, and the average rate grew from 11.47% to 12.01% in the same time frame. Though, the average monthly payment declined to $525 this quarter, from $536 last year. As the automotive industry continues to adapt to the changing market conditions and consumer preferences, it’s important for professionals to leverage the most current data—this will allow them to effectively assist consumers by meeting their financial needs with the available options. To learn more about automotive finance trends, view the full State of the Automotive Finance Market: Q2 2024 presentation on demand.

Voter registration lists are the backbone of our democratic process. However, maintaining accurate and up-to-date lists is a challenge that election agencies constantly face. With several regulations related to voting and election integrity that have been enacted or proposed in the last two years, maintaining a quality voter list is more important now than ever before. Election officials now have a powerful tool at their disposal: commercially available data to enhance voter list maintenance and boost voter confidence. The importance of maintaining voter lists Audit teams within election agencies are tasked with ensuring election integrity through voter list maintenance. These teams need reliable tools to: Verify and correct voter registration data Identify and update contact information Provide a cost-effective method for record updates Reduce election costs for taxpayers Success stories in voter list management Case study: West Virginia Secretary of State The West Virginia Secretary of State (WVSOS) uses Experian’s TrueTrace™ solution to enhance voter roll maintenance. Traditionally a skip-tracing solution for debt collectors, TrueTrace leverages unique data sources to ensure voters receive correct information, reducing wasted resources and improving election efficiency. WVSOS was challenged with enhancing their existing processes to a more robust 50-state comparison for cross-state movers. After WVSOS’s first data pull using TrueTrace, nearly 16,000 individuals were identified with a potential new "best" address that were also not flagged by other data comparison programs used by the state. The results? Of the almost 16,000 mailings sent, about 25% returned were undeliverable, confirming those individuals had moved. Access the full case study to discover best practices for maintaining voter rolls and conducting cost-effective elections. Webinar: El Paso County Clerk & Recorder's Office The El Paso County Clerk & Recorder’s Office was looking to bring transparency, efficiency, and increased voter confidence to the elections in El Paso County, Texas. To achieve this, they required verified enriched data for registered voters. By partnering with Experian, voter data was enriched using our TrueTrace solution. This partnership has enabled the Office to verify and append the most up-to-date voter address, leading to significant improvements in list maintenance. To date, the El Paso County Clerk & Recorder’s Office has seen a reduction of more than $39,860 in undeliverable ballot costs. Their ROI to date is a positive $4,537 back to the citizens of El Paso County. Listen to our on-demand webinar to hear more about this collaboration. Visit us online to learn more about our public sector solutions. Learn more

Housing affordability is a pressing concern across the United States, and Florida is no exception. The affordability issue can be particularly crucial for renters looking to become first-time homebuyers (FTHBs). The desire to live in a sunny location must be measured against the cost of living, particularly housing costs. Experts at Experian Housing carefully examined data from the top 15 Florida cities (by population) to gain insights into the state of housing affordability in Florida.1 Experian examined factors such as mortgage payments, rent prices, income levels, and sales prices to assess affordability. Overview of the Florida FTHB market Experian Housing’s recent report on first-time homebuyers ranked Florida the state with the third highest percentage of FTHBs nationwide, at nearly 7.7% of FTHBs.2 It outranked New York, falling behind Texas and California. In Florida, the younger populations of Generation Y and Z account for 60% of all first-time homebuyers. Nationwide, roughly 70% of FTHBs belong to these populations. Among younger buyers, affordability is often the deciding factor in whether they continue to rent or become homeowners as they balance housing costs with student loan debt and other expenses. Let’s look at some key metrics Comparative monthly mortgage payments and rent prices How this affects affordability: The bottom line for prospective homebuyers often comes down to whether it's more affordable to continue to rent or purchase a home. While the metrics discussed all contribute to the picture of affordability, for this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio, a comparison of monthly rental payments to monthly mortgage payments. Homebuying becomes more attractive to renters when the rent-to-mortgage ratio is higher because mortgage payments are more economically practical. What we observed: Experian Housing found that Pembroke Pines, Palm Bay, and Cape Coral have the highest rent-to-mortgage ratio in Florida, at nearly 80%. In other words, for example, if the average mortgage payment is $1,000, the average rental payment is ~$800. Compare this to Tallahassee, Hialeah, and Hollywood, where the rent-to-mortgage ratio is <60%. These numbers illustrate the varying home purchase and rental market trends across the state. Debt-to-income How this affects affordability: This metric compares monthly debt responsibilities, including mortgages, car loans, student loans, and minimum credit card payments, to monthly income. A high debt-to-income ratio indicates a significant portion of income is dedicated to paying debt, leaving little room for other essential living costs and discretionary spending. What we observed: Down payments How this affects affordability: A higher down payment can also assist buyers, especially first-time buyers, by increasing attractive financing options. Importantly, a down payment of 20% avoids the need for private mortgage insurance (PMI), which is insurance for the lender, protecting the lender against loss should a foreclosure occur. PMI typically costs between 0.5% and 2% of the loan amount, annually. What we observed: Sale prices and financial hurdles How this affects affordability: In comparing home affordability across Florida, first-time homebuyers should consider home prices in relation to income. While other considerations, including an individual’s debt level and other expenses, contribute to the bottom line, this gives an indication of how much income will be consumed by the home purchase. What we observed: Experian Housing examined the median sales prices and median. Comparison is essential because sales prices may be higher in a given area, but correlation with income helps determine affordability. A Florida housing opportunity, up close: Miami metropolitan area The Miami metropolitan area is an example of an area where mortgage lenders who understand their clients and the area they seek to live may well attract first-time homebuyers, loyal clients, and more word-of-mouth business. The Miami suburb of Pembroke Pines, roughly 20 miles from Miami, offers a more affordable housing market. With Florida sunshine, nearby beaches, and access to three main highways, mortgage lenders whose knowledge base is not limited to the Miami city center may have an opportunity to turn a renter into a homeowner. Florida residents navigate the cost of living in the Sunshine State Analysis from Experian Housing highlights the diversity in housing markets and the opportunities to enhance financial well-being for residents in Florida. These insights are crucial for lenders to identify affordable opportunities for all residents. Experian’s data system offers unique value to lenders given the ability to take a more comprehensive look at a borrower’s financial behavior. Experian uses credit, property, rental, and other alternative data sources to capture the borrower profile. Access to such data also gives Experian a unique ability to conduct research for reports like this one and the recent Texas affordability study. For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online. Download white paper Learn more 1 The analysis is based on the trade and rental data reported to Experian and considered first-time homebuyers during the period between November 2022 and January 2024. 2 Based on those getting a mortgage.

This series will dive into our monthly State of the Economy report, providing a snapshot of the top monthly economic and credit data for those in financial services to proactively shape their business strategies. The labor market has been a source of strength for the U.S. economy coming out of the pandemic, providing workers with stable employment and solid wages. However, the labor market has slowed in recent months, with lower-than-expected job creation and rising unemployment, causing weakening sentiment in the broader market. This has resulted in increased pressure on the Federal Reserve to begin cutting rates and places more importance on the incoming data between now and the September FOMC meeting. Data highlights from this month’s report include: Job creation declined in July, falling short of economists’ expectations. Unemployment increased from 4.1% to 4.3%. Inflation cooled again in July, with annual headline inflation easing from 3.0% to 2.9%. GDP picked up in Q2 to 2.8%, primarily driven by strong consumer spending. Check out our report for a deep dive into the rest of this month’s data, including the latest trends in originations, retail sales, and the new housing market. Download August's report To have a holistic view of our current environment, it’s important to view the economy from different angles and through different lenses. Download our latest macroeconomic forecasting report for our views on what's to come in the U.S. economy and listen to our latest Econ to Action podcast. For more economic trends and market insights, visit Experian Edge.

Alternative lending is continuing to revolutionize the financial services landscape. From full-file public records to cash flow transactions, alternative credit data empowers financial institutions to make more informed lending decisions. This article focuses on cash flow insights and how they help financial institutions drive profitable and inclusive growth. Challenges with traditional credit underwriting Traditional underwriting often limits access to credit for marginalized communities, including young adults, immigrants, and those from low-income backgrounds. Because the process relies heavily on credit history and credit scores to determine an applicant’s ability to pay, those with less-than-ideal credit profiles could be overlooked. This then creates a cycle — those who are already disadvantaged face further barriers to accessing credit, limiting their abilities to invest in opportunities that can improve their financial situations, such as education or homeownership. Additionally, traditional underwriting models can be rigid. Consumers with stable incomes or significant assets may be denied credit if their financial profiles don’t fit the narrow criteria established by traditional models. As the financial landscape evolves, it’s important for lenders to adopt more inclusive and adaptive approaches to credit underwriting. What is cash flow underwriting? Cash flow underwriting is a modern approach to evaluating a borrower’s creditworthiness. It uses fresh, consumer-permissioned bank account transaction (balance, income and expense) data, giving lenders greater visibility into loan applicants’ financial situation. This process is made possible through open banking, an established, secure framework that enables consumers to quickly and easily share their bank account information with third-party financial service providers. READ: Learn more about the open banking landscape. Let’s look at a few quick examples: A prospective tenant is filling out a rental application. Instead of manually submitting paystubs to verify their income, open banking facilitates the digital sharing of full cash flow data in seconds, enabling property managers to quickly access the applicant’s full cash flow information. A consumer was previously denied credit due to insufficient credit history. With cash flow underwriting, the consumer is offered a second chance to qualify for the loan by including cash flow data in the lender’s decisioning model. The additional information gathered on the consumer’s ability to pay can transform the initial decline decision into an approval. Cash flow underwriting can also be used for credit line management. By assessing a borrower’s income and expense transactions, lenders can recommend optimal credit limits that cater to their spending potential while minimizing risk. Benefits of cash flow underwriting There are many benefits to integrating cash flow data into the credit underwriting process, including: Enhanced risk assessment. Going off credit scores and repayment behaviors alone won’t provide lenders with a complete or current picture of applicants. Through open banking, lenders can gain access to cash flow data in real-time, allowing them to more accurately assess consumers, increase approvals, and reduce credit risk. Inclusive lending. Millions of American adults are considered unscoreable, invisible, or subprime. However, 71% of consumers are willing to share their banking information if it could improve their chances of getting approved for credit.1 With deeper insights into consumers’ income and expenses, lenders can increase credit access in underserved communities. Improved customer experiences. Gaining a more comprehensive view of a consumer’s financial situation enables lenders to determine what loan products they’re eligible for and craft personalized options. READ: Learn more about the benefits of leveraging alternative data for credit underwriting. Get started Cash flow underwriting represents a significant step forward in the world of lending. It offers a more comprehensive approach to assessing creditworthiness, helping financial institutions drive growth and profitability. Cashflow Attributes are one of Experian's open banking solutions that provides lenders with consumer-permissioned insights into borrowers’ financial behaviors. With 940+ attributes derived from transaction data across 133 categories, financial institutions can make smarter, more inclusive lending decisions. Learn more about Cashflow Attributes Learn more about open banking 1Atomik Research survey of 2,005 U.S. adults online, matching national demographics, 2024.

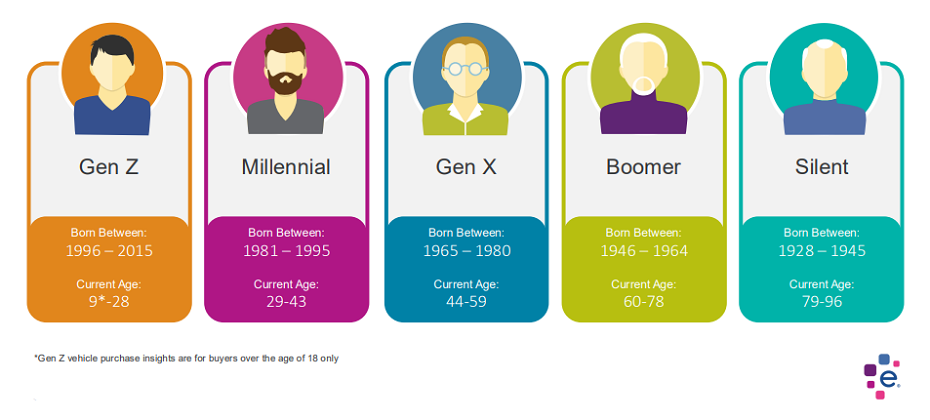

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.